How to view Monad's market-making arrangements? These core messages are also hidden in the 18-page sales document

Can only 0.16% of market-making funds provide support to the bottom?

Can Only 0.16% of Market Making Tokens Provide a Price Floor?

Written by: KarenZ, Foresight News

As the countdown to Monad (MON) token’s public sale on Coinbase begins, its 18-page disclosure document has become the focus of the market.

This document, provided by Monad Foundation’s subsidiary MF Services (BVI), Ltd., offers a comprehensive overview of Monad, covering everything from project architecture and financing, to token allocation and sale rules, as well as transparent market maker information and security risk warnings. It provides investors with the key information necessary for informed decision-making and demonstrates the project’s commitment to operational transparency.

In addition to widely cited key data such as “2.5 billions USD FDV,” “unit price of 0.025 USD,” and “7.5% public sale ratio,” the document also systematically discloses important details such as legal pricing, token release schedule, market making arrangements, and risk warnings.

Of particular note, the document devotes considerable space to systematically listing multi-dimensional risks related to the token sale, Monad Foundation, MON token, Monad project, and its underlying technology. For users interested in investing in MONAD tokens, it is recommended to study this document thoroughly and make rational investment choices.

Legal Structure

- The Monad Foundation is conducting the public sale on Coinbase through its subsidiary MF Services (BVI) Ltd.

- MF Services (BVI) Ltd. is a wholly owned subsidiary of the Monad Foundation registered in the British Virgin Islands and is the seller for this token sale.

- The Monad Foundation is the sole director of MF Services (BVI).

Core Development Entity and $262 Million Financing Details

- The core contributors to Monad are the Monad Foundation and Category Labs, Inc. (formerly Monad Labs, Inc.).

- The Monad Foundation is a Cayman Islands foundation company dedicated to supporting the development, decentralization, security, and adoption of the Monad network through a range of services including community engagement, business development, developer and user education, and marketing. Category Labs, headquartered in New York, provides core development services for the Monad client.

- The three co-founders of Monad are James Hunsaker (CEO of Category Labs), Keone Hon, and Eunice Giarta. The latter two serve as co-GMs of the Monad Foundation.

- The Monad Foundation is overseen by a board of directors, consisting of Petrus Basson, Keone Hon, and Marc Piano.

- Financing timeline:

- Pre-Seed: Raised $19.6 million from June to December 2022;

- Seed Round: Raised $22.6 million from January to March 2024;

- Series A: Raised $220.5 million from March to August 2024;

- In 2024, the Monad Foundation received a $90 million donation from Category Labs to cover operating expenses for 2024-2026. This donation is part of the $262 million raised by Monad Labs in various funding rounds.

Key Information on Sale Terms

- Token sale period: November 17, 2025, 22:00 to November 23, 10:00.

- Token sale ratio: Up to 7.5 billion MON (7.5% of initial total supply).

- Sale price: $0.025 per MON. If fully sold, $187.5 million will be raised.

- Minimum subscription $100, maximum $100,000 (Coinbase One members may enjoy higher limits according to platform terms).

- FDV: $2.5 billions

- “Bottom-up” oversubscription allocation: To ensure broad distribution and prevent whale monopolization, the document discloses a “bottom-up fill” mechanism. In the event of oversubscription, a bottom-up allocation mechanism will be used to maximize broad distribution among participants while limiting asset concentration by large buyers.

- Example: For a sale of 1,000 tokens, three users (small/medium/large) apply for 100/500/1000 tokens respectively. In the first round, each receives 100 tokens (700 remaining, low-tier users fully satisfied). In the second round, the remaining 700 tokens are split equally between medium and large users, each getting 350. Final allocation: small 100, medium 450, large 450.

Token Allocation and Release

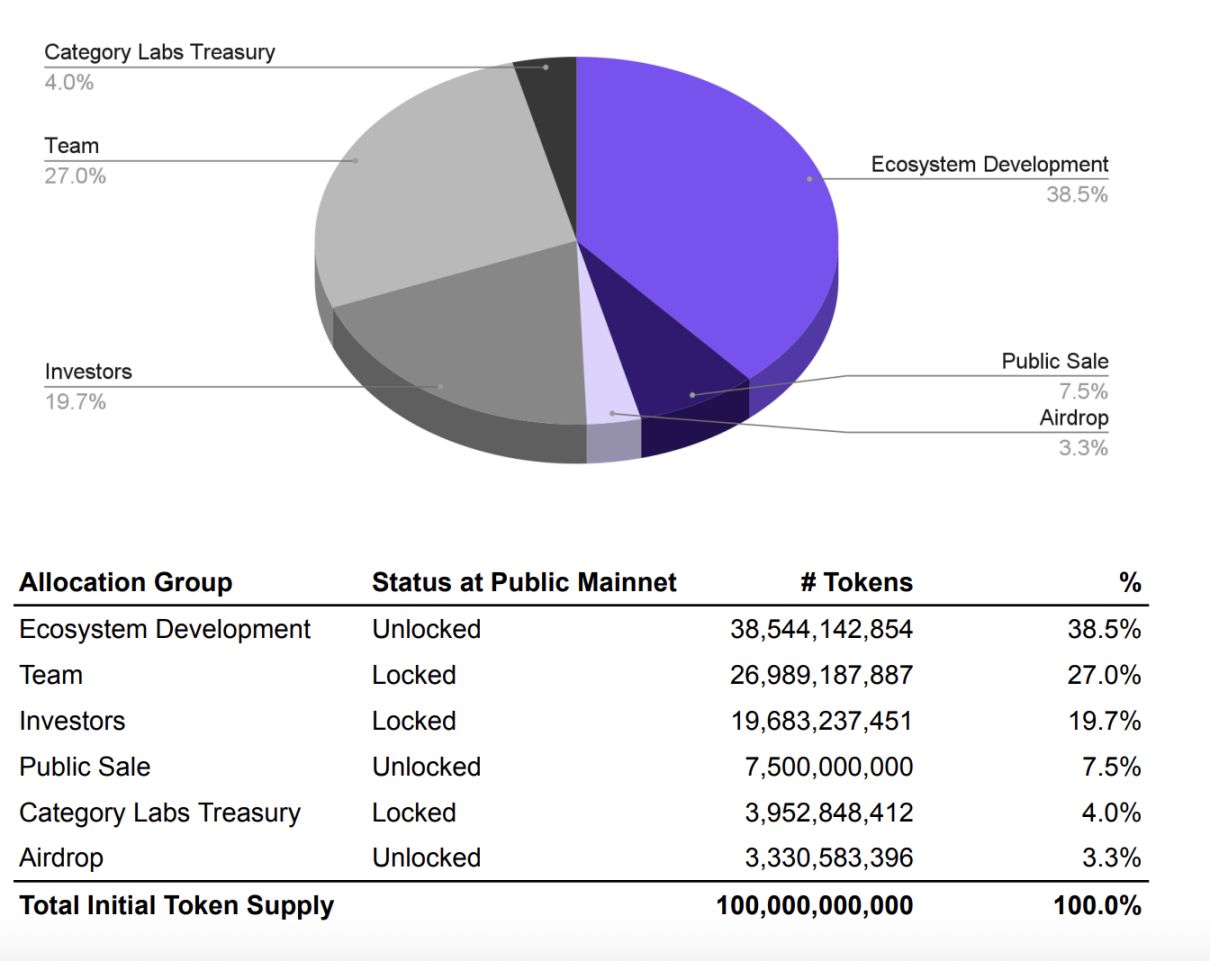

The MON tokenomics model is shown below:

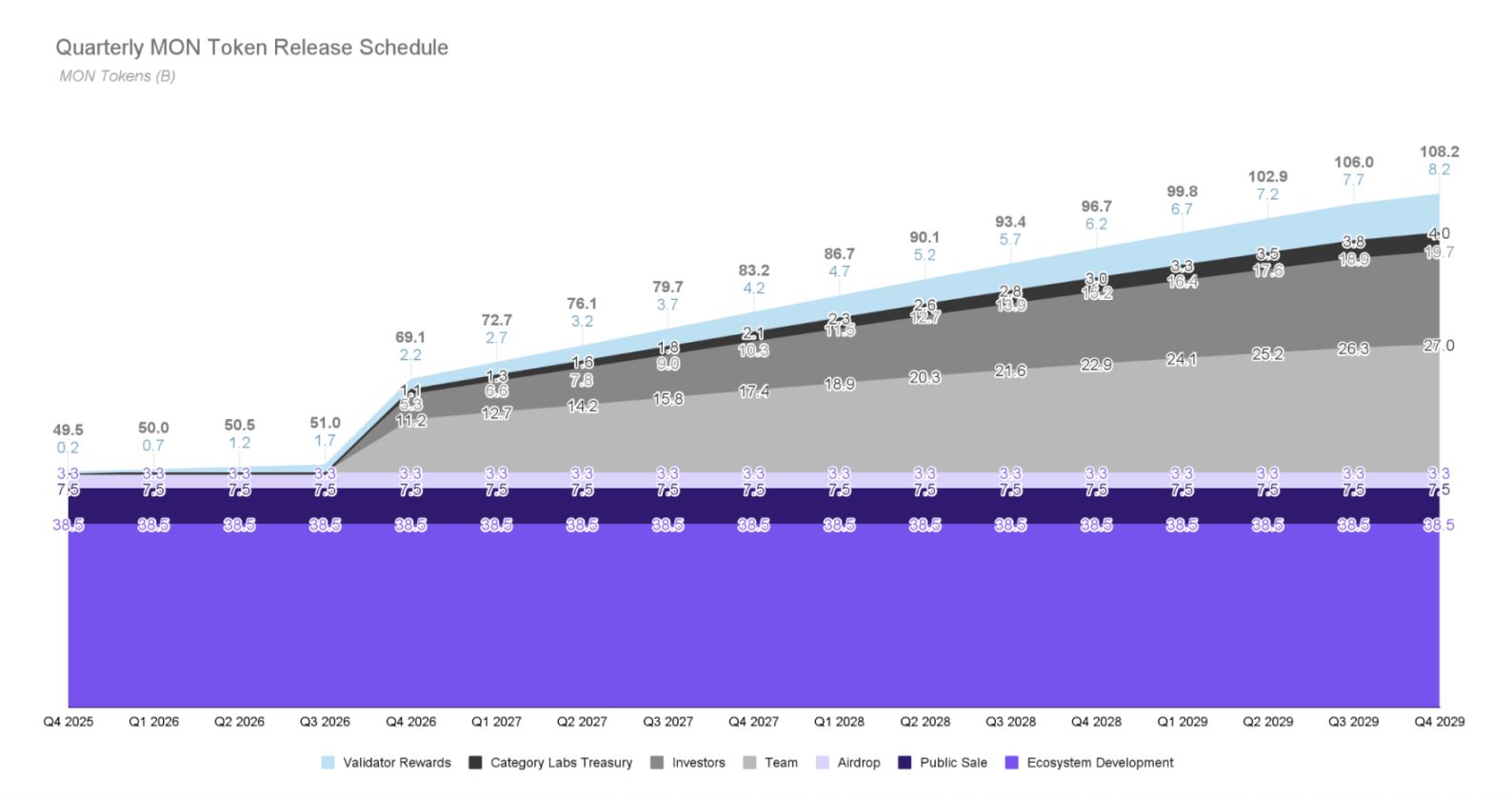

The chart below shows the expected token release schedule:

Overall, on the first day of Monad mainnet’s public launch, about 49.4 billion MON tokens (49.4%) will be unlocked. Of these, approximately 10.8 billion MON tokens (10.8% of initial total supply) are expected to enter public circulation through public sale and airdrops, while about 38.5 billion MON tokens (38.5%) will be allocated for ecosystem development. Although these tokens are unlocked, they will be managed by the Monad Foundation and will be used for grants or incentives at a strategic level over the coming years, and delegated according to the Foundation’s validator delegation plan.

All tokens allocated to investors, team members, and the Category Labs treasury will be locked on the first day of Monad mainnet’s public launch, following a clear unlocking and release schedule. These tokens will be locked for at least one year. All locked tokens in the initial supply are expected to be fully unlocked before the fourth anniversary of Monad mainnet’s public launch (Q4 2029). Locked tokens cannot be staked.

It is worth noting that the document indicates that in the future, after the network launch, the Monad Foundation may continue to conduct airdrops to incentivize exploration and use of applications and protocols within the Monad network and ecosystem.

Future Supply: 2% Annual Inflation + Fee Deflation

- Inflation: Each block generates 25 new MON as rewards for validators/stakers, with annualized inflation of about 2 billion (2% of initial total supply), aiming to incentivize network participants and ensure network security.

- Deflation: All base transaction fees (Base Fee) are burned. This mechanism reduces circulating supply to offset some inflationary pressure.

Monad Market Making and Liquidity Arrangements

To ensure good liquidity after the token is listed and to achieve transparency, MF Services (BVI) Ltd. has disclosed details of its market maker partnerships and liquidity support plan.

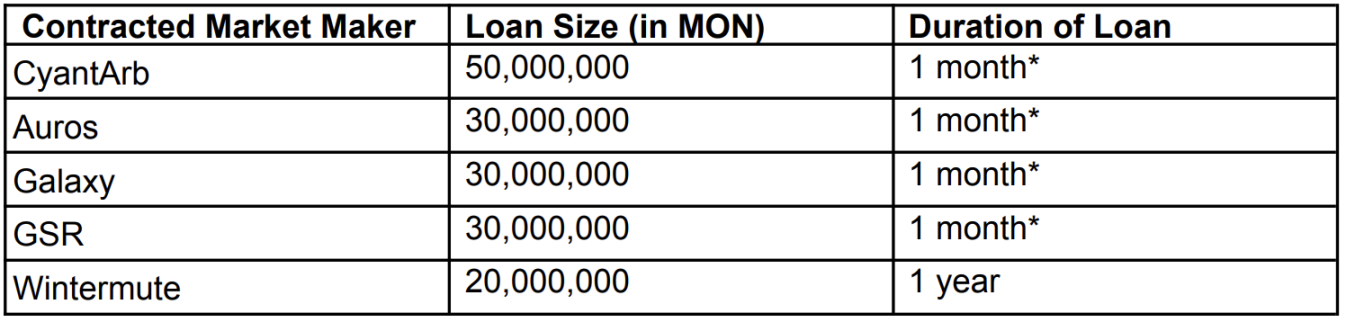

MF Services (BVI) Ltd. has signed loan agreements with five market makers: CyantArb, Auros, Galaxy, GSR, and Wintermute, lending a total of 160 million MON tokens. The loan term for CyantArb, Auros, Galaxy, and GSR is one month (renewable monthly); Wintermute’s loan term is one year. In addition, the project has engaged third-party Coinwatch to monitor the use of the loaned tokens, ensuring the funds are used to enhance market liquidity and not for illicit activities.

In addition, MF Services (BVI) may deploy up to 0.2% of the initial MON token supply as initial liquidity for DEX pools.

How to View Monad’s Market Making Arrangements?

Open and Transparent

In the Web3 space, the transparency and rationality of market making arrangements have always been a core concern for the market. Traditional projects often trigger investor trust crises due to the lack of public information about market makers. Monad’s disclosure of market making details on Coinbase, centered on transparency, breaks industry convention.

Furthermore, monitoring by Coinwatch will maximize assurance that the loaned tokens are genuinely used for market making, demonstrating the project’s emphasis on compliant operations.

Cautious Structural Design

The four market makers have one-month loan terms with monthly renewals, while only Wintermute provides a one-year commitment. This structure reflects Monad’s cautious approach:

- Flexibility: Short-term contracts allow the project to adjust market making arrangements according to market conditions. If a market maker underperforms, the contract can simply not be renewed at month-end.

- Risk Hedging: Wintermute’s one-year commitment provides a stable long-term foundation for market liquidity.

This combination shows that the project wants to ensure initial liquidity without over-relying on any single market maker or making overly long-term commitments.

Restrained Scale of Market Making Loans

Relative to the total supply of 100 billion, the 160 million tokens loaned for market making account for only 0.16%. This is a very small proportion, possibly due to:

- Avoiding excessive market intervention

- Controlling token dilution

- Market-driven considerations: Relying on real trading demand rather than excessive market making to maintain price stability.

Additionally, the foundation may use up to 0.2% (200 million tokens) for initial DEX liquidity, further confirming this prudence.

Potential Risks

However, from Monad’s 18-page sale document, it is clear that the project has struck a very conservative, even somewhat cautious, balance between “initial price discovery” and “long-term decentralization.”

At the current pre-market price of $0.0517, these market making loans are worth only $8.27 million. Compared to many projects that allocate 2–3% for “market making quotas,” this may not be enough to support liquidity in the face of significant selling pressure.

Moreover, the foundation may use up to 0.2% (200 million tokens) for initial DEX liquidity, and it is stated as “may” rather than “must.” This amount can only ensure there is no liquidity vacuum at launch, but cannot support sustained depth. The official document also highlights risks related to DEX and CEX liquidity.

For investors, this means that if there is not enough natural trading depth and organic buying support after launch, the MON token price may experience high volatility. Therefore, when investing, in addition to focusing on the project’s fundamentals and long-term vision, it is wise to remain vigilant about the initial market liquidity and price discovery mechanisms.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

In-depth Analysis of Bitroot Parallelized EVM Technology: High-Performance Blockchain Architecture Design and Implementation

Bitroot's success lies not only in technological innovation, but also in transforming these innovations into practical engineering solutions.

Zeno's Digital Twin Ideal and the Technological Popularization of DeSci

Carbon-based intelligence and silicon-based intelligence coexist under the same roof.

Banmu Xia's forecast for the next two years: Bitcoin enters the early stage of a bear market, while the upward cycle of U.S. stocks is far from over.

The real massive liquidity injection may not happen until May next year, after Trump gains control of the Federal Reserve, similar to what happened in March 2020.

"The biggest victim of the DeFi collapse" suffers losses of over 100 million USD, with funds still inaccessible

Can we still trust DeFi?