3 Indicators Suggesting an Altcoin Season May Be Emerging This November

Analysts say weakening Bitcoin Dominance and key psychological signals hint at an altcoin rebound, though mixed technical signs keep traders divided on whether a true season is near.

The crypto market has faced heavy losses since the October crash, eroding confidence. While many analysts argue that an altcoin season remains distant, emerging signals are beginning to shift sentiment.

In November 2025, a combination of market psychology, technical indicators, and renewed liquidity inflows suggests the early formation of a potential bull cycle in altcoins.

Bitcoin Dominance Signals Potential Capital Rotation

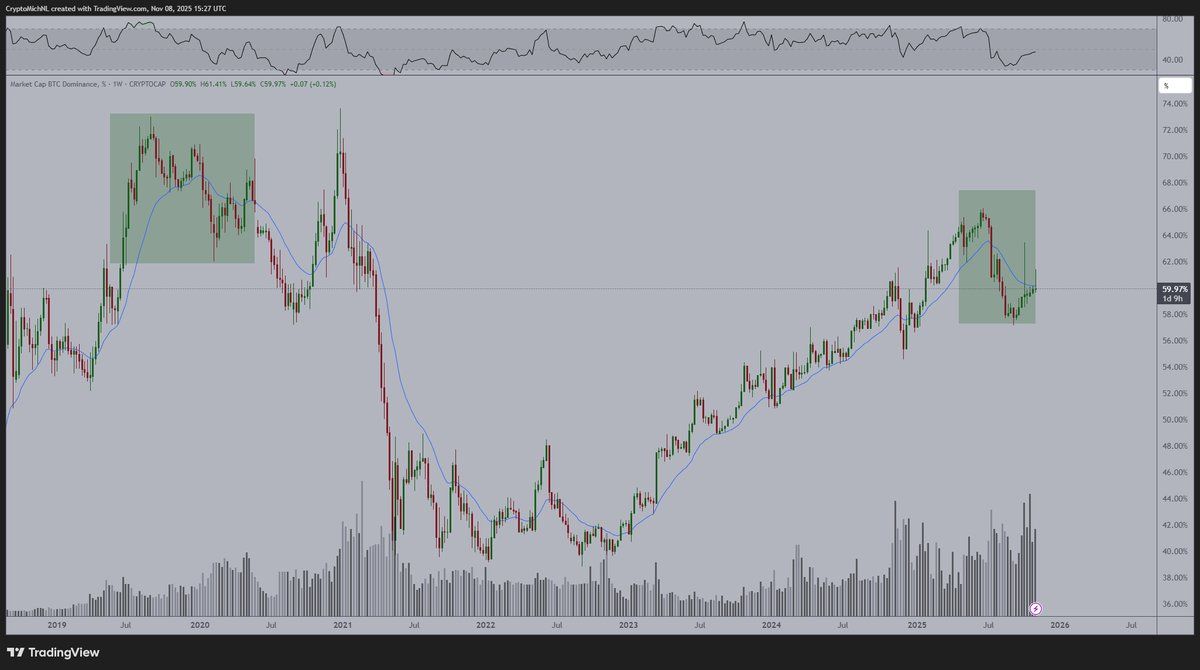

One of the most closely watched metrics in this context is the Bitcoin Dominance (BTC.D). Bitcoin’s share of total cryptocurrency market capitalization.

According to market data, BTC.D dropped in late June and continued moving downwards. It rebounded in September, though it has yet to reclaim its June highs. At press time, it stood at 59.94%

Bitcoin Dominance Chart. Source:

TradingView

Bitcoin Dominance Chart. Source:

TradingView

Despite this, analyst Matthew Hyland noted that the BTC.D chart is still bearish.

“The BTC Dominance…has looked bearish for many weeks. The downtrend is favorable to continue therefore, this relief rally has been a dead cat bounce in a downtrend,” Hyland wrote.

Analyst Michaël van de Poppe compared the current cycle to late 2019 and early 2020. At the time, Bitcoin Dominance first declined, briefly recovered, and then entered another major downward leg.

Van de Poppe suggests that today’s market may be at a similar turning point. The analyst anticipates a second drop in BTC.D this quarter.

Bitcoin Dominance Patterns in 2019-2020 Vs. November 2025. Source:

X/CryptoMichNL

Bitcoin Dominance Patterns in 2019-2020 Vs. November 2025. Source:

X/CryptoMichNL

Adding to this, trader Don pointed to a head-and-shoulders structure on the Bitcoin Dominance chart, a bearish reversal signal. If confirmed, this would likely drive dominance even lower and shift capital toward altcoins.

“Rotation season might be closer than most think,” the trader wrote.

Market Psychology and Retail Participation

From a psychological perspective, an analyst Merlijn emphasized that altcoin seasons begin during market disbelief, when sentiment is at its lowest.

“ALTCOIN SEASON STARTS WHERE EVERYONE GIVES UP. Same base. Same wedge. Same disbelief. Every previous altseason was born here. Bitcoin cools. Liquidity rotates. It’s time for the real fireworks,” he stated.

Additionally, recent weekend rallies across altcoins indicate a renewed interest from retail investors. Such activity is often a bullish short-term sign, with sentiment shifting from apathy to cautious optimism.

New Liquidity, New Rally

Lastly, new sources of liquidity could become crucial catalysts for an upcoming wave of altcoin gains. The Federal Reserve is set to restart its quantitative easing program on December 1, a policy shift that could inject significant liquidity into financial markets.

Historically, such moves have lowered borrowing costs, boosted investor confidence, and redirected capital toward higher-risk assets, such as cryptocurrencies, potentially setting the stage for renewed momentum across the altcoin sector.

Despite several bullish signals, some analysts warn that a broader altcoin rally may still be far off.

We are not in Altseason.Selective alts pumping isn't a sign of Altseason.Until Altcoin MCap excluding stables breaks a new ATH, we won't see any prolonged rally in alts.

— Ted (@TedPillows) November 8, 2025

Thus, the weeks ahead will reveal whether November 2025 launches a lasting altcoin rally or only a brief surge in speculation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Faces a Pivotal Choice: Managing Liquidity or Controlling Inflation

- Fed may expand balance sheet to address liquidity needs amid shrinking reserves, signaling potential end to 3-year QT program. - Officials pause QT as $6.6T reserves deemed "somewhat above ample," but warn of risks from inflation above 2% target and market volatility. - Governor Mester cautions against aggressive rate cuts, citing economic rebound risks and fiscal/regulatory factors boosting 2026 growth outlook. - External pressures including government shutdown delays and stablecoin demand growth compli

Regulation and Innovation: Brazil's Stablecoin Reform Ignites Discussion

- Brazil's central bank classifies stablecoins as forex operations under 2026 rules requiring AML/CTF compliance and capital reserves. - Privacy advocates criticize the framework for enabling "total surveillance" through centralized user data tracking and increased cyber risks. - Regulators defend the measures as essential to combat money laundering in Brazil's $1.7 trillion crypto market while advancing its CBDC project Drex. - Global parallels emerge with UK's £20,000 stablecoin cap, highlighting growing

Uniswap News Today: Uniswap’s UNIfication Brings Ecosystem Incentives Together for a Lasting DeFi Landscape

- Uniswap proposes "UNIfication" to overhaul tokenomics, governance, and position itself as the default tokenized asset platform. - The plan includes burning 100M UNI tokens, activating protocol fees, and introducing fee discount auctions to boost token value. - Governance consolidation under Uniswap Labs aims to streamline operations while avoiding SEC scrutiny by dissolving the nonprofit foundation. - Market analysts highlight potential price stability and ecosystem alignment, though major stakeholders l

Bitcoin Updates: MoonBull’s Innovative Incentive Model Addresses Doubts About Meme Coins

- MoonBull (MOBU) emerges as 2025's top meme coin presale, raising $550K with 1,900+ holders and a 7,244% projected return. - Structured incentives include deflationary tokenomics, 15% referral rewards, and 95% staking APY, differentiating it from peers like Dogecoin and Shiba Inu . - Market shifts toward meme coins as Bitcoin's dominance wanes, though critics warn of high-risk social media-driven valuations despite MoonBull's transparent governance.