Pi Coin Tries to Bounce Back After 15% Drop, But Money Flows Still Lag

Pi Coin is showing early signs of recovery after its October drop, with RSI improving but CMF still signaling weak inflows. A breakout above $0.246 could confirm renewed investor strength and further upside potential.

Pi Coin is attempting to recover after weeks of sluggish momentum, with the altcoin currently holding above the $0.217 support level. The recent rebound attempt follows a mild uptick in price action, but concerns remain as investor inflows appear limited.

Sustained bullish momentum will be crucial for Pi Coin to fully recover from its recent 15% decline.

Pi Coin Investors Attempt Recovery

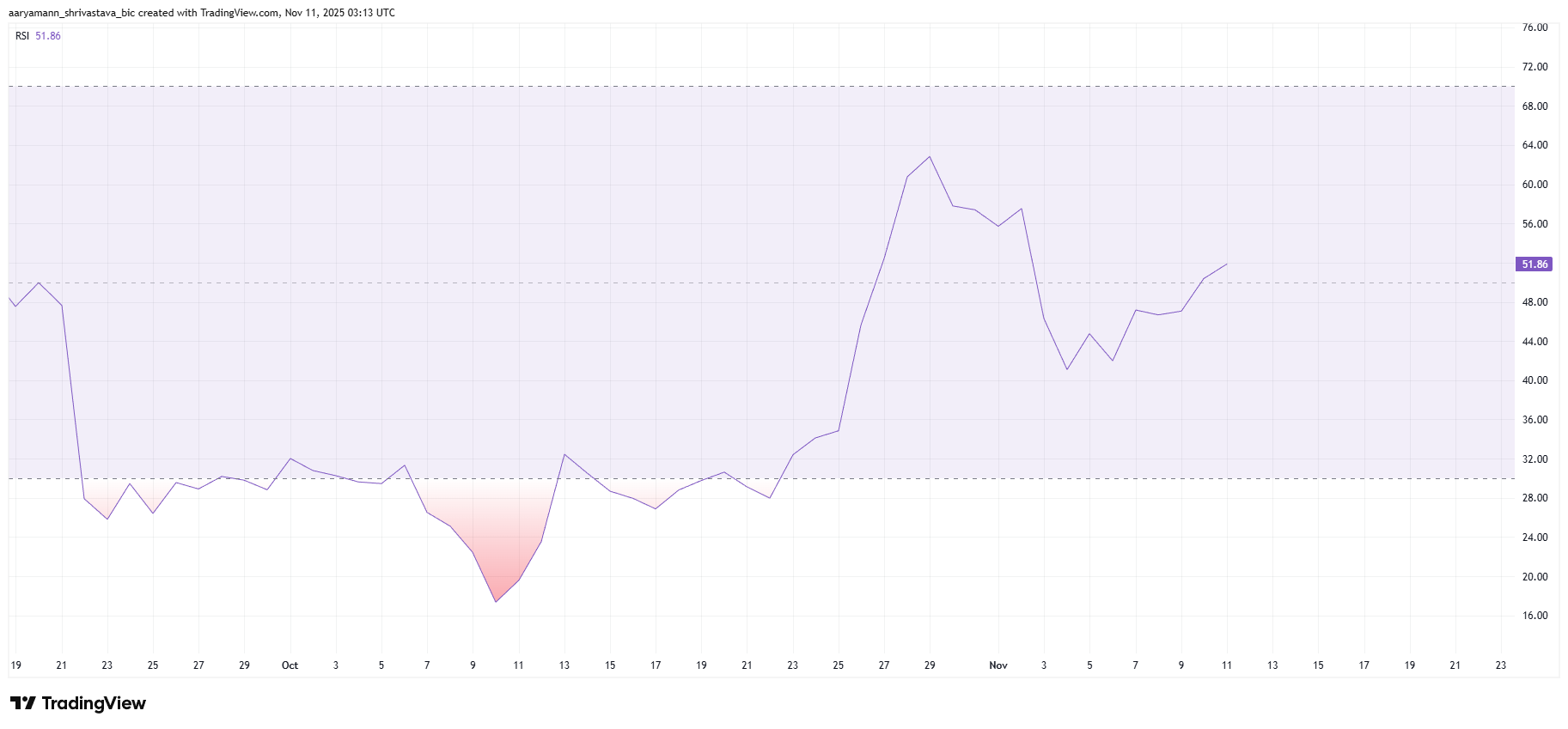

The Relative Strength Index (RSI) indicates that the market has turned slightly bullish after a prolonged period of weakness. The indicator, which had dipped below the neutral mark, has now climbed back into the positive zone. This rebound shows improving momentum and signals that selling pressure is easing while buyers regain confidence.

This shift in sentiment could mark the start of a more sustained recovery phase for Pi Coin. However, for this bullish momentum to solidify, trading volume and investor participation must increase significantly.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Pi Coin RSI. Source:

TradingView

Pi Coin RSI. Source:

TradingView

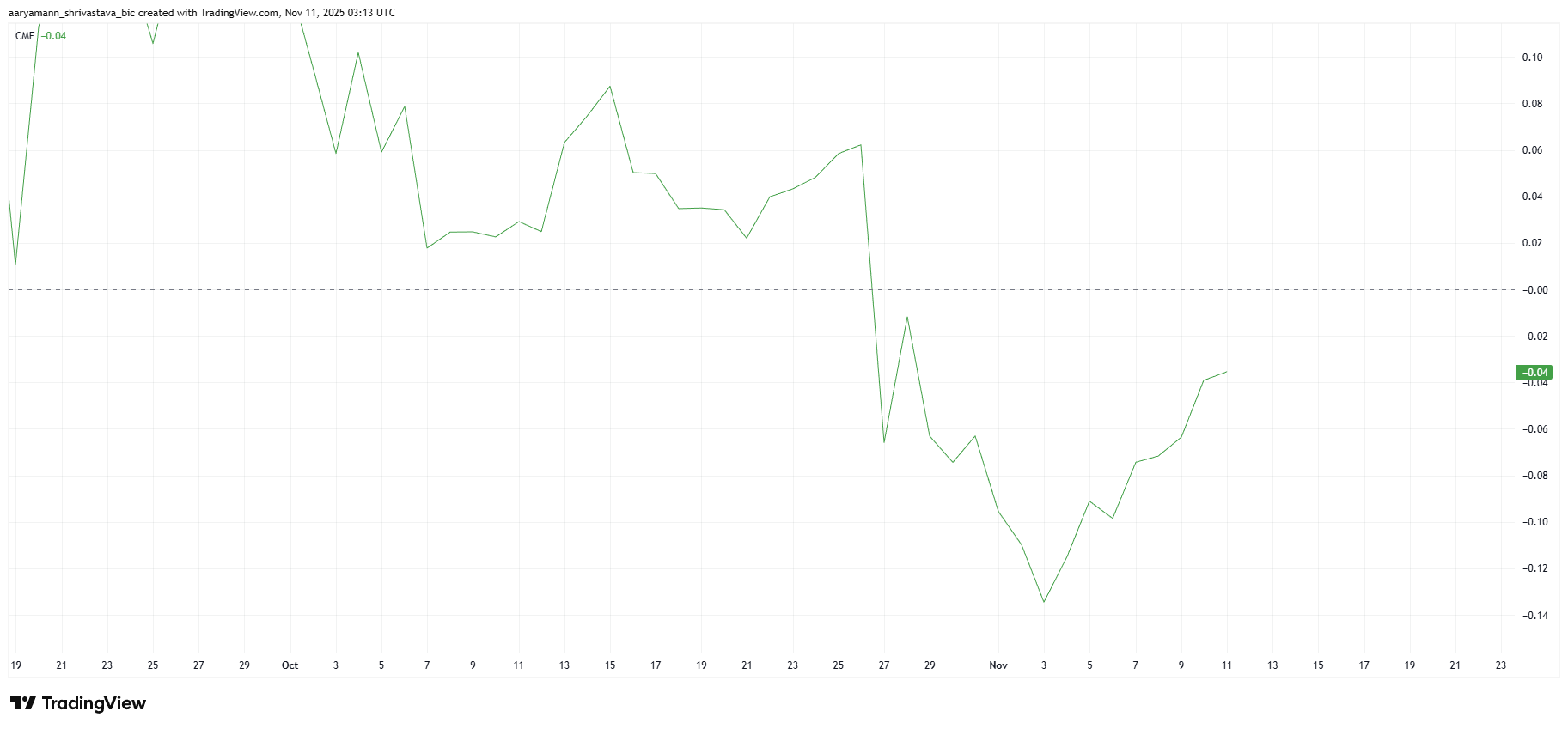

The Chaikin Money Flow (CMF) remains a key indicator for understanding investor behavior surrounding Pi Coin. At present, the CMF continues to sit below the zero line, indicating that outflows still outweigh inflows. While outflows have declined recently, the indicator has yet to cross into positive territory — a necessary condition for confirming lasting market strength.

If Pi Coin manages to push the CMF above zero, it would suggest that inflows are finally dominating, signaling growing investor confidence. This shift could help sustain the ongoing price recovery, potentially allowing Pi Coin to climb higher and stabilize above critical resistance levels.

Pi Coin CMF. Source:

TradingView

Pi Coin CMF. Source:

TradingView

PI Price Can Bounce Off

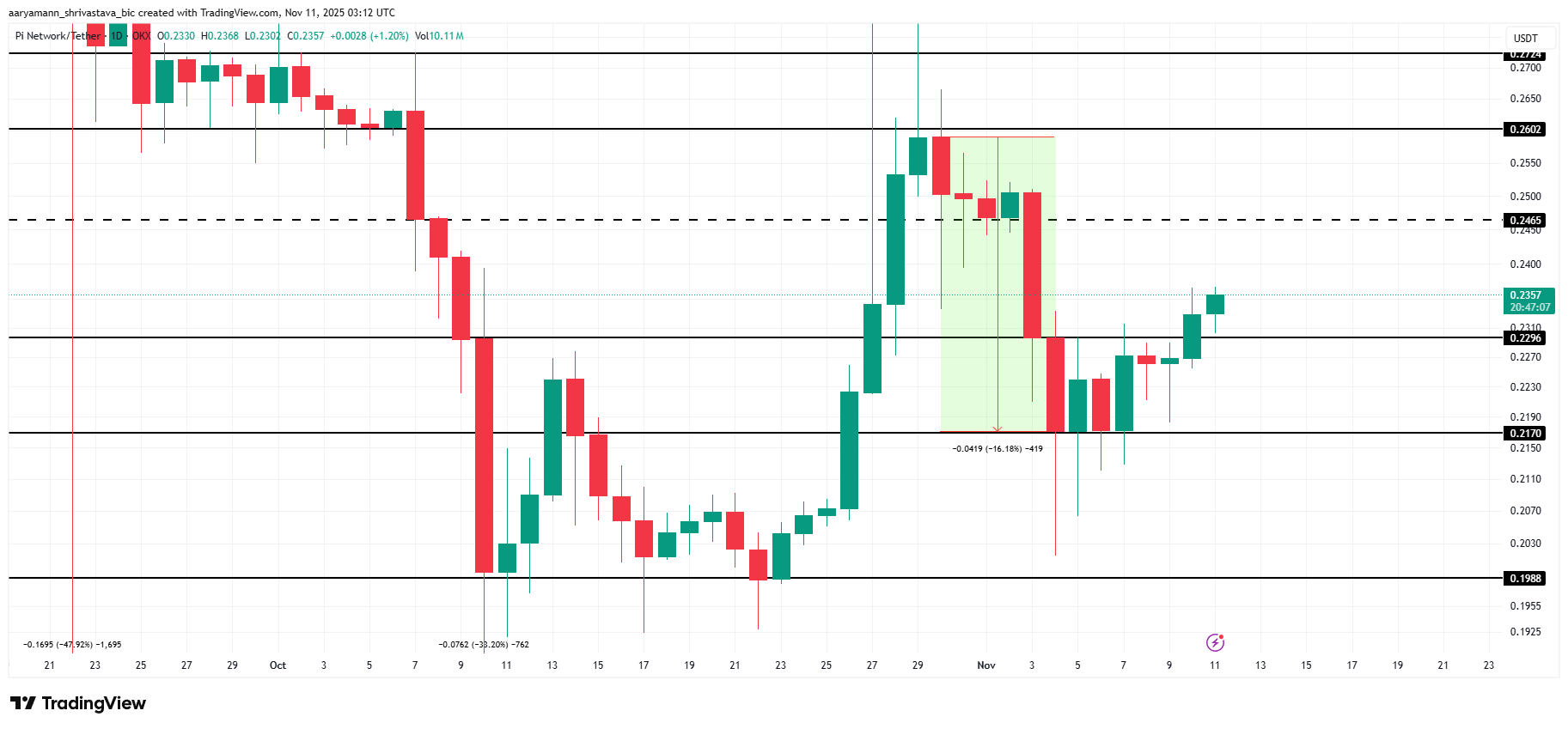

Pi Coin’s price stands at $0.235 at the time of writing, after successfully breaching the $0.229 resistance level within the last 24 hours. The altcoin now appears to be regaining some lost ground from its late October decline.

For Pi Coin to fully recover from its 15% drop, the price must break through the $0.246 resistance and rally toward $0.260. Achieving this would reinforce the bullish outlook and restore market confidence among cautious investors.

Pi Coin Price Analysis. Source:

TradingView

Pi Coin Price Analysis. Source:

TradingView

However, if the bullish momentum weakens, Pi Coin could slip below $0.229 again and test the $0.217 support level. A breakdown beneath this support would invalidate the bullish thesis and expose the cryptocurrency to further downside risks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zero-Knowledge Startup Secures $9M Funding, Introduces Gamified Verification to Bridge Privacy and Compliance

- Zero-knowledge identity protocol Self raised $9M in seed funding led by Greenfield Capital and SoftBank's fund, alongside angel investors like Casey Neistat and Polygon's Sandeep Nailwal. - The startup launched a points program incentivizing on-chain identity verification using ZKPs and verifiable credentials, partnering with Google , Aave , and Velodrome to bridge privacy-compliance gaps. - By enabling biometric passport verification and Aadhaar integration without exposing sensitive data, Self aims to

Gavin Wood Supports Acurast’s Decentralized Computing Revolution Driven by Smartphones

- Acurast, a smartphone-based decentralized computing project, secured $11M in funding led by Ethereum co-founder Gavin Wood and others. - The platform launched its mainnet on November 17, aiming to transform 150,000 smartphones into secure compute nodes for confidential tasks. - By leveraging hardware-backed security and eliminating intermediaries, Acurast challenges traditional data centers while addressing privacy and environmental concerns. - Despite scalability challenges, the project's 494 million pr

Crypto wallets are transforming into comprehensive platforms, connecting Web3 with traditional financial services

- D'CENT Wallet's v8.1.0 update enables multi-wallet management for up to 100 accounts, streamlining digital asset handling across investment, NFTs, and events. - Competitors like Exodus and Blaqclouds advance crypto adoption through features like Mastercard-linked debit cards and decentralized identity systems with biometric security. - Innovations such as fee-free transactions (D'CENT GasPass) and on-chain identity management (.zeus domains) highlight industry focus on accessibility and security for main

Grayscale's Public Listing: Advancing Crypto Adoption as Regulations Vary Worldwide

- Grayscale files U.S. IPO via S-1, joining crypto firms like Circle and Bullish in public markets. - IPO details remain undetermined, contingent on SEC review and market conditions. - Japan's TSE tightens crypto listing rules amid volatile "crypto hoarding" stock collapses. - U.S. regulators advance crypto rulemaking post-shutdown, potentially accelerating Grayscale's approval. - Grayscale's IPO highlights crypto's institutional push amid global regulatory divergence.