Author: Cecelia, TechFlow

Introduction

Only when the tide goes out do you discover who's been swimming naked.

In the narrative inflation of 2025, one grand vision after another has been debunked—do those stories that claim to change the world really solve genuine pain points, or are they just artificially created needs?

No matter how promising things seem in theory, reality is harsh. The real, pressing question is whether we can build applications that truly land and generate profits.

Recently, mainstream assets have seen some pullbacks, market sentiment is volatile, and most of the old quality narratives have already been hyped up.

If you’re still in this space, it’s time to think: what new things are worth paying attention to next? The answer is, those applications that can truly land and are closely tied to daily needs will regain attention.

Neobank is one of them.

Next, let’s take a look at this new narrative that can generate tangible profits, and see what projects and potential investment opportunities are emerging.

Concept Overview

Neobank is not actually a new concept; it originated as early as 2015, arising from the complex monetary system in the Eurozone and the real needs of global travelers for overseas spending.

The earliest Neobanks were actually quite simple, with a straightforward goal: to provide banking services to people without bank accounts.

It may sound unimpressive, but it’s actually astonishing.

Anyone who has tried to open an overseas bank card knows that the cumbersome identity verification, income proof, and risk of information leakage are enough to deter most people.

But Neobank solved these problems a decade ago. In theory, if a Neobank partners with enough banks, it could even achieve global payments with a single card, without the need to open new accounts.

But why has this genius idea only recently moved from the fringes to become a potential Alpha narrative?

If traditional Neobanks only operate as “digital banks,” they are still constrained by traditional financial infrastructure, efficiency, and cost issues. The optimal solution is to combine with crypto: on-chain infrastructure + compliant banking partnerships, ultimately achieving:

-

High-speed real-time: Swipe to pay, near-instant settlement, without the cumbersome and delayed deposit/withdrawal process of traditional exchanges.

-

Secure and compliant: Users’ fiat is custodied by partner banks, on-chain assets are managed by Neobank, and both on-chain technology and compliance systems jointly ensure fund security, transparency, and efficiency.

-

Wide application scenarios: Usable anywhere that supports Visa/Mastercard and other traditional clearing network payments.

Profit Mechanism

And of course, the most important point: high returns can be achieved

The profit mechanism consists of three parts:

Payment Process

At which stage is the profit generated? What exactly is the difference between Neobank and traditional banks?

Essentially, Neobank is not a real “bank”; it does not directly hold a banking license, but relies on partner banks to provide core compliant capabilities such as fund custody and payment clearing, “packaging” traditional banking services into a better fintech experience.

To better understand, you can compare it to AI startups building applications on ChatGPT—they don’t reinvent the underlying technology, but package and optimize it for a better user experience.

However, this may still sound too abstract, so we have broken down the payment process of Neobank step by step:

-

On deposit: Users can deposit via on-chain channels or custodial accounts. The system ensures fund security, transparency, and redeemability based on the correspondence between on-chain assets and fiat reserves.

-

On spending: When users swipe their card, the system instantly converts crypto assets into fiat, and payment clearing is completed via partner banks, achieving a “swipe-to-settle” experience.

-

On returns: Neobank combines payment clearing with on-chain yield protocols, with part of the cashback coming from protocol yields or payment revenue sharing, allowing users to share in ecosystem growth while spending.

In short, compared to using traditional banks, Neobank has obvious advantages:

On the spending side

-

Low cost: Supports more favorable forex rates and cross-border payments. In general, fees are much lower than traditional banks.

-

High efficiency: Self-built global settlement system significantly improves transfer efficiency, achieving near-instant transaction experience.

-

Asset flexibility: Holding crypto assets is equivalent to holding multiple national currencies, with no need for active currency exchange.

On the cashback side

-

High returns: By integrating with DeFi protocols, deposits, stablecoins, and idle funds automatically generate returns, with annualized yields significantly higher than traditional bank deposit rates.

Project Overview

With the background knowledge covered, let’s review the projects.

We’ve put together the most discussed Neobank projects on the market for comparison, helping you quickly understand their positioning and differences.

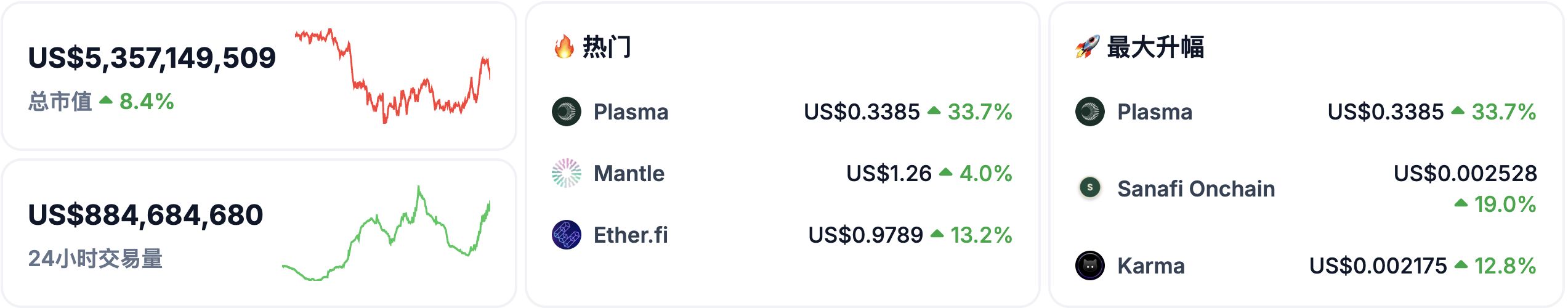

Plasma One: Building the World’s First Stablecoin-Native Neobank

Plasma One initially supports $USDT, with plans to expand to more stablecoins in the future. It is backed by Peter Thiel’s Founders Fund and Tether executives, and its card is issued by Visa partner Signify Holdings.

Highlights: No top-up required for spending, allowing users to spend directly from yield-generating stablecoin balances. Assets are fully self-custodied. Free global on-chain $USDT transfers.

Returns:

-

High-yield savings: $USDT balance annualized yield exceeds 10%, with returns accumulating continuously before spending.

-

4% cashback on spending: Cashback paid in $XPL, with higher reward tiers for frequent users and partners.

-

Seamless DeFi integration: Yields are sourced from EtherFi and other liquid staking strategies.

As a Neobank, Plasma One is not just an application, but the gateway for Plasma to its stablecoin payment system and real-world value network.

-

Infrastructure layer: Based on Plasma’s native chain architecture, it uses its own consensus mechanism combined with LayerZero’s cross-chain infrastructure, achieving extremely low transfer costs and high throughput.

As of October 31, Plasma achieved a single largest cross-chain transfer of $800 million via LayerZero, with users paying only $0.81 in fees—almost negligible.

-

Ecosystem layer: Plasma has integrated USDT₀, Aave, Ether.fi, and Ethena and other core protocols, ensuring liquidity while providing users with high-yield lending and liquid staking opportunities.

Currently, the USDT₀ supply supported by Plasma has exceeded $5 billion, providing a solid capital base for its stablecoin payment and DeFi ecosystem.

All funds of Plasma One are stored on the Plasma main chain, inheriting Bitcoin-level security and Ethereum-like programmability, ensuring asset safety while offering greater flexibility and scalability for stablecoin payments, lending, and cross-chain applications.

According to DefiLlama, Plasma ecosystem currently ranks eighth, and its native token $XPL has completed $373 million in oversubscribed sales.

From an investment perspective, Plasma is actively building a highly potential and strongly interconnected ecosystem. Combined with its impressive current data, users interested in stablecoin scenarios or on-chain payments may want to experience its ecosystem firsthand to more intuitively feel the growth momentum of this emerging chain.

Ether.fi Cash: 3% Instant Cashback, Robust High-Yield DeFi Vault

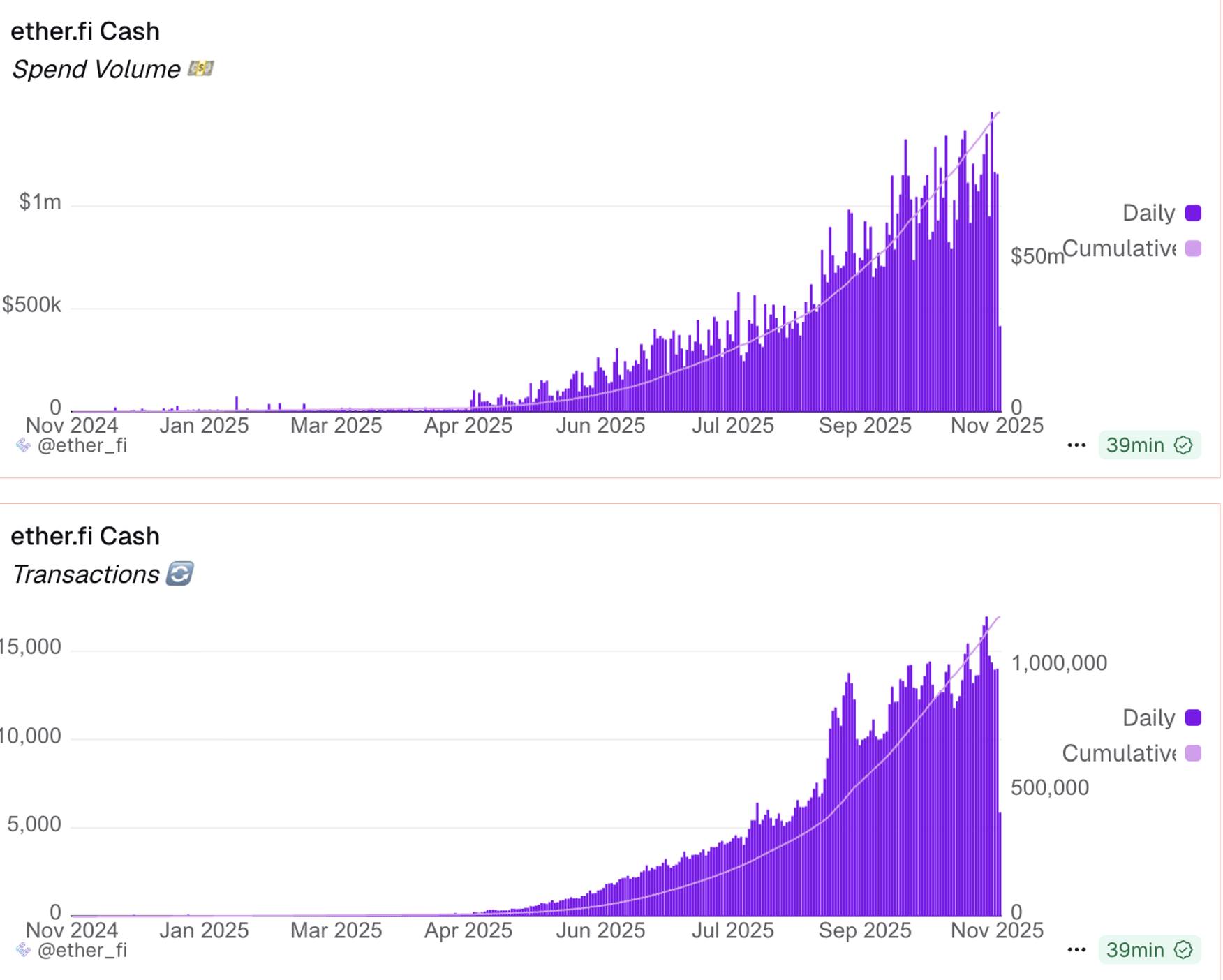

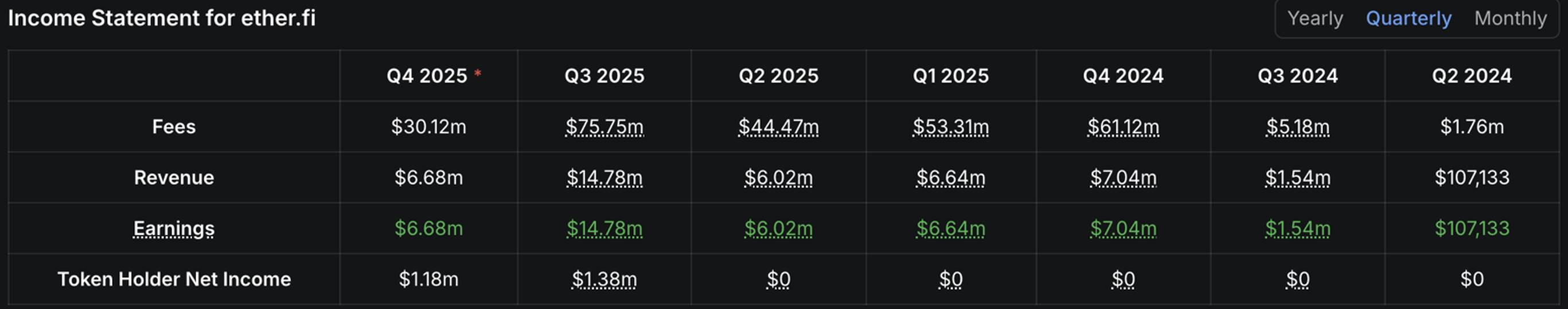

Since its mid-2025 launch, Ether.fi Cash has become one of the most active crypto card products. As of November 7, its cumulative spending has approached $100 million, with over 1.1 million transactions. UserSafe account balances have exceeded $187 million, with cumulative cashback over $4 million, and nearly 40,000 active cards, showing strong market growth momentum.

Highlights: Offers optional DeFi insurance, no card issuance or maintenance fees, supports automatic staking yield repayment, and uses a fully non-custodial model to ensure users have full control of their assets.

Returns:

-

Instant cashback: All spending gets 3% cashback, up to 20%.

-

Direct spending: Spend directly from DeFi yield vaults, earning returns while spending.

-

Competitive high-yield DeFi vaults: Funds deposited into EtherFi liquidity pools can earn up to 10% annualized yield on idle stablecoins, and about 7% on $ETH, allowing assets to “earn while idle.”

The DeFi vault yields are impressive because EtherFi focuses on “liquid staking/re-staking” business. By TVL, it currently ranks seventh and is a well-established project.

Ether.fi protocol revenue is growing steadily and performing well, giving Ether.fi Cash the confidence for high cashback and high yields. Ether.fi Cash is also generous with interactive rewards:

This month, Ether.fi Cash Card launched a “Triple Rewards” campaign, with a total airdrop of 400,000 ETHFI tokens (about $360,000), covering on-chain deposits, off-chain spending, and fiat deposits. Spending cashback is 3%, with generous rewards.

The campaign can actually achieve high returns from multiple sources. For example, by using Borrow Mode to collateralize assets for continuous yield while enjoying 3% cashback; then depositing into the Liquid pool for about 9% annualized yield, deducting the 4% borrowing cost, the actual yield is still 5%.

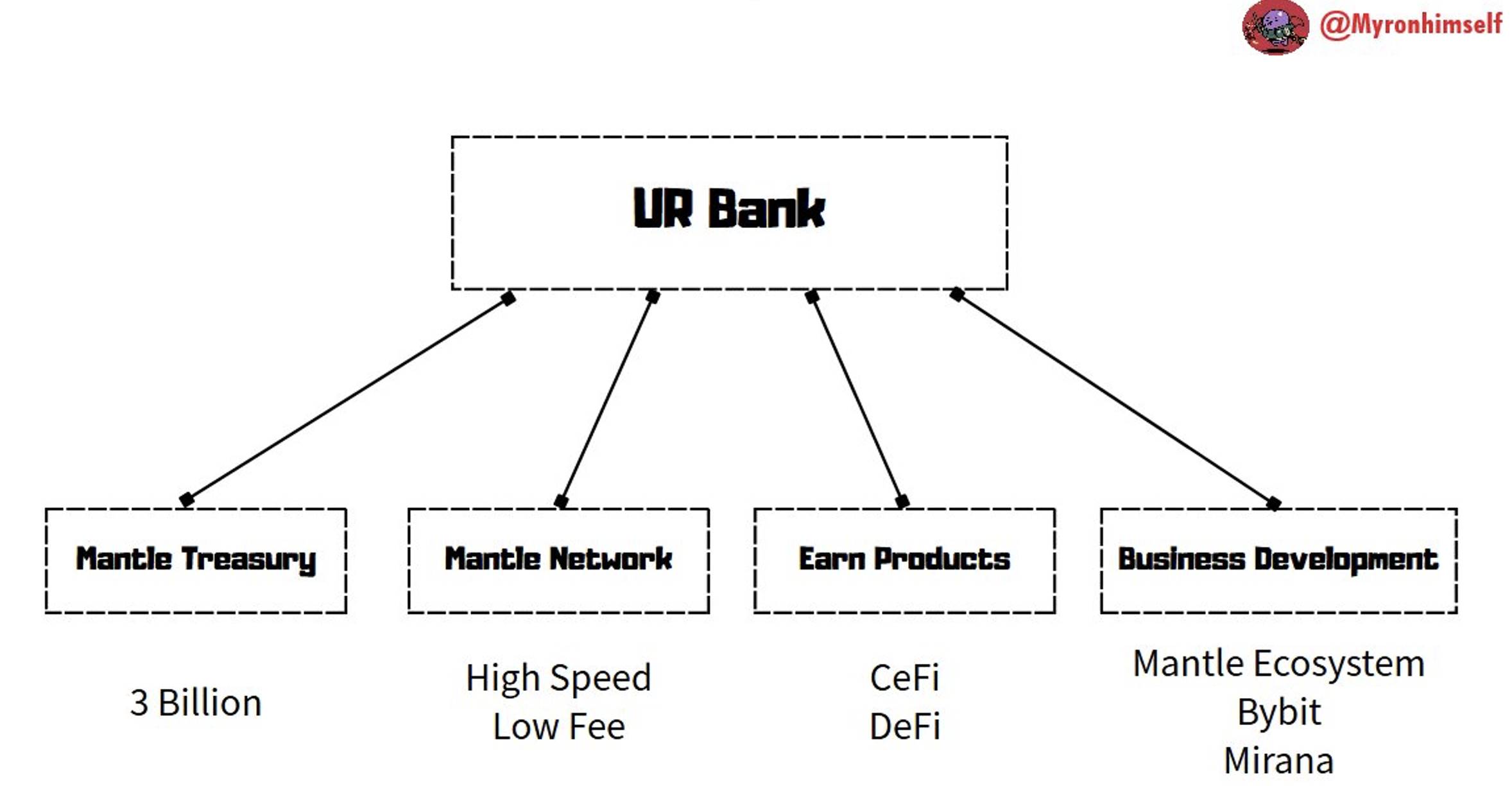

Mantle UR: Compliant Financial Hub, Bybit Ecosystem Interconnected

Mantle UR aims to connect CeFi and DeFi through a borderless smart financial application, enabling seamless spending, saving, and asset withdrawal.

The underlying Mantle public chain focuses on enterprise-grade security, while Mantle UR as a Neobank emphasizes compliance, holding licenses that meet KYC/AML standards. It is supported by Mantle DAO (formerly BitDAO), with a treasury of several billions of dollars.

Highlights: Mantle offers multi-currency Swiss IBAN accounts, supporting USD, EUR, CHF, RMB, etc.; users can earn $MNT tokens via the rewards station; zero fees for USDe and fiat conversions; funds are backed 1:1, protected by a Swiss fintech license and regulated by FINMA, ensuring security and compliance.

Returns:

-

5% APY native yield: Based on USDe’s Ethena integration.

-

DeFi yield vaults: Access to Mantle DeFi yield vaults, including mETH, MI4, and other products.

-

Ecosystem synergy: Can direct traffic to Bybit’s new coin pools and Mantle rewards station, enjoying high-yield opportunities from exchanges and investment institutions like Mirana.

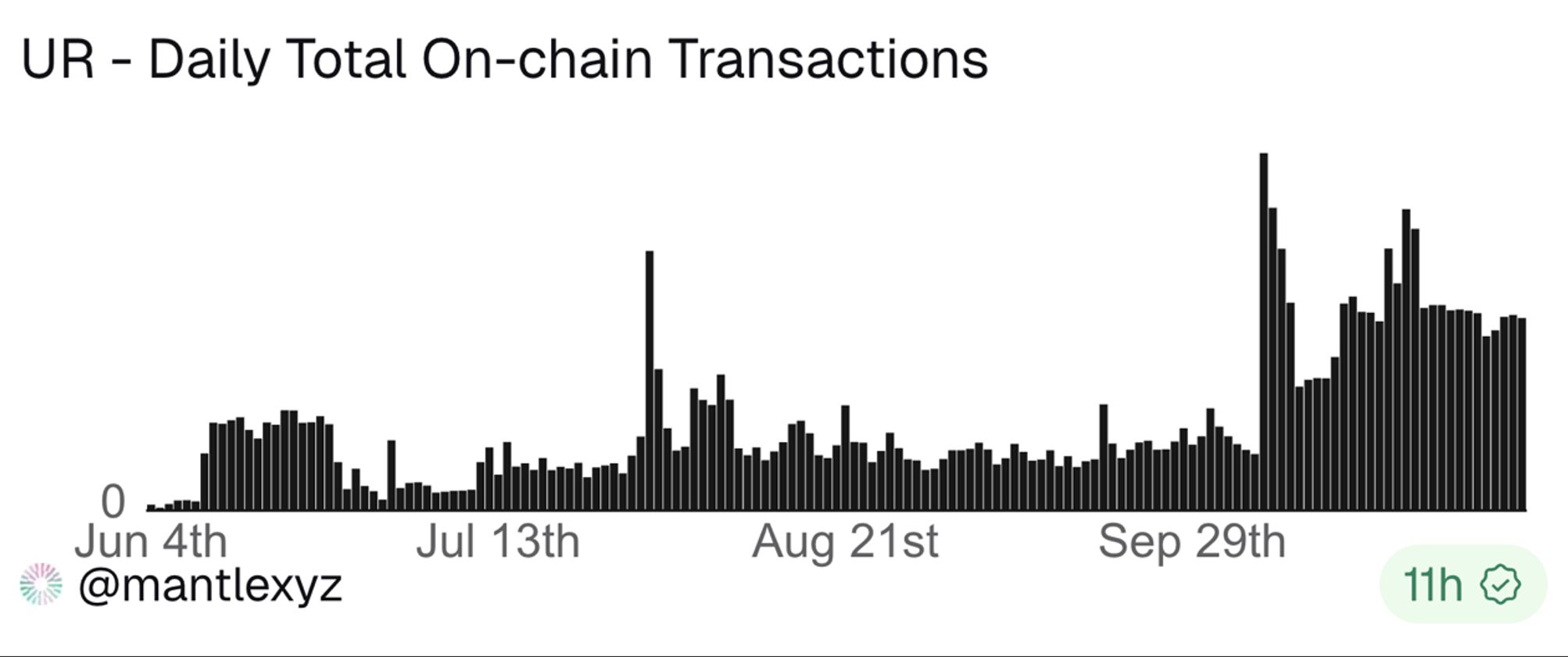

Currently, the total number of accounts has reached 13,598, and the number of transactions has gradually stabilized, rising from about 300 in September to around 900, indicating a steadily growing user base.

With Mantle’s over $2.3 billion in reserves and support from strategic partners like Bybit, UR integrates stablecoin yields, compliant banking services, and global payment capabilities within the Mantle ecosystem.

Payy Wallet (Token Not Yet Issued): Privacy First, Zero Gas Fees

In TradFi, many scenarios require high privacy, with transaction content and participants needing to be completely confidential; compliant privacy requires minimal or selective disclosure to some extent.

This is exactly what Payy Wallet aims to solve.

Compared to other high-yield Neobanks, Payy Wallet chooses to focus first on privacy protection.

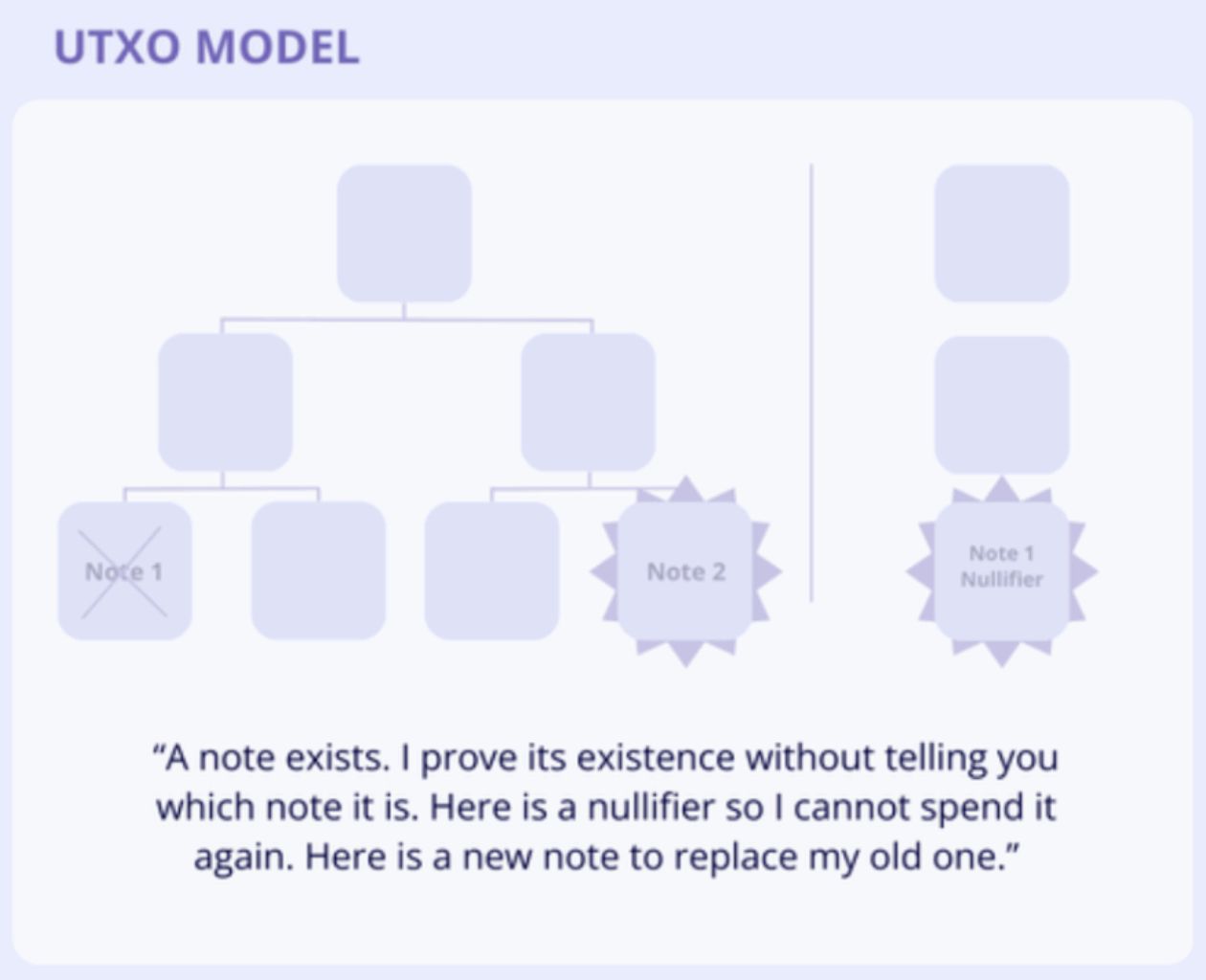

Payy Wallet is built on its own Payy Ethereum Layer 2 network, using a ZK-validium architecture and UTXO state model to achieve private, compliant, and gas-free stablecoin transactions.

Highlights: This is a Web3 wallet focused on privacy and global payment capabilities, supporting stablecoin transactions, self-custody, and zero-knowledge proof privacy protection. It uses a UTXO + note mechanism for high privacy and can be used at 80 million Visa merchants worldwide.

Returns: Spending rewards, with a spending rewards points program coming soon; currently, there is no yield mechanism.

Here’s a brief introduction to Payy’s core privacy mechanism: UTXO + note mechanism

Payy uses a UTXO model like Bitcoin, without the concept of account balances; each transaction “consumes old outputs and generates new outputs.”

But unlike Bitcoin, Payy’s plaintext UTXOs are not displayed; instead, encrypted notes are used, and others only see the hash of the note.

For a real-life analogy, the hash of a note is like sending a letter at the post office—a “sealed envelope” contains money, others can’t see the amount inside, but each envelope has a unique numbered seal, proving the money was spent by you and there’s no fraud.

Once verified, the post office sends the letter, broadcasting your transaction, and after sending, your transaction is on-chain and becomes an immutable fact.

In this process, except for the Visa provider, who needs to obtain necessary KYC information, no one can know your transaction details, greatly protecting privacy.

MetaMask Card: Multi-Asset Card Combining Banking Functions and Wallet Sovereignty

MetaMask Card is a self-custodial crypto debit card for DeFi users, created by ConsenSys in partnership with Mastercard and Baanx. Users can pay directly from their wallet, supporting on-chain swaps, stablecoin yields, and cashback rewards, combining banking functions with wallet sovereignty.

Highlights: This is a self-custodial wallet supporting multi-asset real-time payments. On the Linea network, users can instantly swap ETH, USDC, USDT, etc. to fiat, with real-time limit management and Mastercard-level security. The card-issuing company is affiliated with Mastercard.

Returns:

-

Crypto cashback rewards: Earn 1%-3% USDC cashback per transaction, up to 13% with on-chain partner rewards.

-

Yield-bearing stablecoin feature: Supports aUSDC and Aave Boost, offering 4%-8% potential APY.

-

Built-in DeFi yield integration: Covers Aave, Linea platform, and Coinmunity token rewards, enhancing capital efficiency.

MetaMask Card not only offers high returns but also thoughtfully covers users’ daily spending needs. Recently, it launched the MetaMask Card Travel campaign, providing travel discounts, higher rewards, and other benefits.

MetaMask airdrop is coming soon (for detailed interaction guide, see: MetaMask Season 1 Points Rewards Interaction Guide). There are currently virtual cards (free) and physical metal cards; interested users can try interacting with them.

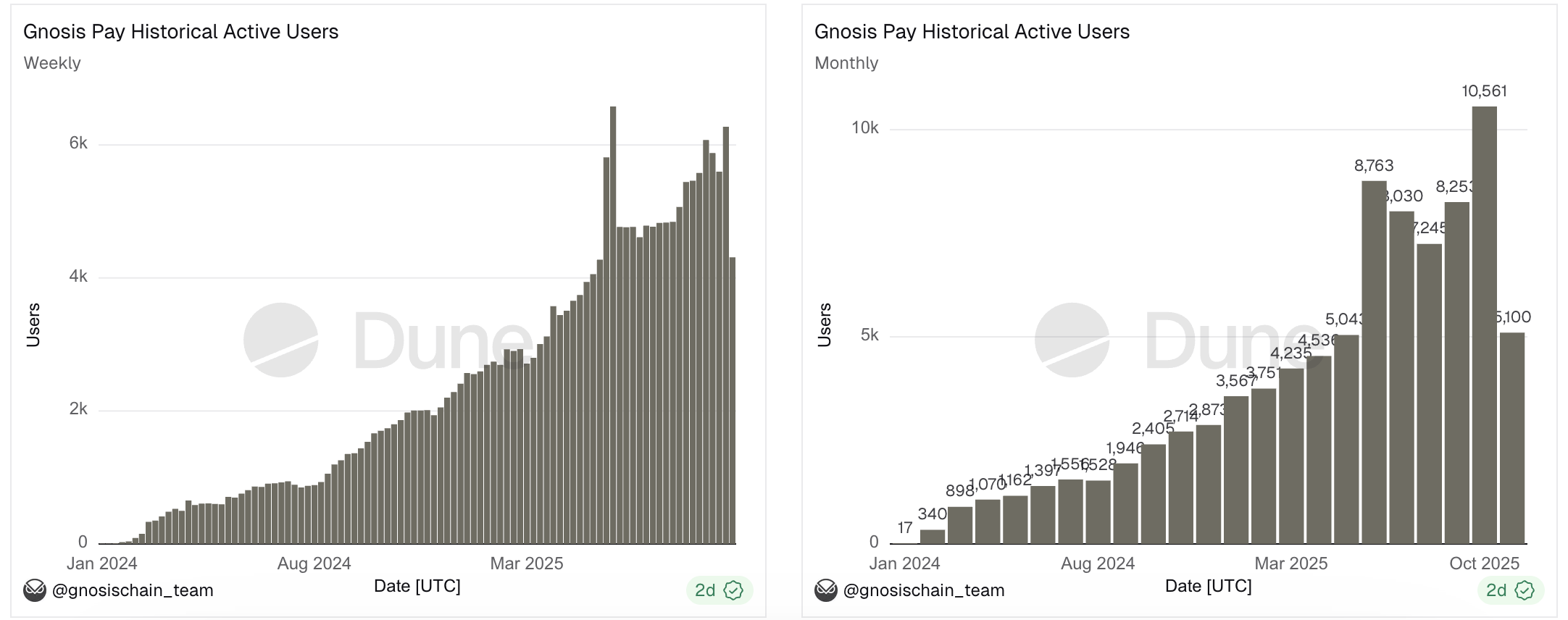

Gnosis Pay: Self-Custodial, Programmable, Compatible with External DeFi Yields

Gnosis Pay is a self-custodial payment network based on Gnosis Chain, offering a Visa debit card that can be directly linked to Gnosis Safe smart accounts. Users can conveniently use stablecoins like cash while maintaining non-custodial control.

Highlights: No pre-top-up required, self-custodial; supports programmable spending controls such as daily limits and token whitelists; can connect to DEXs, lending protocols, etc., and is compatible with external DeFi yields; gas fees are covered by Gnosis Pay, and there is a security module with delayed buffering for suspicious transactions.

Returns:

-

Up to 5% cashback: Cashback paid in $GNO, with tiered rates based on $GNO holdings; OG NFT holders get an extra 1%.

-

Idle balances: No built-in APY, but users can deploy funds to external DeFi strategies via Gnosis Safe for returns.

Since launch, Gnosis Pay has performed well, processing over 1.7 million payments totaling more than $1.7 million, with over 21,000 supported funding addresses. Both weekly and monthly active users have shown steady growth, indicating rising and stabilizing product demand.

Track Status

No matter how volatile the market is, life goes on.

For those whose funds are mainly on-chain, being able to seamlessly connect profit-taking and stop-loss with daily necessities; solve the problem of small withdrawals; and travel the world with just a card, without opening accounts or exchanging currencies, is ideal.

To meet these needs, we are seeing more and more Neobanks springing up, each attracting many users with their own advantages.

Compared to the short-term trading volume spikes of some protocols, Neobank is more like a subtle, gradual change. This kind of growth actually has more long-term potential.

Once you get used to the convenience of using a card, who would go back to traditional deposit and withdrawal methods?

Correspondingly, this kind of opportunity is also more hidden and not easy to identify. Judging only by data, it’s easy to underestimate: a $1 billion AMM swap transaction doesn’t directly create GDP, but every $1 million Neobank transaction is real consumption of goods and services.

What Neobank really wants to do is become the key driver for bringing crypto assets into the real economy.

Fortunately, we don’t have to wait much longer. I’ve already observed that Neobank is gaining traction in English-speaking communities, with public chains and exchanges making moves, high user retention, and steadily growing protocol transaction numbers.

Few anticipated that privacy would be the dark horse of this cycle; perhaps in a hidden corner, another track—Neobank—is brewing its next highlight moment.

Conclusion

At any given moment somewhere in the world, thousands of Neobank transactions may be taking place simultaneously, with thousands of dreamers in the crypto space mapping their on-chain achievements to off-chain joy, converting them into spending, taking a short break, and then returning on-chain to chase the next goal.

What Neobank focuses on is the most fundamental need of every person: whether you have a 100% win rate on-chain or unfortunately get liquidated, when you return to off-chain life, you still need to eat well.

![[Bitpush Daily News Highlights] US Treasury Secretary Bessent: Stablecoin market size may grow to $3 trillion by 2030; Canary XRP ETF has completed listing certification on Nasdaq and will begin trading at market open; Federal Reserve mouthpiece: Most regional Fed voting members are not enthusiastic about a rate cut in December; SEC plans to introduce a “token taxonomy”: anchored to the Howey Test, exploring crypto assets](https://img.bgstatic.com/multiLang/image/social/2784dd8e7bd27fe052703623026817c01762923962365.png)