Don't panic, the real main theme of the market is still liquidity.

Such pullbacks are not uncommon in a bull market; their purpose is to test your conviction.

Original author: @RaoulGMI

Translation: Peggy, BlockBeats

Editor's Note: When the market is gripped by panic, liquidity tightens, and asset rotation loses momentum, being bullish often seems out of place. This article offers a contrarian perspective: if global liquidity remains the dominant macro variable, then the restart of the debt refinancing cycle could trigger the next "liquidity flood." This is a game of time and patience—after the "pain," it may just be the starting point for renewed growth.

The following is the original text:

The Main Plot of the Market

I know, almost no one wants to hear a bullish view right now.

The market is in panic, and everyone is blaming each other. But the road to "Valhalla" is actually not far away.

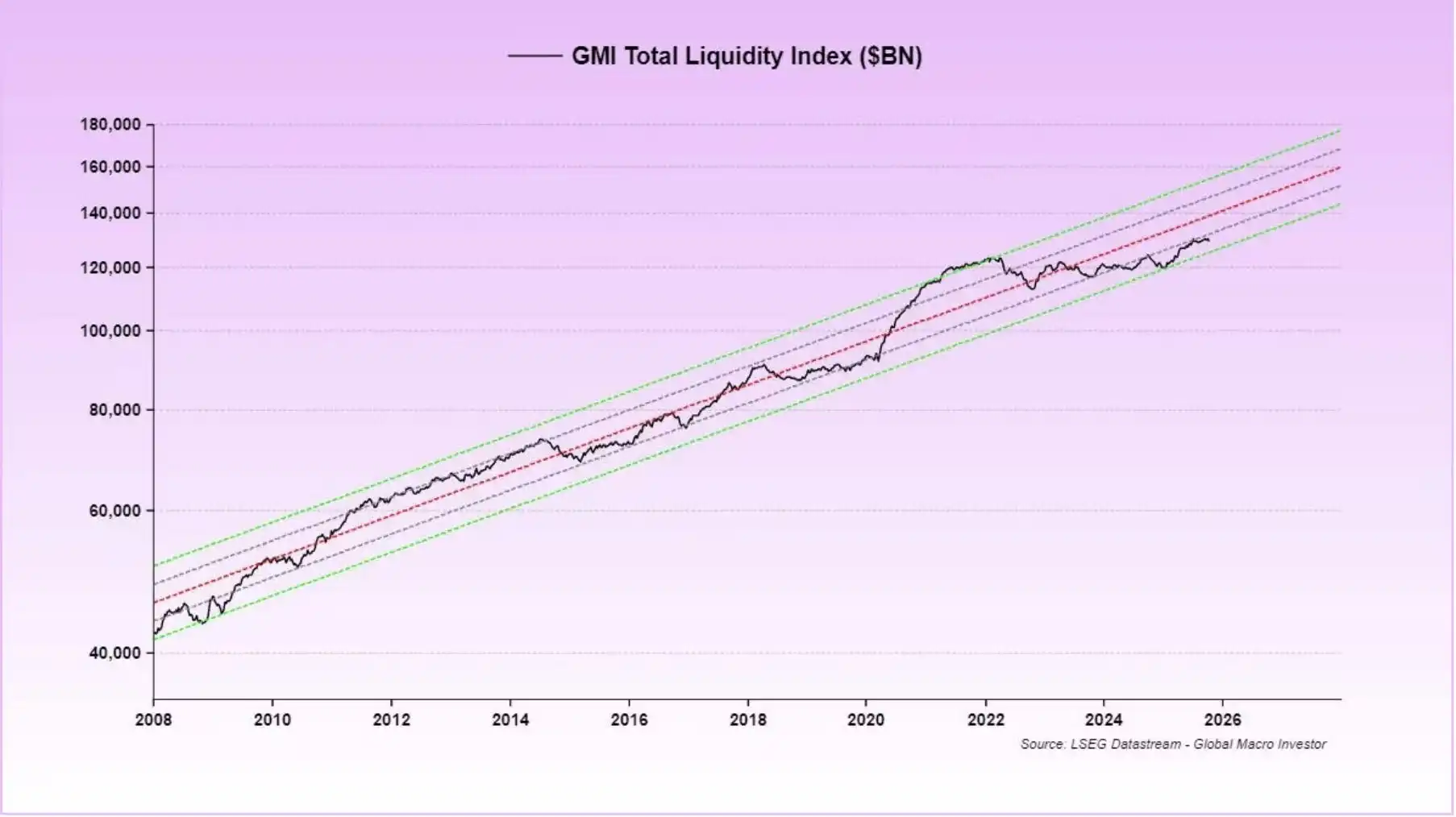

If global liquidity is the most decisive macro factor at present, then the only thing we should focus on is it.

Remember! The real main plot of the market now is the rolling refinancing of $10 trillion in debt. Everything else is a side story. The game for the next 12 months revolves entirely around this point.

Currently, due to the government shutdown, the Treasury's TGA account is rapidly accumulating cash with nowhere to spend it, causing liquidity to tighten sharply. This cannot be offset by reverse repo (since that liquidity has already been drained), and quantitative tightening (QT) is further sucking liquidity out.

This directly hits the market, especially crypto assets, which are most sensitive to liquidity.

This year, traditional asset management institutions have generally underperformed benchmarks, marking their worst performance in recent years. Now they are forced to "chase the rally" passively, making tech stocks perform more steadily than crypto assets. Inflows from 401K funds have also provided some support.

But if this liquidity drought lasts longer, the stock market will also struggle to avoid a downturn.

However, once the government shutdown ends, the US Treasury will resume spending $250 billion to $350 billion within a few months, quantitative tightening will stop, and the balance sheet will nominally expand again.

As liquidity returns, the dollar may weaken again.

Tariff negotiations will also come to an end, and policy uncertainty will gradually dissipate.

Meanwhile, continued issuance of government bonds will inject more liquidity into the market through banks, money market funds, and even stablecoin systems.

Next, interest rates will continue to be cut. The economic slowdown caused by the shutdown will become the reason for rate cuts—but this does not mean a recession.

On the regulatory front, adjustments to the SLR (Supplementary Leverage Ratio) will free up more space on bank balance sheets, supporting credit expansion.

The "CLARITY Act" is also expected to pass, providing the much-needed regulatory framework for banks, asset management institutions, and enterprises to adopt crypto assets on a large scale.

And that "Big Beautiful Bill" will further boost the economy, creating a strong growth environment for the 2026 midterm elections.

The entire system is being restructured toward one goal: a strong economy and a booming market in 2026.

Meanwhile, China will continue to expand its balance sheet, and Japan will strive to support the yen and launch fiscal stimulus.

With falling interest rates and dissipating tariff uncertainty, US manufacturing activity (ISM index) will also rebound.

So, the key now is: get through this "Window of Pain."

On the other side of it lies a "liquidity flood."

Always remember the old rule: don't mess it up.

Be patient and ride out the volatility.

Such pullbacks are not uncommon in a bull market; their purpose is to test your conviction.

If you have the capacity, buy the dip.

TD;DR (In a Nutshell)

When this number (the liquidity index) rises, all other numbers will rise with it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why does bitcoin only rise when the US government reopens?

Is the US government shutdown the main culprit behind the global financial market downturn?

Crypto "No Man's Land": Cycle Signals Have Emerged, But Most People Remain Unaware

If the crypto market of 2019 taught us anything, it's that boredom is often the prelude to a breakout.

Arthur Hayes Dissects Debt, Buybacks, and Money Printing: The Ultimate Cycle of Dollar Liquidity

If the Federal Reserve's balance sheet expands, it will be positive for US dollar liquidity, ultimately driving up the prices of bitcoin and other cryptocurrencies.

What is RaveDAO and why are we doing this?

We are building a new cultural layer, a cultural ecosystem belonging to Web3, where technology, music, and people are brought together once again.