Will Chainlink (LINK) Be the Next Crypto Sensation this November?

Whales Accumulate Chainlink at Key $15 Support Level: A Potential November Crypto Boom?

Key Points

- Chainlink (LINK) token attracts significant on-chain accumulation despite a 6% crash and a 32% drop over the last month.

- The $14-$15 range is a critical test for LINK’s long-term structure, potentially leading to a rebound towards $20 and possibly $27-$46.

Despite experiencing a 6% drop in the past 24 hours, the Chainlink (LINK) token continues to see substantial on-chain accumulation, testing a significant support level. The token is currently trading around $15.14, marking a significant 32% drop over the last month.

Two new wallets have been accumulating tokens at an average entry of about $16.45. One of these wallets withdrew 98,000 LINK, worth approximately $1.57 million. Another wallet added nearly 50,000 LINK, valued at $736,000.

Crucial Test for LINK Bulls

Analyst Ali Martinez pointed out the $14-$15 range as a critical area for LINK’s long-term structure. The price is currently hovering around $15.14, just above the 0.618 Fibonacci retracement at $15.07, a level that has historically served as a strong demand zone.

If the $14-$15 area is maintained, it could confirm a rebound towards $20 and possibly extend to $27-$46, potentially making LINK the next crypto to explode. However, a failure to hold above $15 would invalidate the bullish setup and pave the way for deeper corrections towards $12 or even $10.

The daily chart shows a prolonged downtrend channel, with LINK repeatedly rejected at its upper boundary. The RSI is near 34, while the MACD suggests the selling pressure could be close to exhaustion.

The Bollinger Bands are also tightening, suggesting a breakout could be imminent. Martinez has added that any dip below $15 would be a “golden buy zone” for the LINK token.

Chainlink ACE Launch: Strengthening Fundamentals

The price drop follows the launch of the Chainlink Automated Compliance Engine (ACE) partner ecosystem, a consortium of over 20 compliance providers, frameworks, and blockchain networks.

This initiative integrates identity verification, risk management, and regulatory reporting directly into on-chain systems, positioning ACE as an industry standard for institutional-grade compliance.

The Chainlink ACE partner ecosystem establishes ACE as the industry standard for on-chain compliance, uniting identity, risk, and regulatory infrastructure into the most complete, modular, and enterprise-grade compliance network for digital assets.

It also includes partners such as Chainalysis, TRM Labs, Hypernative, and Kaiko, as well as blockchain networks such as Ethereum for Institutions, Linea, and Taiko.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UNI Whales Lock in $23.415M Profit, Exiting Five Months Early Ahead of 100 Million UNI Burn

Memecoin Dominance Hits All-Time Lows: 5 High-Risk Coins That Could Lead the Next Speculative Rebound

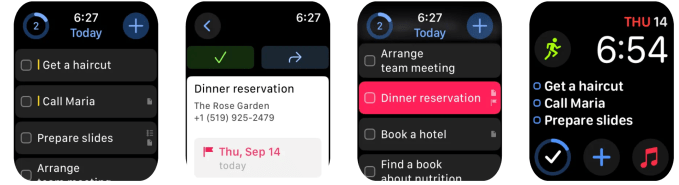

Best Apple Watch apps for boosting your productivity