Ethereum Rebounds as Whales Pile In Ahead of the Fusaka Upgrade

The crypto market is down, and even Ethereum, the world’s second largest crypto, is not spared. For several weeks, ETH has been hovering below 3,600 dollars, in a sea stirred by macroeconomics and regulatory doubts. Yet, a quiet but powerful signal reappears: the big players are active. While small holders sell, whales are filling their pockets. And the Fusaka update, scheduled for December, seems to be the catalyst.

In brief

- Wallets holding 10,000 ETH or more have recently increased their stock by 52%.

- Small holders reduce their exposure while whales accumulate at low prices.

- The Fusaka update could boost scalability while lowering network fees.

- Macroeconomic stability favors a possible local bottom around 3,200 dollars for Ethereum.

When large wallets play the game: discreet accumulation for an ETH comeback

Since late April, addresses holding between 10,000 and 100,000 ETH have accumulated nearly 7.6 million additional tokens, a 52% increase in their balance. These “ whales “, often heralds of major moves in the crypto market, seem to anticipate a reversal.

ShayanMarkets, analyst at CryptoQuant, confirms this trend :

If this behaviour persists and the $3-$3.4K region holds as structural support, Ethereum may be entering a low-volatility accumulation zone, setting up for a potential final bullish impulse toward the upper range of $4.5K–$4.8K.

Meanwhile, retail wallets (100 to 1,000 ETH) have reduced their positions by 16%. This silent transfer to big players recalls the ends of bear cycles. Other cryptos like Bitcoin follow the same path, but Ethereum draws particular attention. Its relative stability against BTC, combined with a resurgence of transactions since September, reinforces the idea of a solid base around 3,200 dollars.

Crypto and Ethereum: Fusaka, the update that can shake everything up

On December 3, Ethereum will activate the Fusaka update . This technical step includes several improvements for the Ethereum ecosystem, including the famous “blob lanes” which will allow layer 2 solutions to access dedicated data lanes. The goal? Speed up transactions, reduce fees, and unclog the main chain.

But this scalability promise comes with a side effect: less fees = fewer tokens burned. In other words, if L2s pay less to use Ethereum, the amount of ETH destroyed decreases, which could weigh on the network’s deflationary dynamic. Shawn Young, analyst at MEXC, notes :

This is a significant update because what’s next for Ethereum adoption is coming from real-world applications and DeFi protocols, all of which would depend on cheaper, faster transactions

It remains to be seen whether this technical dynamic will offset the drop in income for validators. In any case, whales seem to believe in it.

Between macro, regulation and token hunting: when traditional finance comes back to the table

The crypto industry remains hung on several external factors. On one hand, the global macroeconomic situation seems to stabilize. On the other, discussions around a clearer legal framework in the United States resurface with the possible end of the government shutdown.

Lai Yuen, analyst at Fisher8 Capital, points out:

Whale accumulation makes sense, and we see the same for Bitcoin as well, with new participants coming in to absorb sell pressure from OGs that believe in a four-year cycle. If macro conditions continue to hold up well…chances of this becoming a local bottom are high for Ethereum at $3,200 and Bitcoin at $98,000.

Asset tokenization, pushed by major banks, could also accelerate Ethereum adoption. The mechanism is getting back on track. And big holders are not here for nothing.

5 key markers to watch in the Ethereum ecosystem

- The ETH price at the time of writing: 3,549.30 dollars;

- Whale accumulation: +52% since April;

- Decrease in retail wallets: -16%;

- Date of the Fusaka update: December 3, 2025;

- Current observed support level: between 3,000 and 3,400 dollars.

Recently, another positive signal has been added: transaction fees on Ethereum have dropped to 0.067 gwei . This drastic drop promises a smoother and cheaper experience for all users, further strengthening the network’s appeal. Perhaps this is where Ethereum’s true silent revolution begins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The US SEC and CFTC may accelerate the development of crypto regulations and products.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.

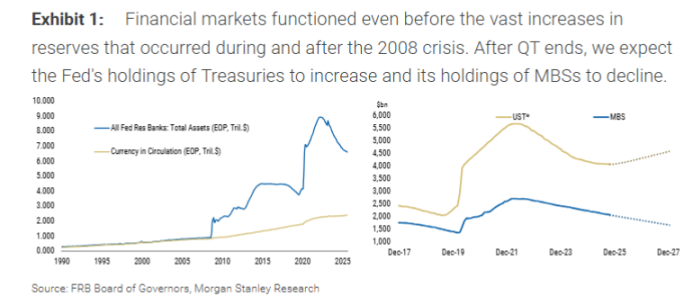

Morgan Stanley: Fed Ending QT ≠ Restarting QE, Treasury's Debt Issuance Strategy Is the Key

Morgan Stanley believes that the Federal Reserve ending quantitative tightening does not mean a restart of quantitative easing.