Robert Kiyosaki Doubles Down on Bitcoin Purchases Despite Warning of Economic Crash

According to Cointelegraph, Rich Dad Poor Dad author Robert Kiyosaki announced Sunday he is actively buying Bitcoin and other hard assets. The financial educator warned of an impending economic downturn in a post on X. He set ambitious price targets of $27,000 for gold, $100 for silver, and $250,000 for Bitcoin by 2026. Kiyosaki stated he views these assets as protection against what he calls the Federal Reserve's "fake money."

The author revealed his gold projection came from economist Jim Rickards. His Bitcoin target aligns with his long-held position on the cryptocurrency as an inflation hedge. Kiyosaki owns both gold and silver mines and has criticized the US Treasury repeatedly. He called the United States "the biggest debtor nation in history" in his post. The author repeated his controversial mantra that "savers are losers" and urged investors to buy real assets.

Kiyosaki also expressed new interest in Ethereum. He cited Fundstrat analyst Tom Lee's perspective on the blockchain powering stablecoins. The author explained his conviction stems from Gresham's Law and Metcalfe's Law. Gresham's Law states bad money drives out good money. Metcalfe's Law ties network value to user count.

Market Data Supports Potential Bitcoin Recovery

On-chain analytics suggest Bitcoin may be positioned for gains. Market analytics platform Crypto Crib noted Bitcoin's Market Value by Realized Value ratio returned to 1.8. This level has historically preceded rebounds of 30 to 50 percent. The MVRV ratio compares market value to realized value. It serves as a key indicator of potential price movements.

We reported that institutional adoption accelerated in 2025, with major financial players expanding cryptocurrency offerings. Bitcoin ETFs introduced in 2024 captured billions in institutional investment. Nasdaq reports that Bitcoin gained 119 percent in 2024. The cryptocurrency rose from $42,221 to $92,627 per coin during that period. Kiyosaki's 2025 projections represent potential gains of 89 to 278 percent.

Former BitMEX CEO Arthur Hayes predicted continued Bitcoin strength. Hayes stated the Federal Reserve will implement stealth quantitative easing as government debt increases. He expects the Fed will inject liquidity through its Standing Repo Facility. This quiet balance sheet expansion would be "dollar liquidity positive" according to Hayes. Higher liquidity typically drives up asset prices including Bitcoin.

Institutional Infrastructure Reshapes Bitcoin Market Dynamics

The approval of spot Bitcoin ETFs transformed institutional access to digital assets. About 106 million Bitcoin accounts exist globally as of December 2024. Only 400,000 Bitcoin transactions process on an average day. This represents limited current usage relative to potential adoption. Rising public interest could change Bitcoin's supply and demand equation rapidly.

BlackRock's iShares Bitcoin Trust and ARK 21Shares Bitcoin ETF provide easy access for traditional investors. These funds manage actual Bitcoin portfolios through custodial services. Buying ETF shares functions essentially as owning a slice of Bitcoin. The ETFs closed Thursday at $97.27 and $55.37 per share respectively.

Regulatory clarity has normalized institutional participation in 2025. Bitcoin ETFs now account for 6.7 percent of the asset's total market cap. Daily inflows exceeded $1.38 billion in October 2025 alone. Corporate adoption continues expanding with 172 public companies now holding Bitcoin. Major wealth management firms have opened access to Bitcoin ETFs for client allocations.

However, some analysts remain cautious about near-term price targets. Galaxy recently slashed its end-of-year Bitcoin target from $185,000 to $120,000. The firm cited whale distribution and treasury company challenges. Bitcoin recently dropped below $100,000 for the first time in six months. Volatility remains present despite increased institutional participation in the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The US SEC and CFTC may accelerate the development of crypto regulations and products.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.

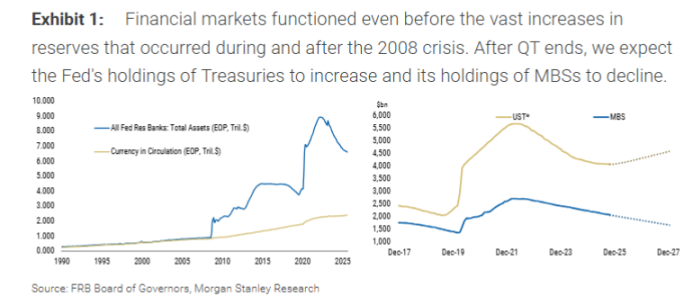

Morgan Stanley: Fed Ending QT ≠ Restarting QE, Treasury's Debt Issuance Strategy Is the Key

Morgan Stanley believes that the Federal Reserve ending quantitative tightening does not mean a restart of quantitative easing.