Why Internet Computer’s (ICP) 100% Rally Might Just Be Getting Started

The Internet Computer’s ICP token has doubled in a week amid mounting on-chain accumulation and investor optimism, suggesting its breakout may reflect lasting confidence in projects with real utility.

The Internet Computer protocol’s native token, ICP, has appreciated by approximately 100% in the past week. The coin has outperformed the broader market, which has dipped 4.3% in the same time frame.

The rally appears to be fueled by core sentiment shifts, clear signs of on-chain accumulation, and a renewed appetite for altcoins that offer real utility, suggesting that ICP’s upward momentum may still have room to run.

ICP Token’s Rally May Not Be Over Yet: Here’s Why

BeInCrypto Markets data showed that ICP’s rally comes even as the token has surged this month, reaching an 8-month high on November 4.

Over the past day, the altcoin has risen by 17.6%. At the time of writing, ICP traded at $6.02.

Internet Computer (ICP) Price Performance. Source:

Internet Computer (ICP) Price Performance. Source:

Investor sentiment toward ICP has been largely positive, with data showing that around 86% of traders hold a bullish view. Supported by strong sentiment along with on-chain and technical signals, these factors suggest that ICP’s upward trend may continue if current market conditions persist.

1. Fundamentals and Utility Driving Renewed Interest

ICP’s breakout comes amid a broader market recalibration. In late 2025, investors appear to be refocusing on projects with solid fundamentals, moving away from speculative, narrative-driven trends.

This is reflected in the recent rallies of privacy-focused assets such as Zcash (ZEC) and Dash (DASH). This trend signals a renewed focus on long-term value rather than short-term momentum.

“ICP is finally entering the phase everyone doubted it would ever reach…It’s the only blockchain that can run end-to-end internet services fully on-chain…The setup feels like early 2017 for ETH. Undervalued tech, misunderstood by most, quietly being accumulated by smart money. When the next wave comes, ICP won’t just run. It’ll remind everyone what real tech looks like,” an analyst noted.

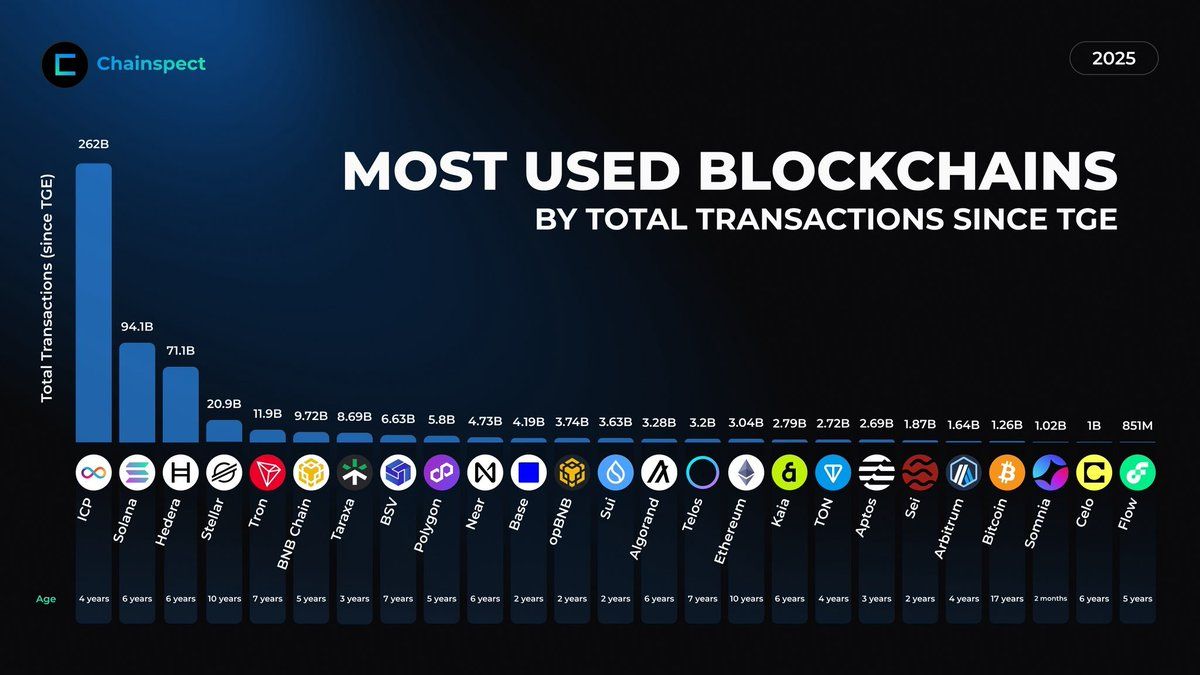

On-chain data further highlights the network’s established utility. The Internet Computer blockchain has processed over 262 billion transactions since its Token Generation Event (TGE), surpassing Solana’s 94.1 billion and Hedera’s 71.1 billion. This positions ICP as the leading blockchain by total transactions since inception.

ICP Ranks First in Total Blockchain Transactions Since TGE. Source:

ICP Ranks First in Total Blockchain Transactions Since TGE. Source:

2. On-Chain Accumulation and Exchange Balance

Data from indicate a notable change in ICP’s supply dynamics. Over the past month, exchange reserves have dropped by 31.4%. At the same time, the top 100 wallet addresses have increased their holdings by about 30%.

This trend typically indicates less selling pressure and increased confidence among large holders. Moving tokens from exchanges typically involves long-term positioning, as opposed to short-term trading.

3. Technical Signals

Lastly, market analysts are turning to technical charts that suggest ICP could continue its rally. Some have even drawn parallels to Zcash, noting that ICP could rise in a manner similar to ZEC.

Notice anything similar on the $ZEC and $ICP charts?After ZEC's initial surge, it Darth Mauled (exacerbated further with the $20b liquidation)… ICP just Darth Mauled yesterday. ZEC is currently 3.5x that price point in 3 weeks.We are going SO MUCH HIGHER

— The Crypto Professor (@TheCryptoProfes) November 5, 2025

Furthermore, other market watchers foresee ICP reaching a valuation of $10, a level last seen in January 2025.

“Current signals suggest that the real bullish movement is yet to come. The structure is improving, volumes are increasing, and the price is starting to regain key levels: elements that indicate that this is no longer just a technical rebound, but a major pump,” a trader added.

What is evident is that ICP’s rally is based on more than market excitement. Drops in exchange balances, increased top-address holdings, and price performance all indicate strong demand.

Whether this leads to a sustained rally or only a short-term spike depends on ICP’s ability to maintain investor interest and the broader market sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Signs Potential Mid-Cycle Bottom As Fear Grips the Market

The "Black Tuesday" for US stock retail investors: Meme stocks and the crypto market plunge together under the double blow of earnings reports and short sellers

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Crypto Market Macro Report: US Government Shutdown Leads to Liquidity Contraction, Crypto Market Faces Structural Turning Point

In November 2025, the crypto market experienced a structural turning point. The U.S. government shutdown led to a contraction in liquidity, pulling about 20 billions USD out of the market and intensifying capital shortages in the venture capital sector. The macro environment remains pessimistic.

Market volatility intensifies: Why does Bitcoin still have a chance to reach $200,000 in Q4?

Institutional funds continue to buy despite volatility, targeting a price level of $200,000.