3 Signs Pointing to Mounting Selling Pressure on Pi Network in November

Pi Network’s price may hit new lows in November as massive token unlocks, rising exchange reserves, and weak liquidity weigh on sentiment. Yet, loyal supporters remain hopeful that long-term fundamentals will eventually spark a rebound.

Trading data for Pi Network (PI) signals a bearish outlook for its price in November. Although Pi has already dropped more than 90% from its peak, market forces may continue to push the price lower.

What are the warning signs, and how do Pi’s loyal supporters explain them?

A Massive Amount of Pi Tokens Being Unlocked

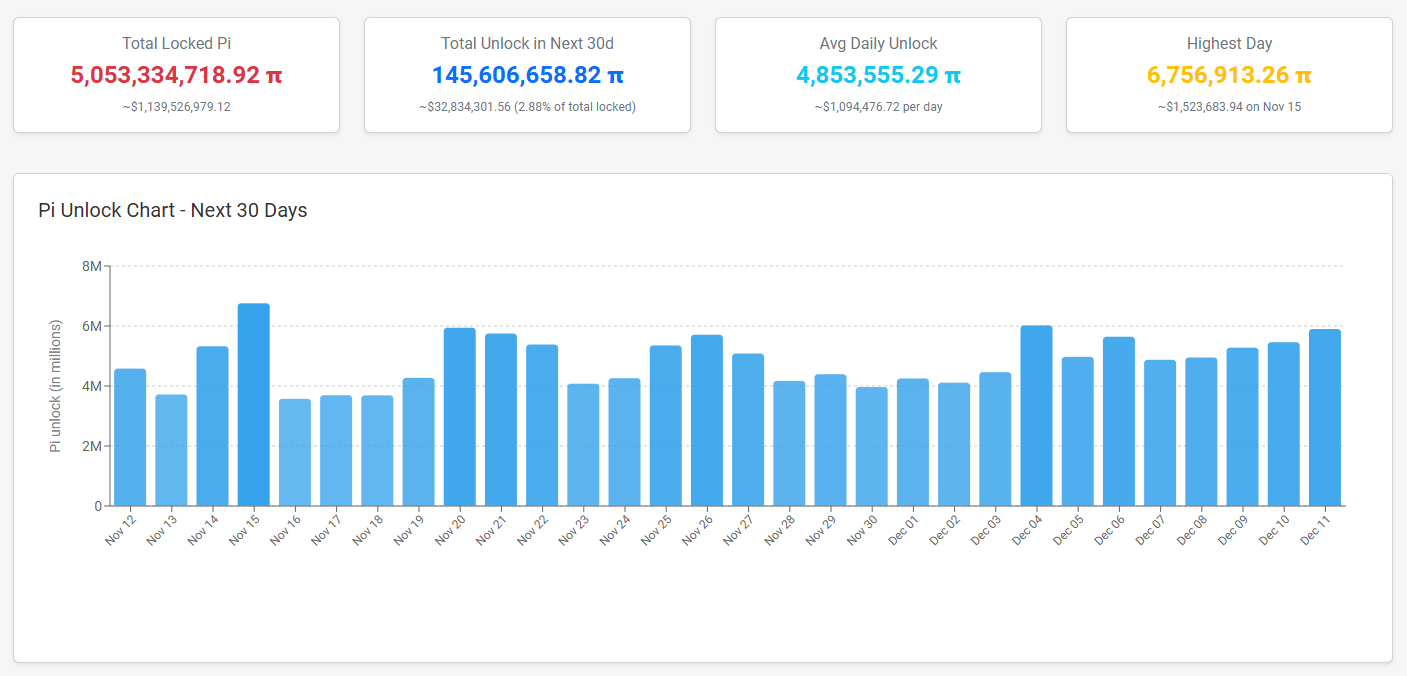

First, Piscan data shows that the number of Pi unlocked per day is up to 4.85 million PI, and the number of Pi unlocked in the next 30 days is up to 145 million Pi.

Number of Pi Tokens Unlocked Per Day. Source:

Piscan

Number of Pi Tokens Unlocked Per Day. Source:

Piscan

Piscan data also reveals that in December, more than 173 million Pi will be unlocked — the highest monthly unlock volume until September 2027.

This steady and increasing unlock pressure is likely to persist through the end of the year, creating a significant obstacle to any price recovery on exchanges.

Rising Exchange Balances Indicate Continuous Selling Pressure

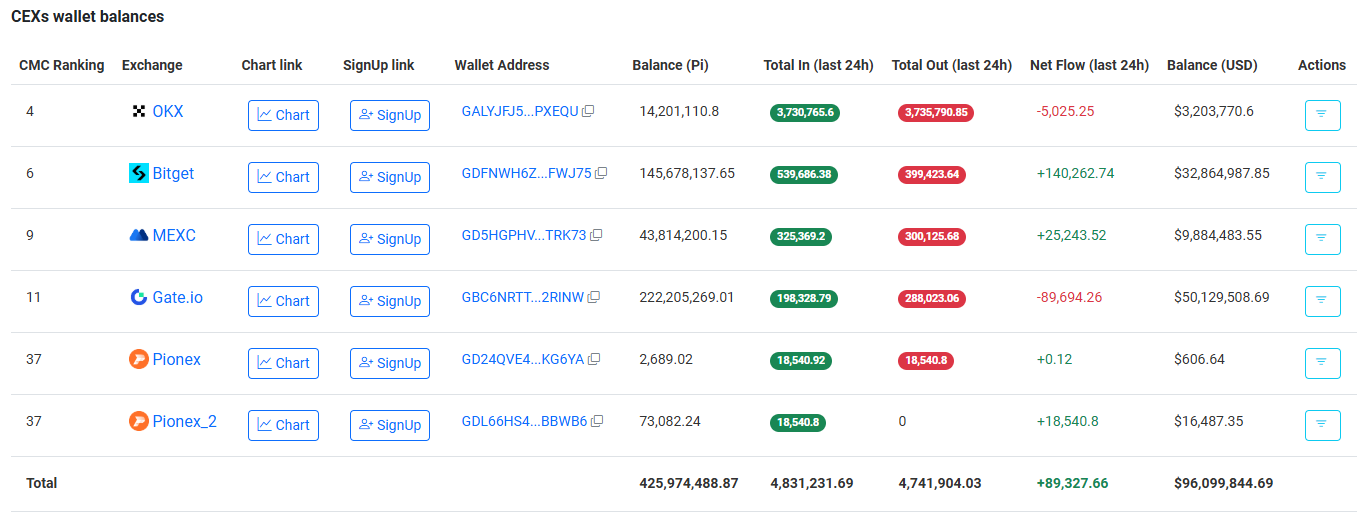

The amount of Pi held on exchanges continues to increase in November.

Pi Supply on Exchanges. Source:

Piscan

Pi Supply on Exchanges. Source:

Piscan

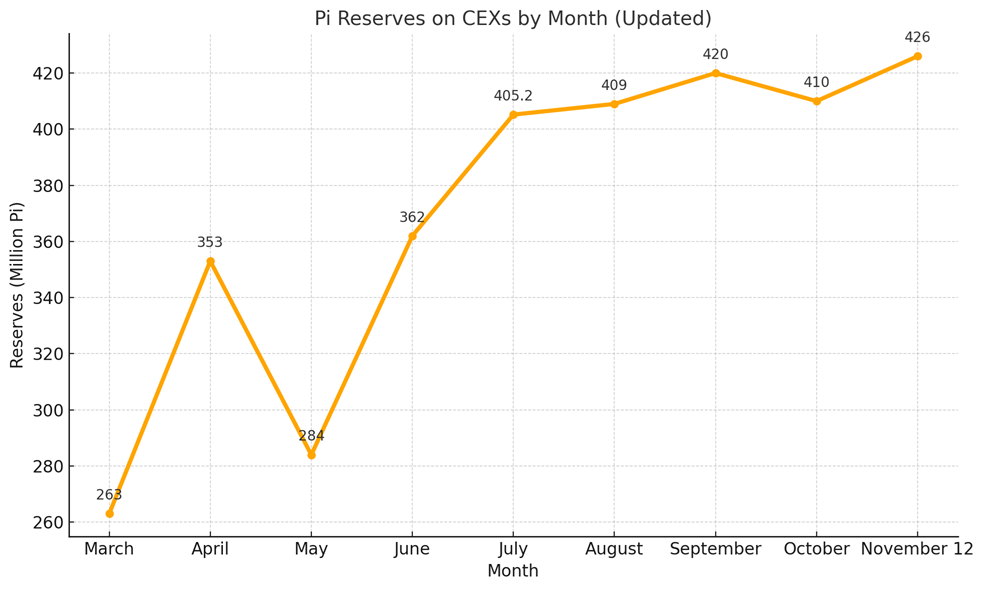

According to Pi Network’s early-month report, there were about 423 million Pi on exchanges. By mid-November, that figure had climbed to nearly 426 million Pi, marking an all-time high.

Pi Reserves on CEXs by Month. Source: Data Curated by BeInCrypto

Pi Reserves on CEXs by Month. Source: Data Curated by BeInCrypto

Such growth in exchange reserves indicates that exchanges now hold more Pi tokens, ready for trading or sale, which could put downward pressure on prices.

Weak Trading Volume Reflects Low Market Activity

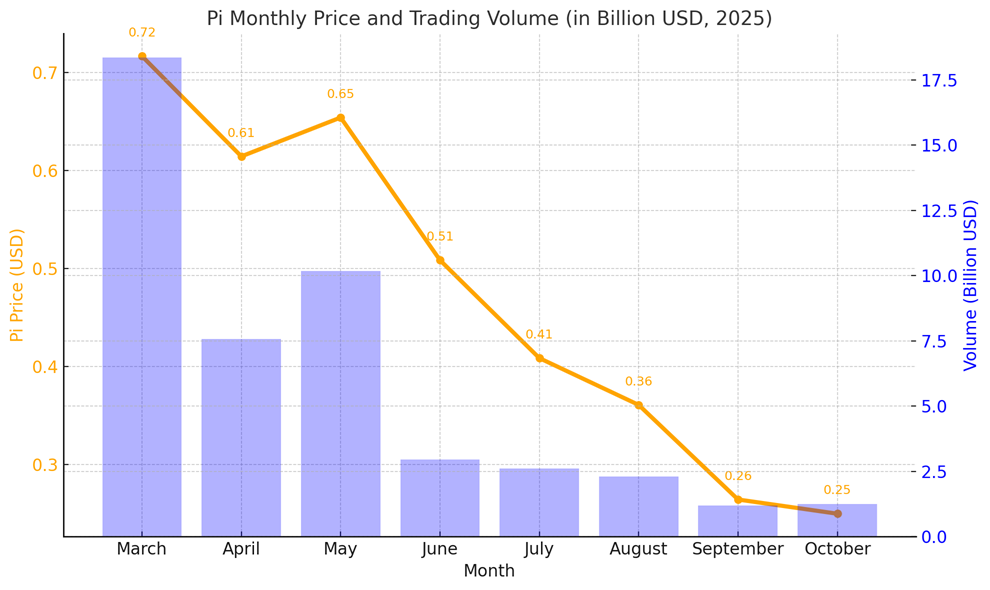

Spot trading volume for Pi on centralized exchanges has shown little improvement in November. The 24-hour trading volume currently hovers around $30 million.

CoinMarketCap data indicates that Pi’s monthly trading volume fell to just $1.2 billion last month. Both price and trading volume have declined in parallel.

Pi Monthly Price & Trading Volume. Source:

CoinmarketCap

Pi Monthly Price & Trading Volume. Source:

CoinmarketCap

Weak liquidity, along with the constant unlocking and inflow of Pi to exchanges, could intensify the downward price movement.

Pi Supporters Remain Confident Despite the Pressure

Despite the bearish signals, Pi supporters remain optimistic.

An X account named Dao World, identifying as a Pioneer, argued that while Pi has a large maximum supply, the actual circulating amount is only around 3 billion. The Pi Core Team, he noted, has not been aggressively selling.

He also suggested that a few market makers (MM) on certain exchanges mainly control Pi’s current price. Once selling pressure is fully absorbed, he believes the price could rebound.

Even though $Pi has a large max supply, considering that the CT has not been aggressively selling tokens and the actual circulating supply is only a little over 3B, and price action is largely managed by MM on a few exchanges — am I the only one who thinks that when it’s time for… pic.twitter.com/0GUIXfx2EF

— Dao world November 11, 2025

Several other Pioneers share this view, claiming that the current $0.20 range presents a buying opportunity — one they expect will be remembered fondly in the future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zero-Knowledge Startup Secures $9M Funding, Introduces Gamified Verification to Bridge Privacy and Compliance

- Zero-knowledge identity protocol Self raised $9M in seed funding led by Greenfield Capital and SoftBank's fund, alongside angel investors like Casey Neistat and Polygon's Sandeep Nailwal. - The startup launched a points program incentivizing on-chain identity verification using ZKPs and verifiable credentials, partnering with Google , Aave , and Velodrome to bridge privacy-compliance gaps. - By enabling biometric passport verification and Aadhaar integration without exposing sensitive data, Self aims to

Gavin Wood Supports Acurast’s Decentralized Computing Revolution Driven by Smartphones

- Acurast, a smartphone-based decentralized computing project, secured $11M in funding led by Ethereum co-founder Gavin Wood and others. - The platform launched its mainnet on November 17, aiming to transform 150,000 smartphones into secure compute nodes for confidential tasks. - By leveraging hardware-backed security and eliminating intermediaries, Acurast challenges traditional data centers while addressing privacy and environmental concerns. - Despite scalability challenges, the project's 494 million pr

Crypto wallets are transforming into comprehensive platforms, connecting Web3 with traditional financial services

- D'CENT Wallet's v8.1.0 update enables multi-wallet management for up to 100 accounts, streamlining digital asset handling across investment, NFTs, and events. - Competitors like Exodus and Blaqclouds advance crypto adoption through features like Mastercard-linked debit cards and decentralized identity systems with biometric security. - Innovations such as fee-free transactions (D'CENT GasPass) and on-chain identity management (.zeus domains) highlight industry focus on accessibility and security for main

Grayscale's Public Listing: Advancing Crypto Adoption as Regulations Vary Worldwide

- Grayscale files U.S. IPO via S-1, joining crypto firms like Circle and Bullish in public markets. - IPO details remain undetermined, contingent on SEC review and market conditions. - Japan's TSE tightens crypto listing rules amid volatile "crypto hoarding" stock collapses. - U.S. regulators advance crypto rulemaking post-shutdown, potentially accelerating Grayscale's approval. - Grayscale's IPO highlights crypto's institutional push amid global regulatory divergence.