By sniping altcoins on DEX, we made a crazy profit of $50 million

A real story of getting rich in one year, growing from $50,000 to $50 million.

Original Title: How We Made +$50M Sniping Shitcoins On DEXs

Original Author: CBB, Crypto KOL

Original Translation: Luffy, Foresight News

Note from Rhythm: The author of this article, CBB, is a well-known player active in the DeFi and leveraged trading community. He previously gained widespread attention for sharing his experience of earning $5 million using a HyperEVM arbitrage bot (see: "Analysis of the HyperEVM Arbitrage Bot: How to Seize a 2-Second Opportunity to Make $5 Million?"). On October 29, CBB also posted a warning about the high leverage risk of xUSD under Stream. Today, possibly affected by the Balancer hack, XUSD indeed experienced a significant depeg.

In this article, he recounts his complete journey over a year, from entering the crypto world to sniping altcoins on DEXs and making $50 million in profits. The following is the original content:

August 2020. My brother was teaching IT at a university, and I had just finished an 18-month stint as a product manager at an insurance company.

The crypto industry was coming out of years of stagnation, slowly recovering from the crash triggered by the COVID-19 pandemic. We made a few small profits on Binance Launchpad, but our total portfolio barely reached $50,000.

At this time, we started hearing about a new protocol called Uniswap. Friends were trading altcoins on it, often making 3-4x returns within hours. We had no idea what it was, but our instincts told us it was something special.

A friend told me about "sniping trades." He said that when the bZx token launched on Uniswap, a bot made $500,000 just by sniping. It was unbelievable. My brother and I were stunned and eager to find out how it was done.

At the time, my brother knew nothing about the Solidity smart contract language, and we didn't even understand the underlying logic of blockchain.

First Sniping Attempt

In late August, we were on vacation with our family in Spain. To try sniping on Uniswap, my brother had just started learning Solidity a few days earlier.

A token called YMPL was about to launch, and the market hype looked promising. We formed a sniping group and pooled funds with a few friends—after all, we were still newbies and didn’t want to take on the risk alone.

We put in 50 ETH (worth about $20,000 at the time). As soon as YMPL launched, we successfully sniped 8% of the launch supply. I logged into Uniswap and sold everything within 30 minutes.

How much did we make? 60 ETH (about $30,000). Considering our entire portfolio was less than $50,000 at the time, we were ecstatic—it felt so easy to make money.

We wanted to make more.

Two days later, a new sniping target appeared: VIDYA. With the profits from the last round, we had more capital and felt more confident. We put in 165 ETH and netted 159 ETH in just 15 minutes, even more than last time.

Four days later, another sniping opportunity came. We put in 460 ETH and made 353 ETH in profit, equivalent to $135,000. This was our first time making a six-figure profit in less than an hour—it felt incredible.

Uniswap’s popularity exploded, trading volumes soared, and crypto enthusiasts flocked in. We knew these easy money days wouldn’t last. We had to become more professional and truly understand the underlying logic of sniping trades.

What Is the Principle Behind Sniping Trades?

To launch a token on Uniswap, the project team must first add liquidity to the pool. In our first few snipes, we waited until the "add liquidity" transaction was on-chain before sending our buy transaction, but we were always one block too late.

Some competitors, however, managed to get their buy transactions into the same block as the liquidity addition.

After some research, we discovered that by running an Ethereum node, we could monitor the public mempool and see pending transactions before they were officially on-chain.

Starting in September, our sniping process became:

1. Monitor the mempool to catch pending "add liquidity" transactions;

2. Immediately send a buy transaction with the same gas fee;

3. The goal is to have the buy transaction included in the same block as the liquidity addition, executed right after it.

A New Era of Sniping on Ethereum

Mid-September 2020.

There were no new token launches for ten consecutive days, giving us a quiet period to upgrade our bot.

But new challenges arose: summer break was over, and my brother had to continue teaching at the university. Sometimes, sniping opportunities coincided with his classes. Luckily, due to the pandemic, all classes were online.

Whenever a token was about to launch, he would tell his students, "Research on your own for ten minutes." During this break, he could focus on sniping trades.

The next sniping target was CHADS. The market hype was unprecedented, and we planned to put in 200 ETH—we were determined to win.

My brother and I were on a voice call, both nervous and excited, feeling the pressure.

He was the first to see the "add liquidity" transaction on the terminal. When the bot detected the signal, he said in a serious tone, "Ça part." (French for "It's starting")

I’ll never forget that phrase. Every time before a snipe, he would say it in the exact same tone, instantly spiking my adrenaline.

As soon as I heard it, I would frantically refresh Etherscan, hoping to see our ETH balance drop to zero—which meant we had successfully entered.

We really got in, with a 200 ETH position. The candlestick chart soared instantly, and my job was to manually sell on Uniswap.

The profits from CHADS were staggering. My hands were shaking, I was sweating, and I was hyper-focused, selling in batches to lock in as much profit as possible.

In the end, we netted 675 ETH (about $270,000). It felt unreal, but the immense pressure and adrenaline left us exhausted.

No time to rest. Three days later came FRONTIER—same process, same tension and excitement, 800 ETH profit.

Two days later, CHARTEX, 700 ETH profit.

In six days, we made a total profit of 2,300 ETH—insane. Just a month earlier, after years in crypto, our total assets had never exceeded $100,000.

On September 18, an unexpected surprise arrived: the Uniswap airdrop. Every address that had interacted with Uniswap was eligible.

Because we had been doing large-scale testing for weeks, we had accumulated many eligible addresses, each able to claim about $20,000. I remember my brother scoured every wallet he could find and claimed millions of dollars in total.

Our last snipe that month was POLS—Polkastarter’s platform token, which later became a top Launchpad that year.

Smart Contract and Infrastructure Upgrades

It was time to upgrade our bot again.

In the first month of sniping, we set a buy limit: invest X ETH and buy at least Y tokens. With this mechanism, we had to split into multiple transactions, especially since we usually had no idea how much liquidity the project team would add.

For example: if the project team only added 20 ETH of liquidity and we tried to buy with 200 ETH, the preset limit would be completely invalid.

My brother designed a new system: for every 1 ETH invested, buy at least Y tokens, and buy as much as possible before reaching this limit. We were the first to implement this mechanism.

Another challenge was that we never knew whether the project team would add liquidity with ETH, USDT, or USDC. My brother designed a smart contract that could automatically buy the target token regardless of the trading pair.

We also worked on improving the bot’s speed. In the CHADS snipe, although we made a lot, we clearly weren’t the first snipers in after liquidity was added.

We deployed Ethereum nodes in multiple regions, letting them compete for sniping rights on the same transaction. Soon, we found that the node in Northern Virginia was always the fastest.

This convinced us that Northern Virginia was the best place to run sniping servers.

Further research confirmed our guess. At the time, almost all users traded via MetaMask, which routed all "add liquidity" transactions through Infura’s public RPC endpoint, and Infura’s servers were located in Northern Virginia. More broadly, most Ethereum infrastructure was concentrated in that region.

Therefore, AWS’s Northern Virginia node proved to be the most competitive and lowest-latency sniping setup.

We also established a very standardized altcoin sniping process:

1. Find sniping targets: usually, 10-15 crypto friends helped us scout for new hot altcoins. Whoever found the target first could participate in the snipe with a 15% share of the funds (and corresponding risk). Some friends made $300,000 to $700,000 just by finding sniping targets.

2. Confirm the DEX for launch (Uniswap, Sushiswap, etc.);

3. Confirm the trading pair (ETH, USDT, USDC, etc.);

4. Identify the wallet address responsible for the launch (on-chain tracking);

5. Deploy the sniping smart contract and set parameters: fund size and buy limit;

6. Sell immediately after launch, usually within 30 minutes—because most altcoins are junk.

The Polkastarter Era

From October to early December, the market was relatively calm. New token launches slowed, and we even thought the sniping era was ending. Fortunately, we had accumulated a lot of ETH, so just holding it felt good and life was comfortable.

But in December, the altcoin market came roaring back. Token launches on Uniswap became active again, and a new Launchpad quietly appeared: Polkastarter.

Its first sale was the SpiderDAO project, with a 2.5 ETH purchase limit per wallet. But my brother discovered that this limit only applied at the UI level—we could still buy large amounts directly through the contract. We sent several large transactions, successfully buying 50% of the total sale, and also sniped at launch. This trade made us $500,000—we were back.

This example perfectly reflects the state of the crypto ecosystem. Most project teams are complete outsiders, with no idea what they’re doing. For us, this was a godsend, and of course we took full advantage.

At the time, some DeFi projects began launching synthetic assets, and we made $600,000 through arbitrage.

December became a turning point in our entrepreneurial journey—my brother decided to resign from his university professor position.

In January of the following year, we moved to Dubai and both devoted ourselves fully to sniping trades.

Our mindset was simple: as long as there was an opportunity, we’d never miss it. Even if there was only a $10,000 profit window, we’d go for it. We knew this window wouldn’t last forever and didn’t want to miss any chance.

In January, we made several more good trades, such as PHOON, with a total profit of $3 million.

Most of these profits were held in ETH, and ETH’s price soared—from $200 when we started sniping to $1,400 by the end of January, all within just five months.

Anti-Sniping Measures

Starting in February 2021, more and more project teams began implementing anti-sniping measures when launching tokens. People were tired of snipers and started adding anti-sniping mechanisms to token launches.

The first measure: buy limits. In the first few minutes after launch, users could only buy X amount of tokens. My brother was the first to design a sniping smart contract with a loop function, allowing us to buy most of the launch supply in a single transaction—each loop bought the limit amount. With this contract, we stood out from the competition, as most competitors didn’t have this technology.

Smart contract innovation was one of our biggest advantages. My brother could always find a breakthrough for sniping, and we actually welcomed anti-sniping measures—they made the competition less fierce.

The second measure: single-wallet buy limits. My brother designed a master contract with "child smart contracts," where the master contract would call a new child contract for each buy transaction.

These features were extremely useful and played a huge role during the altcoin frenzy on Binance Smart Chain in the following months.

The Peak of Polkastarter and Fierce Competition

From February 2021, the Polkastarter era officially began. Every token launched on Polkastarter soared, and for snipers, each one was a seven-figure opportunity.

But competition became extremely fierce. Although we could still profit, it was getting tougher.

We designed a new feature called "suicide sniping."

The principle was simple: we noticed that many enthusiastic players sniped without setting any buy limit. Our "suicide sniping" feature would send an unlimited buy transaction, then automatically sell after four blocks, harvesting all the snipers who entered after us.

It wasn’t a game-changing strategy, but it was easy to make 50-150 ETH from it.

Later, competition became white-hot, and a guy named 0x887 was faster than everyone. We spent countless hours upgrading our bot, trying to customize Ethereum nodes for the fastest sniping speed, testing day after day, but we could never surpass this sniper.

Binance Smart Chain Frenzy

By mid-February 2021, my brother and I moved into the same place in Dubai—which was great, as we hadn’t lived in the same city for six years. We devoted ourselves to sniping, always looking for new opportunities and ready to design and develop new features.

Although competition on Ethereum was already white-hot, we kept sniping and still profited, but we knew it wouldn’t last forever.

We heard that the Binance Smart Chain (BSC) ecosystem was thriving, with some tokens performing well. We decided to buy a lot of BNB, which was about $80 at the time—after all, we might need it for sniping later.

Our first BSC snipe was the altcoin BRY on February 16. We knew nothing about sniping or competition on BSC—it was time to find out.

We put in 200 BNB, sold everything within 30 minutes, and made 800 BNB, about $80,000. Not as much as on Ethereum, but still pretty good and promising.

Our second BSC sniping target was MATTER: we put in 75 BNB and sold 2,100 BNB. My god, a net profit of 2,000 BNB! And BNB’s price was strong, reaching $240 by the end of February. We saw huge potential—top sniper 0x887 didn’t seem to care about BSC, which was like free money for us. We had to go all out and snipe every target.

March was a bumper month. Token launches on Ethereum were still booming, and we made millions; the BSC market was even crazier, and we made 15,000 BNB in March alone, especially with KPAD, where we made 8,300 BNB.

I remember the KPAD snipe vividly—it was our biggest single profit ever.

I was in my Dubai apartment, knowing this token launch was going to be huge. I was sweating with nerves, even doubting if I could get in.

After the project launched, BSCscan was lagging badly. I logged into Pancakeswap and saw a pile of KPAD in my wallet—my god! My focus sharpened instantly, and I became a computer maniac, selling in batches. Just selling 1% of the position made a huge profit. My hands were shaking as I executed the sales, making $2 million in an hour.

Five days later, an altcoin called COOK was launching on multiple chains. I told my brother we should focus on the Huobi Eco Chain (HECO) because competition would be low there. After the token launched on HECO, we bought in with 550 BNB, then successfully bridged to BSC before the BSC trading pair unlocked, selling everything for a profit of 3,000 BNB. It felt amazing!

By the end of March, BNB’s price had reached $300.

BSC Infrastructure and Optimization

In early April, the market slowed down. We took the opportunity to vacation in the Maldives, but as soon as we landed, we heard that several hot altcoins were about to launch on BSC, so we had to get ready.

We decided to run speed tests on BSC. At the time, BSC operated differently from Ethereum: on Ethereum, you needed to quickly detect pending add liquidity transactions and send your transaction to other nodes quickly.

But a few weeks earlier, we found that transaction ordering within BSC blocks was random. When you detected a pending transaction and sent a buy transaction, yours might be ordered before the add liquidity transaction, causing it to fail.

We deployed 10 nodes on AWS global nodes, each sending 50 transactions, trying to snipe a random test transaction. After 20 rounds of testing, we analyzed the transactions included in the same block as the add liquidity transaction.

We drew the following conclusions:

1. The best-performing nodes were in Northern Virginia and Frankfurt, and sometimes Tokyo performed well too;

2. The first 5-15 transactions sent by a single node were most likely to be included in the target block;

3. The highest-spec servers on AWS allowed more transactions to be included in the target block.

For subsequent sniping, we built BSC infrastructure with 150-200 nodes, each sending 10 transactions.

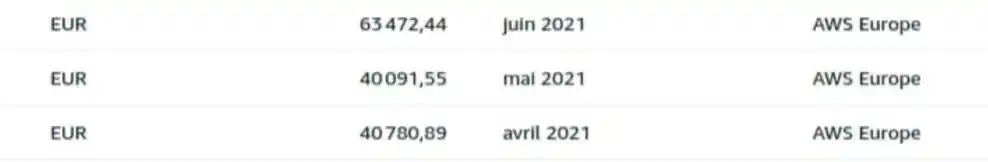

The AWS cost of running this infrastructure was $40,000 to $60,000 per month.

For my brother, operating this infrastructure was a big challenge—he had to start each node on 150 terminals one by one. Remember, we had no employees; it was just the two of us doing everything ourselves.

We had a huge advantage on BSC: on one hand, we had rich experience from Ethereum; on the other, we were willing to invest in infrastructure, setting a high bar for small snipers.

The Memecoin Era on BSC

Now we were fully focused on BSC, sometimes sniping six times a day, with almost no time for normal life—our minds were filled with sniping altcoins. We were always racing against time, spending most of our time preparing for new snipes, with little time to optimize equipment.

I remember many sniping experiences, especially PINKM (Pinkmoon)—due to buy limits, we used 120 wallets to snipe and made $3 million in two hours. The next day, I bought a Lamborghini Aventador SV sports car.

In May 2021, two Launchpads on BSC started gaining popularity, allowing anyone to execute launch transactions. My brother was the first to design and develop a smart contract that could complete both the token launch and buy operation in a single transaction.

In hindsight, this may seem normal, but at the time, no one had done it before. I remember one week when projects on these two Launchpads were extremely hot—we sniped almost every token launched, making seven figures every day for a whole week. One night, I was dining with friends at Nammos restaurant, and my brother messaged me about sniping a project. By the time I got home, we had made another $1 million.

At the end of the month, the BSC market cooled down, and we decided to sell most of our holdings when BNB was around $450.

There were still a few sniping opportunities in June, but the overall market felt quite weak.

The end of this sniping era was actually a relief for us—we were exhausted and really needed a break.

We spent the whole summer traveling and finally got to enjoy life.

An Unexpected Windfall

In August 2021, we were enjoying our summer vacation, barely involved in the crypto market, just doing basic operations. By chance, we discovered that a blacklisted wallet still held some unsold EVN tokens.

At the time, EVN’s price had soared, and the tokens in just this one wallet were worth about $1 million (excluding slippage, according to Etherscan)—and we had more than 20 blacklisted wallets.

We first tried selling $200 worth of tokens on Uniswap, and it worked. We thought, "Wow, maybe we can sell small amounts from each wallet and make a few thousand dollars."

We tried again in the same wallet and made $2,000. We were stunned, feeling that this afternoon could be a big payday.

Then we tried again, selling all the tokens in this wallet: we ended up with 233 ETH (having only spent 2.5 ETH to buy them).

Our adrenaline spiked, and we quickly checked all the blacklisted wallets, selling on Uniswap as fast as possible. Some wallets were still blacklisted, but some had been unblocked—we had no idea why. We sold frantically, watching millions of dollars flow in, like printing money.

For 15 minutes straight, we sold every token we could find and moved all the funds to cold wallets. We originally expected to make $2-3 million, but that summer afternoon, we made $6 million out of thin air.

To this day, we have no idea what happened or why those wallets were unblocked.

That month, we also sold a large amount of ETH earned from sniping when ETH broke $3,000—we felt it was time to lock in profits and achieve financial freedom.

Conclusion

That year was probably the craziest year of our lives. We started with only $40,000, had no understanding of blockchain fundamentals, and didn’t even know Solidity.

In the end, we sniped over 200 altcoins across more than 10 different chains. Experiencing all this with my brother was the greatest honor of my life.

The emotional ups and downs and adrenaline rushes are almost beyond words.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Strategy IPO redefines corporate Bitcoin strategy with euro-denominated offering

Will Ether test the daily resistance at $3,350? Check forecast

Balancer dips below daily resistance level, eyes April 8 low

Altcoins today: Perpetual tokens shed over $2B as ETH slips under $3.5K