Crypto markets are entering a new segment of growth, and whilst Ethereum (ETH) remains a powerhouse in decentralized finance and Web3, buyers are beginning to look somewhere else for higher ability returns in 2025. With Ethereum’s growth maturing and Layer-2 competition closing the overall performance gap, analysts believe the next technology of excessive-ROI assets will come from emerging ecosystems offering faster scalability, real international use instances, and early-degree upside. Among those leading this shift are Ozak AI, Solana, and XRP—3 projects uniquely located to outperform Ethereum’s pace inside the coming year.

While Solana and XRP are mounted leaders in community speed and economic integration, Ozak AI sticks out as a subsequent-generation artificial intelligence blockchain project merging predictive analytics and decentralized automation—a combination that analysts say should deliver significant gains as soon as it hits essential exchanges.

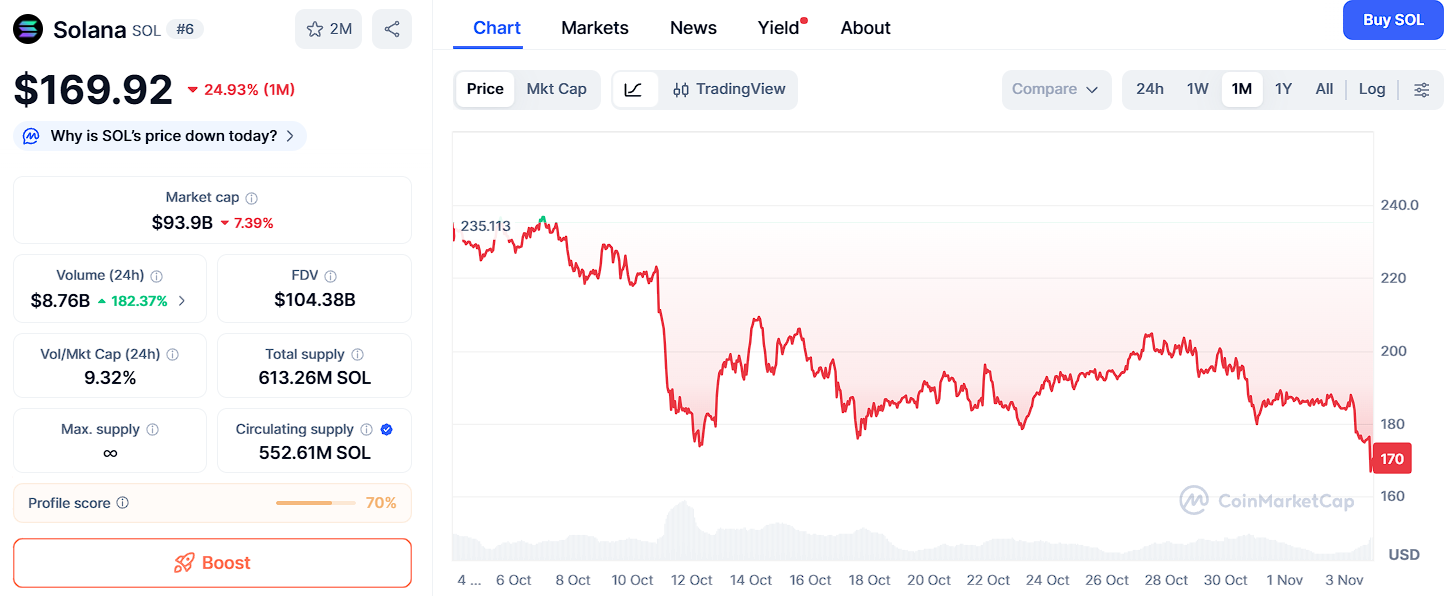

Solana (SOL)

Solana, trading around $160, has re-emerged as one of the top-performing altcoins in 2025. Its attraction lies in unequaled transaction velocity and developer-friendly infrastructure, making it the go-to platform for DeFi, NFTs, and Web3 gaming. Solana’s low charges and rapid affirmation times preserve the ability to draw tasks in search of Ethereum-stage security at a fraction of the cost.

From a technical view, Solana faces resistance close to $172, $185, and $200, with assist tiers at $148, $136, and $120. A breakout above $185 could force momentum toward its long-term goal of $500, especially as institutional investors diversify into Layer-1 alternatives.

However, while Solana’s growth prospects are solid, it has already achieved significant market penetration. The higher risk–reward ratio now lies in emerging projects like Ozak AI, which possess disruptive potential.

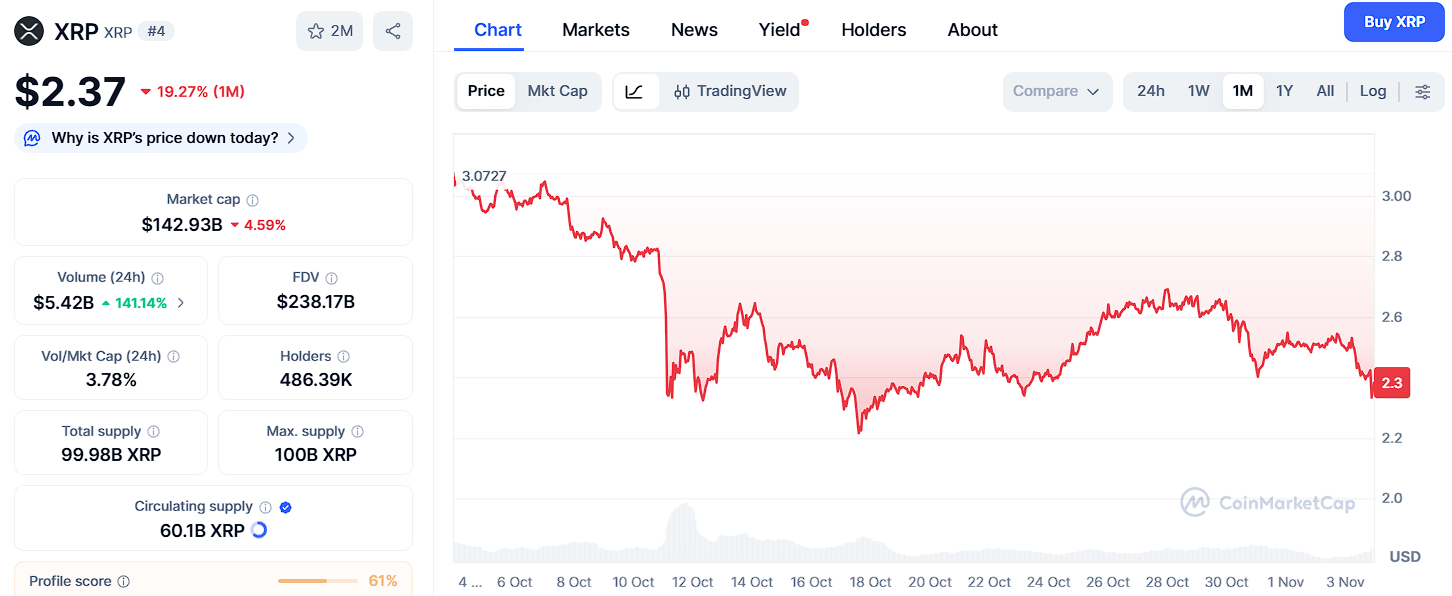

XRP

XRP, currently priced at $2.30, is another asset that could outperform Ethereum’s ROI in 2025, especially as Ripple Labs continues to solidify partnerships with banks, payment providers, and fintech companies worldwide. XRP’s use case in cross-border settlements has never been stronger, as regulatory clarity finally paves the way for institutional expansion.

On the technical front, XRP shows resistance around $2.45, $2.70, and $2.95, with support at $2.10, $1.95, and $1.80. A clean move above $2.70 could set up a run toward the $5 psychological mark—a milestone that has long been anticipated by the XRP community.

Yet, as a mature large-cap token, XRP’s potential gains are likely capped at 3×–5×. For traders chasing exponential upside, early-stage innovation projects like Ozak AI provide a better asymmetrical opportunity.

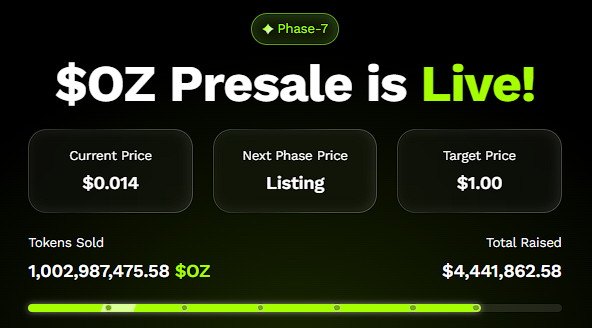

Ozak AI: The Disruptor at the Intersection of AI and Blockchain

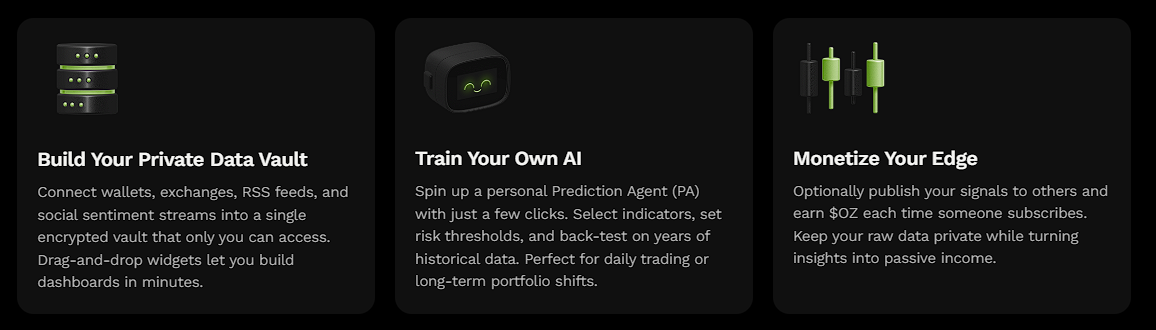

Ozak AI is redefining crypto innovation by merging artificial intelligence with blockchain precision. Its AI prediction agents analyze sizeable amounts of market facts, social sentiment, and on-chain behavior in real time, allowing customers to count on tendencies before they materialize. This predictive energy transforms how investors interact with crypto markets—making choices based totally on intelligence, no longer hypothesis.

Backed by partnerships with Perceptron Network, HIVE, and SINT, Ozak AI is establishing a powerful AI data ecosystem that combines real-time analytics, decentralized computation, and cross-chain integration.

In addition, Ozak AI’s CertiK and Sherlock audits confirm its commitment to security and transparency—two qualities that distinguish it from speculative projects. At its current valuation, Ozak AI presents significant potential as a new player in the market.

The Next Generation of Crypto Winners

Ethereum stays a cornerstone of the crypto space; however, its upside is obviously restrained by using scale and maturity. The future belongs to quicker, greater green, and extra innovative networks—and that’s where Ozak AI, Solana, and XRP come in.

Solana’s speed and ecosystem depth, XRP’s global financial integration, and Ozak AI’s AI-driven predictive capabilities together represent the new wave of high-growth assets. But among them, Ozak AI offers the most asymmetrical potential—combining early-stage accessibility with revolutionary technology.

As investors prepare for the 2025 bull market, these three cryptos stand out as the ones most likely to outperform Ethereum—with Ozak AI leading the charge toward the next era of intelligent, high-ROI blockchain innovation.

About Ozak AI

Ozak AI is a blockchain-based crypto project that offers a technology platform that focuses on predictive AI and superior statistics analytics for economic markets. Through machine learning algorithms and decentralized community technology, Ozak AI allows real-time, accurate, and actionable insights to help crypto lovers and companies make the ideal decisions.