River suspends points redemption mechanism, sparking controversy; River Pts drops over 70% in a single day

"Code is Law" seems to be a thing of the past.

Code is Law seems to be a thing of the past

Written by: ChandlerZ, Foresight News

On the evening of November 9, the chain abstraction stablecoin system River announced that it would temporarily suspend the mechanism for exchanging River Pts for RIVER tokens and plans to carry out a comprehensive upgrade. The official reason given was that the price of RIVER had recently suffered an organized and premeditated short-selling attack. Some large holders concentrated on exchanging River Pts for RIVER in a short period, combined with large short positions, to collaboratively suppress the market price.

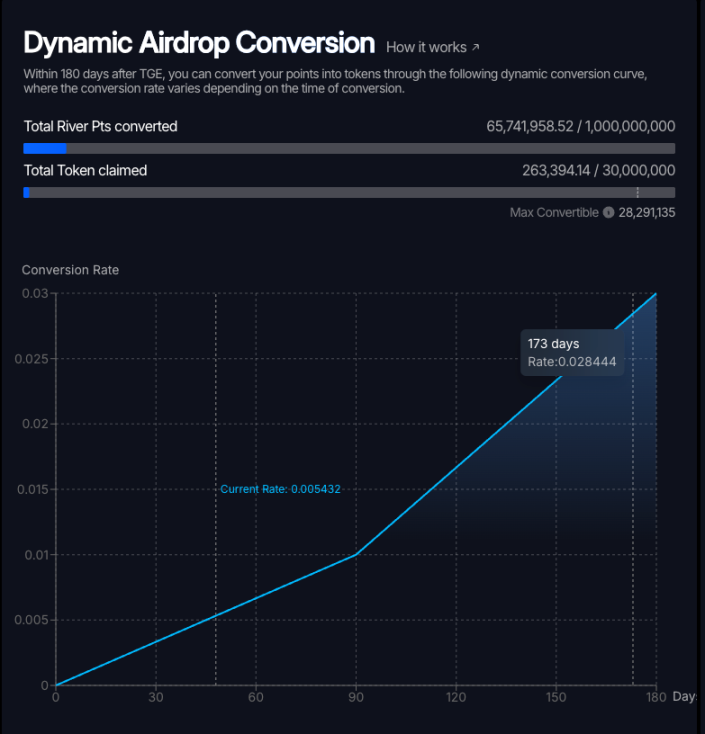

River Pts are River’s ecosystem points, which can be traded and staked as ERC20 tokens. Under River’s unique Dynamic Airdrop Conversion mechanism, River Pts can be converted into RIVER tokens at any time within 180 days, allowing users to choose the timing and market behavior themselves.

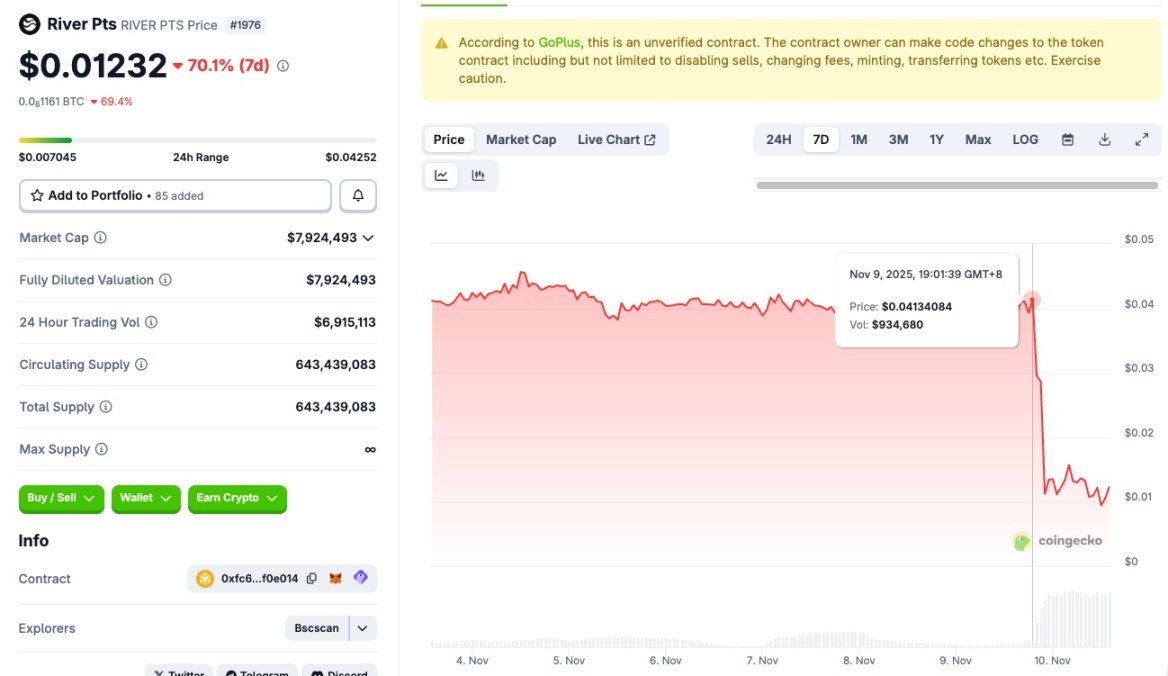

After the announcement, River Pts quickly collapsed in the secondary market. Market data shows that River Pts dropped from about $0.04 to around $0.01 on the same day, a single-day drop of more than 70%, with selling pressure erupting all at once.

What is River? And what is Dynamic Airdrop Conversion?

The River project is developed by the RiverdotInc team, with its core positioning as building a chain abstraction stablecoin system for multi-chain ecosystems. The system aims to connect assets, liquidity, and yields across different blockchains, enabling seamless cross-chain interaction without relying on traditional bridging or wrapping mechanisms.

On September 19, River became the first BuildKey TGE project launched on Binance Wallet. BuildKey is an innovative issuance model launched by Binance in cooperation with Aspecta AI. The model is divided into three stages: In the first stage, users must meet the Alpha Points threshold and deposit BNB to obtain BuildKey certificates, which represent future token allocations. In the second stage (BuildKey trading), users can trade BuildKey in a liquidity pool based on a Bonding Curve, achieving pre-TGE price discovery. The threshold for this stage is relatively low. The third stage (TGE and redemption) is where the core advantages of the BuildKey model—fairness and transparency—are realized. The number of tokens subscribed for this time was 2 million RIVER, accounting for 2% of the total supply. Ultimately, more than 100,000 BNB were deposited, worth over $100 millions, setting a fundraising record for Binance Wallet IDO. The oversubscription rate reached as high as 993 times, with over 33,000 participating addresses.

River previously attracted much attention largely due to its proposed Dynamic Airdrop Conversion mechanism. Unlike traditional “one-time fixed ratio” airdrops, River incorporated time into its tokenomics model.

On September 22, River announced that the RIVER token airdrop was open for claiming, allocating 1 billion River Pts for the airdrop, corresponding to up to 30 million RIVER, about 30% of the total supply. The number of RIVER tokens users could claim would increase over time—the longer the wait, the more tokens could be obtained, with a maximum waiting period of 180 days. If a user claimed on the 180th day, the number of tokens received would be 270 times that of claiming on the first day.

The official example stated that for the same 1 million Pts, if exchanged on the first day, only about a thousand RIVER could be obtained; if held until the 180th day, up to 30,000 RIVER could be received, a return 270 times higher than on the first day.

In the project’s narrative, this design aims to reward long-term supporters and punish “hit-and-run” fast players. The longer users wait, the stronger their trust in the project, and the more tokens they can ultimately receive. Combined with the ability to stake River Pts within the ecosystem and participate in activities to continue accumulating, Dynamic Airdrop Conversion was once touted as a new standard for airdrop distribution.

For this reason, after the TGE, most users chose not to rush to exchange but to continue holding or staking Pts, hoping to receive a higher proportion of RIVER closer to the 180-day mark. This group is also the one experiencing the greatest “expectation gap” in this incident.

According to its official website, as of November 10, about 65.74 million River Pts had been converted into RIVER tokens.

Official: Had to hit the brakes to prevent systemic risk

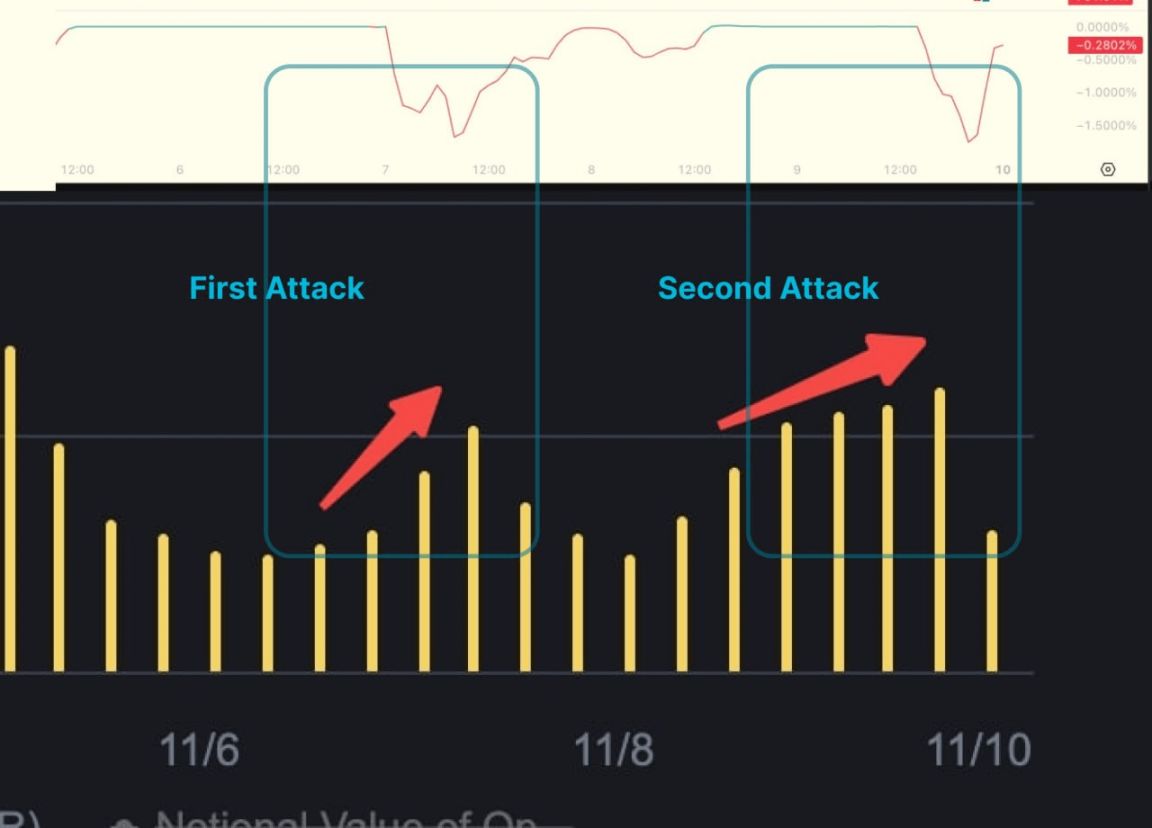

In the November 9 announcement, the River team stated that since November 7, it had observed abnormal and suspicious activities on multiple exchanges, including addresses opening large short positions, large amounts of River Pts being exchanged for RIVER and immediately sold, and sharp changes in funding rates.

The announcement stated that malicious short-sellers were placing large short orders while using the Pts exchange mechanism to quickly obtain RIVER for sale, thereby collaboratively suppressing the price. This was described as an organized and premeditated attack, targeting the River ecosystem and the points exchange mechanism itself.

In this narrative, River’s solution was to immediately suspend the Pts-to-RIVER exchange channel, initiate market buybacks, and begin upgrading the mechanism. The team emphasized that this was a temporary decision made in pursuit of long-term sustainable growth and promised to disclose more data, hold AMAs, listen to community feedback, and jointly design a new mechanism.

From the project’s perspective, this was a forced braking action to avoid a main market crash under extreme market conditions. But for users, this touched on a more sensitive issue: do the rules still count?

180-day anytime exchange—why can it be stopped midway?

The reason this incident escalated so quickly is not just the sharp drop in Pts price, but the way the project handled the boundaries of the rules. Many participants pointed out that River had emphasized the 180-day exchange window, the freedom to choose the timing, and even batch exchanges in its FAQ, official articles, and airdrop page. Many users based their conversion and arbitrage strategies on these rules.

Now, with the window not even halfway through, the exchange mechanism has been announced as temporarily suspended, with no clarity on whether, when, or under what rules it will resume. For these users, this is no longer a simple strategy adjustment, but a forced rule change in an ongoing game. The Pts in their hands, which were chips expected to be converted into RIVER, have become points that can only be sold at a loss on the secondary market, with their time value instantly discounted.

On the other hand, the debate over who is actually being protected is intensifying. Supporters believe that if there really was a large-scale short-selling attack combined with concentrated exchanges, keeping the mechanism open could have caused the RIVER spot market to collapse, dragging down the entire ecosystem and all token holders; suspending exchanges and initiating buybacks may indeed be necessary in extreme situations.

But opponents question whether, in effect, the suspension primarily protects the RIVER main market price while shifting the pressure onto Pts holders. What makes many people uneasy is that this suspension exposes a deeper issue: to what extent can rules written into contracts and treated as on-chain commitments be unilaterally changed by the project team?

If the River contract still retains strong mutability permissions, this means the arrangement of 180-day free exchange is not a hard rule locked in code, but more like an operational plan that can be adjusted at any time by the contract owner switch.

In the crypto world where “code is law” is a creed, such a structure—where a few addresses hold the power of life and death—is enough to trigger a renewed discussion about the foundation of trust in the community. If contracts can be changed at any time, are users really betting against time, or are they betting against the project team’s subjective decisions?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin to $10,000? Bloomberg Makes Shocking Crash Prediction

Bitcoin ETFs See Largest Drawdown Since Launch

933,890,048,712 SHIB in 24 Hours: Can Shiba Inu Still Get a Chance?

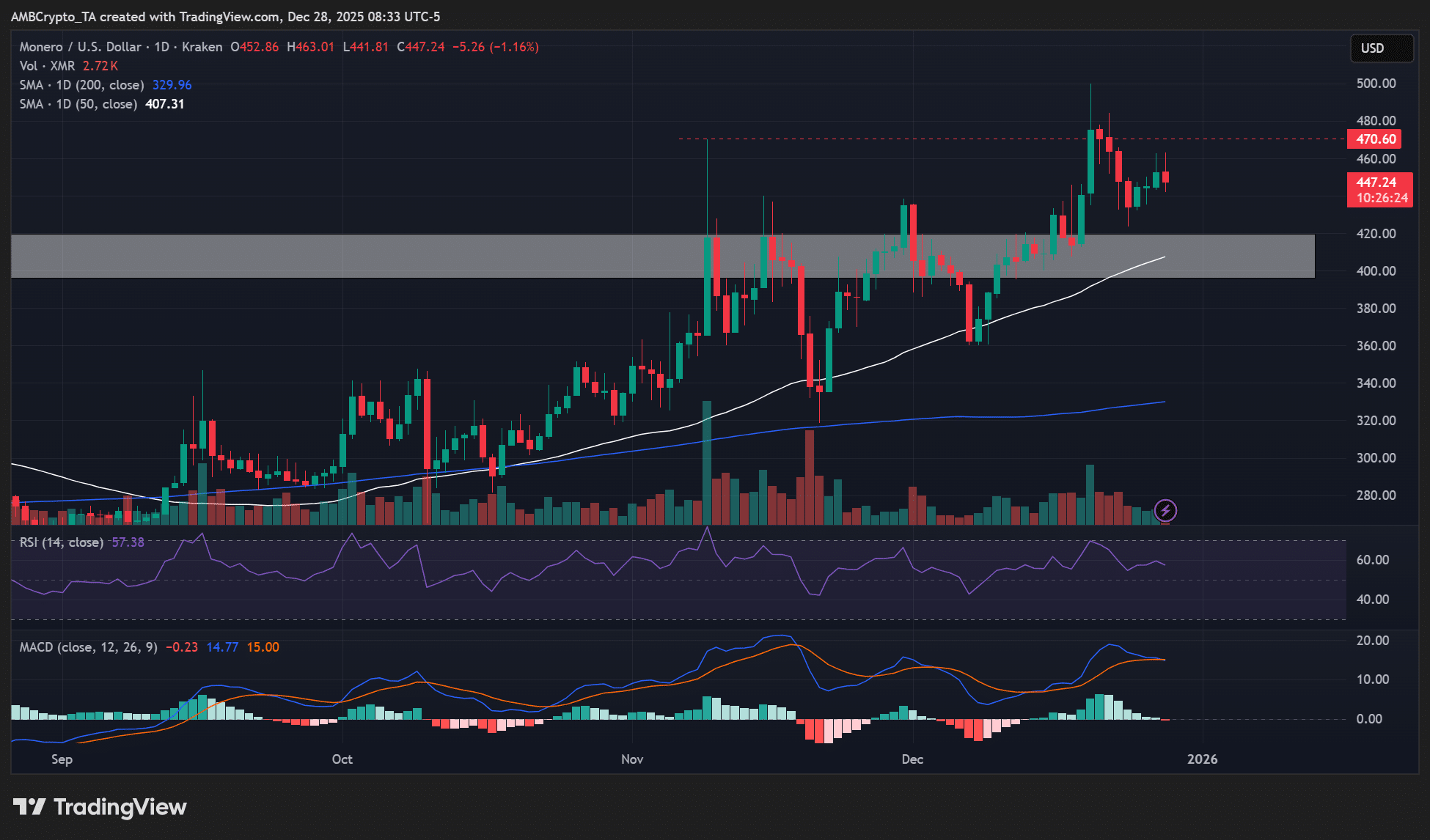

Monero – Why XMR buyers should wait for this potential opportunity