Solana’s Connection To Bitcoin Has Led To Price Capitulation

Solana’s close correlation with Bitcoin has intensified its decline to $157, but with NUPL entering capitulation, a rebound could form if market sentiment improves and Bitcoin finds stability.

Solana’s price continues to decline, extending investor losses and reinforcing the ongoing bearish trend across the broader crypto market.

Despite periods of recovery in recent months, the altcoin now faces intensified downward pressure. Its close correlation with Bitcoin may be a key factor driving Solana’s latest capitulation.

Solana Is Depending On Bitcoin

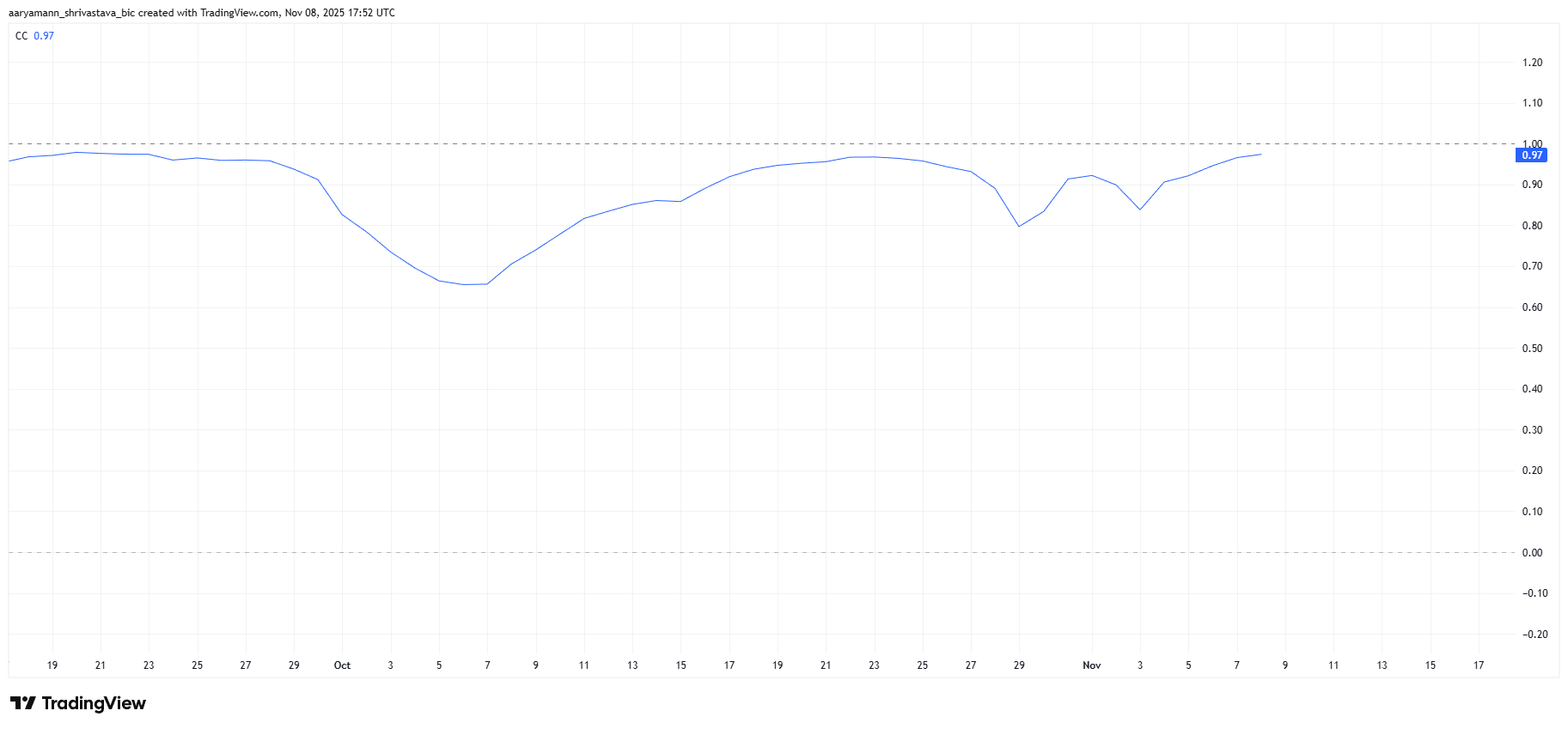

The correlation between Solana and Bitcoin currently sits at an exceptionally high 0.97, indicating that SOL’s price movements closely mirror those of the world’s largest cryptocurrency. This correlation means any weakness in Bitcoin’s market performance directly affects Solana’s trajectory.

With Bitcoin hovering near the $100,000 level and struggling to break higher, Solana’s price faces a continued risk of decline.

The lack of bullish momentum from Bitcoin translates into stagnation for SOL, limiting the token’s potential for independent growth and raising concerns about its near-term stability.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Solana Correlation To Bitcoin. Source:

Solana Correlation To Bitcoin. Source:

Solana Correlation To Bitcoin. Source:

Solana Correlation To Bitcoin. Source:

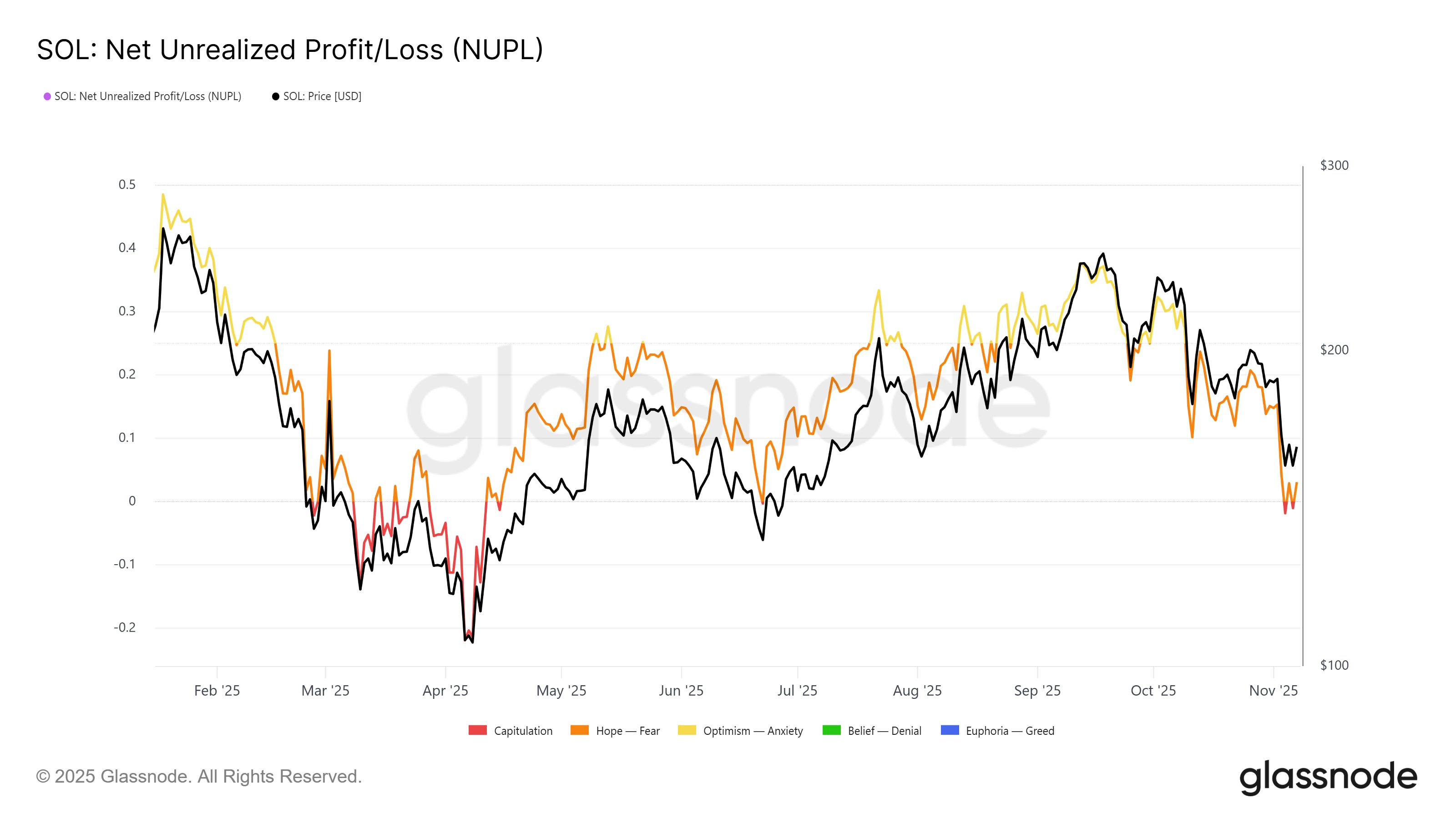

From a macro perspective, Solana’s Net Unrealized Profit and Loss (NUPL) metric has entered the capitulation zone, signaling investor caution.

Historically, dips into this zone have marked critical turning points for Solana, as investors often hold rather than sell at a loss, slowing further downside.

Currently, Solana’s NUPL is hovering just inside the capitulation range. However, given its strong correlation to Bitcoin, the metric could deepen if BTC’s weakness persists.

Ironically, this dip could create the conditions for a rebound, as capitulation phases have historically preceded accumulation and recovery for SOL.

Solana NUPL. Source:

Solana NUPL. Source:

Solana NUPL. Source:

Solana NUPL. Source:

SOL Price Could Bounce Back

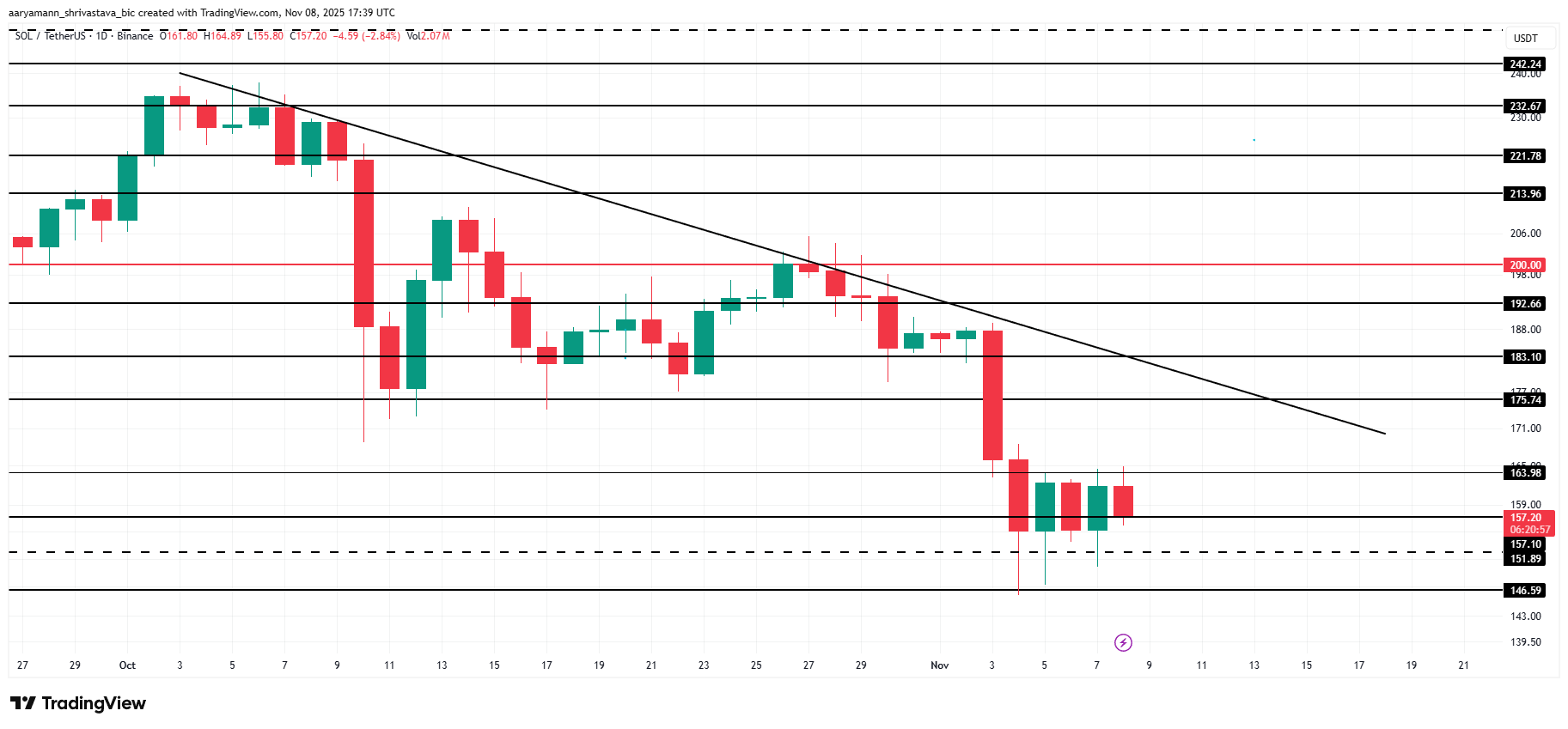

At the time of writing, Solana trades at $157, extending a month-long downtrend. The token’s performance remains tethered to Bitcoin’s movements, making further declines likely if BTC fails to stabilize.

In the short term, Solana could face additional bearish pressure, sliding to $150 or even $146. Such a drop may spark renewed buying interest, helping SOL recover toward $163 and potentially $175 as confidence returns.

Solana Price Analysis. Source:

Solana Price Analysis. Source:

Solana Price Analysis. Source:

Solana Price Analysis. Source:

However, if Bitcoin’s price continues to deteriorate, Solana’s downtrend may intensify. A break below $146 could push the token toward $140, deepening investor losses and invalidating any bullish recovery thesis for the near future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin's Progress in Zero-Knowledge Technology and the Investment Opportunities within Ethereum's Layer-2 Ecosystem

- Vitalik Buterin prioritizes ZK technologies to optimize Ethereum's post-Merge scalability, targeting modexp precompile replacement for 50% faster ZK-proof generation. - ZKsync's Atlas upgrade enables 15,000+ TPS and near-zero fees by redefining L1-L2 liquidity, positioning ZK-based L2s as Ethereum's infrastructure backbone. - Dencun's "blob" data slashes L2 costs by 98%, driving Base and Arbitrum to surpass Ethereum's base layer in transaction volume and user adoption. - ZK L2s like ZKsync and StarkNet s

Vitalik Buterin Supports ZKsync: What This Means for Layer 2 Scaling

- Vitalik Buterin endorses ZKsync, highlighting its ZK-rollup tech as critical for Ethereum's scalability and decentralization goals. - ZKsync's Atlas upgrade achieves 30,000 TPS with 1-second finality, enhancing programmability while maintaining on-chain security. - The project faces competition from Arbitrum and Optimism but differentiates through privacy, low fees, and Ethereum compatibility. - Rigorous audits and emergency response protocols strengthen ZKsync's security, though real-world performance r

ZK Atlas Enhancement: Driving Blockchain Expansion and Business Integration in 2025

- ZKsync's 2025 Atlas Upgrade introduces a high-performance ZK stack with 15,000+ TPS, redefining blockchain scalability through modular Layer 2/3 infrastructure. - The upgrade enables bridge-free Ethereum interoperability and supports EVM/RISC-V/WASM compatibility, addressing enterprise needs for hybrid blockchain solutions. - Institutional adoption surges with ZK token's 50% price jump and $19M+ partnerships, though legacy system integration and regulatory clarity remain key challenges. - BaaS compatibil

ZK-Related Cryptocurrencies: Reasons Behind the ZK Surge in November 2025

- ZK crypto sector dominates 2025 market via on-chain adoption and institutional validation, driven by privacy-compliant infrastructure and real-world use cases. - Zcash (ZEC) surges 400% as shielded pool hits 20% supply, while Immutable (IMX) builds $920M gaming ecosystem using ZK-powered zkEVM technology. - Worldcoin (WLD) advances biometric verification without data exposure, and Succinct's OPL scales ZK infrastructure for enterprise adoption. - Institutional capital prioritizes ZK projects with measura