Author: Zuoye

What are you prepared to do?

There are two futures before us now: one is web-like capitalism, the other is crypto capitalism.

• Brother Sun travels the world, discussing AI or nuclear fusion, all for the massive appreciation of personal capital

• Peter Thiel is "Western" and capitalist, with the core aim of maintaining the hegemony of Western civilization

Image description: You are in me, I am in you

Image source: @justinsuntron @TheFP

For Thiel, maintaining capitalism is equivalent to maintaining Western civilization. In a sense, Thiel does not mind going beyond the usual concepts of democracy and universal values.

For Sun Ge, the economic goal of capital appreciation is his maximized objective. Globalization is increasingly fragmented and irreversible, and this anxiety is gradually collapsing at a deep level.

Especially in the AI era, productivity has not yet outperformed traditional models, but demand for infrastructure such as energy is rising, and New Yorkers’ demand for stable systems is getting younger.

For the increasingly less volatile crypto industry, especially for crypto practitioners, where should they go?

AI Eliminates Volatility

After 34-year-old social democrat Mamdani was successfully elected mayor of New York, an email Peter Thiel wrote to Zuckerberg in 2020 began to circulate. Thiel had already sensed the widespread disappointment of young people with capitalism five years ago.

This sense of disappointment was the direct reason Thiel turned to Trump. When young people can't afford rent, student loans, and healthcare, blaming them for lacking a fighting spirit is meaningless. Protecting housing prices only benefits the postwar and neoliberal era.

When old crypto OGs hold onto Bitcoin and look down on miners, developers, and traders, the post-2005 generation embracing memes is already on the edge of anger, and $100,000 Bitcoin has become a direct manifestation of generational conflict.

Whether it's Labubu or Mamdani, it's all about distribution issues. To solve distribution, we have two practices: one is to move towards AGI and UBI, believing that AI will eliminate human labor and become the main economic agent. When housing problems can't be solved and capitalism can't be eradicated, energy + computing power + storage are already the "hardest" fundamental improvements.

Image description: It’s time to speak.

Image source: @liangsays

The second is to try crypto capitalism. Vitalik's low-risk DeFi and a16z's emphasis on new media fellowships all stress reconnecting the world, whether through the internet, AI, or Web3.

Expression is the lowest-cost leverage, and the power law of global Founder connections will be infinitely large. They will cross language, systems, and technical narratives, keeping the spark of globalized applications alive.

This is also the advantage crypto always has over AI. Claude will not open to specific regions, but Ethereum does not care where you come from or go.

As a response to web-like capitalism—where rentier classes in countries around the world transcend the sovereignty of nation-states and are tightly intertwined like a web—workers (formerly) and young people (now) in various countries feel omnipresent shackles.

Crypto makes such connections extremely simple and is a necessary GTM behavior. Dalio has already predicted a crash. In the recovery after tough times, crypto will allow capital to show its proper efficiency.

Looking back, Sun Ge's profits come from Italian-rooted USDT, the Chaoshan business group controlling Southeast Asian parks, mainland believers in Tron’s public sale, and projects like USDD, which surprisingly did not collapse after the YBS incident.

The core of crypto capitalism is not to eliminate crypto and surrender to AI. Rentiers can connect, and newcomers can also interact directly.

If the large-scale emergence of stablecoins is seen as a sign of crypto maturity, capturing and amplifying external signals will become the mainstream opportunity in crypto’s mature period.

-

• AI companies don’t need to go public only after success. Issuing tokens and growing with entrepreneurship is more cost-effective. Hangzhou has Unitree, BN Alpha has Sapien. Whether they become DJI or Agent Smith, it ultimately comes down to monetization paths.

-

• Web3’s Robotics and Agentics may not become mainstream applications, but they can become mainstream assets. Since Solana phones can be made, after the Huaqiangbei supply chain matures, switching to low-cost Web3 hardware is also a way out.

Don’t resist this historical process or cling to the established notion that physical goods are noble. Tangshan’s steel can be cheaper than cabbage. Human overcapacity is the inevitable result of industrial clustering, and any growth in consumption channels is a good thing.

Stability Under Strongmen

In an era of capital surplus, effective organizers are king.

Before the US entered neoliberalism, finance and the real economy were not yet separated. One dollar did not represent equivalent gold, but corresponded to American goods and Middle Eastern oil, while the Soviet gold ruble could not defeat the dollar in this regard.

Gold houses are good, but basic human needs must still be met with physical goods. Amidst the virtualization wave, Musk has already shown the leverage of industry over finance—at least you can really see Tesla and SpaceX.

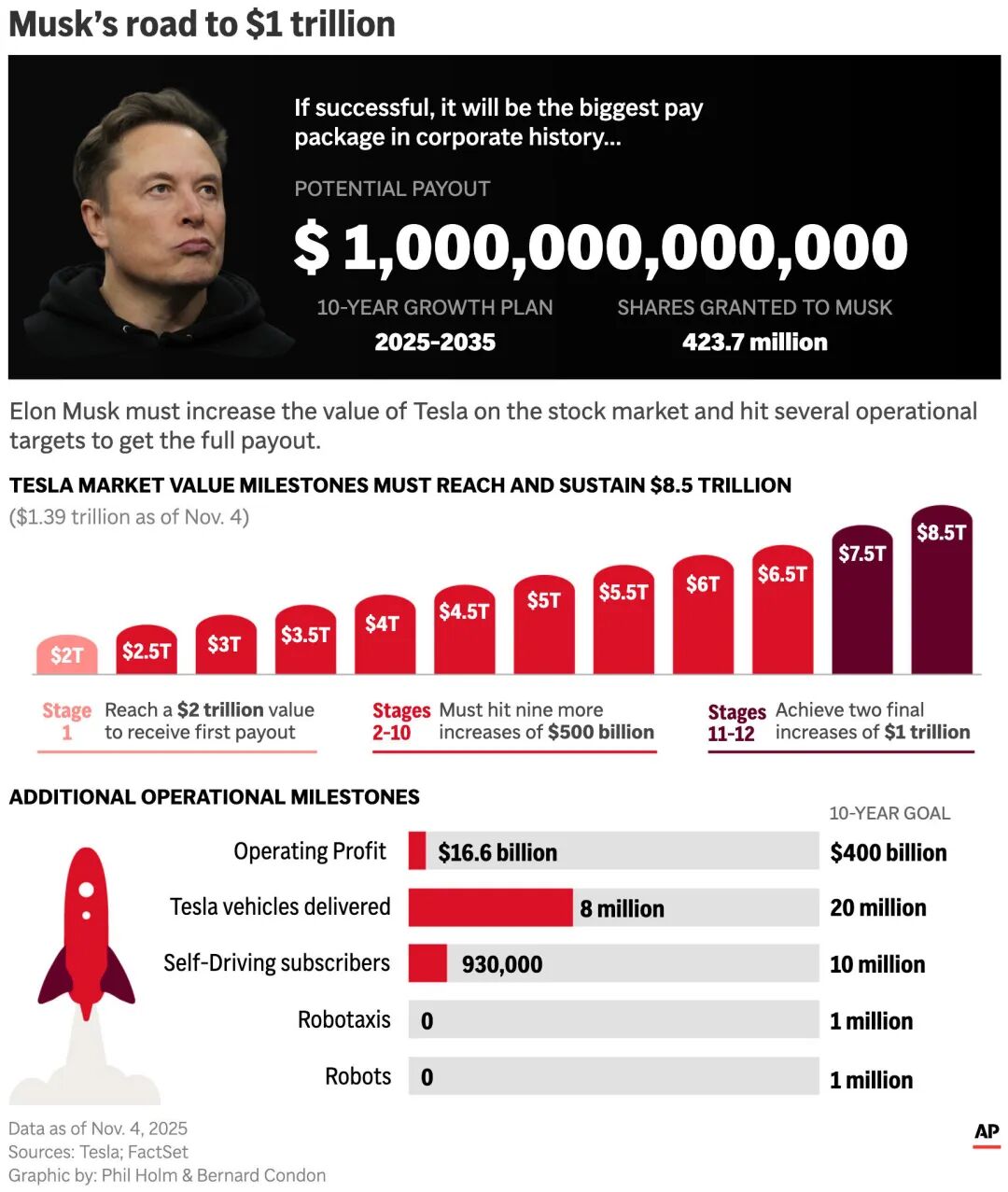

Image description: Musk’s trillion-dollar bet compensation plan

Image source: @AP

AI fuels the bubble. Moral criticism is worthless; the key is how to coexist with and leverage the bubble. a16z believes it’s media—globalized expression creates emotional resonance, thereby seizing control of hot topics and trends.

Understanding this is the only way to see why a16z makes long-term bets on SocialFi. They can invest in 99 projects that don’t make money, but must not miss the one that does.

All kinds of AI tools—reading, writing, editing, publishing, managing—have lowered the entry barrier for individuals to almost zero, making the marginal cost nearly zero. Individuals have become part of the web of countless Agents.

Musk has long been adept at leveraging this media power. He is the media for Tesla, Sun Ge is the media for TRC-20 USDT, Peter Thiel is the media for Western civilization—they are all one person, a one-person media company.

Daily tweeting is as important as SpaceX’s rocket flames. The desire to express is the propellant for exploring Mars.

In addition, the relics of this AI bubble have already been locked in advance. AI Coding/Vibe Coding has become routine. Even if GPT-5 is not satisfactory, Kimi K2 is good enough.

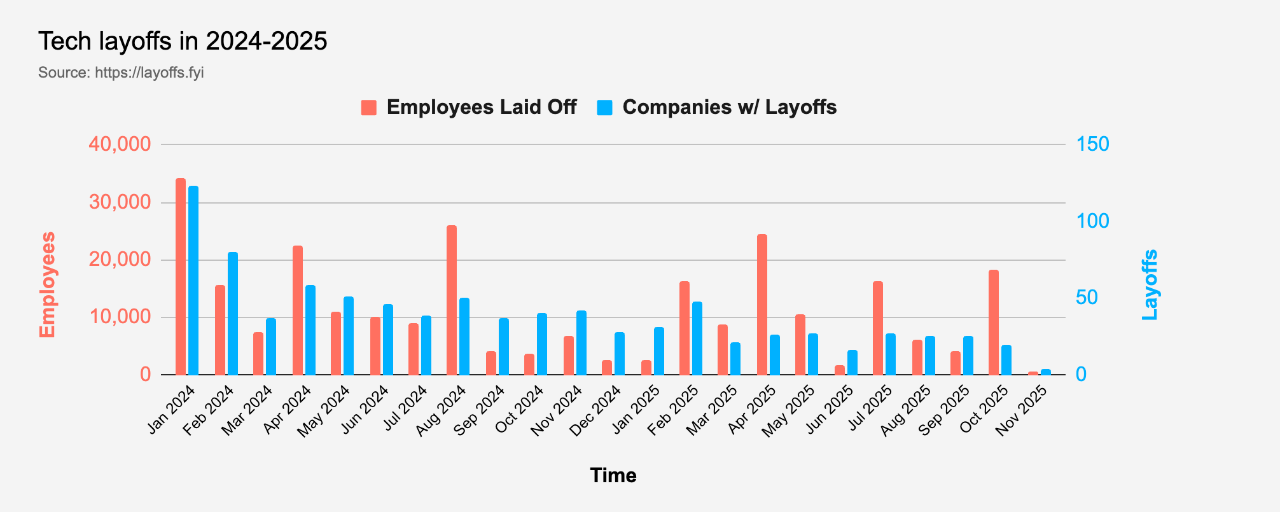

Image description: The new wave of layoffs

Image source: @Layoffsfyi

Entrepreneurship is becoming increasingly individualized, or gang-based. The peak of the traditional bureaucratic system is not the administrative system, but the KPIs and 996 of big tech employees. Human efficiency is increasingly lower than GPUs. The Luddite movement targeted big machines, but smashing GPUs won’t hurt Nvidia’s $5 trillion.

This doesn’t mean people are forced out by AI and can only set up cyber street stalls. Rather, humans are coordinating production systems under AI. This is a process and requires some cost—the cost is being a workhorse.

Media and code have become cheaper than air and water as artificial natural resources. Everyone must learn to coexist with them, and the crypto industry happens to be best at this.

Conclusion

Super individuals, AI Agents, another wave of mass entrepreneurship.

Starting from Peter Thiel’s questioning of capitalism, what we see is the staggering of industrial capitalism and financial/information capitalism. If AI capitalism can still convince people, then crypto capitalism is still in its infancy.

Crypto has always been a reshaping of capital—the core concept of capitalism—programming, transforming, and abusing it. In an era of dual surpluses of capital and industrial goods brought by AI, crypto experiments are no less than aerospace or nuclear fusion.

Crypto practitioners, especially entrepreneurs, should handle the relationship between media and code well, and use new productivity architectures and systems to defeat competitors. This is not far away.

Great waves, great waves, keep rising! Crypto! Crypto! Show your strength and take on the rise and fall of AI!