As stablecoins race ahead at 2.14 times the speed of bitcoin, Cathie Wood has had to slash $300,000 from her optimistic forecast—a move that reflects a profound restructuring of the entire cryptocurrency ecosystem.

“We had to subtract about $300,000 from the optimistic scenario.” Cathie Wood, founder of ARK Invest (nicknamed “Wood Sister”), calmly stated this figure during a live broadcast on CNBC, sending ripples through the entire cryptocurrency market.

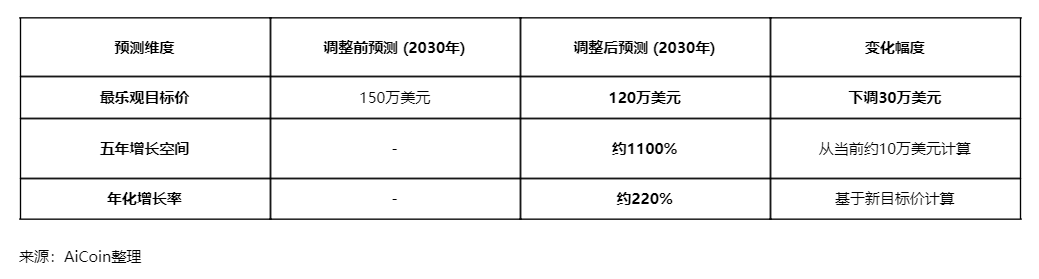

She lowered bitcoin’s most optimistic 2030 price target from $1.5 million to $1.2 million, a direct wipeout of $300,000 in expected value, representing a 20% decrease.

I. The Disappearance of $300,000: Key Details of the Expectation Revision

This most famous bitcoin bull leader admitted for the first time that she had to revise her forecast in response to actual market developments.

● “Given the development of stablecoins, we might be able to subtract about $300,000 from our optimistic view.” Wood was blunt in explaining this adjustment. This $300,000 gap precisely reflects how the explosive growth of the stablecoin ecosystem is squeezing bitcoin’s potential value.

● In ARK Invest’s “ARK's Big Ideas 2025” report published in February 2025, the company set three scenario forecasts for bitcoin in 2030. Now, the most optimistic scenario has been lowered from $1.5 million to $1.2 million.

II. The Rise of Stablecoins: The Driving Force Behind the $300,000 Concession

Stablecoins—digital tokens pegged to traditional currencies—are reshaping the cryptocurrency landscape at a staggering pace.

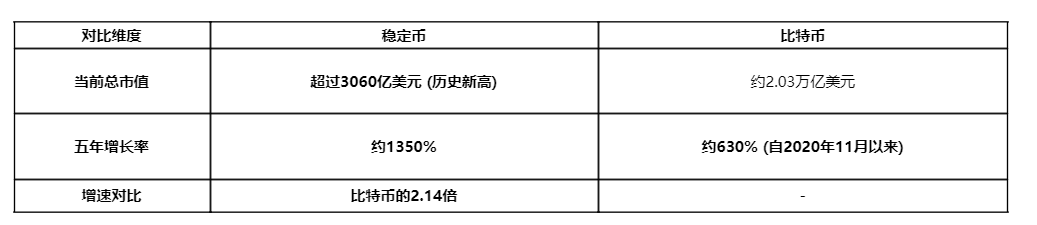

● According to AiCoin data, the market cap of stablecoins has reached a record high of over $306 billion, up from just $21 billion in November 2020.

● This means that in the past five years, the stablecoin market cap has grown by about 1350%, while bitcoin’s growth over the same period was 630%. The growth rate of stablecoins is 2.14 times that of bitcoin—this data directly explains why Wood had to lower her expectations by $300,000.

● “Emerging markets are crucial in this regard,” Wood pointed out. “We’re seeing U.S. institutions begin to lay out new payment pipelines, with stablecoins at their core.” This trend is especially evident in regions plagued by hyperinflation.

III. Role Reconfiguration: Functional Differentiation Behind the $300,000 Gap

ARK Invest previously believed that bitcoin could serve as both a store of value and a global settlement tool. But now, Wood sees a different picture.

● “Stablecoins are usurping the role we originally thought bitcoin would play.” She stated clearly on CNBC. This $300,000 expectation gap essentially reflects the professional division of labor forming within the cryptocurrency ecosystem.

● Wood emphasized that bitcoin remains “digital gold” and a solid asset against fiat currency depreciation. In other words, the $300,000 adjustment does not represent a devaluation of bitcoin’s core value, but is a natural result of market functional differentiation.

● “I think the whole space will become bigger,” Wood explained. “This is a truly digitized global monetary system, with no government oversight, and is very private. So it’s a very grand vision.”

IV. Giants Enter the Arena: Catalysts for Accelerated Differentiation

The rapid rise of stablecoins is not only reflected in the numbers, but also in the strategic moves of tech giants, further reinforcing the rationale behind the $300,000 expectation adjustment.

● Recently, several major tech companies have begun launching payment platforms integrated with stablecoins. Google, in cooperation with Coinbase and over 60 major institutions, will launch an AI-powered payment platform supporting stablecoins in September.

● At the same time, Cloudflare has launched NET Dollar, a dollar-backed stablecoin designed for AI agents and used for automated transactions.

● These initiatives provide strong endorsement for the stablecoin ecosystem, further accelerating its scaling process. According to Standard Chartered’s forecast, by 2028, dollar-pegged stablecoins could divert over $1 trillion from the traditional banking systems of emerging markets.

V. Residual Value: The Confidence Foundation of the $1.2 Million Target

Despite shaving off $300,000 from her expectations, Cathie Wood remains deeply optimistic about bitcoin’s long-term prospects.

● She emphasized that institutional participation in bitcoin is just beginning, with huge potential ahead. “Bitcoin is a global monetary system, a leader of a new asset class, and a technology—all rolled into one.” Wood explained.

● Even after the adjustment, ARK Invest’s forecast still implies that bitcoin has 1,100% growth potential over the next five years. With the current bitcoin price slightly above $100,000, reaching the $1.2 million target would mean an annual growth rate of about 220%.

● Wood pointed out that as a global monetary system, bitcoin’s role as a store of value is similar to gold, but different from stablecoins—which are merely tokenized cash on the blockchain.

VI. Market Reality: Opportunities Amid Volatility

● Just days before Wood’s comments, the bitcoin market had experienced a correction. On Monday (November 3), bitcoin fell below $100,000 for the first time in over four months, mainly due to broad sell-offs in risk assets.

● As of November 6, bitcoin’s price had returned above $100,000. This price fluctuation reflects the high volatility of the cryptocurrency market, but also provides long-term investors with opportunities to position themselves.

● Despite short-term price swings, Wood still regards bitcoin as “digital gold” and a solid asset against fiat currency depreciation. The $300,000 expectation adjustment is more of a professional acknowledgment of market reality than a sign of shaken confidence.

The evaporation of the $300,000 expectation marks a key turning point as the cryptocurrency market matures from youthful recklessness to specialized division of labor. The 1,350% growth rate of stablecoins over five years, far outpacing bitcoin’s 630%, is precisely reflected in that $300,000 forecast adjustment.

The future competition in the cryptocurrency market will no longer be a simple confrontation between bitcoin and other tokens, but a complex process of redefining roles among bitcoin, stablecoins, and various specialized tokens. That $300,000 gap is the quantified value of this process.