Key Market Information Gap on November 13th - A Must-See! | Alpha Morning Report

1. Top News: US Government Reopening Imminent, Crypto Market Still Volatile, Bitcoin Teetering around $100K Mark 2. Token Unlocking: $CYBER, $HTM, $NYAN, $USUAL

Featured News

1.Bitcoin Holds Firm Above $100,000

2.Strategy mNAV Falls Below 1, Market Cap Below $47 Million Worth of Held Bitcoin

3.SEC Advances "Token Safe Harbor" Plan to Differentiate Whether Cryptocurrencies Are Securities

4.OOB Market Cap Temporarily Surges Above $560 Million, 24-hour Increase of 342%

5.SoFi Stock Price Surges Past $32 to Hit All-Time High, Crypto Business Making Rapid Progress

Articles & Threads

1. "The "Fed Whisperer" Analysis: Why Has the Fed's Rate Cut Path Suddenly Hit a Snag?"

The "Fed Whisperer" Nick Timiraos's latest article points out that within Fed Chair Powell's nearly eight-year term, an almost unprecedented split within the central bank is emerging, casting a shadow over the future rate-cutting path. Officials are internally divided, with the debate centering on whether persistent inflation or a slack labor market poses a greater threat. Even if official economic data continues to be released, it may not be enough to bridge these divides. Although investors broadly believe that the Fed is still likely to cut rates at the next meeting, this internal rift has already made a plan that seemed feasible less than two months ago more complicated.

2. "From Dreaming of Royalty to Prison, Qian Zhimin and the Absurd Scam of 60,000 Bitcoins"

In the history of crypto, few scams have combined such absurdity and scale. Qian Zhimin, a Chinese woman who claimed to be on track to be crowned queen of a "micronation," was ultimately sentenced to 11 years and 8 months in prison by a UK court for orchestrating a scam involving 60,000 bitcoins, totaling a staggering $6 billion. She once dreamed of living in a palace, wearing a crown, and being crowned. Now, behind bars, she faces the collapse of the myth she wove with her own hands.

Market Data

Daily Market Wide Fund Flows (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

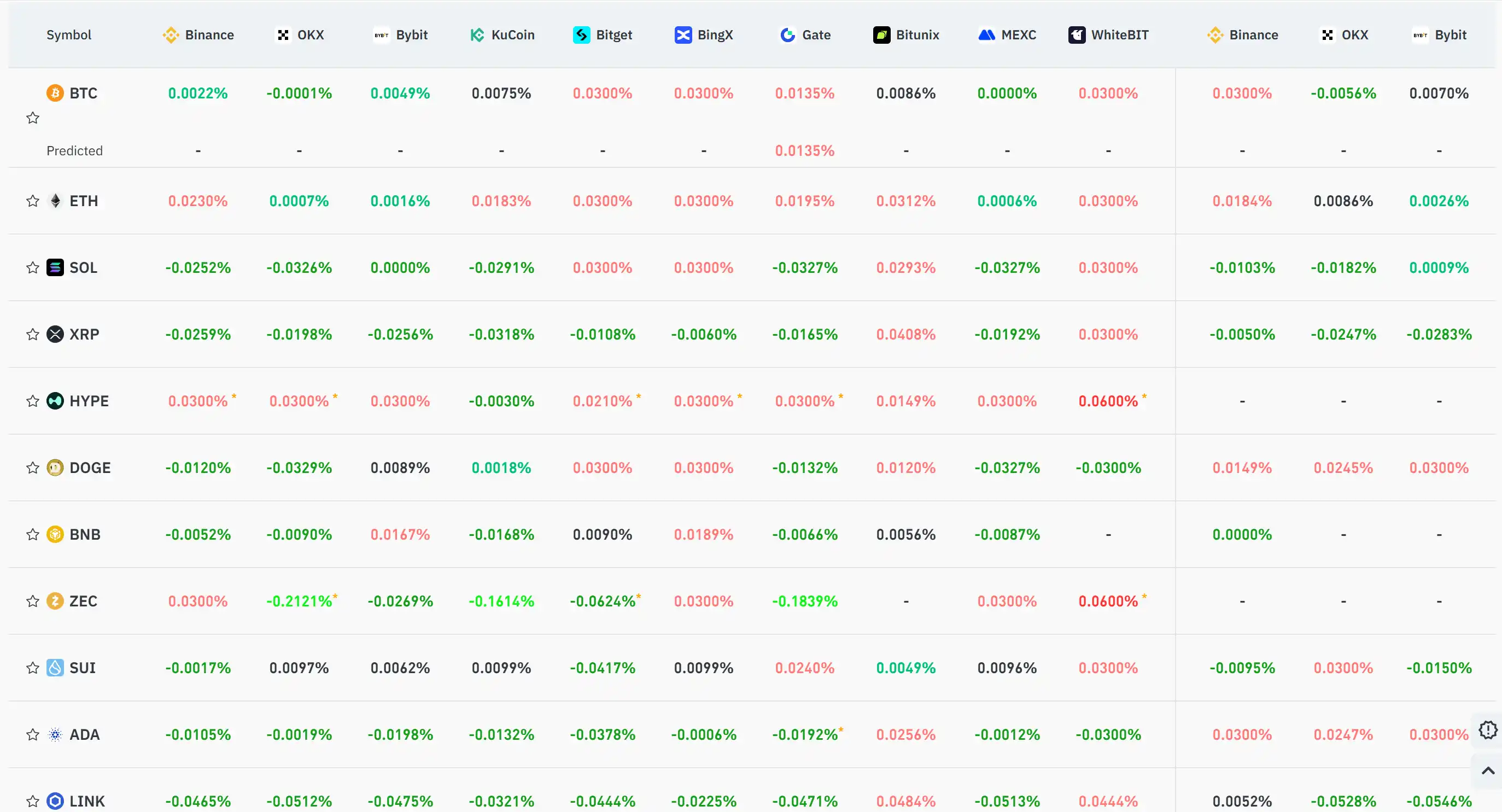

Funding Rate

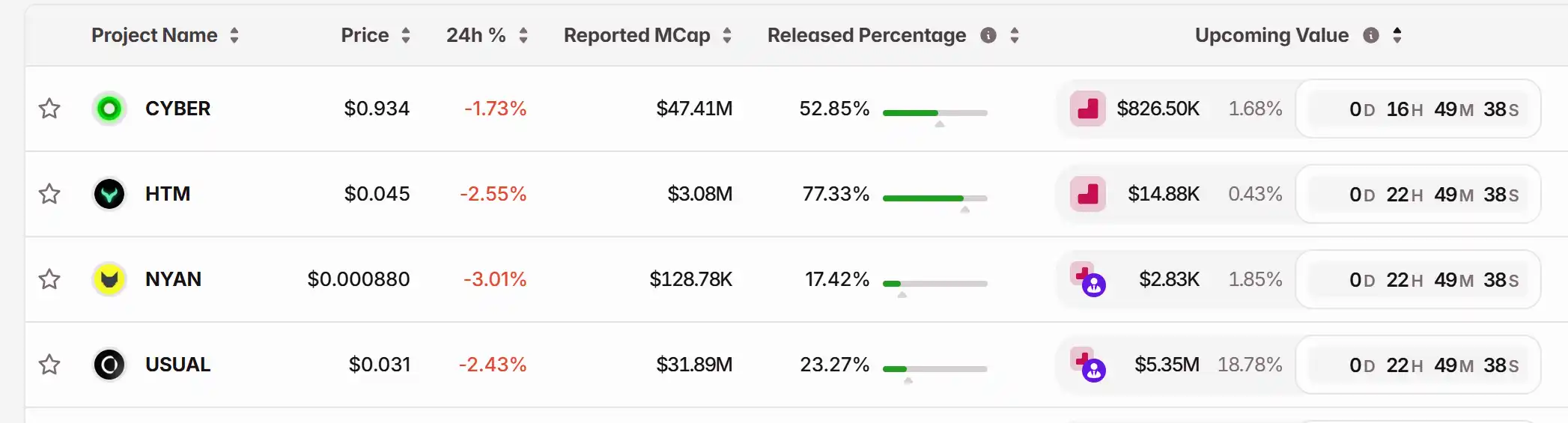

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana's Abrupt Price Swings and Effects on the Market: Blockchain System Vulnerabilities and Changes in Investor Confidence

- Solana's 2025 volatility stems from infrastructure vulnerabilities, unacknowledged outages, and shifting investor sentiment. - Network design prioritizing consistency over availability caused outages, exposing risks in high-throughput systems. - Developer growth (83% increase) contrasts with security gaps and inadequate documentation in smart contracts. - Price dropped 26% in November 2025 amid extreme fear metrics, despite institutional staking and ETF inflows. - Technical upgrades face skepticism due t

Financial Wellbeing Emerging as a Key Investment Trend in 2025: Prospects in Fintech and Personal Finance Management Solutions

- Financial wellness emerges as a 2025 investment theme, driven by AI, cloud tech, and rising demand for budgeting/debt management tools. - Market growth projects $4.2B to $10.2B (2025-2034) for financial wellness software, with PFM tools expanding at 12.5% CAGR to $11.12B by 2035. - Key innovators like MX, Acorns, and Affirm leverage automation and predictive analytics, while ETFs like Invesco PFM offer diversified fintech exposure. - Strategic risks include data privacy concerns and regulatory scrutiny,

Bitcoin Leverage Liquidation Crisis: Exposing Systemic Threats in Cryptocurrency Derivatives Markets

- 2025 Bitcoin's $100,000+ price collapse triggered $22B in leveraged liquidations, exposing crypto derivatives market fragility. - 78% retail-driven perpetual futures trading with 1,001:1+ leverage ratios created self-reinforcing price declines. - Decentralized exchanges enabled $903M ETF outflows and extreme fear index readings, revealing liquidity illusion risks. - Systemic risks now span traditional markets as crypto acts as volatility mediator, amplifying macroeconomic shocks. - Regulatory reforms and

Runway unveils its inaugural world model and introduces built-in audio support to its newest video model