Solana Launches On-Chain Native IPOs and Expands Stablecoin Partnerships, Transforming Capital Markets and Liquidity

Quick breakdown:

- Solana Foundation President Lily Liu announced plans to create an “internet capital market” enabling on-chain IPOs, digitizing share issuance via blockchain.

- This innovation aims to increase market liquidity and transparency while bridging finance and crypto.

- Solana also expands its stablecoin presence, collaborating with Franklin Templeton and Western Union to strengthen blockchain in payments and finance.

Solana launches on-chain native IPOs and expands stablecoin partnerships

President of the Solana Foundation, Lily Liu, revealed ambitious plans to revolutionize capital markets by creating an “internet capital market” that facilitates native on-chain initial public offerings (IPOs). This next-generation capital market infrastructure aims to bridge the gap between traditional finance and blockchain technology, offering wider liquidity access, transparency, and faster, cheaper transactions.

At the Finternet 2025 Asia Digital Finance Summit on November 4, Liu emphasized the future of capital markets will be driven by blockchain’s capacity to shorten market access and optimize price discovery. Instead of issuing shares via conventional stock exchanges, companies will tokenize their shares on the blockchain, streamlining the issuance and trading process.

Liu explained that existing on-chain mechanisms can be enhanced to move beyond traditional price discovery models, making the process more transparent while integrating essential compliance measures like Know-Your-Customer (KYC). The innovation extends to distribution methods, offering new efficiencies and wider access to capital market participants.

Solana’s leadership in the $307 Billion stablecoin market

On the stablecoin front, Liu acknowledged the rapid growth and significance of this sector, valued globally at $307 billion. Solana currently hosts $14.25 billion in stablecoins, predominantly USD Coin (USDC), which accounts for nearly 65% of stablecoins on its blockchain.

A notable example of this expansion is Solana’s partnership with Revoult to launch the U.S. Dollar Payment Token (USDPT), an institutional stablecoin powered by Solana’s blockchain infrastructure and issued by Anchorage Digital Bank. This initiative is expected to roll out fully in the first half of 2026, further cementing Solana’s position as a key player in blockchain-based payments and stablecoin solutions.

With these developments, Solana is set to modernize capital markets through blockchain innovation, enabling more transparent, efficient, and inclusive financial systems worldwide.

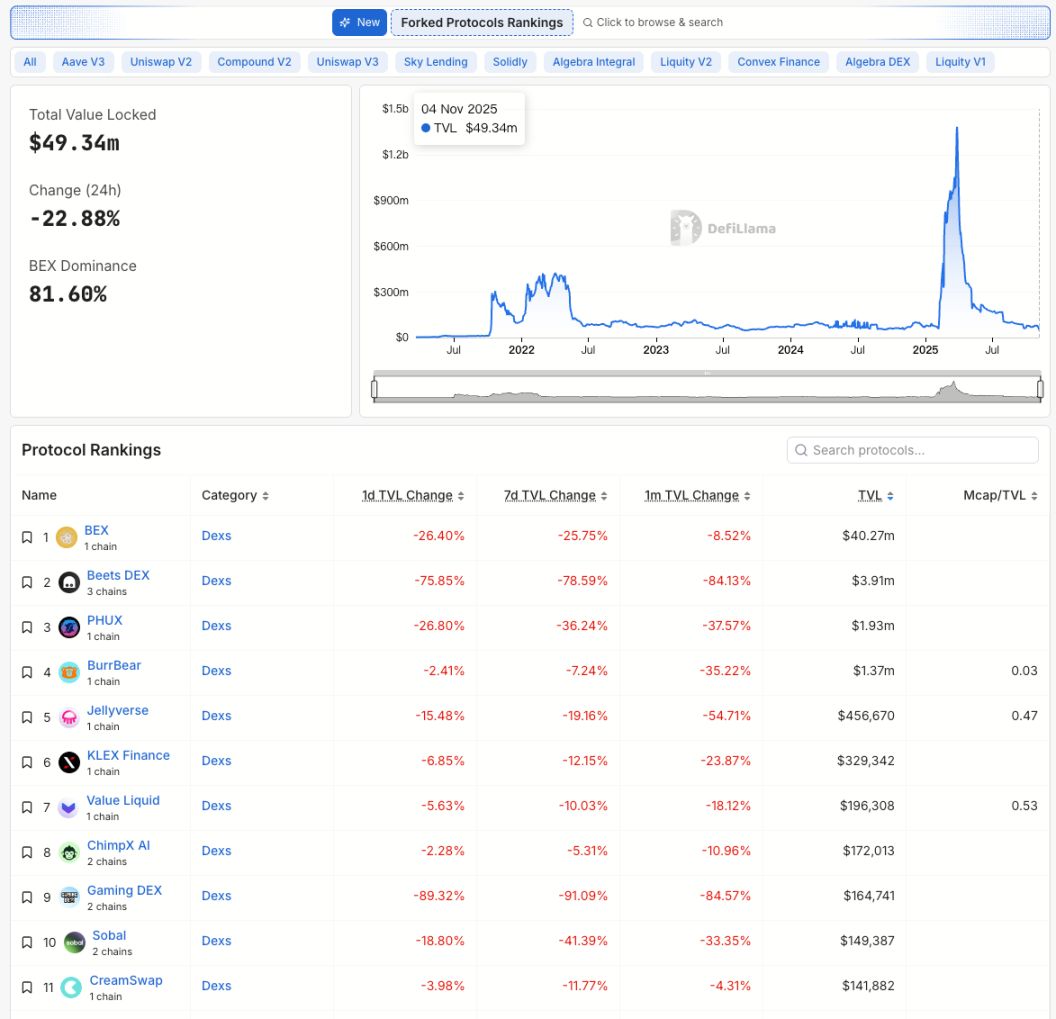

Additionally, Solana’s decentralized exchange (DEX), Jupiter, has launched a beta prediction market in collaboration with Kalshi, a US-regulated prediction market operator. This new market debuted with an event focused on the Mexico Grand Prix, enabling users to place wagers on the winner using a YES/NO trading model, similar to platforms such as Polymarket.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

That summer, I sniped altcoins on DEX and made 50 million dollars.

Starting from just $40,000, we ultimately sniped more than 200 altcoins across over 10 different blockchains.

From Balancer to Berachain: When Chains Hit the Pause Button

A single vulnerability exposes the conflict between DeFi security and decentralization.

Berachain: All funds stolen due to the vulnerability have been recovered.

The Butterfly Effect of the Balancer Hack: Why Did $XUSD Depeg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.