Bitget Daily Digest (Nov 06) | Monad Plans to Launch Mainnet and Native Token MON on November 24; U.S. Government Shutdown May Delay Crypto Market Structure Legislation Until 2026

Today's Outlook

- Axioma Token (AXT) will unlock approximately 18.33 million tokens on November 7, 2025, at 00:00, valued at about $22.68 million;

- Openverse Network (BTG) will unlock approximately 3.87 million tokens on November 7, 2025, at 00:00, valued at about $66.11 million;

- Omni Network (OMNI) will unlock approximately 11.4 million tokens on November 7, 2025, at 00:00, valued at about $33.09 million.

Macro & Hot Topics

- Japan becomes the 11th country to support Bitcoin mining with official resources;

- Multiple whales have scooped up nearly 400,000 ETH over the past 3 days, with total purchases exceeding $1.36 billion;

- U.S. government shutdown may delay crypto market structure legislation until 2026;

- The EU will introduce a new digital currency regulatory framework by year-end, granting ESMA greater cross-border oversight powers, creating a "European SEC" and boosting crypto financial competitiveness;

- U.S. spot Bitcoin ETFs saw a net outflow of $135.94 million yesterday;

- JPMorgan CEO Jamie Dimon: We are heading into an economic recession with credit implications, though the exact timing is unclear.

Market Trends

- BTC and ETH rebound modestly after sharp pullbacks, with market sentiment shifting to extreme fear; liquidations totaled about $46.06 million in the past 4 hours, primarily longs;

- U.S. stocks closed higher on Wednesday, with the Dow up 0.48%, Nasdaq up 0.65%, and S&P 500 up 0.37%; AI sector rebounds, boosted by better-than-expected jobs data;

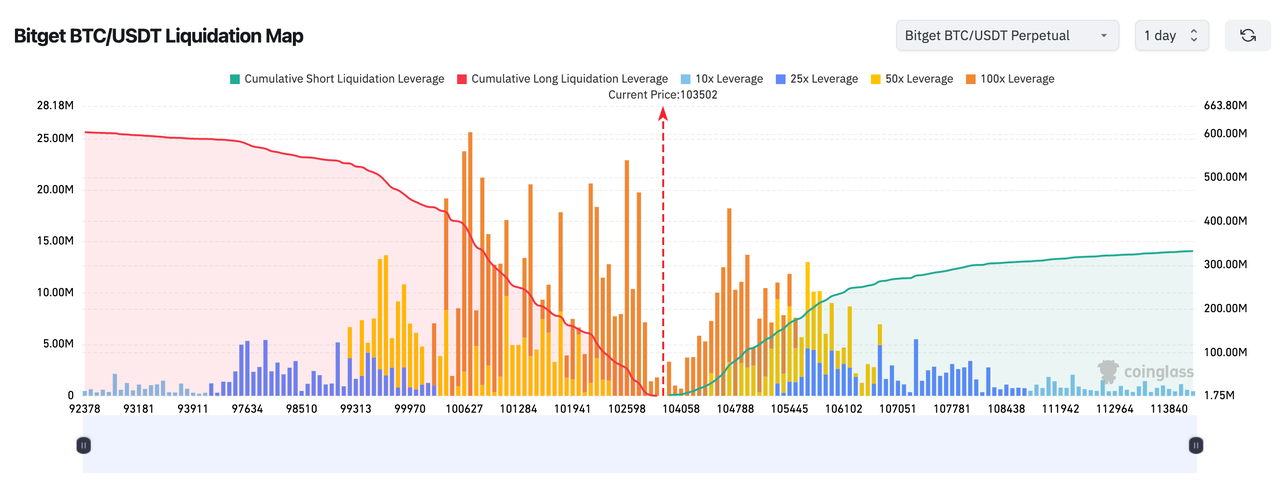

3.Bitget BTC/USDT liquidation heatmap shows high-leverage long liquidations clustered around the current price of 103,502; a breakdown could trigger further cascading, so watch for sharp volatility in the short term;

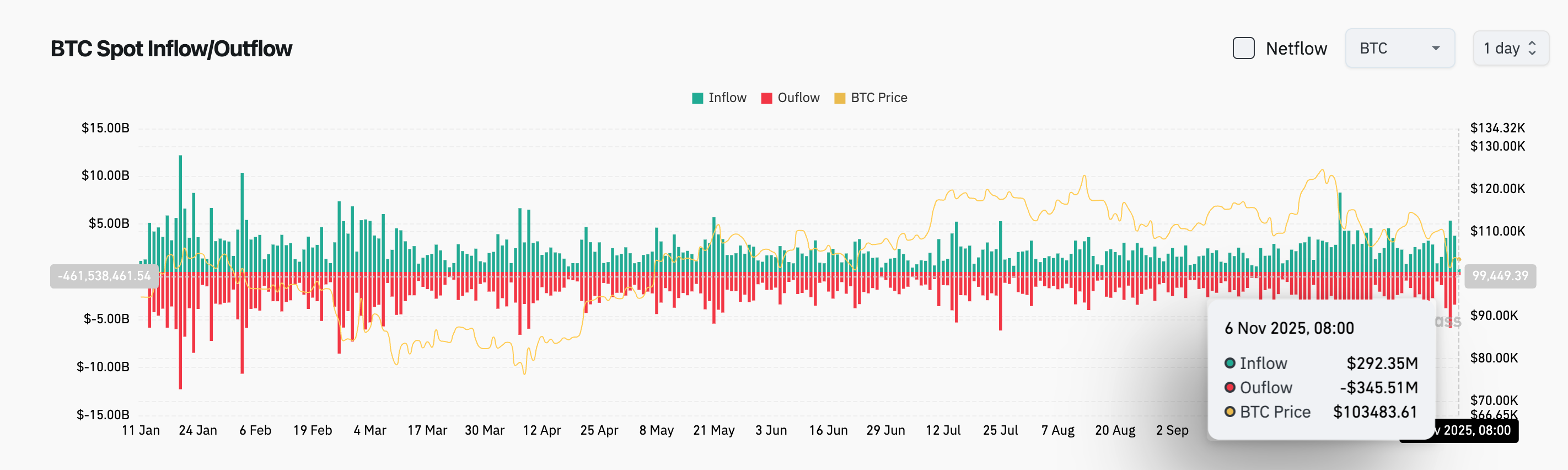

4.In the past 24 hours, BTC spot inflows were $293 million, outflows $346 million, resulting in a net outflow of $53 million;

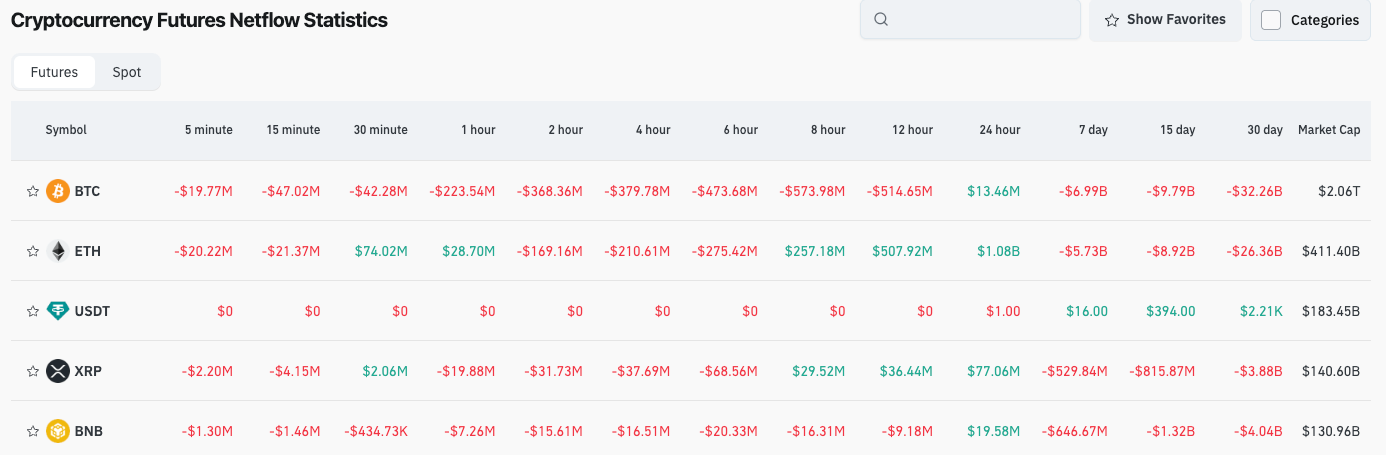

5.Over the past 24 hours, contracts for BTC, ETH, USDT, XRP, BNB, and others led in net outflows, potentially presenting trading opportunities.

News Updates

- Franklin Templeton launches Hong Kong's first AI-driven tokenized fund;

- Bloomberg: Ripple President Monica Long says the company has "no IPO plans or timeline at this time";

- A user lost aBasUSDC after signing a malicious permit, with cumulative losses exceeding $300,000;

- Gemini is preparing to enter the prediction markets, with related contracts pending CFTC approval, expanding its financial product lineup.

Project Developments

- MOVA launches native token and MOVA Liquid derivatives protocol;

- MegaETH announces public sale allocation strategy, with community identified for about 25% USD allocation;

- Folks Finance will launch native token FOLKS on November 6, with an initial release of 25.4% supply;

- Monad plans to release its L1 mainnet and native token MON on November 24;

- Ripple stablecoin RLUSD market cap surpasses $1 billion;

- Tuttle applies for "Crypto Blast" single-stock ETF, aiming to combine put spreads with crypto ETFs;

- Wall Street Journal: OpenAI CFO says OpenAI is not preparing for an IPO;

- Kamino announces an additional $10 million in PT-eUSX deposit capacity;

- Chainlink partners with Dinari to bring S&P crypto stock indices on-chain;

- Folks Finance will open FOLKS airdrop claims today.

Disclaimer: This report is generated by AI, with human verification solely for informational accuracy, and does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Federal Reserve keeps cutting interest rates, so why does the crypto market continue to decline?

The Federal Reserve's ongoing interest rate cuts continue to inject liquidity into the market, which should, in theory, boost the prices of risk assets. However, why does the crypto market continue to decline? In particular, why did BTC experience a significant breakdown yesterday? This article will explore the underlying reasons and present key observation indicators.

10x Research Warns Of Bearish Setup For Ethereum