Bitget Daily Digest(Nov 29)|All Major U.S. Stock Indices Closed Lower; Next Year’s FOMC Voters Emphasize Inflation Risks and Oppose Further Rate Cuts; 72 out of Top 100 Tokens Down More Than 50% from All-Time Highs

Today's Outlook

- The SEC is expected to make a decision on Grayscale’s Polkadot (DOT) ETF application by November 8, 2025.

- 72 out of the top 100 cryptocurrencies by market capitalization are down more than 50% from their all-time highs.

- Circle has submitted comments to the U.S. Treasury on the implementation of the GENIUS Act.

Macroeconomics & Hot Topics

- Deribit: Over $5 billion in Bitcoin and Ethereum options are set to expire this Friday.

- The USDC Treasury saw 10 minting and burning transactions exceeding $50 million each in the past 12 hours.

- Next year’s FOMC voting members emphasize inflation risks and oppose further rate cuts.

Market Trends

- BTC and ETH are consolidating in the short term as market sentiment remains cautious and leans towards fear. Around $563 million in liquidations occurred in the past 24 hours, mainly long positions.

- All three major U.S. stock indices closed lower: the Dow fell 0.84%, the Nasdaq plunged 1.90%, and the S&P 500 dropped over 1%.

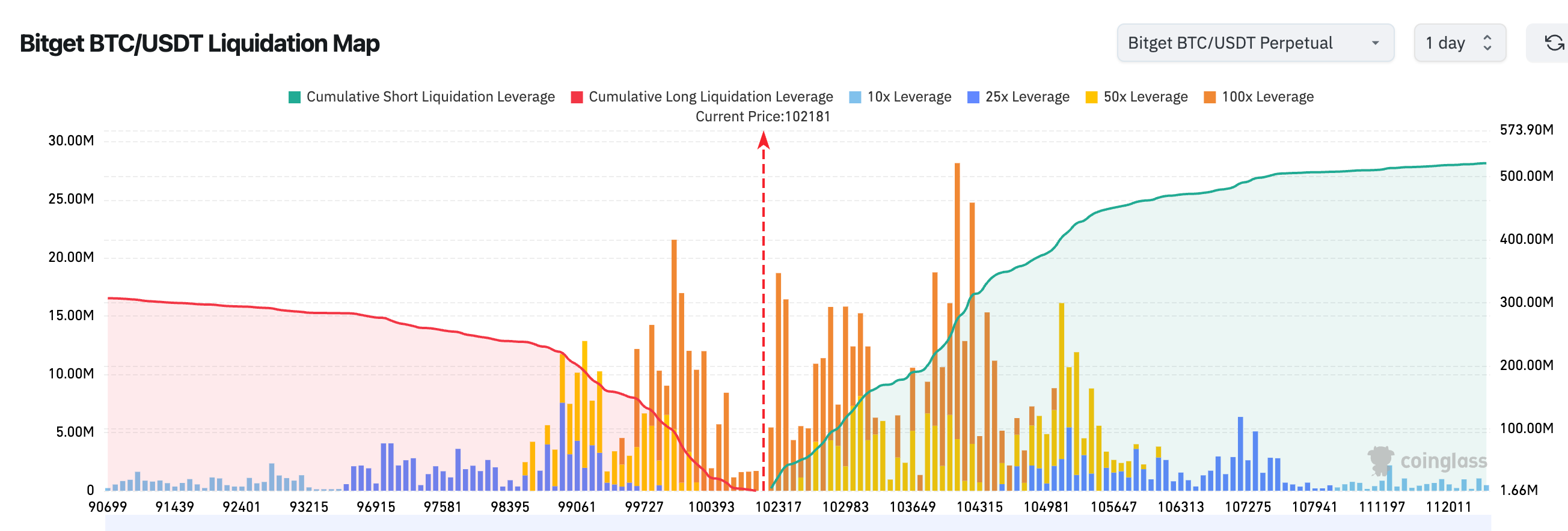

3.According to Bitget’s BTC/USDT liquidation map, BTC is currently priced at $102,181 USDT. There is a concentration of short liquidations in the 101,057 - 102,389 range. A breakdown below this range could trigger a chain reaction of liquidations and significantly increase short-term risks.

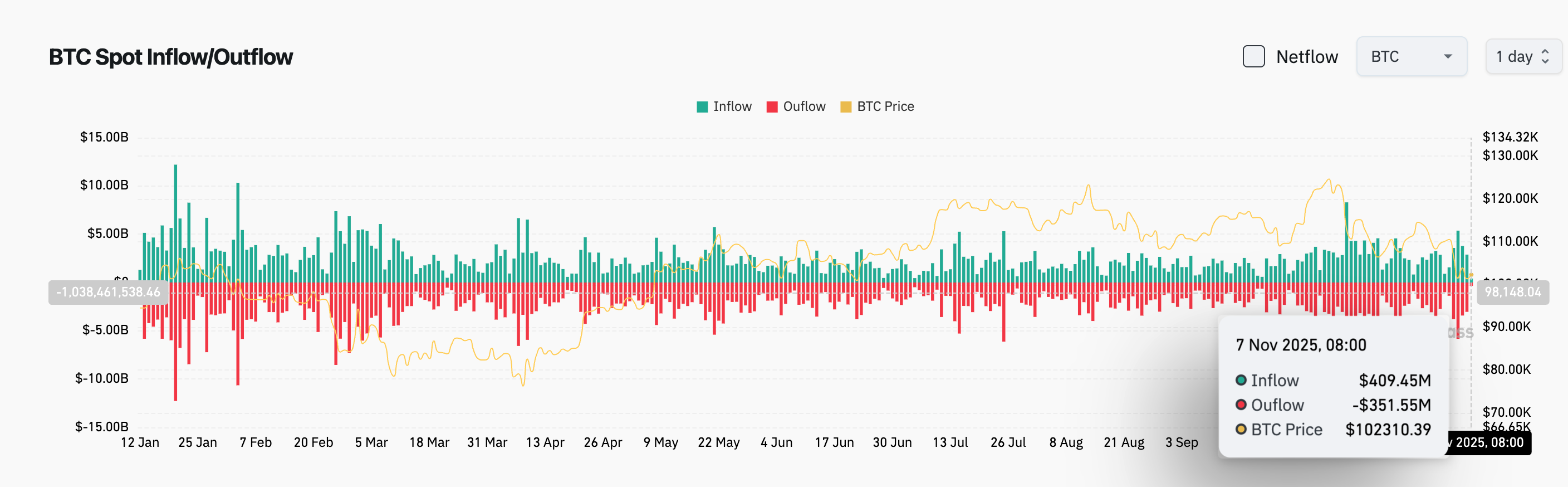

4.In the past 24 hours, BTC spot inflows reached $409 million, outflows were $351 million, for a net inflow of $58 million.

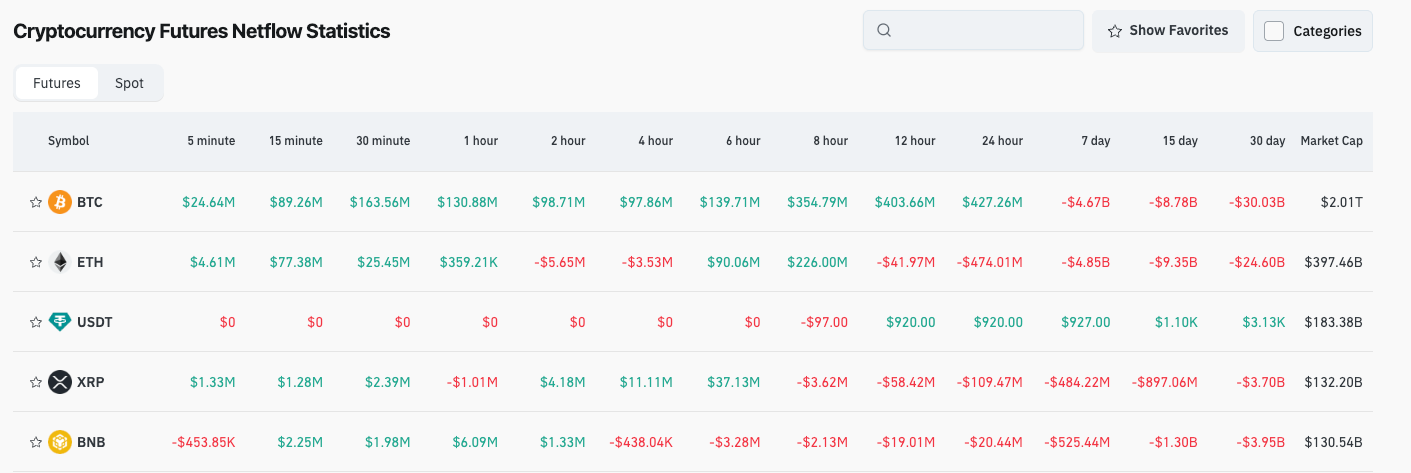

5.Over the last 24 hours, derivatives trading in BTC, ETH, USDT, XRP, and BNB saw net outflows. It's recommended to continue monitoring major cryptocurrencies for potential trading opportunities.

News Updates

- Elon Musk: SpaceX should become a publicly traded company.

- Block posted nearly $2 billion in Bitcoin revenue in Q3, accounting for almost one-third of its total revenue.

- Google will integrate prediction data from Kalshi and Polymarket into Google Finance.

- OpenAI CEO: Does not seek "government guarantees" for its data centers; annualized revenue is expected to surpass $20 billion by the end of this year.

Project Developments

- Credit Blockchain: Launched an AI-driven intelligent financial platform, combining AI with blockchain innovation.

- Ondo Finance appoints former McKinsey executive Ian De Bode as President.

- Aave founder: Gauntlet has suspended Compound withdrawals.

- Aerodrome: Major system upgrades to be released, including Slipstream V2 and Autopilot.

- Folks Finance: Native token FOLKS officially launched on November 6 with an initial circulation of 25.4%.

- Cipher issues $1.4 billion in high-yield bonds to fund Google-related data center construction.

- ORE mining program is now available on the Solana Mobile dApp Store for Seeker users.

- Berachain: Plans to launch a claims page for fund returns early next week and may execute an additional hard fork.

- ZachXBT collaborates with BNB Chain to strengthen Web3 security infrastructure.

- Hourglass: Adjusts Stable pre-deposit activity limits, clarifies KYC and settlement times.

Disclaimer: This report is AI-generated and has been manually verified for accuracy. It does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

YFI rises 2.69% amid technical momentum and latest corporate funding news

- Edgewater Wireless (TSX-V: YFI) issued 595,026 shares to settle $0.05-$0.075/share debt obligations, triggering a 2.69% 24-hour price surge. - The move aligns with Q3 2025 market trends but reflects YFI's specific capital restructuring rather than broad sector momentum. - Technical analysis shows short-term rebound within a 12-month -38.58% downtrend, raising trader interest near key resistance levels. - Equity-based debt settlement conserves cash but dilutes shareholders, prompting backtesting of tradin

ALGO experiences a 3.75% decrease over 24 hours as business news presents a mixed outlook

- Light AI (ALGO) shares rose 3.75% in 24 hours but fell 51.21% annually amid mixed business updates. - Q3 2025 results showed $2.2M operating expenses (excluding non-cash items) and $3.4M share-based compensation surge. - The company prioritizes AI diagnostic software development, with R&D expenses at $1.2M and expected completion by late 2025. - Technical analysis combines VWAP and RSI divergence to model price responses to operational metrics and business updates.

The Federal Reserve's Change in Policy and Its Unexpected Effects on Solana's Price Fluctuations

- Fed's October 2025 rate cut triggered sharp crypto sell-offs, with Solana (SOL) breaching $180 amid bearish technical indicators. - Macroeconomic uncertainty from ambiguous Fed guidance amplified volatility, exposing crypto's interdependence with central bank policy. - AWS outage and ETF inflows worsened liquidity imbalances, highlighting crypto infrastructure fragility during macro shocks. - Solana's 0.9 correlation with gold and -0.2 with S&P 500 signals growing macroeconomic integration of crypto asse

Bitcoin Gains 0.42% Amid Whale Short Positions and Tether Purchases

- Bitcoin rose 0.42% in 24 hours to $101,748.87, but fell 7.93% weekly amid whale shorts and macroeconomic fears. - A top bearish whale secured $12.99M profit from consecutive Bitcoin shorts, holding $124M in contracts at $111,499 avg entry. - Tether boosted Bitcoin holdings by 961 BTC ($97.34M), now holding 87,290 BTC ($8.84B) as part of its long-term bullish strategy. - Market uncertainty deepened with $2B Bitcoin ETF outflows and a 14% put-call ratio, prompting RSI-based backtesting for potential revers