Major blockchains are quietly building the ability to freeze users’ crypto assets, raising fresh questions about decentralization and control.

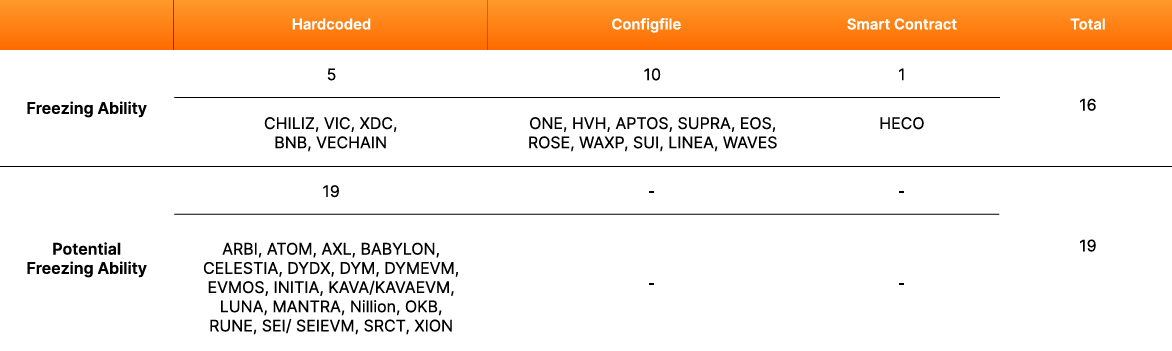

A new report from Bybit’s Lazarus Security Lab shows that 16 prominent blockchains already have mechanisms to restrict or block funds, while 19 more could add similar features with minor protocol changes.

Sponsored

Fund freezing occurs when a foundation can lock a user’s assets without their consent. “Once an address is blacklisted, any tokens within it become inaccessible to the original signer, and no one can access that address until it is removed from the blacklist by the foundation or governance group,” the report states.

Inside the Bybit Study

The study analyzed 166 blockchains using AI-assisted scanning and manual validation. Bybit says the research was launched after the Sui Foundation froze assets stolen from the Cetus DEX, a move that sparked intense debate across the blockchain community.

Among the 16 chains, the report identifies three main fund-freezing mechanisms.

Source: Bybit

Source: Bybit

How Fund Freezing Works

Hardcoded freezing, that is embedded directly into blockchain code and allows foundations to swiftly block malicious addresses and prevent stolen funds from moving. VeChain first used it in 2019 after a $6.6M hack, and BNB Chain applied it in 2022 to limit a $570M exploit to $100–110M.

Bybit’s Security Lab identified five blockchains, including CHILIZ, VIC, XDC, BNB Chain, and VeChain, with hardcoded freezing capabilities.

The largest group uses configuration files to manage blacklists. This method allows developers and validators to block certain addresses privately, without public disclosure.

A similar case occurred this May, when the Sui blockchain froze $223 million stolen in a hack by adding the attackers’ addresses to these private files and restarting the network. This approach is now used by at least ten blockchains, including One, Vic, Aptos, Supra, EOS, Rose, Waxp, Sui, Linea, and Waves.

Meanwhile, the third, the on-chain smart contract freezing method, blocks malicious addresses directly through a smart contract, eliminating the need to restart nodes. It is the rarest method and has only been identified on HECO Chain ( Huobi Eco Chain).

According to Bybit, the interventions show that fund-freezing tools are increasingly being used as emergency safeguards to protect users and limit the fallout from major hacks.

“Blockchain was built on the principle of decentralization — yet our research shows that many networks are developing pragmatic safety mechanisms to respond quickly to threats,” said David Zong, Head of Group Risk Control and Security at Bybit.

The report also identified 19 additional blockchains that could potentially support fund-freezing capabilities. Among them are ATOM, DYDX, KAVA, LUNA, MANTRA, and SEI.

Why This Matters

These fund-freezing powers could protect users during hacks, but they also give a small group of validators or developers the ability to control funds, raising concerns about decentralization and trust.

Delve into DailyCoin’s popular crypto news today:

Paradigm Locks $581M in HYPE, One of DeFi’s Largest Staking Events This Year

Pi Coin’s V23 Testing Win: $1 Price Tag Back In Play?

People Also Ask:

Fund-freezing functions are often activated during major hacks or exploits to protect users and reduce financial damage. For example, Sui froze $223 million in stolen assets after a DEX hack, while BNB Chain used the feature to limit a $570 million exploit.

To freeze funds means temporarily or permanently blocking crypto assets in a wallet so they can’t be transferred or traded. This is usually done by a blockchain’s foundation, governance group, or validators to contain hacks, exploits, or stolen funds.

Not always. Some blockchains publicly disclose blacklisted addresses, while others manage them privately through internal configuration files—meaning users may not know if an address has been restricted.