Research Report|In-Depth Analysis and Market Cap of Aria Protocol (ARIAIP)

Bitget2025/11/07 10:41

By:Bitget

I. Project Overview

Aria Protocol is a blockchain infrastructure project focused on the tokenization of real-world intellectual property (IP) assets. Its core objective is to bring commercially valuable IP—such as music copyrights, film and media content, and other cultural properties—on-chain in the form of

IPRWA (Intellectual Property Real-World Assets). These assets represent income-generating IP rights that can be traded, owned, and distributed on a decentralized platform.

Developed by

Aria Protocol Labs Inc. and governed by the

Aria Foundation, the protocol aims to transform traditionally centralized revenue streams—long dominated by record labels, copyright funds, and media conglomerates—into transparent, fractionalized digital assets. Through this model, Aria seeks to establish a

“cultural asset liquidity market” where IP rights become accessible and investable for a wider audience.

The core value proposition of Aria Protocol lies in enabling high-value IP—especially music copyrights with stable cash flow—to be tokenized and traded on-chain. Historically, royalty income has been controlled by a small group of industry players; Aria’s IPRWA structure opens this asset class to everyday investors. By tokenizing royalty streams such as music streaming revenue, licensing income, and publishing shares, Aria lowers participation barriers and brings transparency to a sector that has long lacked it.

In addition, Aria introduces the idea of

“Programmable IP”, allowing usage rights, licensing rules, and derivative works (e.g., remixes) to be automated through smart contracts. This improves efficiency in copyright management and supports the creation of a new on-chain creator economy. Through on-chain programmability, Aria aims to solve long-standing issues in the IP market—poor liquidity, high entry thresholds, opaque revenue distribution—and lay the foundations for a global cultural IP liquidity ecosystem starting with music.

Positioned at the intersection of

IP asset tokenization and RWA (Real-World Assets), Aria Protocol intends to become the infrastructure and primary issuance platform for cultural assets on-chain, rather than a conventional “music NFT” project. Compared to traditional music royalty funds, Aria enhances liquidity and accessibility; compared to mainstream RWA protocols, it focuses on cultural IP rather than credit, real estate, or government-backed instruments; compared to decentralized music platforms such as Audius, Aria differentiates itself by targeting

cash-flow-generating music rights rather than non-yielding content NFTs.

The IP-RWA vertical is still in its early stages, with limited direct competition. Aria’s differentiation offers early-mover advantage, but copyright complexity and market education remain challenges. Ultimately, the project’s success will depend on its ability to acquire verified IP assets, maintain transparent revenue structures, execute its tokenization model at scale, and establish a trusted market standard for cultural IP assets.

II. Project Highlights

Aria brings real-world intellectual property (IP) on-chain through fractionalized tokenization, beginning with music assets. This opens revenue-generating IP—previously inaccessible to retail investors—to a broader market. The project’s early focus on

music royalties + revenue distribution leverages one of the most mature and transparent IP asset classes, providing a practical starting point for adoption. Its

Programmable IP and remix-economy vision introduces smart-contract-based licensing and automated revenue splits for derivative works. If fully realized, this could transform IP from a passive royalty asset into an active, composable on-chain economy. Aria benefits from strong brand/IP visibility, with access to well-known catalogs and cultural assets, giving the project significant market recognition.

As a new category of RWA, IP tokenization introduces a fresh narrative that blends cultural assets, revenue sharing, and blockchain liquidity—positioning Aria as one of the more differentiated projects in the RWA ecosystem.

III. Market Valuation Outlook

With a leading position in the IP-RWA segment and a clear roadmap toward real asset integration, Aria Protocol has become a notable project in Web3’s cultural asset tokenization landscape. The total token supply is 1 billion, with an initial circulating supply of approximately 333 million. Tokens support governance and revenue distribution across the ecosystem. To date, the project has raised over

$15 million across seed and strategic rounds, with a fully diluted valuation (FDV) of roughly

$120 million. As narratives around RWAs continue to gain momentum, Aria Protocol is well-positioned to emerge as a foundational layer for IP asset tokenization.

IV. Token Economics

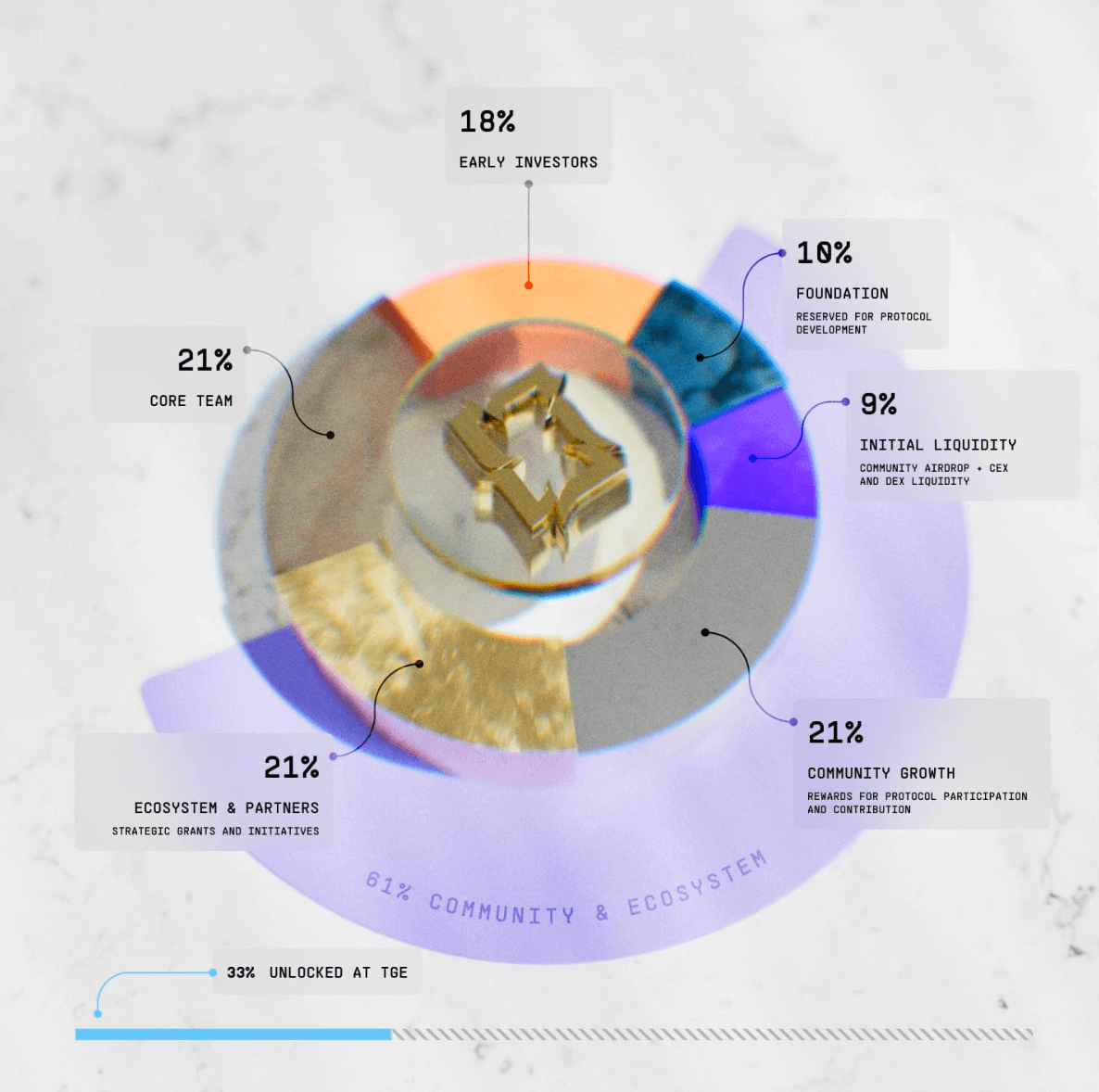

Total Supply: 1,000,000,000 $ARIAIP

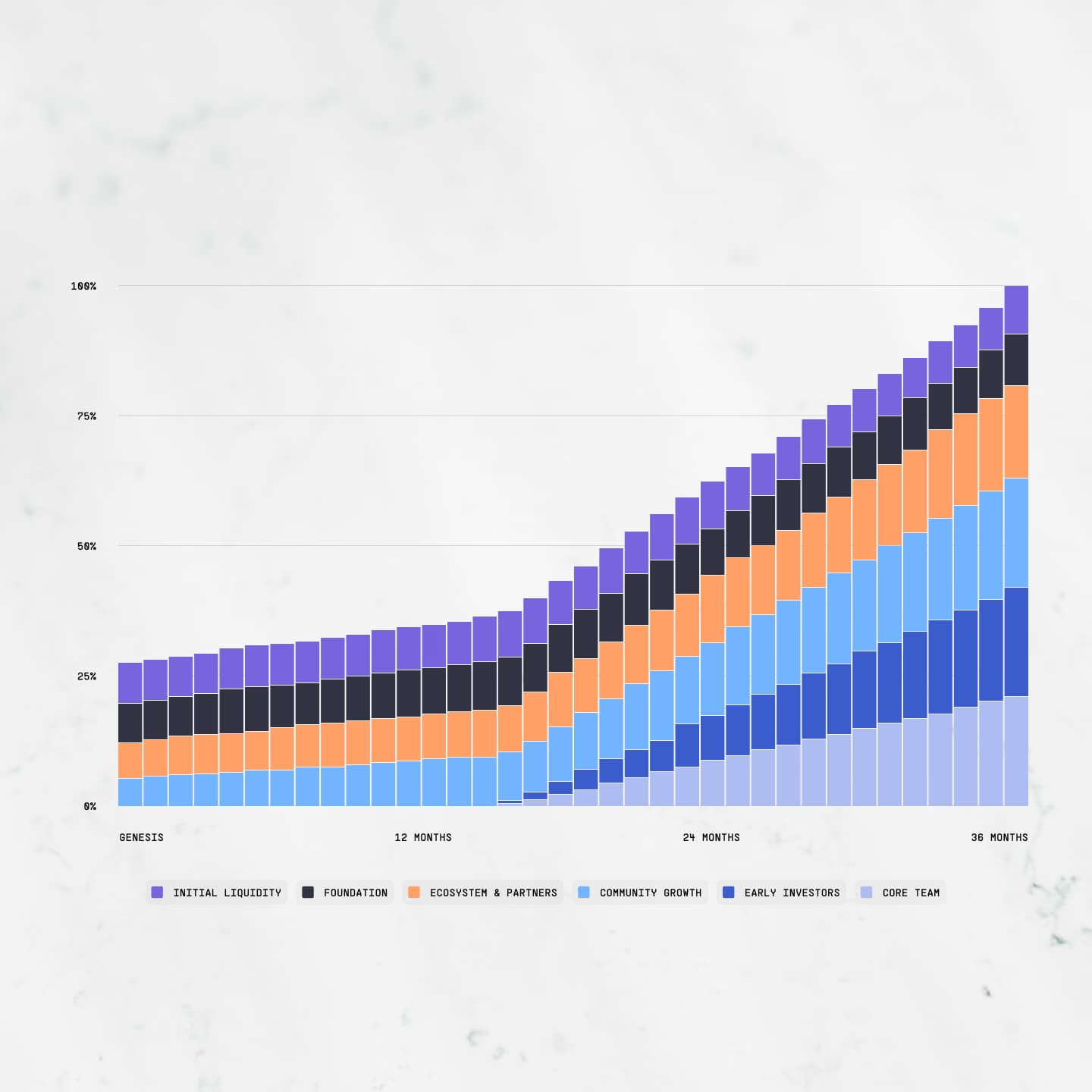

Core Team: 1-year cliff, then 20% unlocked, followed by 2-year linear vesting (approx. 3-year full vesting).

Community Growth (21%): 33% unlocked at TGE; remaining tokens vested linearly over 3 years.

Ecosystem & Partners (21%): 33% unlocked at TGE; remaining tokens vested over 3 years.

Early Investors (18%): 1-year lock, then 20% unlock; remaining vested linearly over 2 years (approx. 3-year full vesting).

Foundation (10%): 100% unlocked at TGE.

Initial Liquidity (9%): 100% unlocked at TGE.

In total,

33% of the ARIAIP supply unlocks at TGE, with the remainder following structured multi-year vesting.

Token Utility

Governance participation through proposals and voting

Ecosystem incentives: liquidity mining, airdrops, and community growth support

Liquidity provision on decentralized exchanges

Royalty-sharing and staking rewards tied to IP revenue streams

V. Team & Funding Information

Led by

Co-Founder and Chief IP Officer David Kostiner, Aria Protocol Labs Inc. and the Aria Foundation jointly oversee the project’s technology development, governance, and IP compliance strategy. The core team focuses on bringing iconic IP catalogs on-chain and integrating with the broader

Story Protocol ecosystem.

Aria has raised a total of

$14.8 million across seed and strategic rounds, with backing from

Polychain, Neoclassic, OKX Ventures, Selini Capital, Story Foundation, and others. An additional

$600,000 was raised in a public round. Across all funding rounds, the

average token price is approximately $0.086.

VI. Risk Factors

Aria Protocol’s economic model relies heavily on community adoption and ecosystem participation. Although the large community allocation is intended to boost growth, the initial 33% TGE unlock combined with future team and investor unlocks may introduce near-term liquidity pressure if IP revenue streams are not yet mature. Additionally, the IP-RWA sector is sensitive to market cycles, legal frameworks, and revenue-realization timelines; disappointment in catalog performance, slow IP onboarding, or weaker-than-expected adoption could amplify volatility in ARIAIP’s secondary market. While the project includes price-protection mechanisms (such as the 30-day post-TGE refund program), changing regulatory conditions or licensing complications may pose additional risks.

VII. Official Links

Website:

https://ariaprotocol.xyz/

X (Twitter):

https://x.com/Aria_Protocol

Disclaimer: This report is AI-generated, with human verification of information only. It does not constitute any investment advice.

0

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Why Can’t Bitcoin Experience Massive Rallies Anymore? Anthony Pompliano Says the “Wild Era” Is Over and Explains Why

BitcoinSistemi•2025/12/23 17:54

Bitcoin Stalls Below $90K as Traders Eye $86K Support, Says Michaël van de Poppe

BlockchainReporter•2025/12/23 17:00

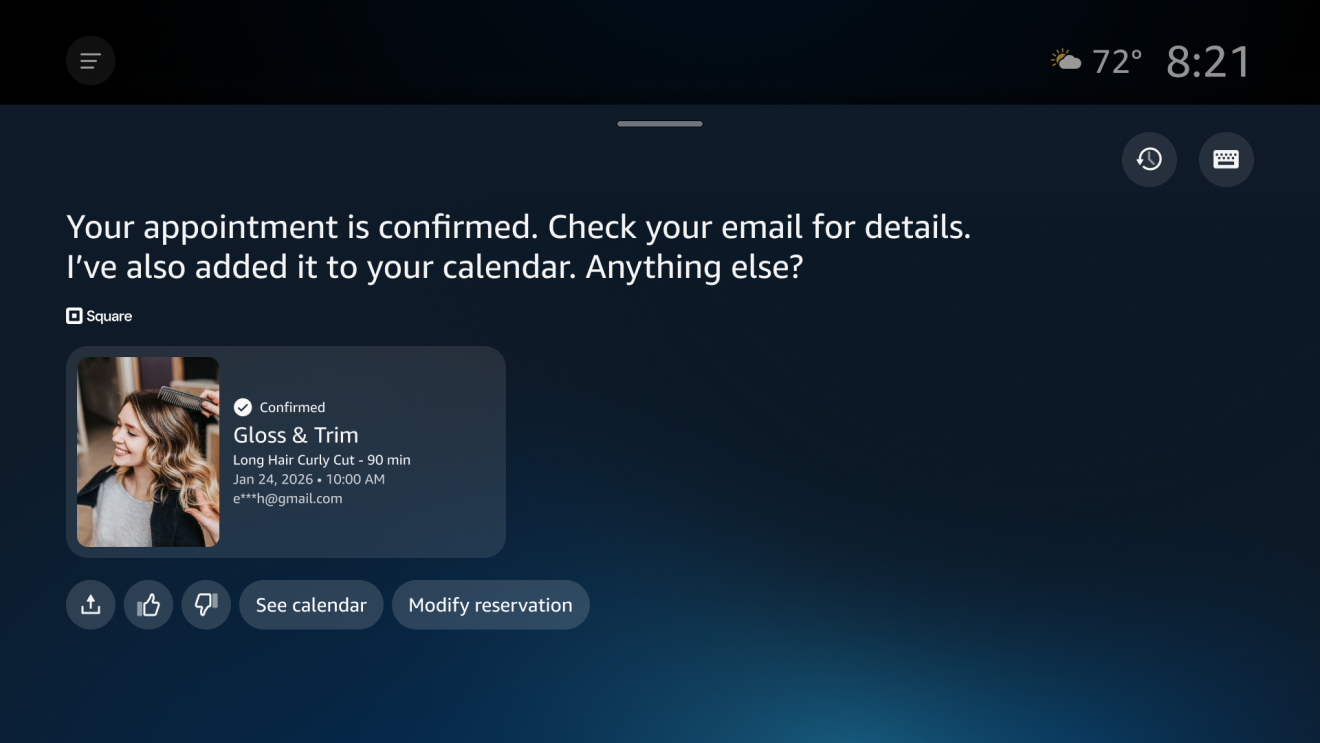

Amazon’s AI assistant Alexa+ now works with Angi, Expedia, Square, and Yelp

TechCrunch•2025/12/23 16:06

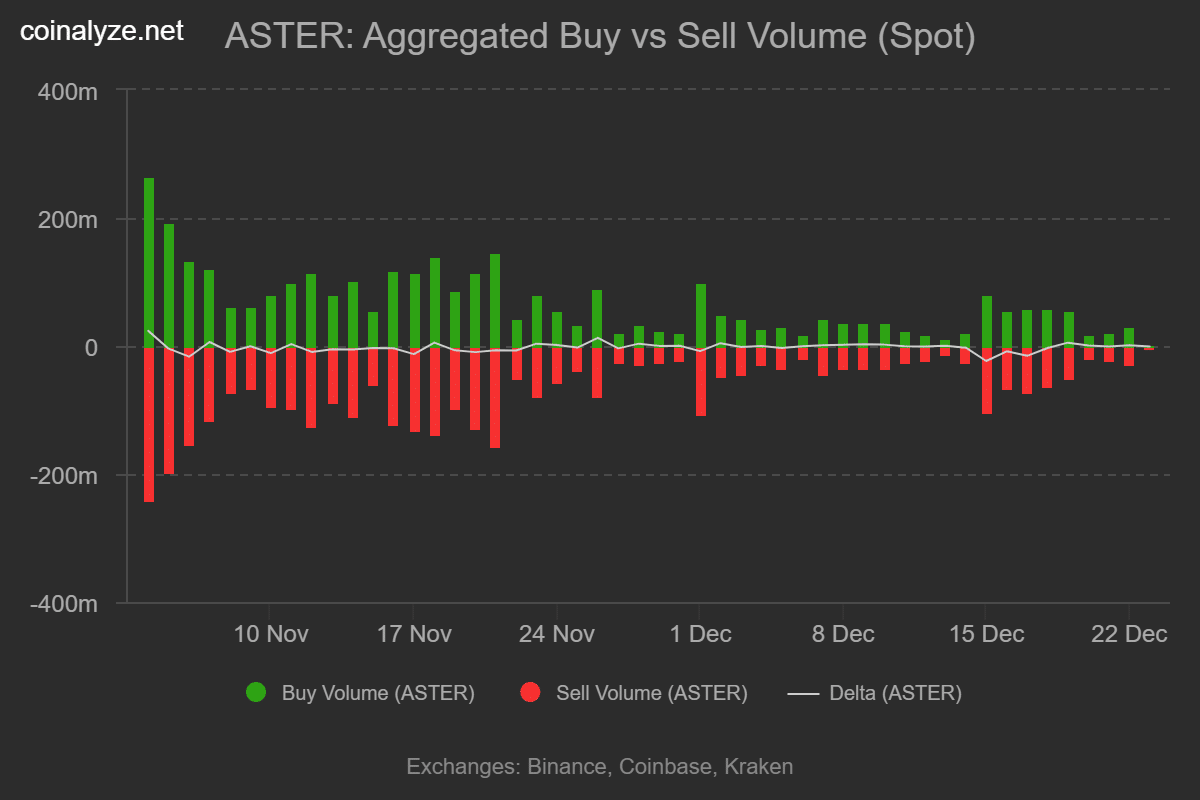

Aster DEX buys back $140M in tokens, yet prices stall – Why?

AMBCrypto•2025/12/23 16:03

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$87,543.12

-2.00%

Ethereum

ETH

$2,930.62

-3.35%

Tether USDt

USDT

$0.9996

+0.00%

BNB

BNB

$840.73

-3.08%

XRP

XRP

$1.87

-3.19%

USDC

USDC

$0.9999

+0.01%

Solana

SOL

$123.25

-2.80%

TRON

TRX

$0.2827

-0.85%

Dogecoin

DOGE

$0.1289

-3.76%

Cardano

ADA

$0.3610

-4.41%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now