Best 1000x Cryptos: MoonBull’s Ethereum Edge Challenges Cronos’s Growth and HYPE’s DeFi Momentum

As macro headlines trigger waves of uncertainty across global markets, and fiscal data releases remain stalled, capital is gravitating toward crypto projects that show structured mechanics, not just hype. For investors searching for high-potential crypto projects, the shift is clear: projects with transparent design, established infrastructure, and measurable adoption are gaining an edge. Enter three compelling candidates: MoonBull, Cronos, and HYPE.

Points Cover In This Article:

Toggle

MoonBull brings a clear architecture built on Ethereum’s proven foundation. Cronos is registering media and ecosystem alignment that mirrors real-world momentum. HYPE is advancing its liquidity engine and derivatives platform. Each project represents a unique path toward massive upside in a market where conventional triggers are muted and structured opportunities matter.

MoonBull’s Ethereum Deployment: MOBU Leads High-Potential Cryptos

Moonbull, currently developing on Ethereum, is turning heads. Its technical foundation is rooted in the Ethereum blockchain to deliver security, liquidity, and scalability; three qualities investors crave when volatility hits. By deploying as an ERC-20 token, $MOBU integrates seamlessly with leading wallets, dashboards, and decentralized exchanges, offering immediate access across millions of users and developers.

Looking ahead, being on Ethereum enables cross-chain bridges, governance frameworks, and yield protocols to slot in smoothly. In a macro-soft market where many flights pause, MoonBull’s architecture stands ready. For those hunting high-potential crypto opportunities, the combination of launch design and infrastructure gives MoonBull serious appeal.

MoonBull Project Details: Timing, Pricing, and Modeled Upside

MoonBull’s project is structured across multiple progressive stages, strategically designed to reward early participants while gradually tightening supply as demand accelerates. Each phase is set at specific price points, offering investors an attractive entry with significant potential ROI by the time it reaches the intended listing price.

The roadmap indicates periodic price increases, highlighting the limited window to enter before the next jump. With each advancing stage, the entry price climbs, meaning the same investment amount secures fewer tokens, directly influencing potential holdings and long-term returns. For investors tracking high-potential crypto opportunities, MoonBull’s structured approach stands out as a calculated path toward exponential upside.

Cronos Eyes Ecosystem Growth as Market Uncertainty Increases

Even as macro headlines keep markets guessing, Cronos is quietly advancing its ecosystem. Recent updates show regulatory scrutiny of a major $105 million partnership, as well as the rollout of prediction markets and increased on-chain activity. The real takeaway: when fiscal signals dim and risk appetite wavers, platforms that support use-cases and volume hold a strategic advantage. Cronos’s EVM compatibility, low fees, and strong exchange backing position it as a contender for those seeking high leverage without purely speculative mechanics. It may not match earlier-stage multiples, but in the current environment, ecosystem growth paired with real-world utility is a path to scale. That makes Cronos worthy of consideration in the race for the best crypto to buy.

HYPE’s DeFi Engine Fires Amid Liquidity Shift

In a market where institutional participation is maturing, HYPE (the token of the Hyperliquid platform) is making noise. Its liquidity provider engine now services over $500 million in assets and recorded $40 million in profits during a downturn. Ongoing developments include the BLP testnet, support for multi-margin systems, and a perpetual volume record above $300 billion. In plain terms, HYPE is evolving into the backbone of next-generation DeFi amid retreating macro liquidity. For the investor focused on the best crypto to buy, HYPE offers a high-beta alternative where infrastructure, liquidity, and derivatives converge. The risk is higher—but so is the upside if momentum returns.

Conclusion

In a market shaped by policy headlines and intermittent data flow, investor preference is shifting toward projects that pair clear mechanics with credible infrastructure. Cronos offers ecosystem traction and EVM familiarity that can compound as new applications launch. HYPE brings a high-beta DeFi angle built on liquidity depth and derivatives throughput, a profile that can accelerate if risk appetite returns. Both add valuable diversification for readers building a forward-leaning watchlist.

MoonBull stands out as the best choice today for those pursuing high-potential crypto opportunities. It combines Ethereum-grade security and compatibility with a structured launch model that turns timing into a measurable advantage, then reinforces launch week with immediate claimability, a 48-hour liquidity lock, and a first-hour sell-requires-buy safeguard. That blend of infrastructure, transparency, and modeled upside gives MoonBull a practical edge from initial launch to day-one trading, while the broader market waits for traditional catalysts to catch up.

For More Information:

FAQs for High-Potential Cryptos to Buy

What qualifies a crypto as a top choice to buy?

It must pair measurable mechanics or widespread utility with growth potential, even when macro signals are weak. Transparent entry rules and real infrastructure give it an edge.

Why does MoonBull’s Ethereum deployment matter in real life?

Deploying on Ethereum means holders use familiar wallets and OpenSea-style dashboards, enjoy deep liquidity from day one and access bridges or yield tools without extra steps. It lowers friction for businesses and users alike.

What is Cronos doing that supports scale?

Cronos has EVM compatibility, low network fees, and a growing ecosystem of apps driven by Crypto.com leverage. Recent deals and token flows show builder and user engagement strengthening.

Why is HYPE considered high-beta in the race?

HYPE’s platform already handles vast liquidity pools and perpetual volumes. As DeFi evolves into institutional channels, HYPE is positioned to catch rotations away from lower-liquid markets.

Is MoonBull’s project open right now?

MoonBull is currently in a layered structure with stage-based pricing and designed launch mechanics. Early participation could secure higher token stacks and stronger upside.

Glossary

ERC-20 – A standard for tokens on Ethereum that facilitates smart contract compatibility.

EVM-compatible – Blockchain architecture that supports the Ethereum Virtual Machine, allowing seamless migration of apps.

Project stage ladder – A tiered token development where each stage increases the entry price, rewarding earlier participants.

Liquidity provider (LP) – A contributor of funds to trading pools that enable decentralized exchange activity.

Multi-margin system – A Financial tool allowing multiple assets to serve as collateral for leveraged positions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

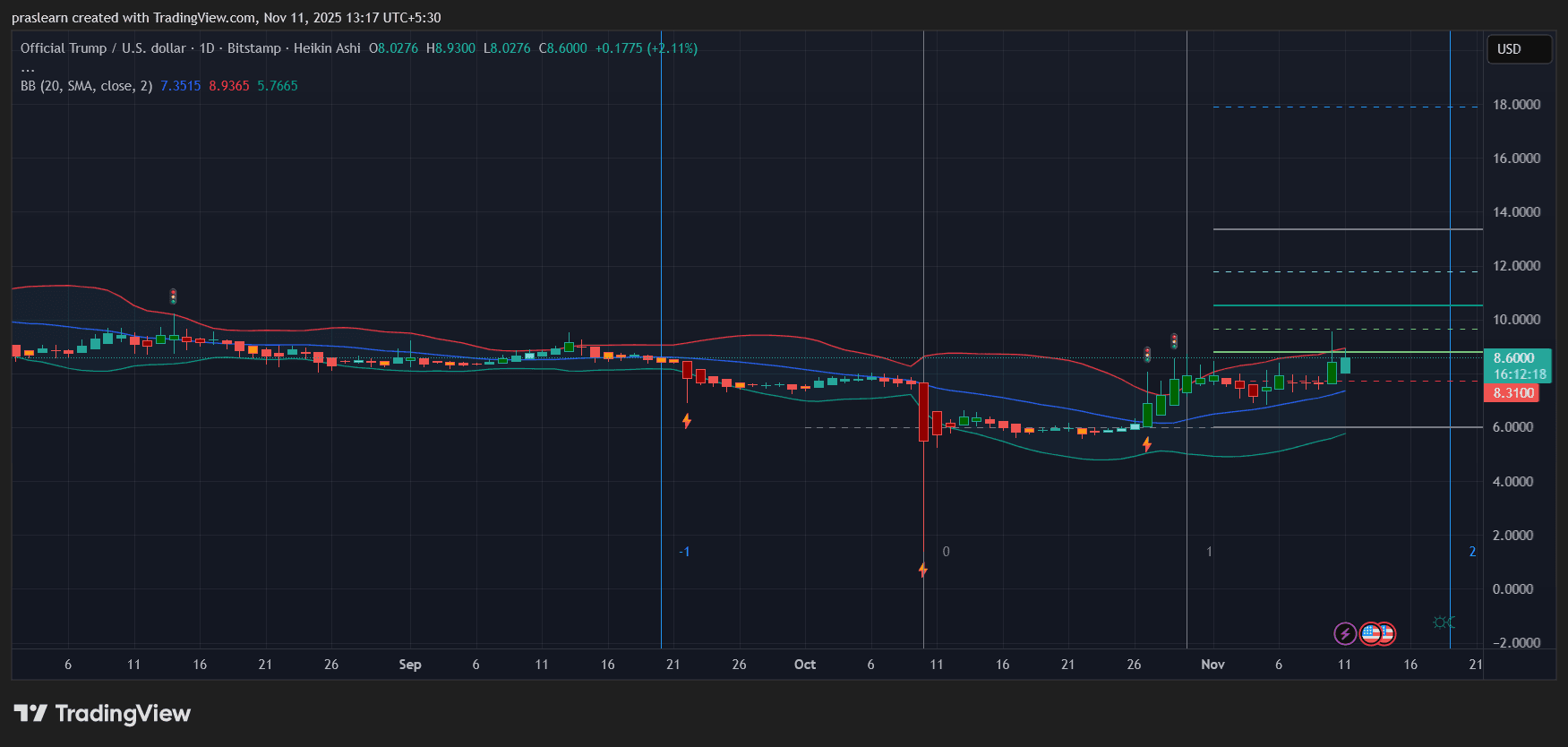

TRUMP Token Explodes as $2,000 “Dividend” Promise Fuels Hype

Harvest Today, Decrypt Tomorrow: The Drive for Quantum-Resistant Encryption Intensifies

- Quantum computing threats accelerate post-quantum cryptography (PQC) adoption as "harvest now, decrypt later" risks expose sensitive data to future decryption. - Companies like Gigamon and BTQ integrate quantum-resistant algorithms while governments race to develop standards amid geopolitical quantum technology competition. - Technical challenges include larger key sizes straining blockchain networks and limited expertise, despite NIST's standardized protocols like ML-KEM and SLH-DSA. - Experts warn imme

Ethereum Updates: Alternative Coins Rise on New Developments While Major Cryptocurrencies Remain Unchanged

- Altcoin Lisk (LSK) surges 70% amid short squeeze and Optimism Superchain migration, driven by Binance/Bybit open interest and Upbit's 81% trading volume share. - Aero (Aerodrome+Velodrome) merger aims to create $536M TVL cross-chain liquidity hub, challenging Uniswap's $4.9B dominance with MEV auctions and Ethereum integration. - DeFi faces headwinds as TVL plummets across major chains, exacerbated by $120M Balancer exploit, while Injective Protocol launches gas-free Cosmos-based mainnet to boost scalabi

Institutional and individual investors are leading the transformation of cryptocurrency towards greater functionality and openness

- BlockDAG's $435M presale with $86M institutional backing highlights growing demand for transparent, utility-driven crypto projects. - IPO Genie's 320% presale surge and AI-powered private market access demonstrate institutional/retail appetite for governance-focused tokens. - Both projects' 40/60 vesting models and referral programs reflect maturing crypto markets prioritizing liquidity, scarcity, and community growth. - As Filecoin and Bonk show modest gains, utility-first platforms like BlockDAG and IP