What Crypto Whales Are Buying Before the October 2025 US CPI Print

Crypto whales are buying ahead of the November 13 CPI report, quietly adding LINK, PENDLE, and ADA as charts point to potential trend reversals.

The delayed US CPI report — previously postponed due to the historic government shutdown — is scheduled for release on November 13, with high market expectations. October’s inflation is projected to stay close to September’s 2.6% headline and 3.3% core year-over-year readings. A cooler print could revive rate-cut hopes, while a hotter one might delay them again. Ahead of the release, crypto whales are making selective purchases.

They appear to be shifting away from broad risk-on bets toward tokens with steady fundamentals and clear use cases. Their accumulation pattern suggests a focus on DeFi-linked assets and lower-volatility projects. And price structures that hint at early signs of trend reversals.

Chainlink (LINK)

Crypto whales are buying Chainlink again after weeks of steady selling. In the past 24 hours, whale holdings have increased from 542.92 million LINK to 543.07 million LINK. That’s roughly 150,000 LINK, worth about $2.36 million at the current price.

LINK Whales:

Santiment

LINK Whales:

Santiment

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This sudden buying comes just before the US CPI report, suggesting whales expect a cooler or steady inflation print that could lift broader market sentiment. Their renewed interest signals confidence that Chainlink’s recent weakness may be close to bottoming out.

On the technical side, LINK’s price made a lower low between October 10 and November 4, while its Relative Strength Index (RSI) — which measures buying and selling strength — made a higher low. This rare bullish divergence often appears before a trend reversal, showing hidden accumulation beneath the surface. As for the existing trend, LINK is down about 33% over the past three months, making the latest reversal theory more meaningful.

If this pattern plays out, the first key level to watch is $18.76, which has capped several rallies since late October. A breakout above it could open the next leg toward $23.80, and possibly $27.92, confirming that whales timed their entries right.

LINK Price Analysis:

TradingView

LINK Price Analysis:

TradingView

However, if the LINK price breaks below $13.72, the setup would fail, and the price could revisit lower supports. For now, the combination of whale accumulation, bullish divergence, and CPI-linked optimism shows why crypto whales are buying Chainlink ahead of this crucial report.

Pendle (PENDLE)

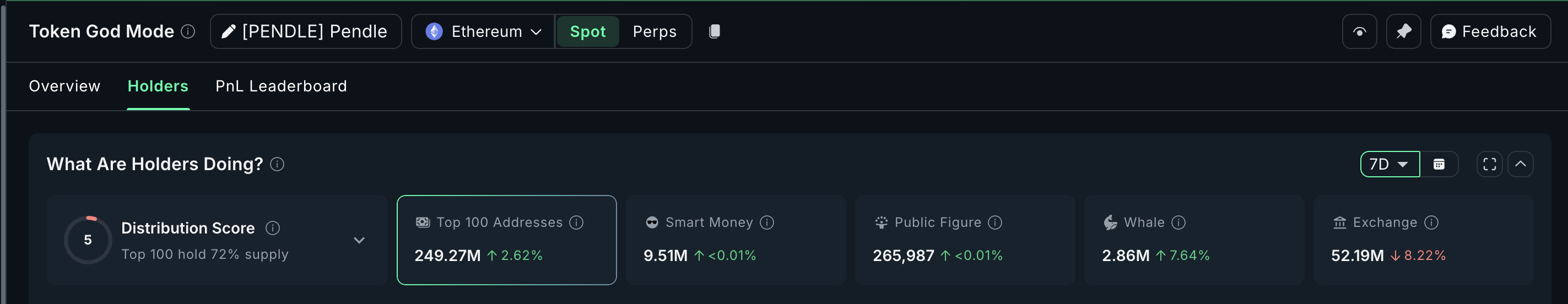

Crypto whales are buying Pendle too, steadily ahead of the CPI release. Unlike Chainlink’s 24-hour surge in whale activity, Pendle’s accumulation has been building quietly over the past week.

Whale wallets holding between 100,000 and 1 million PENDLE have increased their balances by 7.64%, reaching 2.86 million tokens. At the same time, the top 100 addresses (mega whales) boosted their holdings by 2.62%, now sitting at 249.27 million tokens — an addition of about 6.37 million PENDLE, worth nearly $17.7 million.

Together, whales and top holders have accumulated around 6.57 million PENDLE in the last seven days, totaling nearly $18.3 million in value.

Pendle Whales:

Nansen

Pendle Whales:

Nansen

This buying came during a modest 6.5% price rise in the same period, showing that large holders are positioning early, possibly expecting a CPI-driven market lift. Despite the near-term rebound, Pendle remains down 47.9% over the past three months, making these levels attractive for accumulation.

Technically, the chart hints at why whales are stepping in. The Money Flow Index (MFI) — which tracks money entering or leaving an asset by comparing price and volume — has just broken above a descending trendline that connected lower highs since early November. This breakout suggests improving money inflow momentum after weeks of decline, often seen at the start of recovery phases.

If the price follows through, PENDLE could test $3.37 first. A clean daily close above that would open a path to $3.94. And if macro sentiment strengthens further, $6.25 remains a long-term target.

PENDLE Price Analysis:

TradingView

PENDLE Price Analysis:

TradingView

However, if Pendle drops below $2.50, the MFI breakout could fail, and short-term selling might resume. That would expose new lows for this DeFi token.

Cardano (ADA)

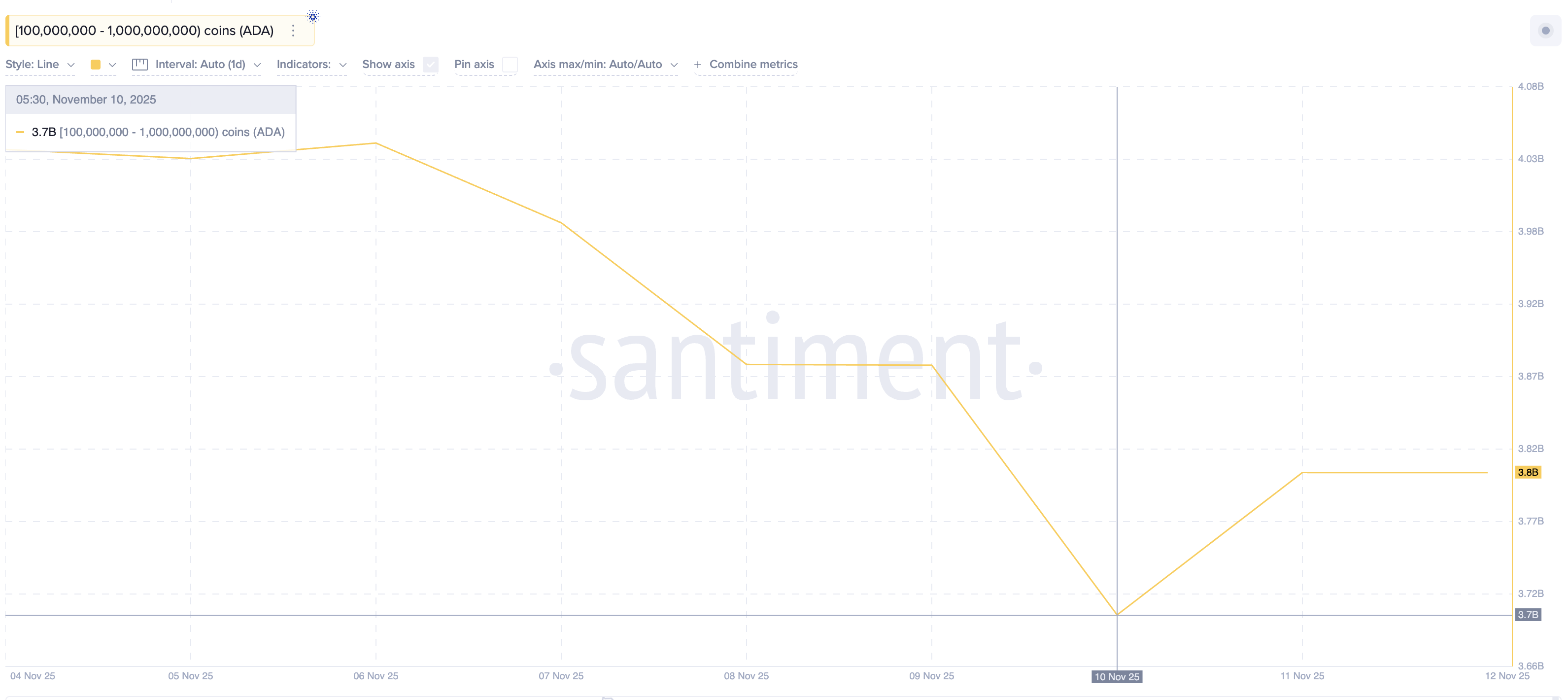

Crypto whales are buying Cardano again — but this time, the tone feels more cautious. Large ADA holders owning between 100 million and 1 billion tokens have increased their balance from 3.7 billion ADA to 3.8 billion ADA since November 10.

That’s roughly 100 million ADA added in just two days, worth about $57 million at the current price.

ADA Whales Back To Buying:

Santiment

ADA Whales Back To Buying:

Santiment

This marks the first notable accumulation wave in weeks and comes right before the US CPI report, hinting that whales may be positioning in safer, low-volatility assets while waiting for macro clarity. Over the past year, ADA has barely moved — trading in a wide but slow range. This makes ADA one of the more “defensive” plays among major altcoins.

The technical chart adds weight to this move. ADA has dropped 41% over the past three months. Yet, between June 5 and November 4, the price made lower lows while momentum indicators formed higher lows. It is a classic bullish divergence pattern that often precedes a trend reversal.

Do note that a similar divergence setup appeared earlier between June and mid-October. But previous rebounds were capped at under $0.69.This time, however, the lower lows are more pronounced, which could give stronger upward momentum if the pattern plays out.

ADA’s next key resistance sits at $0.61, roughly 8% above current levels. A breakout above that would open the door to $0.73, and a sustained daily close above $0.73 could extend gains toward $0.93 or higher.

ADA Price Analysis:

TradingView

ADA Price Analysis:

TradingView

However, if the price breaks below $0.49, the bullish setup would fail, exposing a deeper pullback.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Separating Hype from Reality—Crypto Market Shifts as BlockDAG, Ethereum, and XRP Aim for Leadership by 2026

- BlockDAG's $435M presale and hybrid DAG/Proof-of-Work model position it as a top 2026 growth candidate with 3.5M active miners. - Ethereum faces technical risks like potential death cross but retains 53% stablecoin dominance through JPMorgan/BlackRock partnerships. - XRP shows $2.40 recovery amid Bitcoin ETF inflows but needs sustained confidence to maintain $3.95B derivatives open interest. - Market shifts toward projects with institutional validation (CertiK audits) and real-world adoption (Seattle spo

Brazil's Cryptocurrency Clampdown: Combating Illicit Activity or Hindering Progress?

- Brazil's Central Bank enforces strict crypto rules by Feb 2026, requiring VASPs to obtain authorization or exit the market. - Stablecoin transactions and cross-border transfers are reclassified as foreign exchange operations under $100k capital controls. - $2-7 million capital requirements spark industry criticism, with concerns over stifling competition and compliance timelines. - Mandatory reporting for international transactions aims to combat money laundering, aligning with global standards like EU's

Whales Offload PEPE While Bulls Resist Decline, Forecasting Record High

- A major PEPE whale liquidated a $46M position this week, reflecting broader memecoin market weakness as prices fell 31% year-to-date. - Institutional holders offloaded 0.5% of PEPE holdings amid bearish technical indicators, while some long-term investors predict a new all-time high. - Cross-chain activity highlights volatile memecoin dynamics, with whales shifting focus to ASTER as Coinbase restructures in Texas over regulatory concerns. - Technical analysts warn of continued losses as PEPE forms a "bea

South Korea Seeks to Compete with USD Stablecoins Through Blockchain-Based VAT Reimbursements

- NH NongHyup Bank tests VAT refund system using stablecoin tech with Avalanche , Fireblocks, Mastercard , and Worldpay. - Aims to challenge USD stablecoin dominance by streamlining cross-border refunds via blockchain automation. - South Korea’s FSC plans KRW-pegged stablecoin rules by year-end, restricting non-bank issuers. - Domestic stablecoin transactions exceed $41B, as major banks collaborate on won-backed infrastructure. - Pilot could redefine cross-border payments with faster processing and reduced