Solana ETFs Smash Expectations with $342 Million Inflows

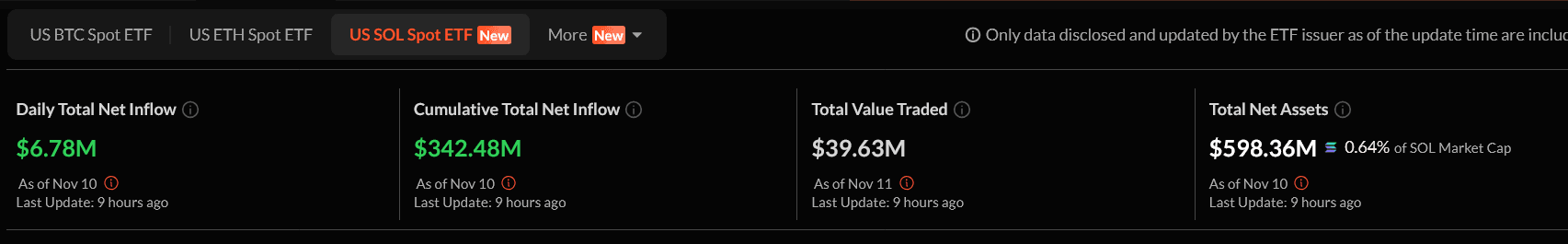

Solana continues to defy the skeptics. The two US spot Solana exchange-traded funds (ETFs) have now logged ten consecutive days of net inflows, signaling strong investor appetite despite recent market pullbacks. Data shows the funds brought in another $6.78 million on Monday alone, pushing their total net inflows since launch past $342 million.

Solana ETF: What’s Behind the 10-Day Inflow Streak?

According to SoSoValue , Bitwise’s BSOL led Monday’s activity with $5.92 million in net inflows, while Grayscale’s GSOL added $854,480. The consistent flow of funds comes even as Solana’s price dipped nearly 2% in the past 24 hours to $164.24. Since the debut of these ETFs on October 28, investors have kept pouring in money almost daily—an impressive trend for a relatively young product in the altcoin ETF space .

Why Are Investors Betting Big on Solana ETFs?

Analysts say Solana ETFs are becoming a “high-beta” play for those already holding Bitcoin and Ethereum ETFs. Nick Ruck from LVRG Research explained that institutional investors view Solana as a diversification tool within crypto portfolios, offering potentially higher returns—albeit with greater volatility. This growing appetite shows confidence in Solana’s maturing ecosystem and its role as a complement to the top two cryptocurrencies.

Surpassing Expectations and Skepticism

When the funds launched, many doubted they would attract meaningful institutional interest. Concerns over Solana’s regulatory clarity and technical history fueled that skepticism. Yet, the performance told a different story. Last Wednesday alone, daily inflows topped $70 million—an amount Bloomberg analyst Eric Balchunas called a “huge number, good sign.”

What This Means for Solana’s Price and Future

While ETF inflows don’t directly dictate price, they often tighten supply and support long-term stability. Ruck noted that continued inflows could sustain upward pressure on SOL by bringing more institutional capital into the ecosystem. In contrast, Bitcoin ETFs saw modest $1.15 million in inflows on Monday, and Ethereum ETFs saw none, suggesting investors are diversifying beyond the majors.

The Bigger Picture

Solana’s ETF success underscores a shifting narrative in the crypto market. What started as a speculative altcoin has now entered mainstream institutional portfolios. If this momentum holds, Solana could cement its place as the third pillar of crypto investing—right behind Bitcoin and Ethereum .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin Backs ZKsync: Accelerating Institutional Embrace Within Ethereum's Layer-2 Network

- Vitalik Buterin endorsed ZKsync's Atlas upgrade, highlighting its 15,000 TPS capacity and ZK-secured scalability for Ethereum's institutional adoption. - The upgrade's ZK Stack enables seamless Layer 1-2 liquidity sharing, attracting enterprises with privacy-focused, Ethereum-compatible solutions. - ZK token's deflationary model and 50% price surge post-endorsement demonstrate growing institutional confidence in ZKsync's enterprise-grade infrastructure. - Upcoming Fusaka upgrade (30,000 TPS target) and e

ZK Atlas Enhancement: Accelerating Institutional Embrace in the Age of Blockchain

- ZK Atlas Upgrade addresses institutional blockchain scalability needs with 15,000 TPS and 1-second finality, aligning with trading/settlement demands. - ZKsync's deflationary tokenomics model ties token value to network usage, boosting institutional confidence through yield generation and scarcity. - Vitalik Buterin's endorsement and Ethereum compatibility lower adoption barriers, enabling seamless integration with existing institutional workflows. - Post-upgrade $300M+ daily trading volume and 20% token

Pi Coin’s Pursuit of AI Faces Challenges from Market Instability and Scalability Issues

- Pi Coin (PI) fell below $0.30 amid market volatility, despite a 21% surge driven by whale activity and 535% higher trading volume. - Node 0.5.4 upgrades improved reward accuracy and network reliability, addressing bugs in block creation and automatic updates. - Collaboration with OpenMind demonstrated Pi Nodes' AI processing potential, positioning the network as a decentralized computing alternative. - Sustaining gains above $0.27 is critical to test $0.36 resistance, while competition from Bitcoin and S

Ethereum News Update: Ethereum’s $201B Utility Boom Contrasts with ETH’s Stagnant Price—Is Broader Market Direction Needed?

- Ethereum's tokenized assets hit $201B, capturing 64% of global market share, driven by institutional adoption and stablecoin dominance. - Stablecoins like USDT/USDC and PayPal's PYUSD ($18.6B in 2025) fuel DeFi, cross-border payments, and exchange liquidity. - Tokenized RWAs ($12B) and BlackRock/Fidelity's on-chain funds surge 2,000% since 2024, outpacing traditional finance infrastructure. - ETH price remains below $3,500 despite strong fundamentals, with technical indicators showing weak buying pressur