Ripple’s SEC Victory Sparks $500M Funding and Global Adoption

Quick Take Summary is AI generated, newsroom reviewed. Ripple’s legal victory confirms XRP is not a security. SEC penalty cut by 94%, settlement likely around $50 million. Ripple raises $500M at a $40B valuation. Grayscale files for XRP ETF amid market optimism.References X Post Reference

Ripple Labs won a big lawsuit that is transforming the crypto world. On August 8, 2025, the U.S. District Court, and Judge Analisa Torres, threw out important SEC claims. The judge ruled once again that XRP is not a security and reduced the SEC demand of cutting the penalty to only 125 million. Ripple can accept the sum of 50 million dollars. Ripple CEO Brad Garlinghouse and CLO Stuart Alderoty rejoiced on the move terming it victorious to crypto transparency. The decision sees XRP off the hook in terms of larger trades, and even an ETF.

Surge in Liquidity and Exchange Momentum

XRP pairings are being scaled by the liquidity providers. Other exchanges and Gemini are gearing up to trade volumes of huge proportions. The confidence of the XRP market is flying high, and it breaks the resistance against the backdrop of institutional confidence. The on-chain DEX activity of Ripple is also growing but it is more of market strength rather than a spike. Ripple raised a $500 million funding led by Citadel and Fortress, and it was valued at 40 billion. The resources will drive the innovation of new enterprise tools and products. Major global banking corporations such as SBI Holdings are currently increasing the use of RippleNet. Recent AWS case study proved that XRP is efficient in terms of liquidity costs cutting in making payments in emerging markets.

Ripple raises funds to the tune of 500 million

Technology, Exchange Traded Funds, and Decentralized Finance are brought together in order to create utility. Ripple keeps enhancing the position of XRP as a cross-border transaction bridge currency by settling transactions within 35 seconds. Grayscale has already made another amendment to an XRP ETF, and the DTCC has registered five possible XRP ETFs. Ripple also purchased a digital wallet to increase institutional coverage. XRP is becoming more and more popular in DeFi initiatives, such as the KYC-enabled crypto payments of Tangem Visa.

With its legal victory, the path to regulated fiat onramps and wider institutional acceptance has been opened by Ripple. Analysts believe that prices will carry on a rapid trend as confidence will go back to the market.

Traditional financial services such as SWIFT are the ones that the crypto community hopes that XRP will replace, as Ripple becomes bigger and bigger in the world financial network.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

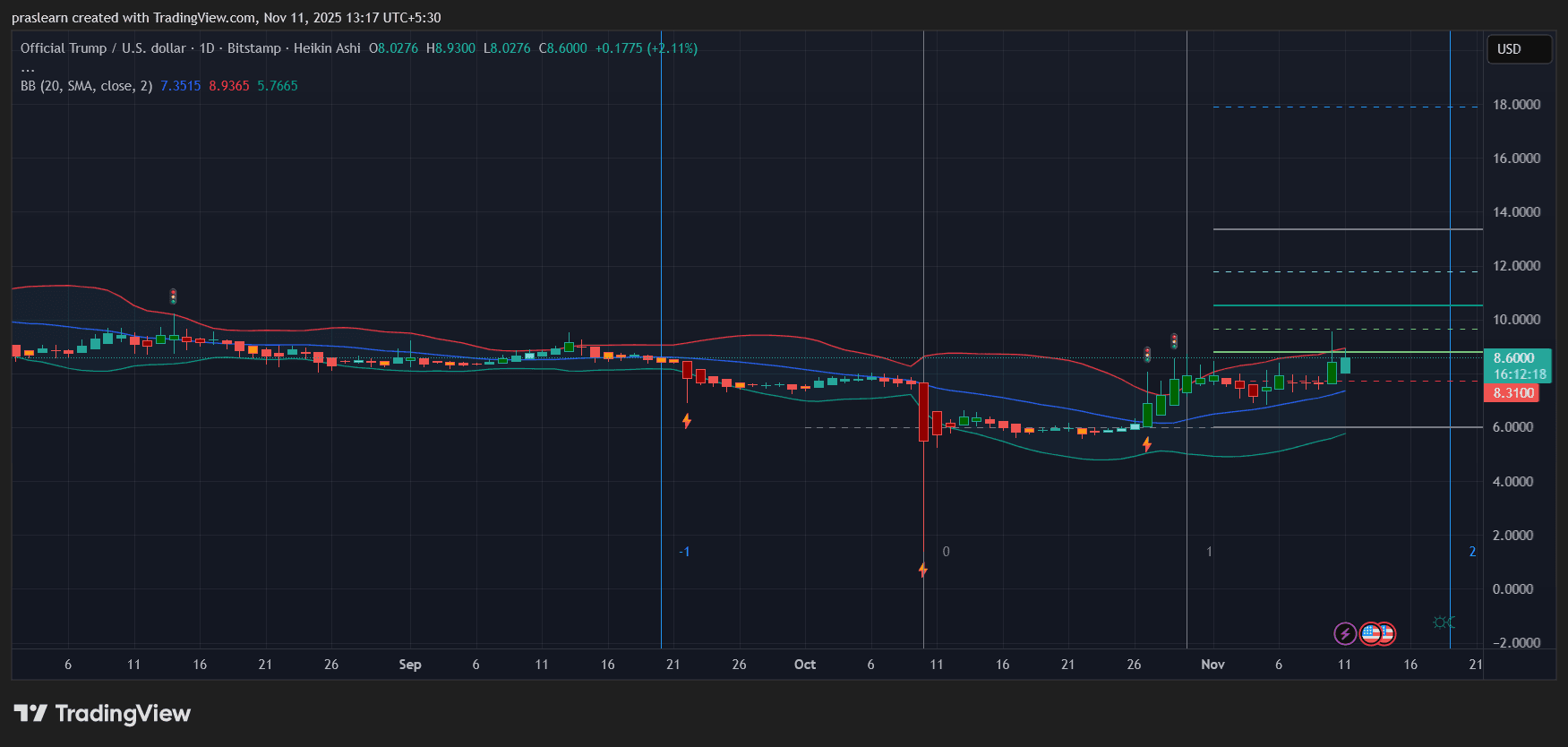

TRUMP Token Explodes as $2,000 “Dividend” Promise Fuels Hype

Harvest Today, Decrypt Tomorrow: The Drive for Quantum-Resistant Encryption Intensifies

- Quantum computing threats accelerate post-quantum cryptography (PQC) adoption as "harvest now, decrypt later" risks expose sensitive data to future decryption. - Companies like Gigamon and BTQ integrate quantum-resistant algorithms while governments race to develop standards amid geopolitical quantum technology competition. - Technical challenges include larger key sizes straining blockchain networks and limited expertise, despite NIST's standardized protocols like ML-KEM and SLH-DSA. - Experts warn imme

Ethereum Updates: Alternative Coins Rise on New Developments While Major Cryptocurrencies Remain Unchanged

- Altcoin Lisk (LSK) surges 70% amid short squeeze and Optimism Superchain migration, driven by Binance/Bybit open interest and Upbit's 81% trading volume share. - Aero (Aerodrome+Velodrome) merger aims to create $536M TVL cross-chain liquidity hub, challenging Uniswap's $4.9B dominance with MEV auctions and Ethereum integration. - DeFi faces headwinds as TVL plummets across major chains, exacerbated by $120M Balancer exploit, while Injective Protocol launches gas-free Cosmos-based mainnet to boost scalabi

Institutional and individual investors are leading the transformation of cryptocurrency towards greater functionality and openness

- BlockDAG's $435M presale with $86M institutional backing highlights growing demand for transparent, utility-driven crypto projects. - IPO Genie's 320% presale surge and AI-powered private market access demonstrate institutional/retail appetite for governance-focused tokens. - Both projects' 40/60 vesting models and referral programs reflect maturing crypto markets prioritizing liquidity, scarcity, and community growth. - As Filecoin and Bonk show modest gains, utility-first platforms like BlockDAG and IP