Key Market Intelligence on November 11th, how much did you miss?

Top News

1. The U.S. Senate approves a bill to end the government shutdown and sends it to the House

2. On-chain tokens related to the Base ecosystem see a general decline today, with tokens like PAY AI and PING dropping over 20%

3. Coinbase discloses full details of the Monad document, including market maker fund size and protocol cycle, with third-party oversight of market maker token usage

4. FARTCOIN's market value briefly drops by 10%, with over $7.8 million in liquidations in less than 1 hour, ranking first in network-wide liquidations

5. UNI retraces about 20% from the daily high and is currently priced at $8.246

Featured Articles

1. "Destruction is Uniswap's last trump card"

Waking up, UNI surged by nearly 40%, leading a general DeFi rally. The reason for the rise is that Uniswap revealed its last trump card. Uniswap founder Hayden released a new proposal focused on the age-old "fee switch" topic. In fact, this proposal has been put forward 7 times in the past two years, so it is not new to the Uniswap community. However, this time is different. The proposal is initiated by Hayden himself, and in addition to the fee switch, it also includes a series of measures such as token burning, Labs, and Foundation merger.

2. "Earning Nearly $3 Million by Winning the Championship with Faker"

The League of Legends S15 Global Finals has come to a close, and Faker has once again stood on the highest award podium, claiming his 6th championship title and continuing to write his legend. In the cryptocurrency community, as the prediction market has risen, players have been enjoying esports events while participating in the prediction market. Among the many cryptocurrency players involved in the prediction market, an ID named "fengdubiying (Winning at Every Bet)" has become a new legend. In the prediction for the T1 vs. KT finals, he boldly wagered around $1.58 million on T1's victory, ultimately making a profit of around $820,000.

On-chain Data

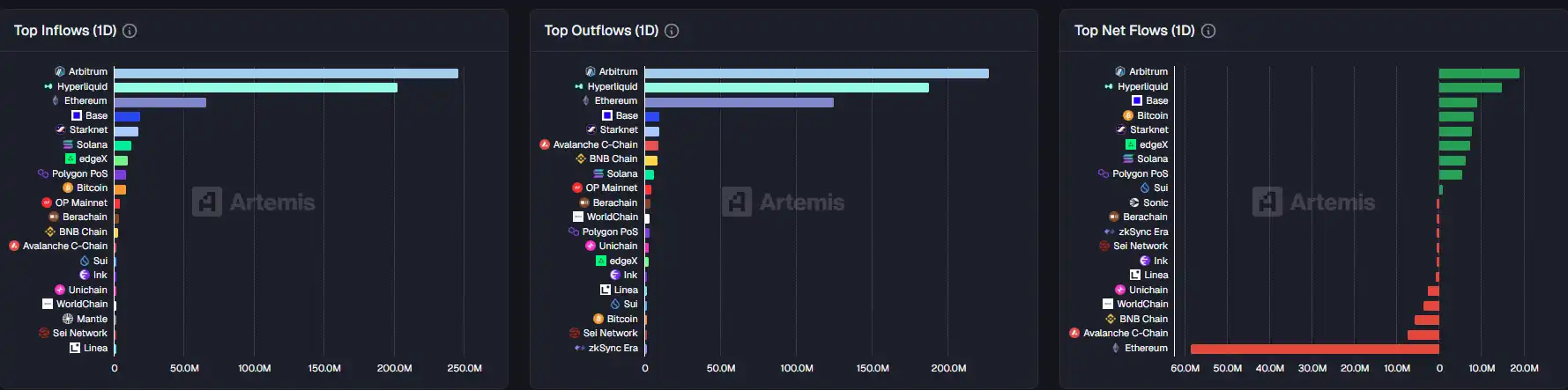

On-chain Fund Flow last week on November 11

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. Debt Fluctuations Surge Amid AI-Driven Borrowing Growth and Fed Faces Fiscal Uncertainty

- U.S. Debt Volatility Index hits one-month high in November, reflecting market anxiety amid government shutdown resolution and fiscal risks. - AI infrastructure debt surges 112% to $25B in 2025, driven by tech giants’ $75B in bonds for GPU/cloud projects, raising overleveraging concerns. - Fed faces mixed signals: October job losses push December rate cut odds to 68%, while gold/silver rise 2-3% as investors seek safe havens amid fiscal/geopolitical risks. - Delayed economic data from shutdown complicates

ChainOpera AI Token Plunge: An Alert for Investors in AI-Based Cryptocurrencies

- ChainOpera AI Index's 54% 2025 collapse exposed systemic risks in AI-driven crypto assets, driven by governance failures, regulatory ambiguity, and technical vulnerabilities. - C3.ai's leadership turmoil and $116.8M loss triggered sell-offs, while the CLARITY Act's vague jurisdictional framework created legal gray areas for AI-based crypto projects. - Model Context Protocol vulnerabilities surged 270% in Q3 2025, highlighting inadequate governance models as 49% of high-severity AI risks remain undetected

Navigating the Dangers of New Cryptocurrency Tokens: Insights Gained from the COAI Token Fraud

- COAI token's 2025 collapse exposed systemic risks in algorithmic stablecoins, centralized governance, and fragmented regulatory frameworks. - xUSD/deUSD stablecoins lost dollar peg during liquidity crisis, while 87.9% token concentration enabled panic selling and manipulation. - Regulatory gaps pre-collapse allowed COAI to exploit loosely regulated markets, but post-crisis reforms like MiCA and GENIUS Act now demand stricter compliance. - Investor sentiment shifted toward transparency, with demand for re

Filecoin (FIL) to Bounce Back? This Emerging MA Fractal Setup Suggests So!