BlackRock’s $213 Million Bitcoin Move Exacerbates Fears of Sub-$100,000 Drop

BlackRock’s $213 million Bitcoin transfer to Coinbase has rattled traders, reigniting fears of a drop below $100,000.

Bitcoin’s latest slide to $103,525 has reignited market jitters, revisiting price levels last seen in June and fueling fears of a deeper drop below $100,000.

The move comes amid renewed selling pressure tied to institutional activity, most notably, BlackRock’s $213 million Bitcoin transfer to Coinbase.

BlackRock’s Move Raises Eyebrows

According to on-chain data, BlackRock moved 2,042 BTC (worth $213 million) and 22,681 ETH ($80 million) to Coinbase on Tuesday during the early hours of the US session.

JUST IN: Blackrock deposits 2,042.8 $BTC ($213.49 million) and 22,681 $ETH ($79.83 million) into Coinbase. pic.twitter.com/LUFu6cG1Kp

— Whale Insider (@WhaleInsider) November 4, 2025

The timing of the transfer has drawn attention from traders watching institutional wallet movements for early signals of potential sell-side activity.

Historically, large transfers from major fund managers to exchanges tend to precede either strategic rebalancing or profit-taking, both of which can weigh on near-term price sentiment.

“Last time they did this, the market dipped soon after. Now with Bitcoin sitting near $104K… is sub-$100K next?” Kyle Doops posed on X.

Adding to market anxiety, Daan Crypto Trades noted persistent outflows from Bitcoin and Ethereum spot ETFs over the past four trading sessions.

“BTC & ETH have seen large ETF outflows the past 4 trading days. This is compounding on the already high selling amounts of OG whales the past few weeks,” Daan wrote.

He cautioned that while ETF outflows are often lagging indicators, they can signal shifts in sentiment, pointing out a recurring cycle pattern.

“…we’ve often seen large outflows near a bottom and inflows near a top… Big outflows plus price refusing to move lower could indicate a local bottom, while big inflows plus price refusing to move higher could indicate a top,” the analyst added.

Against this backdrop, he suggests that Bitcoin’s failure to break sharply lower despite heavy ETF redemptions could imply underlying bid support around the $100,000 region, potentially setting up for a short-term rebound if selling pressure eases.

Bitcoin (BTC) Price Performance. Source:

TradingView

Bitcoin (BTC) Price Performance. Source:

TradingView

Analysts See a Cooling-Off Period

ETF expert Eric Balchunas added broader context, linking Bitcoin’s sluggish price action to wider risk-market fatigue.

“Valuation angst is a good way to put it. SPY is up 83% since the end of ’22… a pullback makes sense, even healthy. Bitcoin sniffed out this pullback — like the way an animal can tell a rogue wave is coming — and that’s why it’s been meh,” Balchunas said.

The ETF analyst also reaffirmed his view that the current phase is a natural “back step” in ETF market development.

We said bitcoin ETFs would grow via two steps fwd and one step back and rn it is back step time. You can see this pattern in IBIT's flows. If anything we due a few steps back given all the steps fwd. Part of process IMO. Only a small child would expect green all day every day. pic.twitter.com/3EGrWIAnCT

— Eric Balchunas (@EricBalchunas) November 4, 2025

Despite the market’s fragility, some traders believe Bitcoin could find stability if buyers defend the $100,000 psychological level, a zone that has repeatedly drawn institutional demand in past dips.

With ETF momentum cooling and macroeconomic uncertainty rising, analysts view the coming days as critical in determining whether this marks a local bottom or a prelude to a deeper correction.

All eyes are on whether BlackRock’s move signals broader institutional rotation, or simply another passing tremor in Bitcoin’s volatile new normal.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

That summer, I sniped altcoins on DEX and made 50 million dollars.

Starting from just $40,000, we ultimately sniped more than 200 altcoins across over 10 different blockchains.

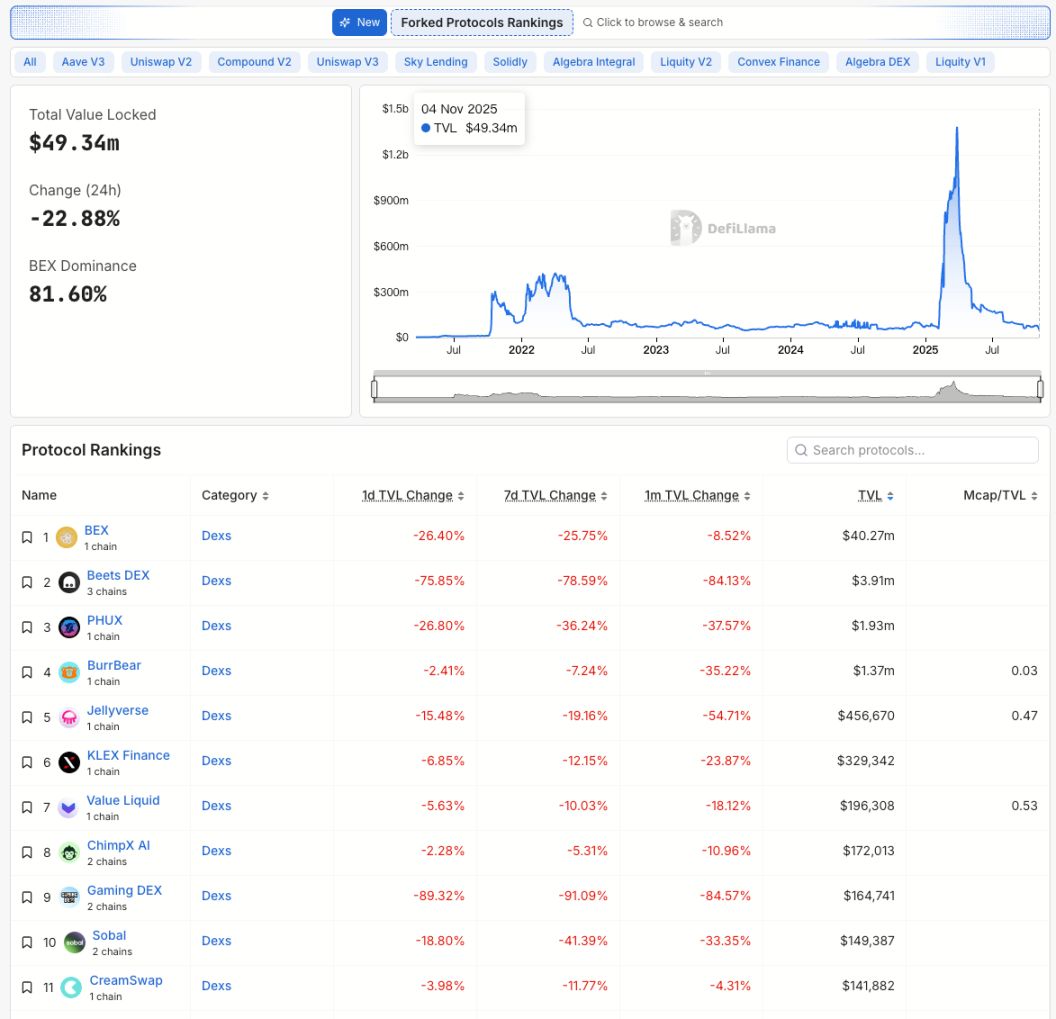

From Balancer to Berachain: When Chains Hit the Pause Button

A single vulnerability exposes the conflict between DeFi security and decentralization.

Berachain: All funds stolen due to the vulnerability have been recovered.

The Butterfly Effect of the Balancer Hack: Why Did $XUSD Depeg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.