Author: Jasper De Maere

Translation: TechFlow

Preface

Liquidity drives cryptocurrency cycles, but capital inflows through stablecoins, ETFs, and DATs (Digital Asset Trusts) have clearly slowed down.

Global liquidity remains strong, but higher SOFR (Secured Overnight Financing Rate) is directing funds toward government bonds and away from the cryptocurrency market.

Currently, cryptocurrency is in a self-financing phase, with capital circulating internally, waiting for new inflows to return.

Liquidity determines every cryptocurrency cycle. While in the long run, technological applications may be the core driving force of the cryptocurrency narrative, it is capital flows that truly drive price changes. In recent months, the momentum of capital inflows has weakened. Among the three main channels for capital entering the crypto ecosystem—stablecoins, ETFs, and Digital Asset Trusts (DATs)—the momentum of capital flows has slowed, putting cryptocurrency in a self-financing phase rather than a period of expansion.

Although technological applications are an important driving force, liquidity is the key factor that drives and defines every cryptocurrency cycle. This is not just about market depth, but about the availability of capital itself. When global money supply expands or real interest rates fall, excess liquidity inevitably seeks out risk assets, and cryptocurrency has historically—especially in the 2021 cycle—been one of the biggest beneficiaries.

In past cycles, liquidity mainly entered the digital asset space through stablecoins, which are the core fiat on-ramp. As the industry matures, three major liquidity channels have gradually become key to determining new capital inflows into cryptocurrency:

-

Digital Asset Trusts (DATs): Tokenized funds and yield structures that connect traditional assets with on-chain liquidity.

-

Stablecoins: The on-chain representation of fiat liquidity, providing foundational collateral for leverage and trading activities.

-

ETF: Access points in traditional finance for passive investment and institutional capital to gain exposure to BTC and ETH.

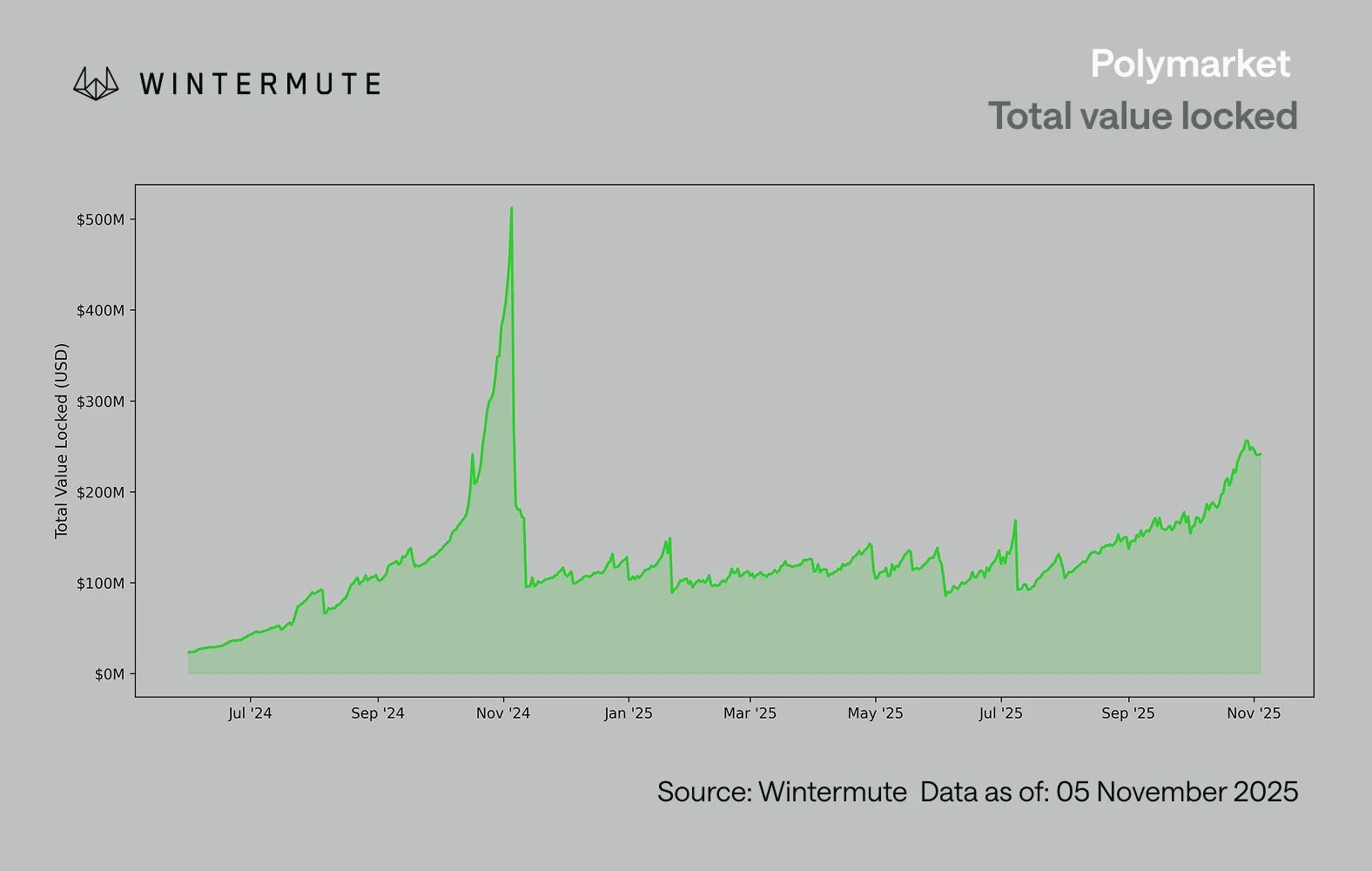

By combining ETF assets under management (AUM), DAT net asset value (NAV), and the amount of stablecoins issued, it is possible to reasonably estimate the total capital flowing into digital assets. The chart below shows the trend of these components over the past 18 months. At the bottom of the chart, it is clear that the total change is closely related to the total market capitalization of digital assets: when capital inflows accelerate, prices rise accordingly.

The key observation is that the momentum of capital inflows into DATs and ETFs has significantly slowed down. Both performed strongly in Q4 2024 and Q1 2025, with a brief rebound at the start of summer, but this momentum gradually faded. Liquidity (M2 money supply) no longer flows into the crypto ecosystem as naturally as it did at the beginning of the year. Since early 2024, the total size of DATs and ETFs has grown from about $40 billion to $270 billion, while the size of stablecoins has doubled from about $140 billion to about $290 billion. Although this shows strong structural growth, there is also a clear stagnation in growth.

This slowdown is crucial because each channel reflects a different source of liquidity. Stablecoins reflect the risk appetite within the crypto industry, DATs capture institutional demand for yield, while ETFs reflect broader traditional finance (TradFi) allocation trends. The simultaneous flattening of all three indicates an overall slowdown in the deployment of new capital, not just a rotation of funds between products. Liquidity has not disappeared, but is only circulating within the system, rather than expanding.

Looking at the broader economy outside of cryptocurrency, liquidity (M2 money supply) is not stagnant either. Although higher SOFR rates temporarily constrain liquidity, making cash yields attractive and locking funds into government bonds, the world is still in an easing cycle, and quantitative tightening (QT) in the US has officially ended. The overall structural backdrop remains supportive, but currently, liquidity is choosing other risk expressions, such as the stock market.

As external capital inflows decrease, market dynamics become increasingly closed. Capital rotates more between mainstream coins and altcoin sectors, rather than through new net inflows, creating this "player versus player" (PVP) situation. This also explains why market rebounds are short-lived and why market breadth narrows, even as total assets under management (AUM) remain stable. The current volatility peaks are mainly driven by liquidation cascades, rather than sustained trend formation.

Looking ahead, a significant recovery in any liquidity channel—such as the reminting of stablecoins, the creation of new ETFs, or an increase in DAT issuance—would indicate that macro liquidity is once again flowing back into the digital asset space. Until then, cryptocurrency remains in a self-financing phase, with capital only circulating internally and not achieving value expansion.