Bitrace's Perspectives and Outlook at Hong Kong FinTech Week

During the 9th Hong Kong FinTech Week, Bitrace CEO Isabel Shi participated in the Blockchain and Digital Assets Forum...

During the 9th Hong Kong FinTech Week, Bitrace CEO Isabel Shi participated in a blockchain and digital assets forum roundtable, engaging in a lively discussion with Animoca Brands President Evan Auyang, Terminal 3 Co-founder & CEO Gary Liu, and Hua Xia Fund’s Thomas Zhu on topics such as Hong Kong’s Web3 environment and the integration of Tradfi and Defi. She also joined a fireside chat at Cyberport with Slowmist Partner & CPO Keywolf to discuss issues such as virtual asset security and VAOTC regulation.

Below are Isabel’s main viewpoints from both events:

Blockchain and Digital Assets Forum: Integration or Coexistence? Exploring the Relationship Between Native Hong Kong Web3 and Traditional Finance

1. Traditional finance (Tradfi) and decentralized finance (Defi) may seem mutually exclusive by definition, but we are seeing increasing cooperation between the two. The government has established a special task force to strengthen the development of the Web3 ecosystem. Earlier this year, we saw the first batch of crypto ETFs listed. However, risks in compliance, fraud, security, and money laundering remain concerns. What is the key to integrating Tradfi and Defi?

On this issue, I would like to mention two key factors: a clear regulatory framework and reliable custodians.

Regulatory framework: Regulators should provide a clear legal framework for DeFi and TradFi, especially regarding compliance requirements in anti-money laundering (AML), know your customer (KYC), data privacy, taxation, and more. This can reduce legal and compliance uncertainties between DeFi projects and TradFi institutions, lowering risks. We are pleased to see the Hong Kong government, after adopting industry feedback, has formulated new laws and regulations specifically for the Web3 industry, marking significant progress in Hong Kong’s push to become a global virtual asset center.

In addition, as crypto is a global asset class with frequent cross-border transfers, this will inevitably pose challenges for international regulators. Perhaps, in the future, formulating a globally unified regulatory framework will become a trend.

Custodians: From trustless, anonymous on-chain assets to trust-based, real-name financial assets, bridging Defi and Tradfi requires not only compliant bridge platforms to handle KYC, KYT, AML, etc., and help users conveniently convert between the two types of assets, but also trustworthy custodians to help financial institutions and users securely store assets and enhance trust.

2. Hong Kong’s cryptocurrency ecosystem is unique. In the US, we have large crypto trading platforms, while Hong Kong regulators have so far only licensed three different VATPs. What are the main obstacles in Hong Kong’s crypto ecosystem? What are the best ways to overcome these challenges?

The current regulatory framework is more inclined towards traditional financial regulation. Although Hong Kong has introduced a regulatory framework for virtual asset service providers (VASP), the relevant laws and policies are still not clear and comprehensive enough. For example, there are no explicit provisions for anti-money laundering, and the regulatory boundaries are relatively vague. In addition, Hong Kong’s Web3 regulation is divided among different departments: the HKMA is responsible for stablecoins, the SFC regulates VATPs, and Customs participates in VAOTC regulation. There is a lot of business overlap among various VASPs, so there are also challenges in interdepartmental regulatory collaboration. All these factors can become potential obstacles to the development of Hong Kong’s crypto ecosystem.

Because cryptocurrencies can be transferred across borders, Hong Kong has a very large over-the-counter (OTC) market. Local users tend to deposit and withdraw funds via online or offline OTC, and use overseas CEXs for crypto-to-crypto exchanges. We know that well-known international exchanges have already captured the vast majority of market share, attracting a large number of users and liquidity, which puts tremendous competitive pressure on local exchanges.

Therefore, my suggestions are:

First, it is necessary to solve the issues of regulatory boundaries and collaboration, ensuring a balance between regulation and development, rather than just imposing constraints. At the same time, relying solely on local regulation is not enough. The Web3 world is borderless, so cross-border regulation, collaboration, and information sharing need to be further strengthened.

Second, provide more policy and development support to local VASP enterprises to help them attract users and actively innovate, among other things.

3. Hong Kong is committed to becoming the Web3 and crypto hub of the Asia-Pacific region. What are Hong Kong’s main competitive advantages in the Web3 field? What are your policy expectations?

First, Hong Kong itself has a liberal market environment, a sound commercial legal system, and a leading position in the Asian financial market, providing a solid foundation for Web3 development. It’s worth noting that many large exchanges and stablecoin issuers originally set up their parent companies in Hong Kong. At the same time, when analyzing local market data, we found that even though there are few locally licensed exchanges, the scale of crypto OTC activity is very large, which also shows that Hong Kong has a natural advantage in Web3.

Second, since the end of 2023, Hong Kong has been vigorously promoting the construction of Web3. Among the world’s major financial centers, Hong Kong’s efforts and resource investment are also leading. I believe that in the long run, this will definitely help accumulate advantages.

4. What additional regulatory measures could help Hong Kong achieve its goals?

First, in my view, Regtech must take the lead. The biggest difference between Web3 and traditional finance is that Web3, especially crypto, is a field that allows for high anonymity, permissionless access, and cross-border activity. Therefore, traditional regulation cannot be directly applied to Web3. For example, in crypto crime, if it cannot be detected or prevented in time, it is basically very difficult to track and recover losses. This is also the challenge for regulators. Years ago, the US invested a lot of resources and effort in Regtech. I think Hong Kong, as a pioneer of Web3 in Asia, must let Regtech play an important role to find a balance between business development and compliance. In addition, Hong Kong needs to further establish its influence and leadership in APAC and even globally through its own regulatory and anti-money laundering standards.

Second, there should be better talent policies to attract talent inflow and promote local talent education and training. Talent is a very important productive force. Currently, as regulatory policies change in various countries, talent in the crypto market is rapidly shifting and flowing. We need to strengthen crypto talent education and training, cultivate local talent, and thus better develop the Web3 industry. At the same time, this will help establish better connections with the world. Whether it’s capital or business, talent is the most direct lever. Image

Cyberport: 2024 New Observations on Virtual Asset Security & Opportunities and Challenges on the Road to Compliance under the New Policy Address

5. What notable security incidents have occurred in the virtual asset and crypto space in 2024?

Japanese exchange DMM was hacked for 4,502.9 BTC, with losses exceeding $300 million, making it the third largest loss in Japanese exchange history. The stolen DMM funds were transferred through various means such as dispersal, cross-chain, and exchange. Many OTC merchant addresses were tainted in this process, including business addresses of well-known Southeast Asian institutions, which were subsequently frozen by tether due to this incident. After the DMM incident, Asian crypto service providers, especially OTCs, should pay more attention to KYT.

6. Hong Kong is about to further increase the number of licensed virtual asset exchanges. Can you introduce some common crypto crime tactics to help the public avoid pitfalls?

Bitrace recently released the "Web3 Anti-Fraud Manual," which, based on our long-term exposure to a large number of real crypto fraud cases, summarizes the most common typical tactics in various scenarios. These include fake wallets stealing coins through apps downloaded from third-party sites, romance scams targeting non-blockchain-savvy outsiders, QR code transfer fraud (where the amount sent does not match the amount displayed on the phishing site), and many traditional scams being applied in the Web3 field.

Interested friends are welcome to download it from the Bitrace official website https://bitrace.io/zh/blog.

7. The 2024 Policy Address mentions "completing the second round of consultation on the regulation of virtual asset OTC trading and submitting the proposed licensing regime for virtual asset custodians." Please interpret this.

We have long been very concerned about the VAOTC market, especially in Asia, and have been continuously collecting and analyzing VAOTC-related addresses. According to our data, in the past three years, the total transaction volume of the Hong Kong VAOTC market has approached $500 billion.

Among these transactions, in addition to normal investor deposits and withdrawals, there are also many risky transactions, such as funds transferred from sanctioned regions, risk funds associated with Southeast Asian black and gray market business addresses, and money laundering funds linked to other criminal activities. These funds further contaminate the business addresses of ordinary investors and innocent financial institutions through VAOTC addresses, causing widespread legal risks. For example, investors who receive funds from theft or fraud incidents may be investigated.

By establishing a licensing regime, the Hong Kong government will be able to identify and isolate these risky funds by requiring VAOTC operators to comply, so that ordinary investors/financial institutions cannot access them. As long as this is enforced sufficiently, we will soon be able to build a trustworthy and compliant VAOTC market in Hong Kong.

8. What preparations should OTC and custodian service providers make? Any suggestions?

Establishing standard crypto AML and KYT mechanisms is necessary. Before accepting user funds, conduct fund audits on their transfer addresses to determine risk levels and, if possible, take corresponding control measures for high-risk addresses.

Adopting mature Regtech solutions is more efficient than building your own. However, risk control personnel also need to continuously enhance their understanding of the crypto market, including the basic principles of blockchain, the latest crypto crime tactics, Web3 application innovations, and more.

9. What products can "escort" regulators and financial institutions?

We have two standardized products: Detrust—a blockchain risk fund monitoring and management platform. Through real-time monitoring and assessment of crypto addresses and transactions, it helps clients quickly identify, manage, and investigate risk funds, suitable for all types of VASPs and traditional enterprises with crypto businesses.

Bitrace Pro—a collaborative crypto tracking and analysis platform. With powerful features such as visual analysis, entity identification, and address clustering, it helps clients quickly reconstruct risk events and conducts comprehensive and intelligent analysis through more than 20 advanced risk analysis models. Suitable for law enforcement agencies or compliance departments of large VASPs.

In addition, we can also provide customized solutions for clients, such as stablecoin monitoring platforms, OTC monitoring platforms, and integrated compliance platforms.

10. As an outstanding company based in Hong Kong Cyberport, please share some advice for companies preparing to come to Hong Kong.

First, entrepreneurship is definitely not an easy task, so be prepared for long-term pressure.

Second, joining support organizations like Cyberport is crucial. As Hong Kong’s innovation and technology hub, Cyberport not only provides valuable resources and networks for startups but also enables in-depth exchanges with other like-minded entrepreneurs, which is vital for business development and establishing long-term partnerships.

Website:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

INJ Price Prediction 2025: Will Injective’s Multi-year Support Ignite a Massive 2025 Rally?

Filecoin (FIL) Price Breakout Could Ignite a 1,700% Rally, Predicts Top Trader

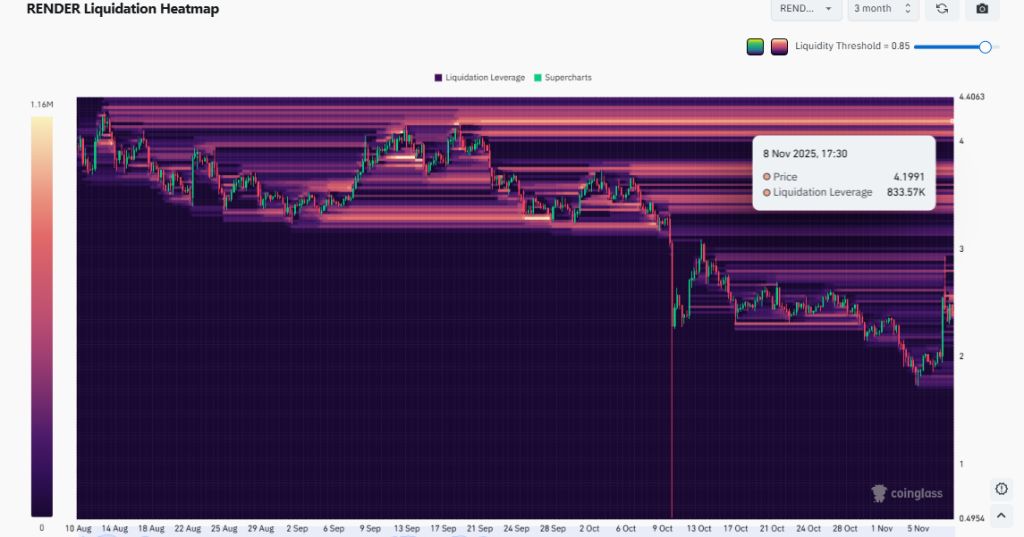

RENDER Price Prediction 2025: How Far Can RENDER Rally If $4.19 Flips?