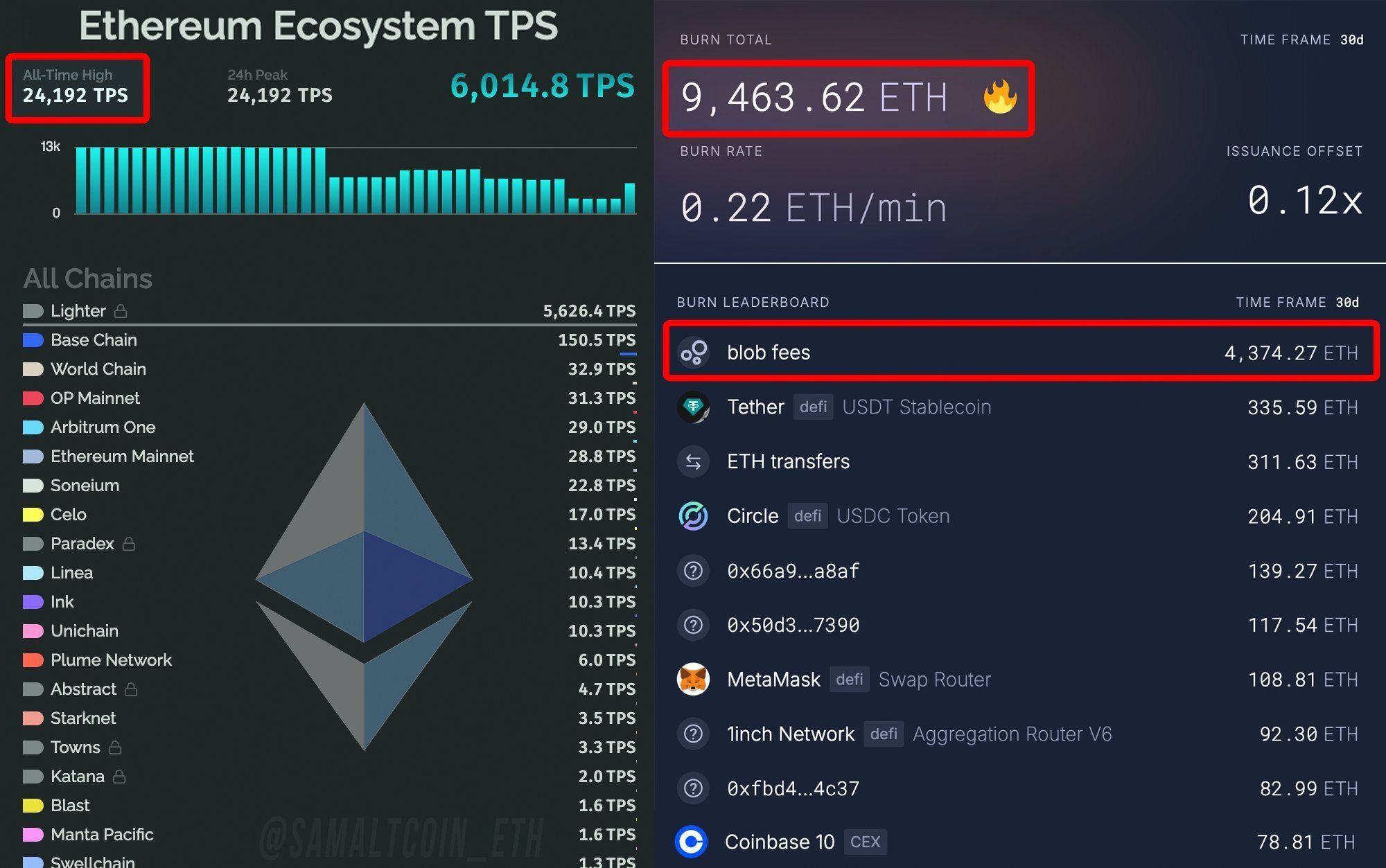

Ethereum Burns $32 Million in ETH as Network Hits Record 24,192 TPS

Ethereum has achieved a historic milestone, processing 24,192 transactions per second, the highest ever recorded for the network.

The data, compiled by analytics platform Growthepie, attributes this record to the inclusion of Lighter. The protocol is a Layer 2 solution that recently joined Ethereum’s scaling ecosystem.

Lighter alone is processing about 4,000 TPS, far outpacing Base Chain, which typically handles between 100 and 200 TPS. Consequently, the surge highlights the influence of Layer 2 platforms. In particular, these solutions extend Ethereum’s scalability, achieving performance levels the base layer alone could not reach.

Waidmann noted that “blobs are scaling L2s at warp speed,” which indicates that more user activity across Layer 2s directly translates into more ETH being burned, reducing supply and potentially influencing long-term price dynamics.

Community Reactions

In a tweet, Ethereum co-founder Vitalik Buterin celebrated the development. “Ethereum is scaling,” he wrote, highlighting how the network handles increasing transaction volumes more efficiently.

Ryan Sean Adams, the voice behind the Bankless podcast, emphasized that Layer 2 solutions now offer a 200 times scaling factor for Ethereum. He attributed the breakthrough to the increasing adoption of zero-knowledge proofs (ZK tech).

Based on this advancement, he predicted that the network could soon reach 100,000 TPS, and ultimately 1 million TPS.

Pectra and Dencun Upgrades Power Layer 2 Growth

Notably, Ethereum’s improved performance is rooted in the recent Pectra and Dencun upgrades, which significantly enhanced the throughput and efficiency of Layer 2 (L2) networks. These updates enable faster and cheaper transactions, laying the groundwork for Ethereum’s record-breaking performance.

By optimizing data handling and supporting zero-knowledge technology, these upgrades enable L2 networks to process transactions with unprecedented speed and efficiency, thereby reinforcing Ethereum’s multi-layer scaling model.

While Lighter is driving much of Ethereum’s record performance, the platform has faced several network outages since its October 1 launch. The disruptions have drawn comparisons to Solana’s early instability.

Following an outage on October 28, Lighter’s team compensated 3,900 wallets with $774,872 in USDC. Despite these challenges, Lighter remains a central player in Ethereum’s recent scaling success.

Debate Over Ethereum’s Value Capture

Meanwhile, the rise of Layer 2s has raised strategic questions for Ethereum’s long-term economic model. Rezso Schmiedt, founding partner at ₿RRR Capital, questioned where the value accrual lies for Ethereum’s mainnet if Layer 2 networks capture most transaction fees.

Nevertheless, some community members argue that new mechanisms, such as fee sharing, MEV capture, and protocol-level integrations, are needed to ensure that Layer 1 continues to benefit financially from Layer 2 growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Surge in MMT Token Value: Could It Trigger a DeFi Market Adjustment?

- Momentum's MMT token surged 224% post-Binance listing in November 2025, sparking debates about DeFi's volatility as a capital attraction strategy. - Rapid price spikes and 7.2 turnover ratio highlight speculative risks, while phishing scams during TGE raise trust concerns. - MMT's governance role and ve(3,3) DEX model aim to create sustainable value through liquidity incentives and cross-chain interoperability. - Upcoming Momentum X platform (Q2 2026) targets institutional adoption by stabilizing retail-

COAI Faces Steep Drop: Uncovering the Causes Behind India's Crypto Industry Turmoil

- India's crypto sector faces panic as COAI's sharp decline highlights regulatory ambiguity and macroeconomic pressures. - Forex reserves fell $5.6B by October 2025, with gold reserves dropping $3.8B, signaling broader financial fragility. - Institutions avoid crypto investments due to unclear tax frameworks and RBI's e-rupee focus, stifling market growth. - Regulatory uncertainty fuels volatility, with minor policy hints triggering panic despite no concrete crypto bans. - Clearer policies or regulatory sa

Bitcoin Updates: BlackRock’s $1 Billion Crypto Custody Initiative Reflects Growing Institutional Adoption of Digital Assets

- BlackRock deposits $135M in Bitcoin into Coinbase to optimize custody for its crypto ETFs. - JPMorgan increases holdings in BlackRock’s Bitcoin ETF, reflecting institutional demand for regulated crypto products. - BlackRock explores tokenizing funds on XRP Ledger and partners with Intesa Sanpaolo for digital services in Belgium/Luxembourg. - Market speculation intensifies on Bitcoin’s future price, with 48% chance of hitting $1M before GTA 6’s 2026 launch. - BlackRock’s actions highlight institutional ma

Monad's Decision to Lock 50% of Tokens: Combating Speculation or Raising Concerns?

- Monad's mainnet launch locks 50.6% of 100B MON tokens for up to four years to prevent early staking concentration. - Coinbase hosts first public sale (Nov 17-22) offering 7.5% supply at $0.025, expanding retail access via its new token platform. - 38.5% unlocked tokens allocated to ecosystem growth through grants and validator delegation, with mainnet launch on Nov 24. - Market skepticism persists despite $225M funding and Solana-Ethereum hybrid design, as pre-launch valuation questions remain unresolved.