Cardano Looks Dormant, But Whales Quietly Scoop Up $200 Million Worth of ADA

Cardano whales are quietly accumulating ADA at the fastest pace since May, echoing patterns that preceded past bull runs. As consolidation continues and the Summit 2025 nears, on-chain data hints at a potential upside for ADA.

Although Cardano (ADA) remains among the top 10 altcoins by market cap, its price is still hovering around 2024 levels. While many holders express disappointment with ADA’s performance, accumulation continues quietly beneath the surface.

What evidence supports this trend, and what impact could it have? The following analysis draws on on-chain data and expert insights.

How Have Cardano (ADA) Whales Been Accumulating in November?

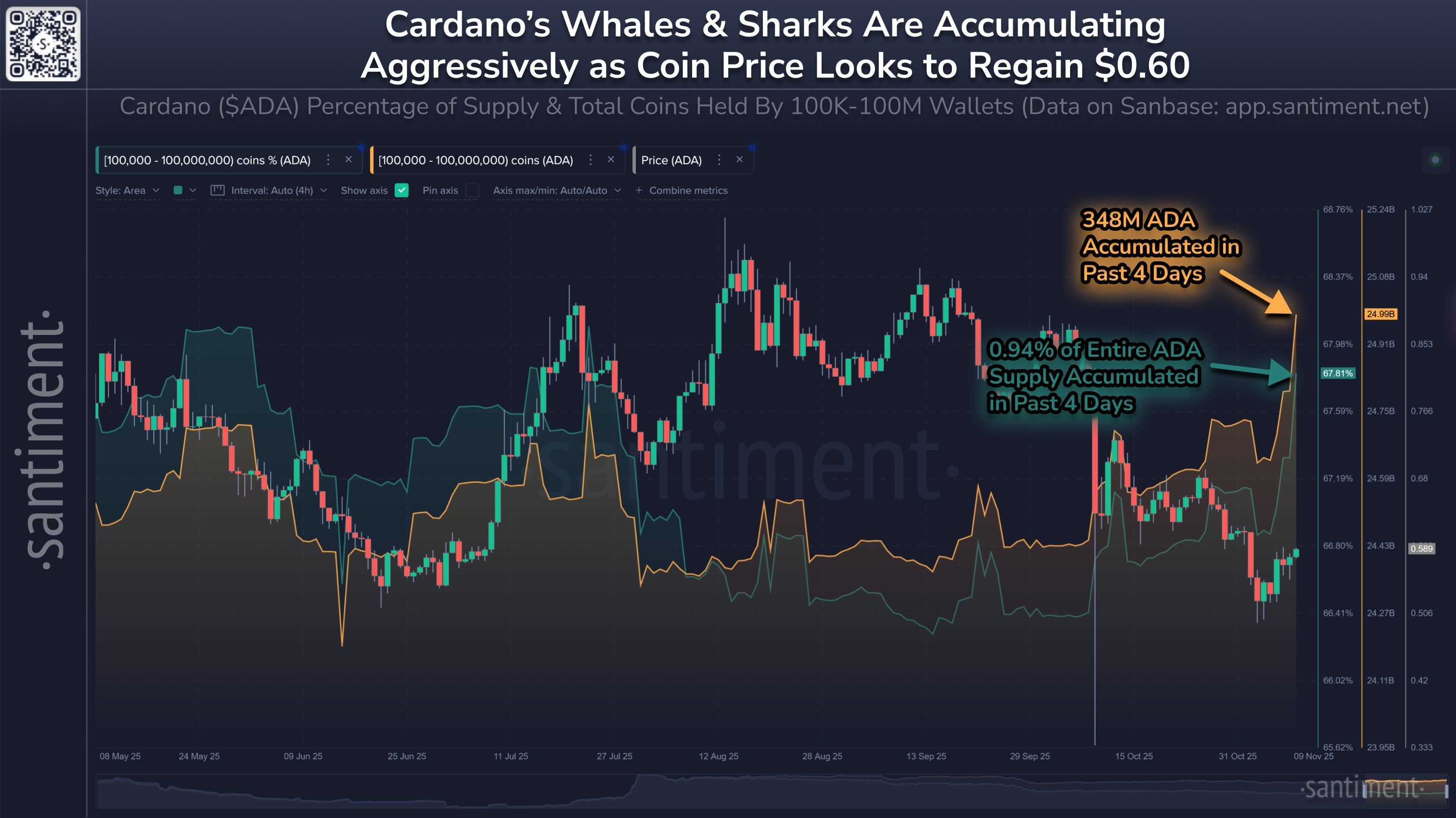

Data from Santiment shows that “whales” and “sharks” — investors holding between 100,000 and 100 million ADA — have been accumulating heavily in a short period.

Over the past four days, these large holders have purchased 348 million ADA, valued at approximately $204.3 million, which represents 0.94% of the total ADA supply.

Cardano Whales Accumulation. Source:

Santiment

Cardano Whales Accumulation. Source:

Santiment

This marks the strongest accumulation since May. Notably, this buying activity comes as ADA’s price has corrected by more than 30% from last month and remains below $ 0.60.

While many retail investors appear to have exited, whales seem to view the pullback as a chance to secure better entry positions. With smaller traders sidelined, smart money is accumulating quietly, creating minimal volatility. Analysts see this as a potential signal for an upcoming bullish phase.

“While many call Cardano (ADA) ‘dormant,’ the charts whisper a different story — millions of ADA are quietly being scooped up by whales and institutions. On-chain data shows this ‘silence’ isn’t weakness — it’s precision accumulation. With retail out of the picture, smart money is loading up without triggering alarms.” — BeLaunch.

Historical Patterns Suggest Possible Rally

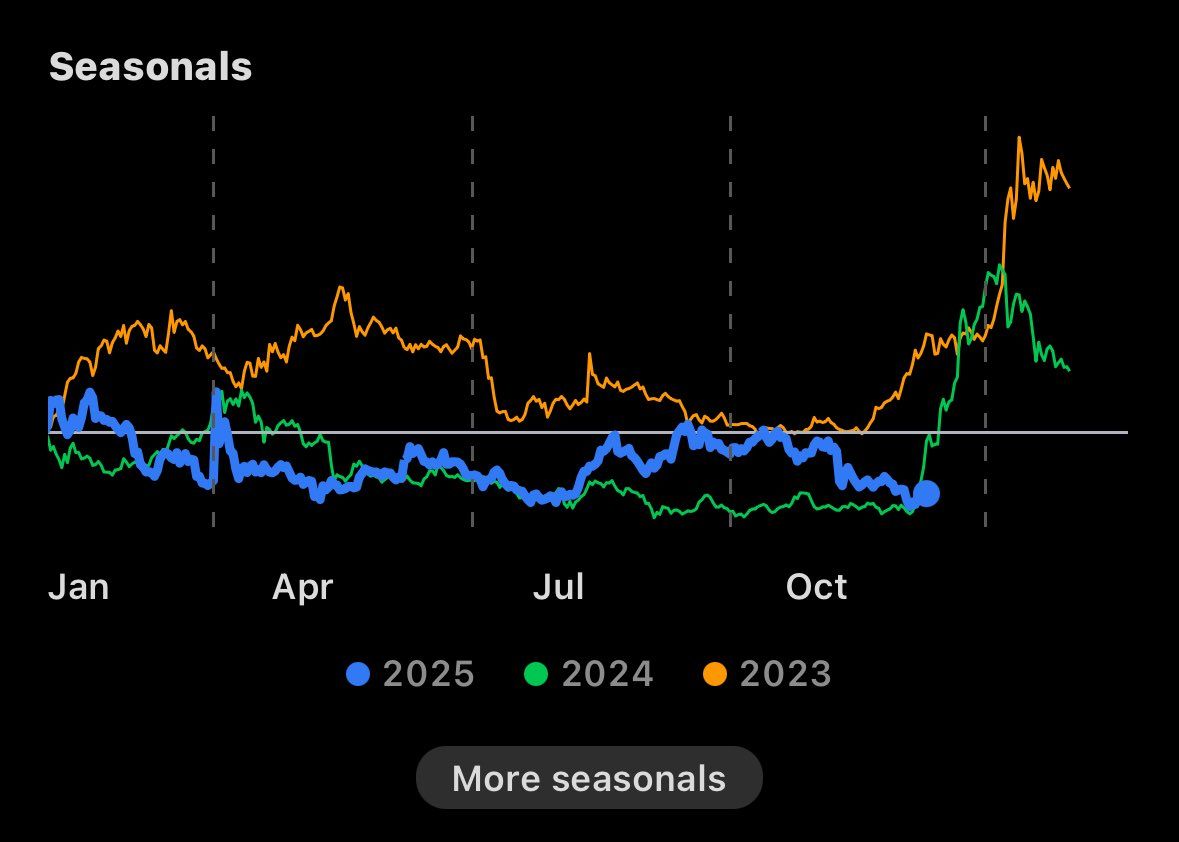

Historical ADA price patterns suggest that strong rallies frequently follow extended consolidation periods of approximately ten months.

The DApp Analyst highlighted this trend, comparing 2025’s behavior with that of the previous two years. In both 2023 and 2024, ADA experienced powerful bull runs following prolonged consolidation phases, delivering gains of 200% to 300%.

Comparing ADA Price Models in 2023, 2024, and 2025. Source:

The DApp Analyst

Comparing ADA Price Models in 2023, 2024, and 2025. Source:

The DApp Analyst

Now, in October 2025, conditions appear similar to those of historical setups — potentially forming a base for another upward move. Combined with current whale accumulation, this alignment strengthens the bullish outlook.

“Will 2025 be like ‘23 & ‘24? $ADA has spent the entire year consolidating between $0.5 and $1.3. Can we finally get a breakout?” — The DApp Analyst.

November also brings the Cardano Summit 2025 in Berlin. Statements from project leaders at the event are expected to renew optimism among ADA investors this month.

However, overall market sentiment remains cautious. The altcoin season index sits at a low 39 points, reflecting lingering fear — a potential headwind for ADA’s recovery despite growing accumulation and bullish setups.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Monero’s reputation for privacy faces challenges from modular competitors and evolving regulations

- Monero (XMR) nears $400 as privacy-focused crypto gains traction amid evolving market demands for modular solutions. - Emerging rivals like Solana's GhostwareOS and Zcash challenge Monero's dominance with interoperable privacy features. - Regulatory pressures, including South Korea's expanded AML rules, heighten scrutiny on privacy coins despite their anti-surveillance design. - Analysts highlight Monero's "extreme privacy" legacy but note growing adoption of integrated privacy tools in active blockchain

As Crypto Markets Fluctuate, BI DeFi's Eco-Friendly Cloud Approach Draws Growing Attention from Institutions

- BI DeFi launches a blockchain-powered cloud computing platform combining renewable energy and advanced security to stabilize crypto market risks. - XRP's $180M inflow highlights growing institutional interest in digital assets despite broader market volatility and billions in sector outflows. - The platform's green energy data centers and automated yield settlements address ESG priorities while reducing blockchain's carbon footprint. - User-friendly features like $17 introductory contracts and $50K affil

FDV's Dilemma: Assessing Opportunity While Concealing Risk

- FDV (Fully Diluted Valuation) has become a 2025 key metric for evaluating crypto projects' long-term risks and scalability, especially for new layer-1 blockchains like Monad and Apertum. - Monad's $3.9B FDV despite 12% unlocked supply highlights "low float, high FDV" dynamics, while Apertum's 1.05x FDV-to-market cap ratio signals minimal dilution risk. - Critics note FDV's limitations, including price volatility assumptions and irrelevance for uncapped supply projects like Ethereum , requiring contextual

Switzerland Delays Crypto Information Exchange Pending International Coordination

- Switzerland delays crypto tax data sharing with foreign nations until 2027, citing unresolved CARF partner agreements. - The OECD's 2022 framework requires member states to exchange crypto account details, but 75 countries including the EU and UK face implementation challenges. - Transitional measures ease compliance burdens for Swiss crypto firms while awaiting finalized international data-sharing protocols. - Major economies like the U.S., China, and Saudi Arabia remain outside CARF due to non-complian