Key takeaways:

Bitcoin spot demand has flipped positive, signaling a potential bullish reversal.

Increasing spot volume suggests higher speculative activity.

BTC price must reclaim $110,000 as support to secure the recovery.

Demand for Bitcoin ( BTC ) has shown signs of recovery, signaling a possible bullish reversal. Still, traders say momentum will increase once the BTC/USD pair breaks above $110,000.

Bitcoin apparent demand hits a four-month high

Bitcoin’s apparent demand has shifted to a positive outlook after rising to its highest level since July, as traders and investors adopt a risk-on approach due to improving macroeconomic conditions.

Capriole Investment’s Bitcoin Apparent Demand metric is a commodity metric that gauges demand, measuring production (mining issuance) minus inventory (supply inactive for over one year).

This demand had increased sharply to 5,251 BTC on Nov. 11, levels last seen on July 31.

Related: Bitcoin’s next move could shock traders if BTC price breaks above $112K

Bitcoin's apparent demand has been negative since Oct. 8, bottoming around -3,930 BTC on Oct. 21, before reversing sharply as shown in the chart below.

Bitcoin apparent demand. Source: Capriole Investments.

Bitcoin apparent demand. Source: Capriole Investments.

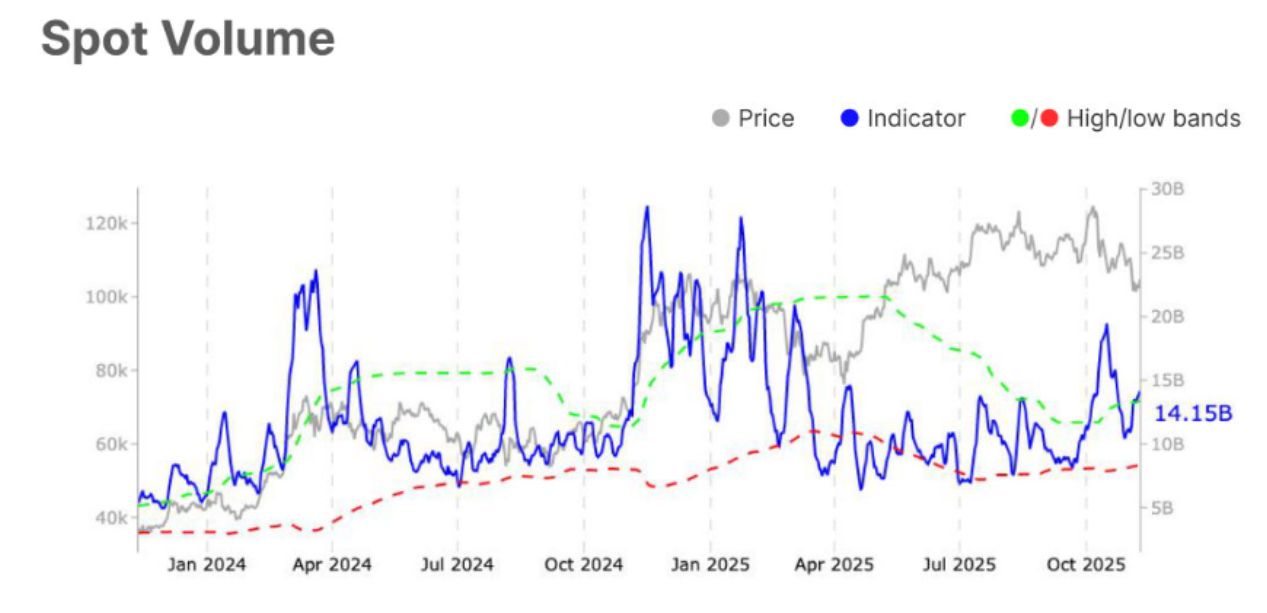

Meanwhile, spot trading volume has increased by 23% to $14.1 billion from $11.5 billion over the last week, suggesting increased speculative activity.

The increase suggests that Bitcoin’s recent recovery to $106,000 was “an early sign of buyer re-engagement,” Glassnode wrote in its latest Weekly Market Impulse report, adding:

“The rise in spot volume suggests stronger investor participation and a potential for a breakout move.”

Bitcoin spot volume. Source: Glassnode

Bitcoin spot volume. Source: Glassnode

Optimism around the end of the US government shutdown and Trump’s promise of $2,000 tariff dividend payments , coupled with the Fed’s expected December rate cut and upcoming quantitative easing, are causing investors to scale back into risk assets .

Bitcoin price must reclaim $110,000

Bitcoin’s bullish weekly close above the 50-week simple moving average has convinced traders of its ability to move higher from current levels.

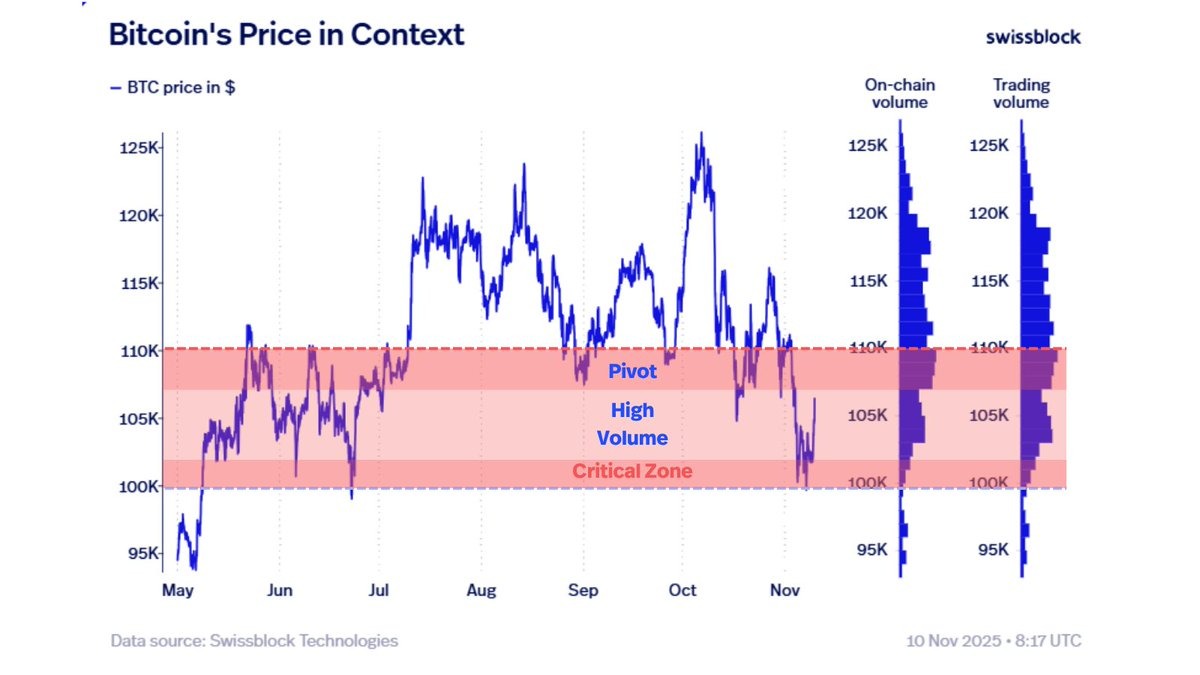

Bitcoin’s bullish case now hinges on bulls reclaiming $110,000 as support, according to Swissblock.

“After defending the critical zone, BTC’s next move is all about consolidation and confirmation,” the private wealth manager said in a Monday X post.

Swissblock said that since the price is still holding the macro structure, momentum will start igniting once bulls “reclaim $108K–$110K pivot zone,” adding:

“Selling pressure is easing, and $BTC is giving early signals of a bullish reversal.”

BTC/USD price chart. Source: Swissblock

BTC/USD price chart. Source: Swissblock

MN Capital founder Michael van de Poppe said Bitcoin will likely rally toward its all-time high of $126,000 if it breaks through $110,000.

Crucial resistance coming up for #Bitcoin .

— Michaël van de Poppe (@CryptoMichNL) November 10, 2025

The government shutdown is nearly over, which would be an ideal signal for the markets to turn back into bull mode.

To be honest, if $BTC breaks through $110K, we'll likely see a rally towards the ATH.

I do expect #Altcoins to… pic.twitter.com/5j0UEAkq3S

Fellow analyst Jelle said reclaiming the $110,000 support level is “very important as rejecting here would be a clear sign of further weakness in the market.”

As Cointelegraph reported , Bitcoin’s double bottom pattern may boost bullish momentum toward $110,000, but the BTC/USD pair could first see a short-term retracement to fill the CME gap near $104,000.