Only 0.2% of traders can exit at the bull market peak: The art of "smart exits" in the crypto cycle

In the crypto market, everyone thinks they can sell at the very top.

The reality is—49.9% of people exit too early, and 49.9% exit too late.

Only that 0.2% manage to achieve a “precise exit” at the right moment.

Why? Because they don’t operate on intuition, but on systematic strategies.

① The market ultimately has cycles, and emotions will always backfire

The ups and downs of the crypto market follow cyclical patterns.

But most people are confident they can “feel the top,” only to be swayed by greed or fear.

When the market overheats, intuition fails—only systematic analysis and a preset exit plan

can allow you to exit safely before the bubble bursts.

② Emotion is the biggest enemy of retail investors

Two typical mistakes from the last bull market:

Selling too early out of fear of losing profits.

Selling too late due to being addicted to the fantasy of getting rich.

Both mindsets are essentially emotional decisions.

Top traders, on the other hand, rely on structured strategies and disciplined execution.

③ The two core questions of an exit strategy

You must answer in advance:

When to exit?

How to exit?

Fortunately, we already have enough historical data and tools to guide the answers.

④ BTC Extreme Oscillator: Market Overheat Alert

When this indicator reaches a reading of 3, it has almost always signaled a cycle top in history.

Currently, the indicator is still in the safe zone,

which means the market may still have one last sprint left.

But the alarm bell is far from silent.

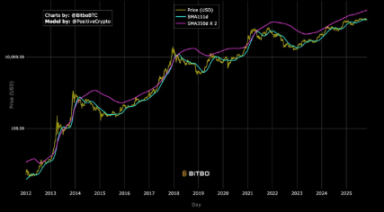

⑤ Pi Cycle Top: The Most Famous Top Signal

When the 111-day moving average crosses above the 350-day moving average,

it has historically marked the bull market top.

Currently, no crossover has occurred—meaning there is still room for growth,

but once the two lines start to converge, it’s time to start planning your exit.

⑥ MVRV Bands: Profit-Taking Pressure Zone

This indicator measures the ratio of investors’ average holding cost to the current price.

When it enters the upper band, it means a large amount of capital is starting to take profits.

It doesn’t necessarily mark the top, but is often the last warning before the top.

⑦ The Right Way to Exit: Layered Selling, Not “Betting on the Top”

Most people wait for the “perfect top” to exit,

but as a result—there’s a 99% chance they’ll miss it.

The correct approach is to reduce positions in stages (Scale-out).

When the market is still strong and sentiment is still greedy, gradually realize profits.

This locks in profits while retaining some positions in case of a “final surge.”

⑧ Sell When Others Are Greedy

The core logic of layered exits:

While others are still chasing highs, you are quietly taking profits.

This way, even if the market suddenly changes, you can keep your footing.

At the same time, keep a small amount of chips to participate in the final climax, ensuring psychological balance.

⑨ Set Clear Exit Prices and Signals

Set multiple price target ranges and cross-validate them with the indicators mentioned above.

When market sentiment enters extreme greed,

that’s the signal for “smart money” to start exiting in batches.

You should quietly exit when the masses are entering.

⑩ Real Winners Never Rely on Luck

Whether it’s the top, a correction, or a pump,

everything always happens when you least expect it.

The market rewards those who are prepared—

not those who fantasize about the perfect timing.

Conclusion:

Real profits are not the numbers in your wallet,

but the gains you have already realized.

The top is not something you can sense by intuition, but something you can plan for with discipline.

The 0.2% who can exit precisely,

rely not on luck, but on calmness, systems, and a preemptive action plan.

Want to join the “0.2% club”?

From now on, make your exit strategy part of your investment plan.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin May Face "The Last Drop": The Real Scenario of Liquidity Squeeze Is Unfolding

Bitcoin may be in the "final drop" stage of this correction. At the intersection where fiscal spending resumes and the next interest rate cut cycle begins, a new liquidity cycle will also be restarted.

Galaxy Research Report: What Is Driving the Rise of the Doomsday Vehicle Zcash?

Regardless of whether ZEC’s price strength can be sustained, this round of market rotation has successfully forced the market to reassess the value of privacy.

Asian stock markets plunge with circuit breakers triggered; Korea hits circuit breaker during trading, Nikkei falls below the 50,000 mark

Wall Street warns: This is just the beginning, and the panic triggered by the bursting of the AI bubble has only just started.

Ripple launches a crypto prime brokerage service dedicated to institutional investors!