Bitget Connects Speculation and Risk Control through STABLEUSDT Futures

- Bitget launched STABLEUSDT pre-market futures with 25x leverage, offering 24/7 trading since Nov 6, 2025. - The contract features 4-hour funding settlements and 0.00001 tick size to enable flexible positioning. - As the world's largest UEX, Bitget aims to boost market depth for emerging tokens through strategic liquidity initiatives. - Partnerships with LALIGA/MotoGP and a $2M loan program highlight its mission to democratize crypto access. - Risk warnings emphasize volatility concerns for leveraged prod

Bitget, recognized as the largest Universal Exchange (UEX) globally, has introduced STABLEUSDT futures trading, allowing up to 25x leverage. This move signifies a deliberate step into new speculative and hedging possibilities for the STABLE token. The futures product became available on November 6, 2025 (UTC+8), granting traders continuous, round-the-clock access to a USDT-margined perpetual contract. This contract is designed to let users gain early exposure to the asset before its full market launch, according to a

This STABLEUSDT futures contract is part of Bitget’s comprehensive suite of futures offerings, which also includes USDT-M Futures, Coin-M Futures, and USDC-M Futures. Notably, USDT-M Futures enable users to manage several trading pairs at once through a unified account balance, improving both risk management and capital utilization, as described in the Bitget announcement. Bitget also noted that contract details such as leverage, tick size, and maintenance margin requirements may be updated in response to market dynamics, reflecting the platform’s flexible approach to risk control.

This launch supports Bitget’s broader goal of making new tokens and real-world assets more accessible. As a UEX, Bitget serves a global user base exceeding 120 million, providing a single platform for trading cryptocurrencies, tokenized equities, ETFs, and more. Its notable partnerships—including being the official crypto partner for LALIGA and MotoGP™, as well as working with UNICEF to promote blockchain education—demonstrate its commitment to advancing crypto adoption at both institutional and community levels, as noted by Benzinga.

Bitget’s futures trading offers a distinct benefit for those looking to interact with assets before they become widely traded. By granting early access to STABLE, the platform facilitates price discovery and allows traders to manage risk against potential price swings. This initiative is part of Bitget’s ongoing efforts to deepen market liquidity, especially for smaller-cap tokens, as seen in its recent $2 million interest-free loan program for altcoin liquidity providers, according to a

Although the announcement does not provide extensive details about the STABLE token, it is positioned as a key asset within Bitget’s expanding lineup. By including STABLE in its offerings, Bitget signals its belief in the token’s future value and demand. Traders can access this contract through Bitget’s website or mobile application, with seamless integration into the platform’s ecosystem as mentioned in the Bitget announcement.

Gracy Chen, Bitget’s CEO, has previously stressed the significance of liquidity for smaller-cap tokens in maintaining a healthy crypto market—a point also highlighted in the PR Newswire release regarding institutional funding. While the STABLEUSDT contract is not directly linked to that financing initiative, it further demonstrates Bitget’s dedication to building strong trading environments for up-and-coming assets. The platform’s risk disclosures, which remind users of the inherent volatility in digital assets, emphasize the importance of careful participation in leveraged trading, as reported by Benzinga.

With 25x leverage and adaptable settlement options, Bitget aims to appeal to both individual and institutional traders navigating the fast-changing world of tokenized assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi Vulnerabilities: Advanced Attacks Reveal Deep-Rooted Systemic Issues

- 2025 crypto hacks (Bybit $1.5B, Balancer $116M) expose systemic vulnerabilities in DeFi infrastructure and governance mechanisms. - SafeWallet rearchitected security protocols after developer workstation compromise enabled JavaScript injection attacks. - Industry adopts institutional-grade solutions like Fireblocks MPC and HUB Cyber Security's SSI integration to combat evolving threats. - Experts emphasize need for real-time transaction monitoring and standardized practices to address blind signing and k

‘Landfall’ surveillance malware exploited an undisclosed vulnerability to compromise Samsung Galaxy devices

MMT Token TGE and Its Impact on the Market: Evaluating the Trigger for Altcoin Price Fluctuations and Institutional Embrace

- MMT token's 2025 TGE sparked 1330% price surge post-Binance listing, driven by $82M oversubscribed sale and strategic exchange listings. - TVL exceeding $600M highlights DeFi innovations like YBTC.B pools and ve(3,3) tokenomics, aiming to balance liquidity with governance incentives. - Institutional adoption targets through MSafe wallets and Momentum X platform, though speculative trading risks overshadow long-term stability. - Phishing threats and name confusion with NYSE fund MMT raise volatility conce

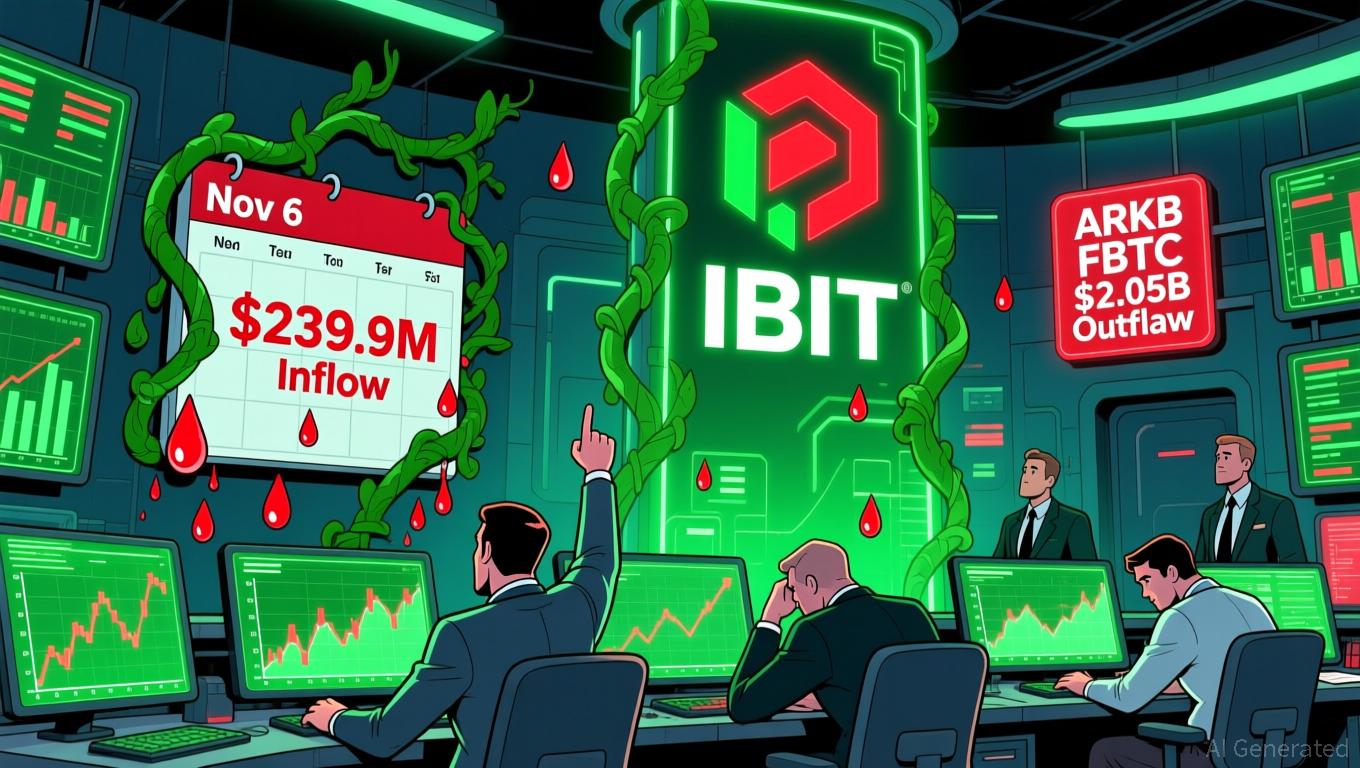

Bitcoin Updates: Investor Optimism Grows as Bitcoin ETFs End Outflow Trend

- U.S. spot Bitcoin ETFs ended a six-day outflow streak with $239.9M net inflows on Nov 6, led by BlackRock's IBIT ($112.4M) and Fidelity's FBTC ($61.6M). - Bitcoin's price rebounded to $103,000 from below $99,000 as improved liquidity and reduced macro volatility drove inflows, though risks persist without sustained buying pressure. - Ethereum ETFs saw smaller $12.5M inflows while Grayscale's ETHE continued outflows, highlighting diverging investor preferences between BTC and ETH. - Solana ETFs emerged as