Ethereum Updates: ETH Rebounds from $3,300 While Experts Warn of Potential Drop to $1,700

- Ethereum rebounded above $3,300, ending a three-day decline with a 2.72% gain to $3,859.45, its largest rise since October 2025. - Analysts warn of a potential $1,700 drop by mid-2026 if Ethereum fails to sustain above $3,800, citing weak technical indicators and bearish momentum. - Ethereum ETFs saw $136M in outflows, while broader crypto market volatility and Fed rate uncertainty amplify downward pressure on prices. - Negative MACD and suppressed funding rates reinforce bearish sentiment, with analysts

Ethereum has bounced back above $3,300 in recent sessions, narrowing its 24-hour decline to 8.98% based on the latest figures. The digital asset advanced 2.72% to reach $3,859.45, ending a three-day slide and registering its biggest single-day gain since October 26, 2025, according to TradingView.

Market analysts have responded to these price movements with mixed opinions. Well-known crypto commentator Ali Martinez cautioned that Ethereum could face a "worst-case scenario," potentially dropping to $1,700 by mid-2026 if it fails to reclaim the $4,000 mark, as reported by Yahoo Finance.

Martinez pointed to bearish technical patterns, such as the inability to sustain levels above $3,800. "Should ETH fail to maintain this support, a decline to $2,400 or even $1,700 is possible," he noted, suggesting a potential 46.4% drop from current prices.

Ethereum's challenges are further intensified by significant outflows from spot exchange-traded funds (ETFs), which have heightened institutional caution. According to SoSoValue, Ethereum ETFs saw $136 million in outflows just on Monday, with BlackRock's ETHA accounting for $82 million of that, as reported by FXStreet.

While total net inflows for U.S.-listed ETH ETFs have reached $14.23 billion, the recent trend points to declining interest from both large institutions and individual investors. Retail sentiment has also weakened, with futures open interest (OI) falling to $44.72 billion from a high of $63 billion in October. This reduction indicates that traders are closing long positions and increasingly betting against ETH, adding to the selling pressure.Wider market dynamics are also weighing on prices. The Federal Reserve's recent suggestion that further rate cuts may be postponed has unsettled investors, according to TradingView.

Ongoing speculation—such as rumors involving Wintermute—has further fueled negative sentiment. In addition, spotTechnical analysis continues to indicate a bearish trend. Ethereum's daily chart reveals a negative MACD, and the OI-weighted funding rate remains low at 0.0038%, showing little bullish momentum. Experts warn that unless a major catalyst—such as regulatory progress or increased adoption—emerges, Ethereum may continue to face downward pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

YFI rises 1.75% on NOV 5 2025 During Brief Pullback and Sustained Upward Trend

- YFI surged 1.75% on Nov 5, 2025, but faces 6.51% weekly/monthly declines and a 44.94% annual drop. - Market remains volatile short-term yet retains long-term bullish momentum from multi-year trends. - Mixed technical indicators show daily RSI recovery but weekly oversold conditions and positive MACD divergence. - A backtest strategy evaluates YFI's rebound potential after 10% single-day drops using 2022 historical data.

Bitcoin Bloodbath: BTC Price Plunges Below $100K as Whales Vanish and Traders Brace for More Selloff

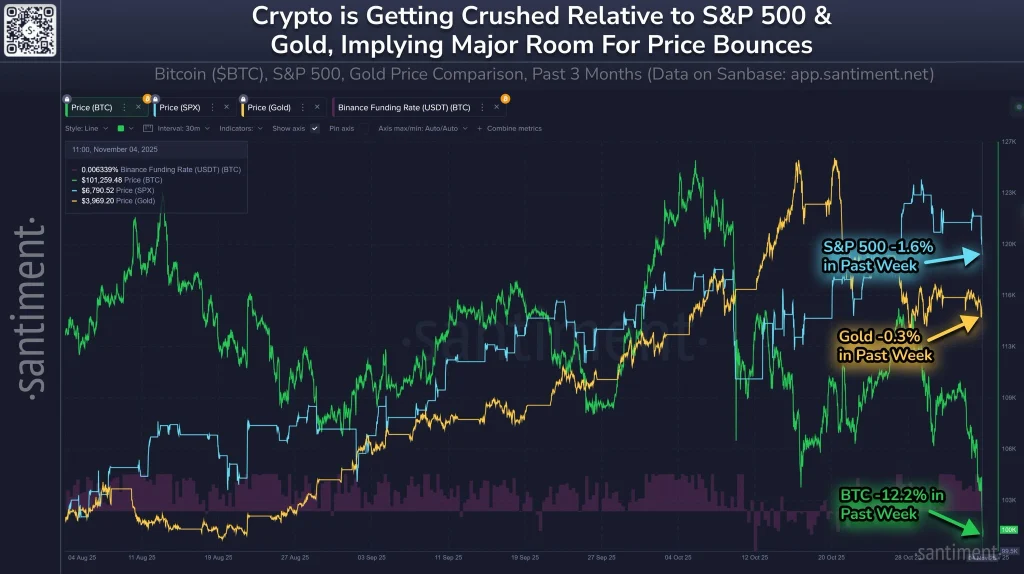

Crypto Get Crushed Relative to Gold and S&P 500, Santiment Predicts a ‘Rubber-Band’ Rebound