BitMine snapped up 34% more ETH last week as prices dipped

BitMine’s digital treasury accumulation is showing no signs of slowing down, with its latest week of Ether buying marking a 34% increase from the week before.

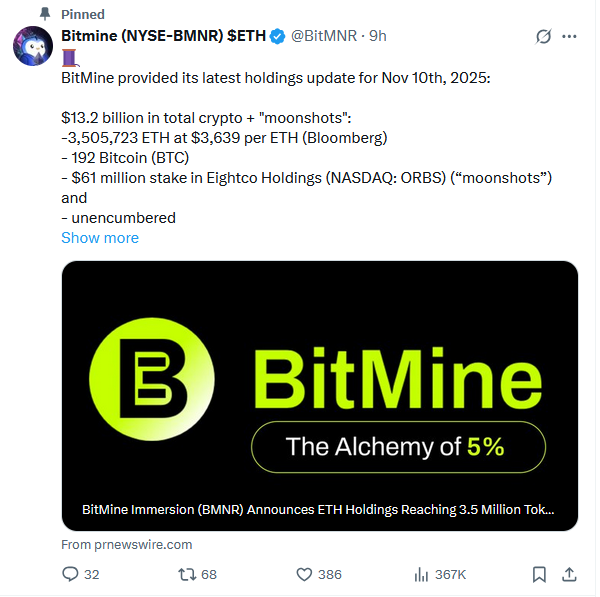

BitMine Immersion Technologies announced the purchase of 110,288 Ether (ETH) on Monday, bringing its total to 3,505,723 ETH at an average purchase price of $3,639 per token.

As part of the announcement, BitMine’s chairman Tom Lee said the recent ETH price dip presented an attractive opportunity” for the firm, as he went on to highlight Ether adoption happening on Wall Street:

“To me, it is evident that Wall Street is very interested in tokenizing assets onto the blockchain, creating greater transparency and unlocking new value for issuers and investors. This is the key fundamental story and supports our view that Ethereum is a super cycle story over the next decade.”

BitMine Immersion Technologies, which initially started as a cryptocurrency mining company, is now the largest Ethereum treasury company, with its total ETH holdings currently valued at around $12.5 billion.

The firm has outlined the goal of owning 5% of the total 120,696,594 ETH supply, and its latest purchase takes its tally up to 2.9%.

Related: Ethereum network gas fees drop to just 0.067 gwei amid slowdown

Tom Lee, who is also the co-founder of financial research firm Fundstrat, is unsurprisingly extremely bullish on the price potential of ETH. In mid-October, with less than three months left in the year, Lee tipped the price to hit between $10,000 and $12,000 before the end of 2025.

At the time of writing, ETH is currently trading at $3,561, down 13.4% over the past two weeks and 4.7% in the past 30 days. At current levels, BitMine’s mammoth treasury is in the red, and the price needs a 180% pump between now and the end of December to hit Lee’s $10,000 prediction.

Meanwhile, BitMine’s stock BMNR stormed the market in 2025, surging by over 400% year-to-date to hit $41.15 at the time of writing.

Magazine: Solana vs Ethereum ETFs, Facebook’s influence on Bitwise: Hunter Horsley

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Trump's Pause on China Tariffs Triggers Worker Protests Over Future of U.S. Shipyards

- Trump administration suspends China tariffs on shipbuilding imports, drawing labor union criticism over domestic industry risks and worker refunds. - 175 H-1B visa abuse investigations reveal $15M+ potential refunds, as unions warn of wage suppression and corporate favoritism in trade policies. - Square enables Bitcoin payments for 4M U.S. merchants, advancing crypto adoption while Trump dismisses inflation concerns and vows meatpacking crackdowns.

Bipartisan Legislation Assigns Crypto Regulation to CFTC to Clarify Oversight Uncertainty

- U.S. lawmakers propose shifting crypto regulation from SEC to CFTC via a bipartisan bill, reclassifying most digital assets as commodities. - The draft aims to resolve regulatory ambiguity stifling innovation, building on stalled House CLARITY Act efforts during the 38-day government shutdown. - Market optimism surged as shutdown relief pushed Bitcoin above $105k, with ETF outflows persisting amid anticipation of clearer CFTC-led oversight. - Critics warn of CFTC resource constraints, while proponents hi

Solana News Update: DevvStream Invests in SOL Despite $11.8M Deficit, Shows Strong Confidence in Sustainable Blockchain Prospects

- DevvStream Corp. (DEVS) disclosed holding 12,185 SOL and 22.229 BTC, staking SOL for 6.29% annualized yield amid a $11.8M fiscal 2025 loss. - The company launched a digital asset treasury via BitGo/FRNT Financial, securing $10M liquidity from a $300M convertible note facility. - Plans include a 2026 tokenization platform for carbon credits and Solana staking, aligning with its de-SPAC/Nasdaq listing strategy. - Despite crypto market outflows, DevvStream's staked SOL attracted inflows, contrasting broader