Artificial Superintelligence Alliance (ASI), a project seen as the future among AI-themed crypto assets, is experiencing unexpected internal strife. Established in collaboration with SingularityNET, Fetch.ai, and Ocean Protocol, this alliance aimed to accelerate decentralized artificial intelligence. However, the unity quickly devolved into legal battles as Fetch.ai and Ocean Protocol faced a lawsuit filed in the Southern District Court of New York by some investors.

Unexpected Surge in FET Value: Buyers Dominate

The lawsuit alleges that Ocean Protocol’s founders misled the community, damaging the autonomy of OceanDAO, and converted 661 million Ocean tokens into 286.4 million FET, selling 263 million of those. This massive sale reportedly caused a sharp decline in the token ‘s price, with the proceeds allegedly transferred to Ocean Expedition, an organization in the Cayman Islands.

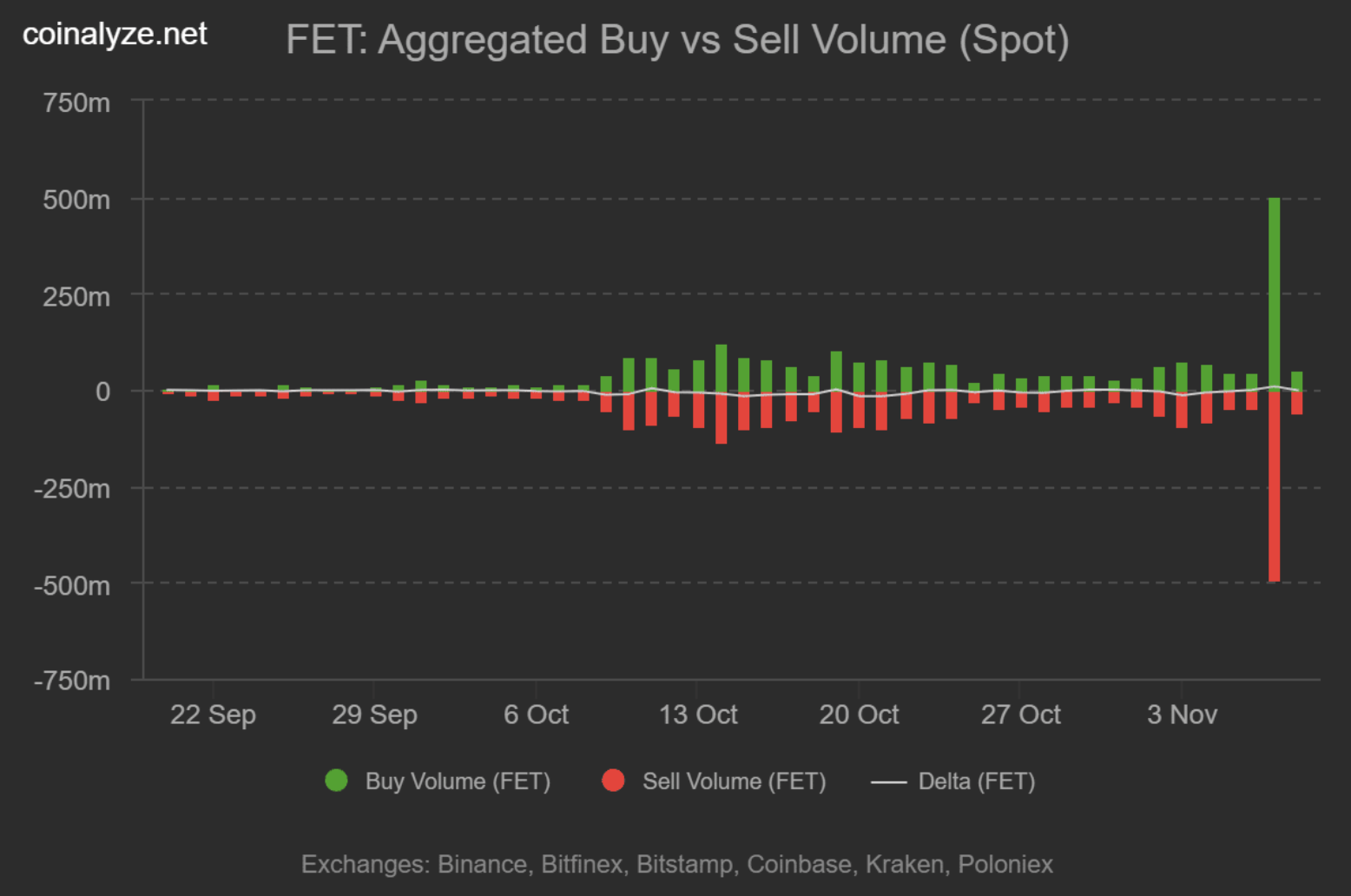

Surprisingly, instead of causing panic, news of the lawsuit seemed to stimulate buying interest in the market. From being under seller control since October 31, by November 7, buyers made a significant comeback. FET surpassed the $0.3 resistance, reaching a trading volume of 545 million tokens while sellers offloaded 493 million. This resulted in a favorable 52 million token difference for buyers, signaling an “aggressive spot accumulation” in the market.

According to CoinGlass data, FET’s “Spot Netflow” value dropped from $2.86 million to -$1.35 million, indicating investors were withdrawing tokens from exchanges. Such a situation typically indicates increased buying pressure and a potential upward price movement. Consequently, FET rose to $0.45, marking a 40.7% increase in the last 24 hours.

Price Movements and Technical Outlook: Bulls Gain Strength

Recent charts show that FET’s Stochastic RSI hit the 100 level, entering the overbought zone. While this suggests strong bullish momentum, it also warns of potential volatility increases. If this momentum is maintained, FET is expected to reclaim the $0.48 EMA100 resistance. The next resistance level is seen at the EMA200 level of $0.6. However, if the price closes below $0.37, the support level is at the EMA20 line, which is $0.28.

As these developments continue to resonate, a similar short-term price recovery was recently observed in SingularityNET (AGIX) tokens. Experts suggest this movement may signal a renewed interest in AI-themed tokens. The ASI Alliance, aiming for blockchain-based synergy among AI projects, continues amidst internal conflicts. The legal proceedings may undermine the project’s credibility in the long run. However, in the short term, investors’ “buying the dip” strategy provides temporary support to token prices. The final outcome relies on court decisions and the alliance’s future restructuring.