Rethinking Sideways Trading: Major Cryptocurrencies Are Undergoing a Massive Whale Shakeout

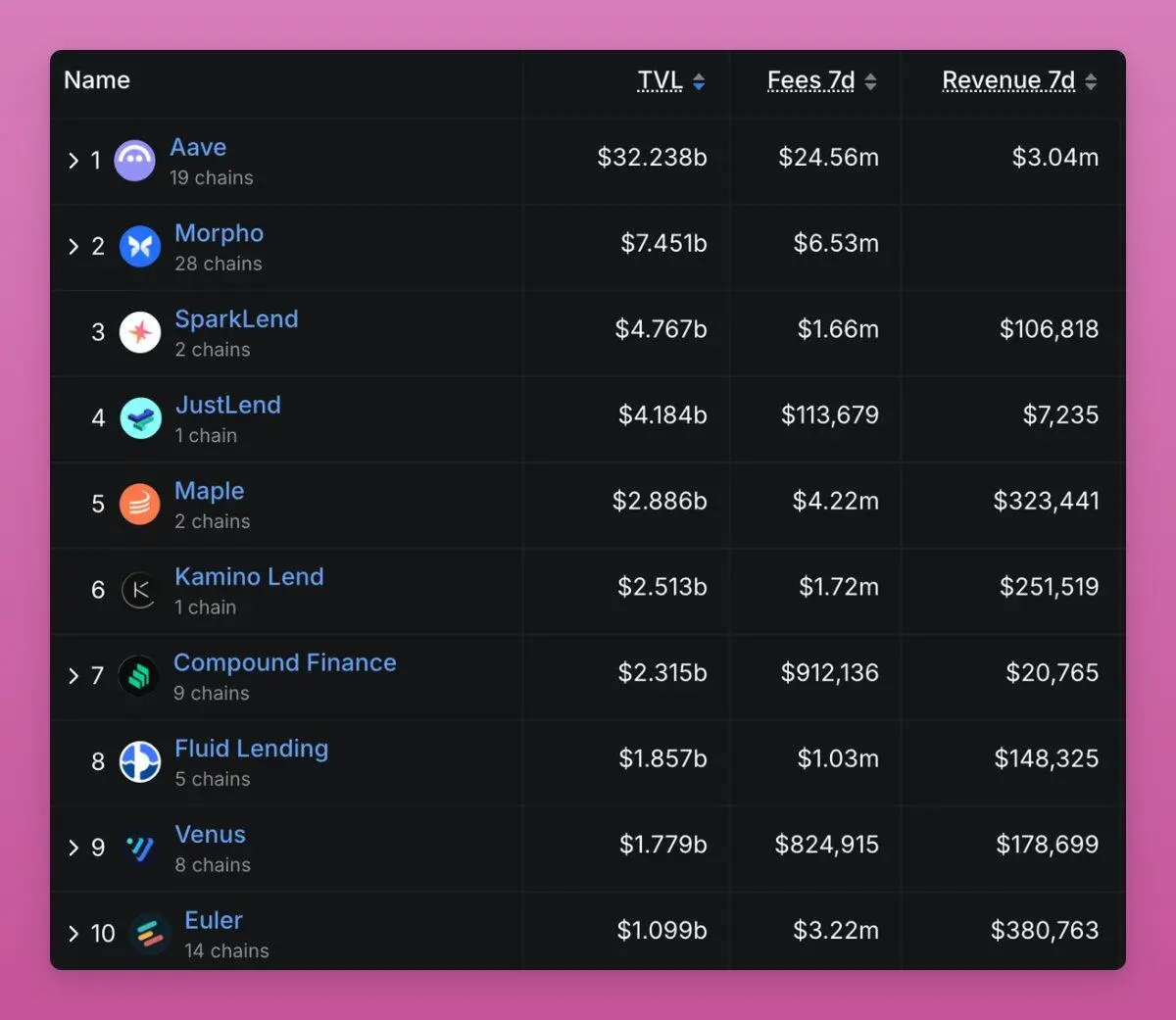

Ignas also pays special attention to lending protocols that generate fees.

Original Translation: CryptoLeo ( @LeoAndCrypto )

Odaily Note: Ignas raised a point that despite the approval of the BTC ETF, accelerated institutional adoption, the passage of the "Genius Act," the upcoming "Clarity Act," no regulatory crackdowns, no major hacks, and no fundamental narrative collapse, BTC remains range-bound with insufficient liquidity. At this moment, early BTC investors are systematically cashing out (rather than dumping), while new investors are planning to buy the dip.

Key Insights

Early BTC believers are realizing their profits;

This is not panic selling, but a natural transition from whale concentration to broader distribution among all holders;

Among all trackable on-chain indicators, the most obvious signal is whale selling.

Let’s Look at BTC First

Long-term holders sold 405,000 BTC within 30 days, accounting for 1.9% of the total existing BTC supply.

Take Owen Gunden as an example. Owen Gunden is one of the early BTC whales. He made large trades on Mt.Gox, holds a massive position, and is a board member of LedgerX. His associated wallet holds over 11,000 BTC, making him one of the largest individual on-chain holders.

Recently, his wallet started transferring large amounts of BTC to Kraken, moving thousands of BTC in batches. This usually indicates he is selling. On-chain analysts believe he may be preparing to sell most of his BTC, worth over 1 billion dollars.

He hasn’t tweeted since 2018, but this move fits my “great rotation” theory: some are transferring to ETFs for tax benefits, or selling for portfolio diversification (perhaps to buy ZEC?).

As supply shifts from early whales to new buyers, BTC’s average cost price continues to rise, and new holders are now taking control.

As the average cost basis shifts from early miners to ETF buyers and new institutions, we can see MVRV climbing.

Odaily Note: MVRV is “current price” ÷ “holder cost basis,” a classic on-chain valuation metric for Bitcoin, proposed by Murad Mahmudov and David Puell in 2018, now widely used to judge whether Bitcoin is overvalued (overheated) or undervalued (oversold).

Some might say this seems bearish, as old whales have held huge profits for years, while new whales are mostly underwater.

BTC’s average cost basis is close to 110,800 dollars, and people worry that if BTC continues to underperform, new investors might choose to sell.

But the rise in MVRV indicates ownership is becoming more dispersed and mature. Bitcoin is transitioning from a few ultra-low-cost holders to a more distributed group with higher cost bases.

This is actually a bullish signal. What about beyond Bitcoin?

Ethereum Token Rotation

What about ETH? Can ETH also exhibit the same “great rotation” pattern? Similar to Bitcoin, this might partly explain ETH’s lagging price performance.

From one perspective, ETH also wins: both have ETFs, DATs, and institutional investors, though of different natures.

Data shows that ETH is also in a similar transition period, just earlier and more convoluted.

In fact, from some angles, ETH has caught up with BTC: currently, about 11% of all ETH is held by DATs and ETFs.

About 17.8% of BTC is held by spot ETFs and large treasuries (thanks to Saylor’s years of effort), and ETH is catching up with this momentum.

I tried to find relevant ETH data to verify whether, like BTC, old whales are distributing ETH to new whales, but was unsuccessful. I even contacted Ki Young Ju of CryptoQuant, who told me that because ETH uses an account model, unlike BTC’s UTXO model, it’s difficult to track the data.

Regardless, the main difference seems to be that ETH is shifting from retail to whales, while BTC’s main transition is from old whales to new whales.

The chart below also shows the trend of ETH ownership shifting from retail to whales.

The realized price of large accounts (over 100,000 ETH) is rising rapidly, meaning new buyers are entering at higher prices while small holders are selling.

Notice that now all the lines (orange, green, purple) are converging at the same level, meaning the cost basis of wallets of various sizes is similar, indicating that old tokens have flowed into new holders’ hands.

This cost basis reset should occur near the end of the accumulation cycle and before a significant price surge. Structurally, this suggests ETH supply is concentrating in the hands of stronger holders, and ETH’s outlook is bullish.

The rationale for this shift is:

-Retail investors are selling, while whales and funds are accumulating, due to: 1) the proliferation of stablecoins and tokenization; 2) staking ETFs; 3) institutional participation;

-Retail sees ETH as “fuel,” losing confidence when other L1 tokens emerge. Whale investors, on the other hand, see it as yield-generating collateral, accumulating for long-term on-chain returns;

-When BTC wins, ETH remains in a gray area, so whales get in first, blocking institutional entry.

The ETF+DAT combination makes the ETH holder base more institutionalized, but it’s unclear if they are more inclined toward long-term growth. The main concern is ETHZilla announcing the sale of ETH to buy back its shares. This is not a reason for panic, but it has set a precedent.

Overall, ETH also fits the “great rotation” theory. Its structure is less clear than Bitcoin’s because Ethereum’s holder base is more diverse, with more use cases (such as liquid staking into a few large wallets), and more reasons for holders to move tokens on-chain.

Solana Token Movements

It’s really hard to determine what stage SOL is in within the rotation theory, and even identifying institutional wallets or major holders is difficult. Still, some patterns can be found.

SOL is entering the same institutionalization stage as ETH. Last month, a SOL spot ETF appeared on CT, and there was no hype. The inflow isn’t particularly high (totaling 351 million dollars), but there are positive inflows every day.

Some DAT companies have also started buying SOL, and the amounts are considerable:

Currently, 2.9% of all circulating SOL is held by DAT companies, worth 2.5 billion dollars. You can read more about the SOL DAT structure in this article by Helius.

Therefore, SOL now has the same TradFi infrastructure investors as BTC and ETH, including regulated funds and treasury companies, just on a smaller scale. SOL’s on-chain data is messy, but still concentrated in early insiders and VC wallets. These tokens are slowly flowing into new institutional buyers via ETFs and treasuries.

The great rotation has reached SOL, just a cycle later.

So, if the rotation for BTC and, to some extent, ETH is nearing completion and prices could rise at any time, then SOL’s situation is not hard to predict.

What Happens Next

BTC’s rotation ends first, ETH follows but lags slightly, and SOL will take longer. So, where are we in this cycle?

In past cycles, the strategy was simple: BTC pumps first, then ETH, and the wealth effect gradually appears. People profit from mainstream crypto and move to lower-cap altcoins, boosting the entire market.

This time is different.

BTC stagnates at a certain stage of the cycle. Even if the price rises, old players either move to ETFs or cash out and leave, ultimately improving their lives outside of crypto. There is no wealth effect, no spillover effect, only PTSD from FTX, and the hard work continues.

Altcoins no longer compete with BTC for monetary status but instead compete in utility, yield, and speculation. Most products fail to meet these criteria. The currently recommended categories are:

- -Blockchains with real usage: Ethereum, Solana, maybe one or two others;

- -Products with cash flow or real value accrual;

- -Assets with unique demand that BTC cannot replace (such as ZEC);

- -Infrastructure that attracts fees and attention;

- -Stablecoins and RWA.

Innovation and experimentation in crypto will continue to emerge, so I don’t want to miss this new hotspot—everything else becomes noise.

Uniswap activating the fee switch is a key moment: it’s not the first, but it’s the most prominent DeFi protocol so far. Uniswap is forcing all other protocols to follow suit and start distributing fees (buybacks) to token holders.

5 out of 10 lending protocols already share profits with token holders.

Therefore, DAOs are becoming on-chain companies, and the value of their tokens depends on the income they generate and redistribute. This is where the next rotation will take place.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Exodus Acquires Uruguayan Startup Grateful to Expand Stablecoin Payments in Latin America

This Public Company Rebrands and Starts Accumulating Zcash

Sui Partners With Stripe’s Bridge to Launch Interoperable Stablecoin USDsui

SOL Price Outlook: Whale Accumulation Rises Despite Solana Network 12-Month Activity Slump