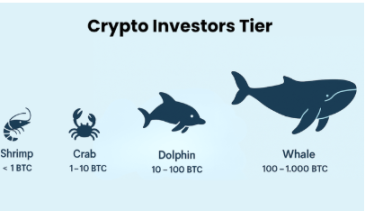

The Secret Script of the Crypto Market: How Whales Manipulate 90% of Traders, and How You Can Stop Being "Liquidity"

In the crypto market, most people lose money not because of poor skills, but because they fundamentally do not understand the rules of the game.

You may think the market is “freely fluctuating,” but in reality, it is a chessboard precisely manipulated by whales and institutional capital.

Understanding “manipulation” is the real dividing line between retail investors and winners.

1. The market is not chaotic, but driven

The market is not the result of random fluctuations.

Whales do not “react” to the market; they create the market.

Retail investors simply follow these fluctuations—therefore, the vast majority are destined to be on the wrong side.

2. Whales’ strategies are simple, repetitive, and covert

Since institutional funds entered the market, their tactics have hardly changed.

They use liquidity and emotional cycles to continuously harvest followers.

As long as you learn to identify these signals, you will no longer be their “liquidity provider.”

3. The standard manipulation cycle of whales

The entire manipulation cycle usually follows four stages:

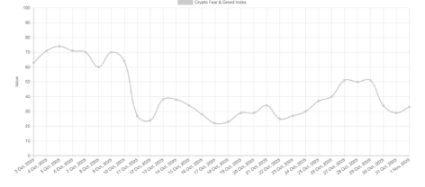

1️⃣ Silent accumulation phase: price moves sideways, low volume, cold sentiment.

2️⃣ Bull trap rally phase: large volume pushes the price up, triggering FOMO (fear of missing out).

3️⃣ Distribution phase: when retail investors rush in, whales start to offload in batches.

4️⃣ Panic dump phase: price crashes, sentiment collapses, whales buy back at low levels.

This play is performed every cycle, just with different tokens and narratives.

4. False breakouts and fake patterns: creating liquidity traps

Whales often deliberately “buy high and sell low” at key positions to create false patterns.

They do not care about technical indicators, but rather guide the public’s psychology.

When “false breakouts” trigger stop-losses and chase orders, they gain massive liquidity,

which becomes the fuel for their next real move.

5. Stop hunting: precisely targeting retail investors’ psychological lines

Big capital knows exactly where every important “stop-loss pool” is.

They only need to create a brief price shock to clear out the entire market in minutes.

This is the so-called “stop hunting”—making you panic and exit, while they accumulate positions.

6. Sideways consolidation: the cruelest psychological warfare

When the price oscillates within a range and repeatedly sweeps orders, there is only one purpose:

to make retail investors lose patience and exit voluntarily.

Once the market is cleared of weak hands, whales can build positions at low cost and drive the next trend.

7. Imbalance Zone: the real clue

When the price quickly passes through a range, it often leaves “untouched areas.”

These “gaps” are places where whales may return to fill in the future.

By analyzing volume distribution and order cluster areas (cluster analysis),

you can judge their next intentions.

8. False breakout ≠ new trend

Many traders get excited and chase long at the moment of a “breakout,” only for the market to reverse within minutes.

That’s when whales are collecting retail stop-loss liquidity.

Remember: in the crypto market, there is no real “support” or “resistance,”

only “emotional checkpoints” that have been designed.

9. Wash trading and fake depth: manipulating attention

“Wash trading” creates fake trading volume,

“spoofing” creates fake depth.

They are not just manipulating prices, but also your attention and reactions.

When you are driven by emotion, you are already in their script.

10. The real rule: whales do not predict, they control

Once you understand these logics, you no longer need to “guess the direction.”

You only need to know:

Do not buy at emotional peaks

Do not blindly add positions at “support”

Do not predict, but wait for confirmation

Because the winner is not the one who reacts fastest, but the one who waits most calmly.

Conclusion:

In this market manipulated by whales, information asymmetry is the norm.

But once you learn to identify “fake moves,” you become an observer instead of prey.

Manipulation will always exist, but being manipulated can be avoided.

Understand the essence of liquidity, the rhythm of emotions, and the structure of the market—

You do not need to become a whale, just stop being their prey.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polymarket, Kalshi Hit Record Volumes as Sports Betting Dominates Prediction Markets

One of Tesla's top ten shareholders challenges Musk's trillion-dollar compensation plan

Ahead of Tesla's annual shareholders meeting, Norway's sovereign wealth fund, with assets totaling 1.9 trillion, has publicly opposed Elon Musk's 100 million compensation package. Musk previously threatened to resign if the proposal was not approved.

Bitcoin falls to its lowest point since June, with the "after-effects" of October's flash crash still lingering!

Multiple negative factors are weighing on the market! Trading sentiment in the cryptocurrency market remains sluggish, and experts had previously warned of a potential 10%-15% correction risk.

"The Big Short" Burry takes action: $1.1 billion short positions target two major AI giants!

The AI stock rally has been targeted by "the Big Short" investor! Scion Asset Management, led by Michael Burry, has made a major shift in its 13F holdings, taking short positions against Nvidia and Palantir. Not long ago, he broke his long silence to warn about a market bubble.