Aster Whales Bought 51 Million Tokens – Will Price Rally?

Aster whales added over $53 million in ASTER this month, signaling growing confidence. With the Squeeze Momentum Indicator turning bullish, the altcoin could soon break above $1.25 if support near $1.00 holds.

Aster (ASTER) has been trading sideways for nearly a month, showing limited volatility as it struggles to break through resistance.

The altcoin remains trapped under “The Void,” a previously untested resistance zone that must be cleared for meaningful recovery. However, whale accumulation hints at rising optimism among large investors.

Aster Whales Could Trigger The Recovery

Whales have become increasingly active over the past few weeks, signaling growing confidence in Aster’s long-term outlook.

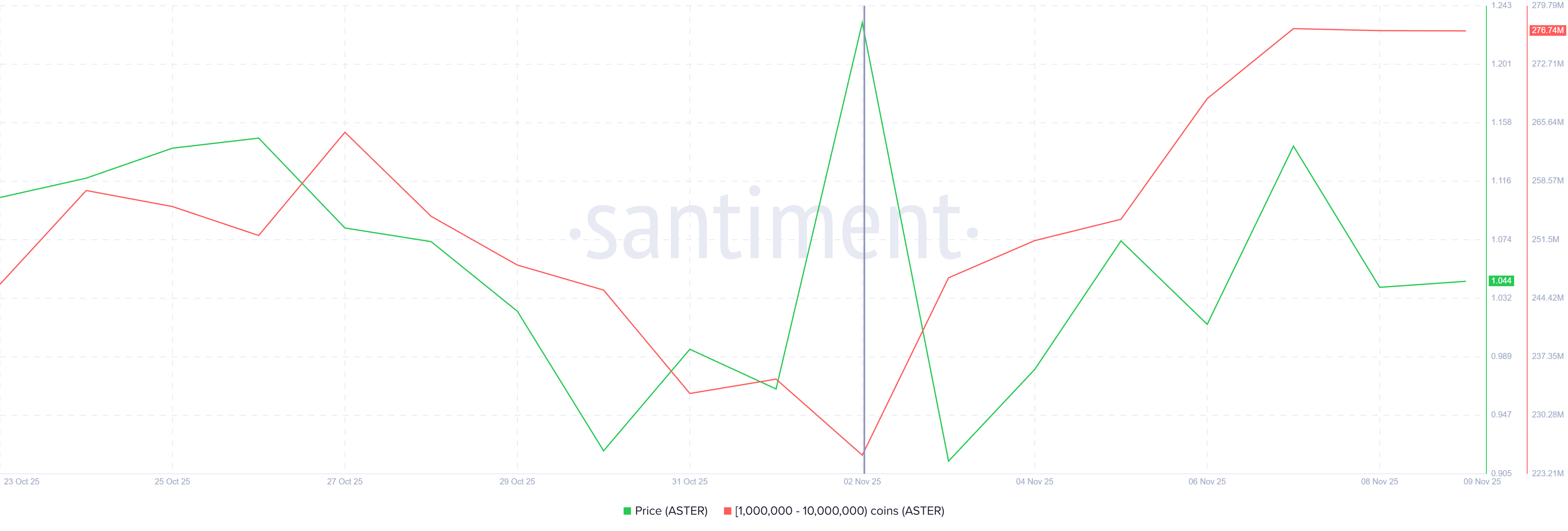

On-chain data reveals that addresses holding between 1 million and 10 million ASTER have accumulated over 51 million additional tokens since the start of November, equating to roughly $53 million in value.

This surge in large-wallet accumulation suggests whales are positioning for potential upside. Historically, such accumulation phases precede sharp rallies, as these investors tend to buy at perceived market bottoms.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Aster Whale Holding. Source:

Aster Whale Holding. Source:

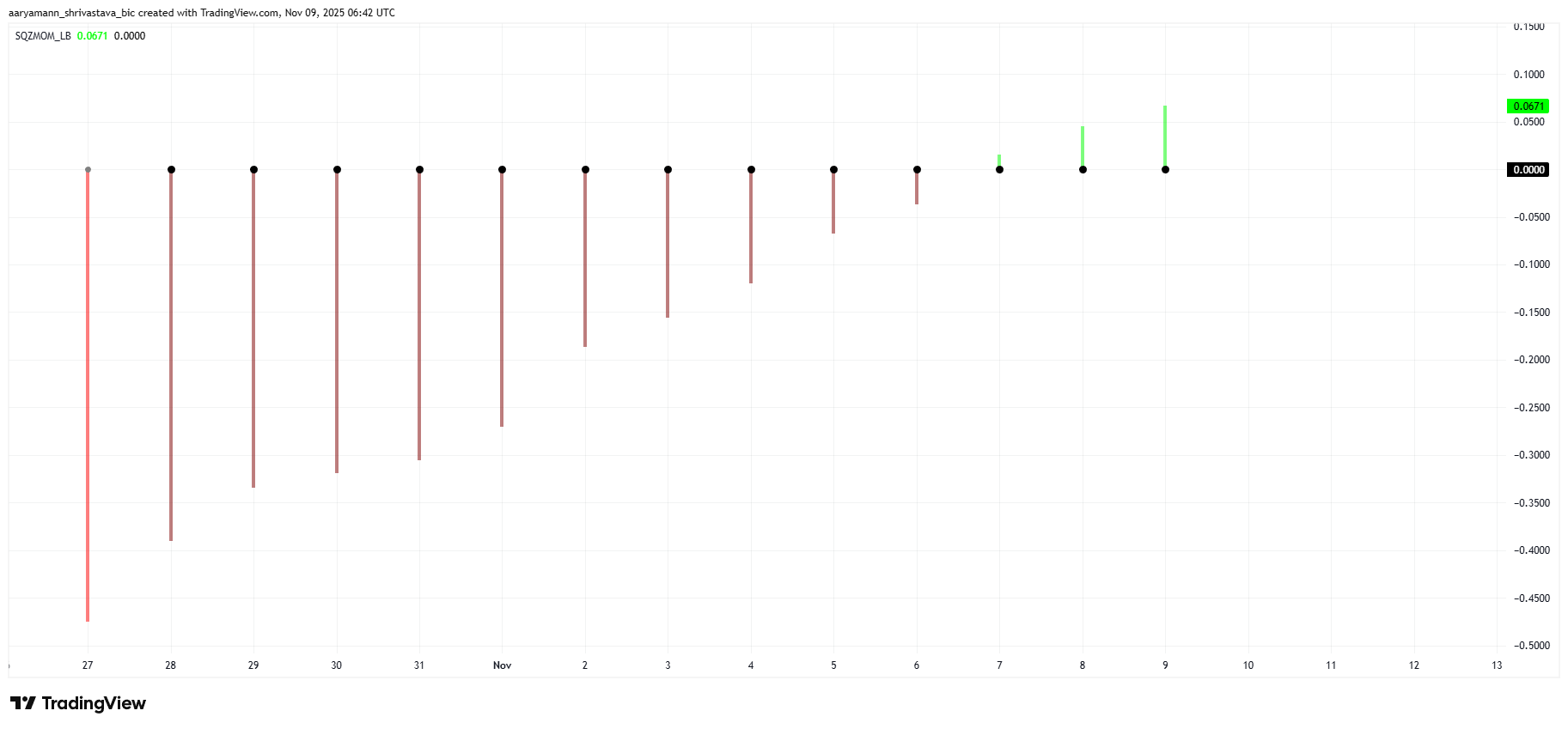

The Squeeze Momentum Indicator currently indicates a developing squeeze, marked by black dots that typically precede a significant price move. This setup often signals a volatility breakout, suggesting that Aster could soon see stronger directional movement. Currently, the indicator’s green bars indicate that bullish momentum is building within this phase.

If this bullish volatility expands, ASTER could finally escape its tight range, with buying pressure propelling it toward higher price levels. However, squeezes can occasionally flip bearish if market sentiment weakens or broader conditions turn negative.

ASTER Squeeze Momentum Indicator. Source:

ASTER Squeeze Momentum Indicator. Source:

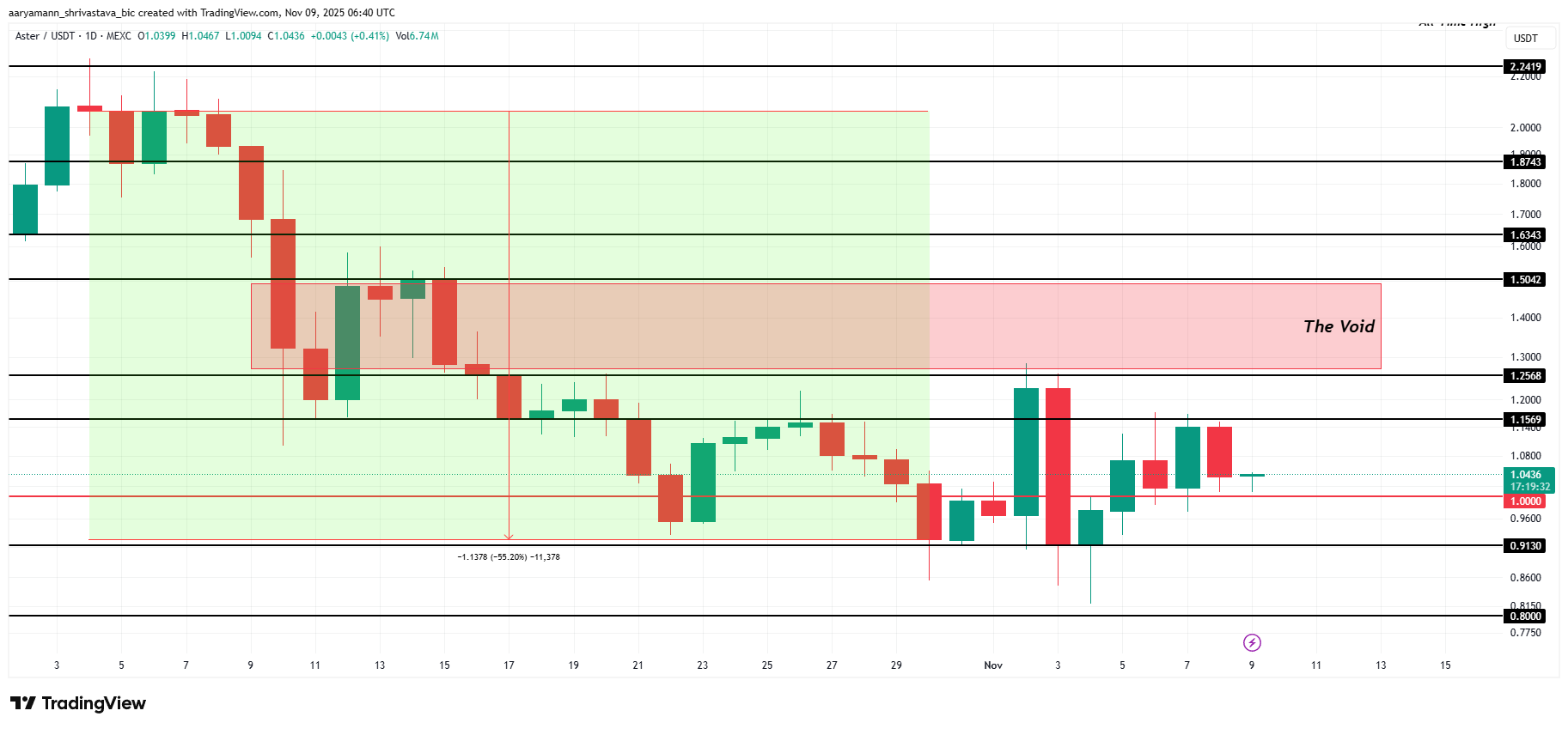

ASTER Price Faces Resistance

ASTER’s price stands at $1.04, maintaining a stable position above the $1.00 psychological level. While this support has held firm, the more critical floor lies at $0.91, which has underpinned price action throughout the recent consolidation phase.

$0.91 and $1.25 make up the consolidation range for ASTER. Above $1.25 lies “The Void”, a previously untested resistance zone, breaching which is necessary to recover October’s 55% losses. The above-mentioned factors suggest this is likely for ASTER, which could push the price past $1.50 and towards $1.63.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

If market sentiment weakens, however, Aster could extend its sideways pattern or fall below $0.91. Such a drop could trigger a decline toward $0.80, invalidating the current bullish thesis and delaying recovery prospects.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Solana ETF Investments Face Off Against Negative Technical Signals at the $166 Turning Point

- Solana (SOL) faces mixed signals as ETF inflows wane despite short-term price rebounds, with $70M November inflows dropping to $6.78M by Nov 10. - Technical indicators show bearish bias: RSI near 40, MACD/AO below zero, and 50-day/100-day EMAs at $188-$190, suggesting $144 support risks. - Institutional confidence persists with $420M November inflows, but declining stablecoin liquidity (-8.16% to $13.8B) raises network depth concerns. - Ecosystem growth through DeFi and staking offsets bearish pressures,

Global AI Competition Sparks Data Center Boom: Companies Invest $2.35B in Modular Power Solutions

- APLD Compute Co raises $2.35B via secured notes to build North Dakota data centers and repay debt, aligning with AI/cloud demand growth. - Solaris Energy targets 2.2GW operated capacity by 2028, focusing on industrial data center power solutions amid rising GPU cluster energy needs. - Microsoft and Google commit $16B to expand European AI infrastructure, reflecting global competition for energy-efficient high-capacity facilities. - Array Digital reports 68% YOY site rental revenue growth but faces operat

Ethereum Updates: UBS Launches Tokenized Fund, Highlighting Blockchain’s Growing Role in Institutional Finance

- UBS executed first tokenized fund transaction using Chainlink's DTA standard on Ethereum , automating fund operations via smart contracts. - The uMINT fund with DigiFT's real-time processing demonstrated blockchain's potential to streamline institutional asset management and reduce reconciliation costs. - Institutional adoption accelerates as BNY, Goldman Sachs , and WisdomTree launch tokenized fund projects, with Ethereum's tokenized assets growing 2,000% YoY. - XRP and cross-border crypto projects gain

XRP News Today: XRP's Strong Fundamentals Face Off Against Death Cross—Will Institutional Investment Trigger a Recovery?

- XRP fell to $2.32 as technical indicators showed a death cross and bearish patterns, despite RLUSD's $1B supply milestone. - ETF filings by Bitwise and 21Shares could boost institutional liquidity, but U.S. government shutdown delays regulatory approvals. - Market sentiment remains cautious (Fear & Greed Index at 31) amid Bitcoin's downtrend dragging altcoins lower. - Analysts split between $1.9 support retests and potential rebounds above $2.40-2.50, with RSI at neutral 49.98.