Institutional Outflows Hit Bitcoin and Ether ETFs as Solana Demand Accelerates

US digital asset ETFs came under pressure this week as institutional traders shifted to a more cautious stance. Bitcoin and Ether products recorded sharp outflows, while Solana funds continued to draw steady interest. Activity suggested uneven sentiment across major crypto assets as markets reacted to recent volatility.

In brief

- Bitcoin ETFs logged over $2B in weekly outflows, marking their second-worst streak as institutional investors turned cautious.

- Ether ETFs saw nearly $1.2B leave in six days, with BlackRock’s ETHA driving the bulk of redemptions as volatility rose.

- Despite broader weakness, issuers like Fidelity and Ark continued attracting inflows, showing uneven market sentiment.

- Solana ETFs bucked the trend with a seventh day of inflows, signaling rising demand for alternative Layer-1 exposure.

Bitcoin ETFs Suffer Second-Worst Outflow Run on Record With $2B Pulled

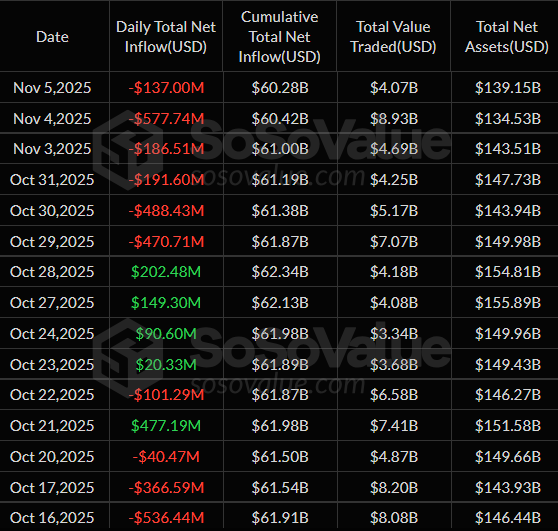

U.S.-listed Bitcoin ETFs have now logged more than $2 billion in withdrawals since Oct. 29, marking their second-worst outflow streak on record. Another $137 million left the group on Wednesday, extending redemptions to a sixth straight session.

According to SoSoValue, BlackRock’s IBIT carried the heaviest load, with $375.49 million lost after a small 0.20% decline on the day. Even so, several issuers managed to bring in fresh capital despite wider market pressure.

Key points shaping the current Bitcoin ETF trend include:

- Outflows surpassed $2.04 billion over the past week.

- Tuesday marked the heaviest session, with $566 million withdrawn.

- Fidelity’s FBTC and Ark’s ARKB continued to attract steady inflows.

- Total net assets for all Bitcoin ETFs still stand at $139.15 billion.

Fidelity’s FBTC attracted $113.30 million in new allocations , even with a slight 0.13% dip. Ark & 21Shares’ ARKB added $82.94 million, while Bitwise’s BITB drew $16.97 million. VanEck’s HODL brought in $3.68 million, and Grayscale’s BTC product collected $21.61 million, although GBTC itself recorded no flows.

Combined ETF activity now represents 6.72% of Bitcoin’s market value, with cumulative net inflows totaling $60.28 billion. Only the late-February sell-off—when weekly outflows topped $3.2 billion—has produced larger losses.

Redemptions Intensify Across Ether ETFs While Solana Attracts Steady Demand

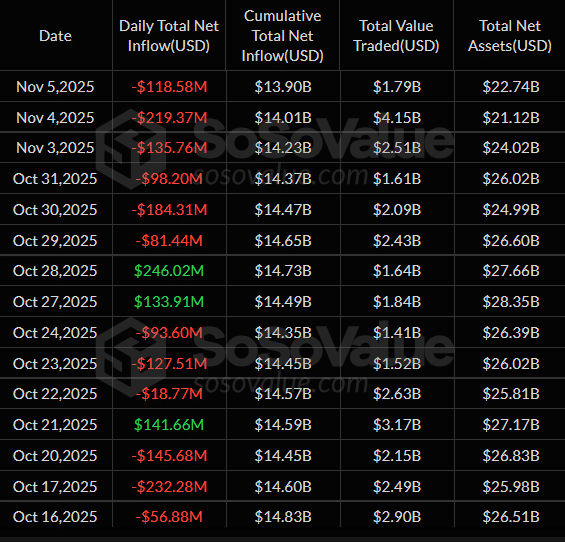

Similar to Bitcoin, selling pressure also intensified in the Ether ETF category as investment exits on Wednesday touched $118.5 million. BlackRock’s ETHA mainly drove this outflow with $146.61 million in redemptions. Notably, this marked the sixth consecutive session of withdrawals, with nearly $1.2 billion exiting Ether products in that span.

Other issuers posted more balanced activity, as Fidelity’s FETH posted $3.45 million in inflows despite the broader selling pressure. Grayscale’s ETH product brought in $24.06 million as it traded at a small premium.

Meanwhile, 21Shares’ TETH added $518,680. All other Ether ETFs, including ETHE and ETHW, saw no movement on the day. Even with the latest selling wave, cumulative inflows for all Ether ETFs still total more than $13.9 billion.

Broader market behavior produced several meaningful signals:

- Bitcoin and Ether ETF outflow streaks now stretch six sessions.

- BlackRock’s IBIT and ETHA remain the primary sources of redemptions.

- Secondary issuers continue to draw new capital despite wider pullbacks.

- Discounts and premiums shifted as traders focused on liquidity moves.

- Demand for alternative assets strengthened, led by Solana.

Solana ETFs again broke from the pattern seen in BTC and ETH products. Funds tied to SOL added $9.7 million on Wednesday, marking a seventh straight day of inflows. Net additions since launch have now reached $294 million, supported by renewed interest in alternative Layer-1 assets during a volatile market phase.

Total ETF trading volume reached $4.07 billion, reflecting ongoing institutional engagement even as redemptions picked up. Despite recent outflows, long-term inflows remain strong across major crypto ETF categories, and investor participation continues to expand year over year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Current Correction: At the End of the “Four-Year Cycle,” Government Shutdown Intensifies Liquidity Shock

A Citi report indicates that the liquidation event in the crypto market on October 10 may have damaged investors' risk appetite.

Bitcoin Price Stalls Below $105K Amid Heavy Selling and Pending Tariff Ruling

36 Days of Shutdown in the USA: The Crypto Bill Threatens to Derail for Good

Render (RENDER) Holds Key Support — Could This Pattern Trigger an Upside Breakout?