Crypto Whales Switch Sides: What Do They Know That the Market Doesn’t?

After over $1 billion in liquidations wiped out long positions, key crypto whales are taking the opposite side—opening new longs that test market sentiment and hint at possible recovery plays.

The crypto market decline has punished traders who were betting on further upside, wiping out over $1 billion in long positions.

Yet, a handful of high-profile crypto whales are taking a contrarian stance, opening new long positions despite the broader sell-off.

Crypto Market Carnage Wipes Out Long Positions

that the crypto market’s downturn has deepened in recent days, with $1.38 billion in long positions wiped out in just 24 hours. The sudden sell-off has left investors divided over what comes next.

Even seasoned traders haven’t escaped the fallout. Trader 0xc2a3, once boasting a perfect 100% win streak, has now seen his fortunes take a sharp turn.

According to on-chain analytics platform, 0xc2a3 closed all Bitcoin (BTC) longs and sold portions of Ethereum (ETH) and Solana (SOL) longs at steep losses. The trader’s total portfolio swung from over $33 million in gains to more than $26 million in losses.

“After losing $44.67 million on his long positions…..trader 0xc2a3 has flipped bearish. He just opened a 25x short on 8,562.84 ETH ($28.3 million),” Lookonchain added.

Machi Big Brother() has been fully liquidated again!His account balance is now down to just $1,718.

— Lookonchain November 4, 2025

Top Crypto Whales Make Contrarian Bets Amid Market Chaos

Despite broad losses, several traders on Hyperliquid have shifted direction, possibly signaling new sentiment among experts. Lookonchain identified “0x9263” as a key contrarian.

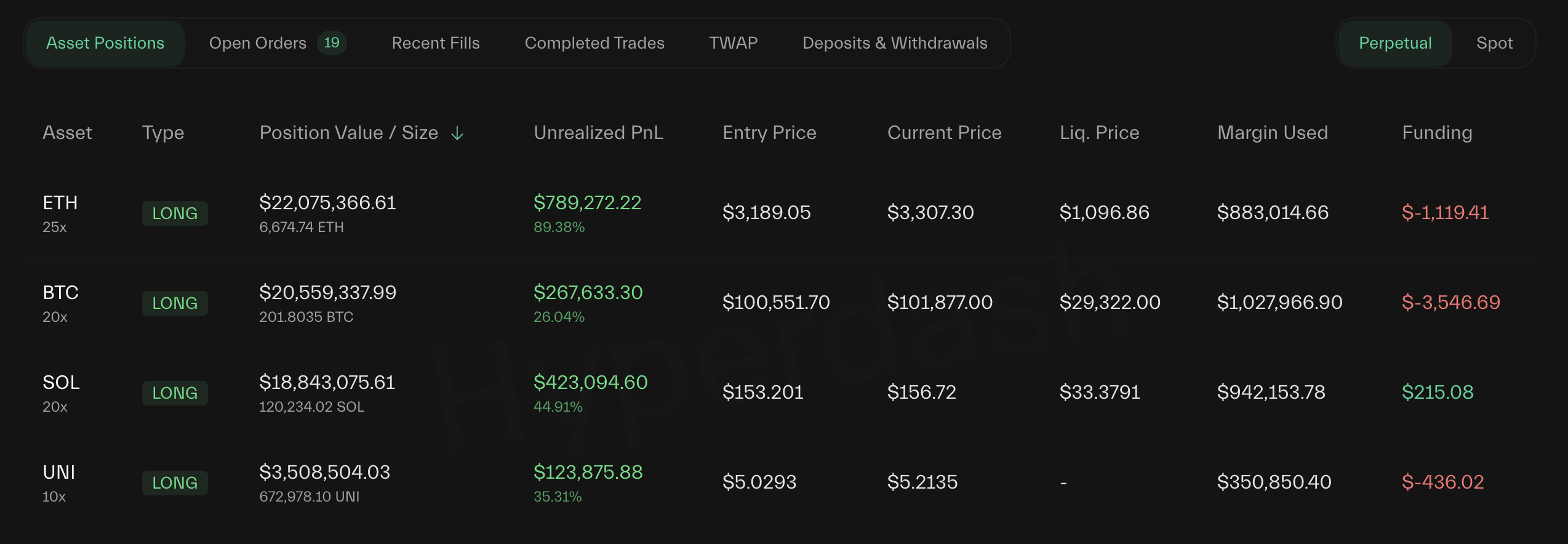

After closing 20 profitable trades since October and generating a $23.7 million profit, 0x9263 closed all shorts and moved to open long positions in Bitcoin, Ethereum, Solana, and Uniswap.

HyperDash data showed that his open positions are currently yielding an unrealized profit of around $1.6 million. The crypto whale’s win rate stands at 73.73%.

Crypto Whale’s (0x9263) Open Long Positions. Source:

Crypto Whale’s (0x9263) Open Long Positions. Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC breaks $102,000

U.S. Elections 2025: Democrats’ Big Wins Challenge Trump’s Pro-Crypto Agenda

India to Launch ARC Token Stablecoin Backed by Government Securities