Bitcoin Updates: Bitcoin Stands Strong Against Withdrawals While Solana ETFs Spark Optimistic Investments

- Bitcoin stays above $100,000 despite ETF redemptions, driven by whale buying and Solana ETF inflows. - Solana ETFs attract $421M in 5 days, outperforming Bitcoin/ETH ETFs with $799M+ outflows. - Analysts link market resilience to institutional confidence in Solana, macroeconomic uncertainty, and seasonal crypto trends. - Grayscale's low-fee GSOL ETF enters market with $102M AUM, highlighting growing institutional demand for Solana exposure. - Long-term optimism persists as Bitcoin's $1T+ market cap chall

Bitcoin stays above $100,000 as large-scale investors and ETF inflows boost market confidence, analysts say.

Despite significant withdrawals from U.S. spot

Solana ETFs have seen $421 million in net investments over the last week, marking five straight days of positive inflows, as reported by a

This divergence in fund flows has prompted discussion among market observers. "Solana ETFs' strong performance in a challenging market shows institutional trust in the asset," said Vetle Lunde, research head at K33. Meanwhile, BlackRock's

Bitcoin's price movement appears disconnected from ETF activity, dropping nearly 6% to below $100,000 over the past week, even as whales accumulated close to 50,000 BTC in the last month, according to a

Ethereum ETFs have faced similar challenges as Bitcoin, with BlackRock's ETHA responsible for $81.7 million of the $135.7 million in weekly withdrawals. Analysts suggest these outflows are due to profit-taking amid uncertainty about interest rates and broader market corrections.

Grayscale's GSOL ETF, which recently converted from a closed-end fund and entered the market with $102 million in assets, further demonstrates the market's resilience. Although its $2.2 million in inflows was modest compared to Bitwise, the ETF's structure points to rising institutional interest in affordable Solana exposure.

Despite short-term volatility, long-term optimism remains. Plan C, a well-known crypto analyst, highlighted that institutional involvement has fundamentally changed Bitcoin's risk landscape. "With a market cap well above $1 trillion, the idea that Bitcoin could go to zero is no longer relevant," he stated. He predicted a bottom between $80,000 and $90,000 in a bearish scenario, but expects a likely rebound to $117,000 if macroeconomic conditions improve.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Traditional Hedge Funds Deepen Crypto Exposure Despite Market Swings

Cybercriminals Are Now Using AI to Create Shape-Shifting Malware, Google Warns

Fed's Ambiguity Causes Dollar to Weaken and Triggers Divergent Responses in Gulf Markets

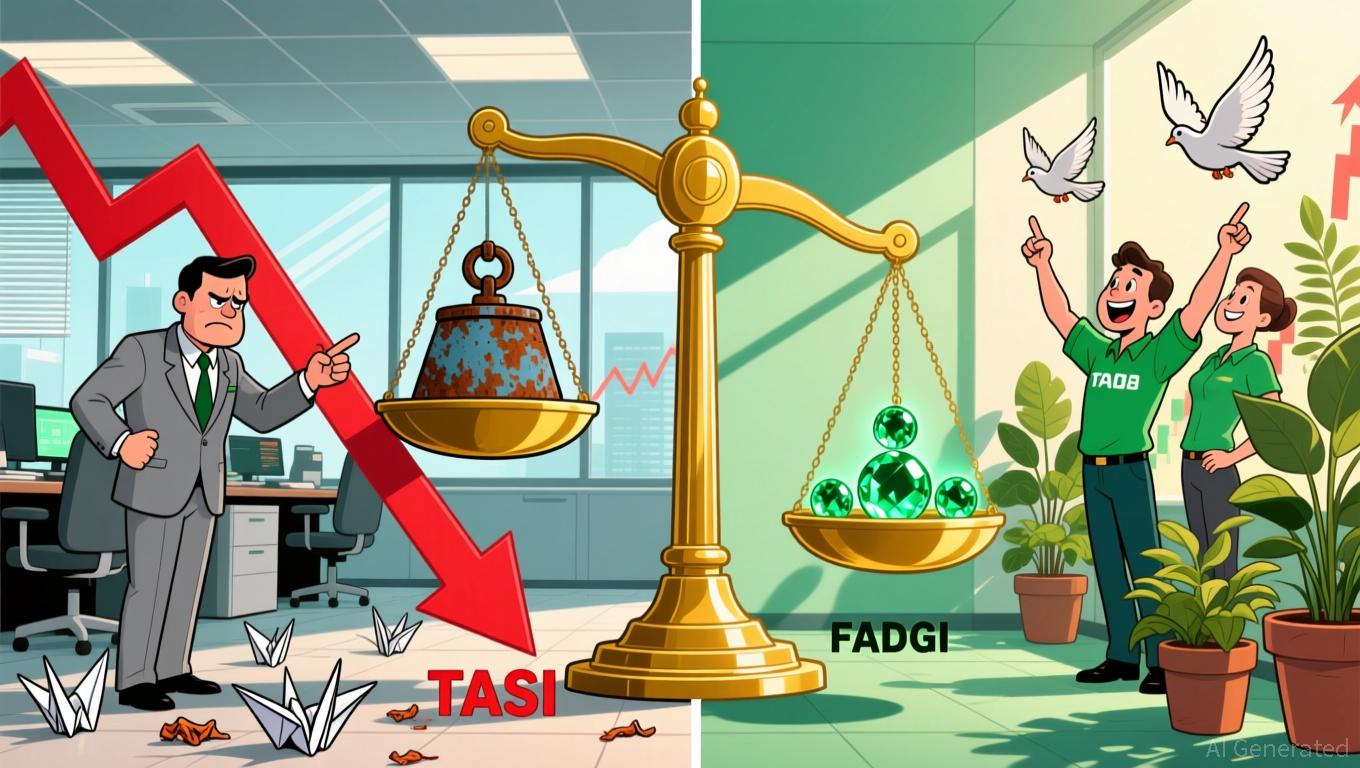

- Fed policy uncertainty weakens U.S. Dollar, causing Gulf markets to react diversely as rate cut odds drop to 65% from 90%. - OPEC+'s output pause and falling oil prices amplify market anxiety, while Saudi TASI declines and Abu Dhabi FADGI rises. - U.S. Treasury Secretary Bessent demands aggressive Fed rate cuts to address housing crisis, aligning with some officials' calls for easing. - Dollar Index hits 100+ amid geopolitical fragmentation, as global investors shift capital toward Europe and Asia. - Fed

"Shattering Limits: On-Chain Cryptocurrency Now Enables Effortless Spending Worldwide Through the Visa Network"

- Tangem launched Tangem Pay, a non-custodial Visa card enabling global on-chain USDC spending via Polygon, retaining self-custody. - The service uses a dual-key security model with Rain handling compliance, operating in the U.S., Latin America, and Asia-Pacific. - It targets developing markets by reducing remittance costs and plans 2026 European launch under MiCA, aiming for 10M users by 2026. - Partnering with Paera and Rain ensures regulatory compliance, differentiating it from no-KYC alternatives like