Public Company's $IP Token Reserve Marks the Beginning of a Programmable IP Economy Era

- Crypto.com partners with IP Strategy, first public company to use $IP tokens as primary reserve asset. - Agreement includes custody, trading, and staking for 52.5M $IP tokens valued at $230M, boosting institutional IP token adoption. - Partnership enables regulated exposure to $80T programmable IP economy via Story Protocol's blockchain infrastructure. - Executives highlight infrastructure's role in securing IP assets while risks like liquidity and custody execution remain critical concerns.

Crypto.com (CRO) has formed a strategic alliance with IP Strategy (Nasdaq: IPST), marking the first instance where a publicly listed firm has selected $IP tokens as its main reserve asset. As part of this partnership, Crypto.com will handle custody, trading, and staking for IP Strategy’s treasury, which consists of 52.5 million $IP tokens valued at more than $230 million, according to

Eric Anziani, President and COO of Crypto.com, highlighted the necessity of secure and scalable infrastructure for institutions embracing digital assets. “As more companies incorporate digital assets into their treasury management, having access to reliable execution and custody becomes essential,” he commented in the

The $IP token, which is built on Story’s blockchain, is supported by $136 million in investments from a16z crypto, Polychain Capital, and Samsung Ventures, as referenced in the

Nonetheless, the alliance comes with operational risks. Ensuring smooth onboarding for custody, maintaining liquidity for substantial trades, and dependable staking are all vital for preserving the liquidity and worth of IP Strategy’s reserves. In the months ahead, market observers will pay close attention to updates regarding custody insurance, staking conditions, and counterparty arrangements.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

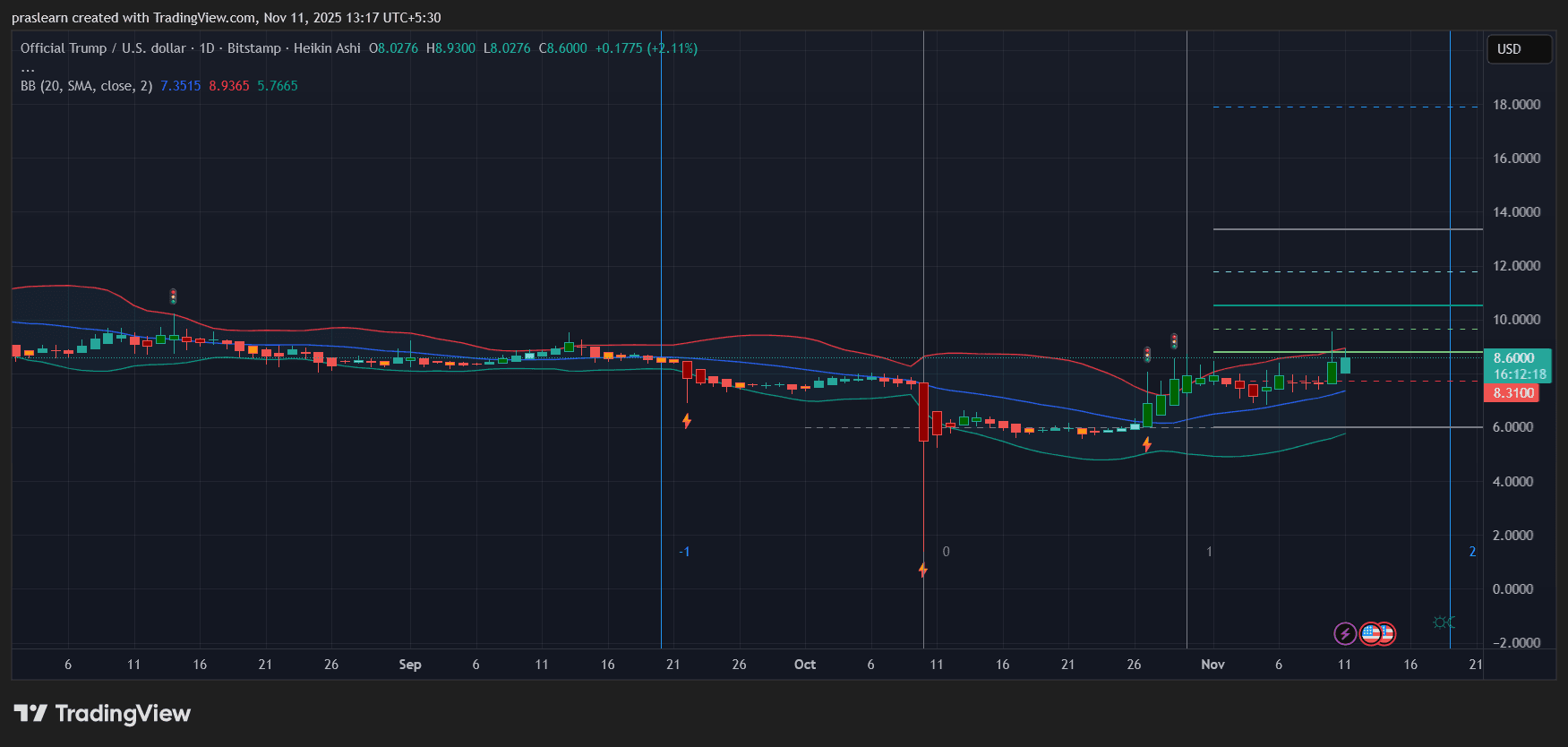

TRUMP Token Explodes as $2,000 “Dividend” Promise Fuels Hype

Harvest Today, Decrypt Tomorrow: The Drive for Quantum-Resistant Encryption Intensifies

- Quantum computing threats accelerate post-quantum cryptography (PQC) adoption as "harvest now, decrypt later" risks expose sensitive data to future decryption. - Companies like Gigamon and BTQ integrate quantum-resistant algorithms while governments race to develop standards amid geopolitical quantum technology competition. - Technical challenges include larger key sizes straining blockchain networks and limited expertise, despite NIST's standardized protocols like ML-KEM and SLH-DSA. - Experts warn imme

Ethereum Updates: Alternative Coins Rise on New Developments While Major Cryptocurrencies Remain Unchanged

- Altcoin Lisk (LSK) surges 70% amid short squeeze and Optimism Superchain migration, driven by Binance/Bybit open interest and Upbit's 81% trading volume share. - Aero (Aerodrome+Velodrome) merger aims to create $536M TVL cross-chain liquidity hub, challenging Uniswap's $4.9B dominance with MEV auctions and Ethereum integration. - DeFi faces headwinds as TVL plummets across major chains, exacerbated by $120M Balancer exploit, while Injective Protocol launches gas-free Cosmos-based mainnet to boost scalabi

Institutional and individual investors are leading the transformation of cryptocurrency towards greater functionality and openness

- BlockDAG's $435M presale with $86M institutional backing highlights growing demand for transparent, utility-driven crypto projects. - IPO Genie's 320% presale surge and AI-powered private market access demonstrate institutional/retail appetite for governance-focused tokens. - Both projects' 40/60 vesting models and referral programs reflect maturing crypto markets prioritizing liquidity, scarcity, and community growth. - As Filecoin and Bonk show modest gains, utility-first platforms like BlockDAG and IP