Hyperliquid News Update: Significant Leverage, Limited Liquidity: POPCAT's $5 Million DeFi Breach

- Hyperliquid suffered a $4.9M loss after a trader manipulated Solana-based memecoin POPCAT through leveraged long positions and a sudden price crash. - The attacker used $3M in USDC from OKX to create a $20–30M leveraged position, inflating POPCAT’s price before triggering cascading liquidations. - Hyperliquid paused its Arbitrum bridge to stabilize the platform, highlighting vulnerabilities in DeFi’s automated liquidation systems and low-liquidity markets. - Experts warn such attacks expose DeFi risks, u

Hyperliquid, a prominent decentralized derivatives platform, suffered a $4.9 million loss after a trader orchestrated a deliberate manipulation involving the Solana-based

The perpetrator withdrew $3 million in

This marks the third significant exploit Hyperliquid has faced in 2025, following a comparable attack on the memecoin JELLYJELLY in March, which left the HLP with $12 million in unrealized losses. Critics say the platform’s dependence on community-managed liquidity pools makes it susceptible to manipulation in illiquid markets.

Following the incident, POPCAT’s price plunged 43%, falling from $0.21 to $0.12, and total liquidations on Hyperliquid soared to $63 million.

Industry experts caution that incidents like this highlight the instability of leveraged trading in DeFi. "When traders exploit liquidity gaps, the HLP, designed as a safeguard, ends up bearing the losses," one market participant commented. The event has led to renewed calls for enhanced risk controls and stricter leverage restrictions, especially for volatile assets such as memecoins

Hyperliquid has yet to announce when normal operations will resume, but the platform’s administrators stressed that the blockchain itself was not compromised. This incident underscores that even decentralized systems can be vulnerable to sophisticated manipulation, particularly when high leverage is combined with low liquidity

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple Commits $4B to Build Crypto’s Bridge to Wall Street

Bitcoin price risks deeper losses as Nasdaq correlation turns one-sided: Wintermute

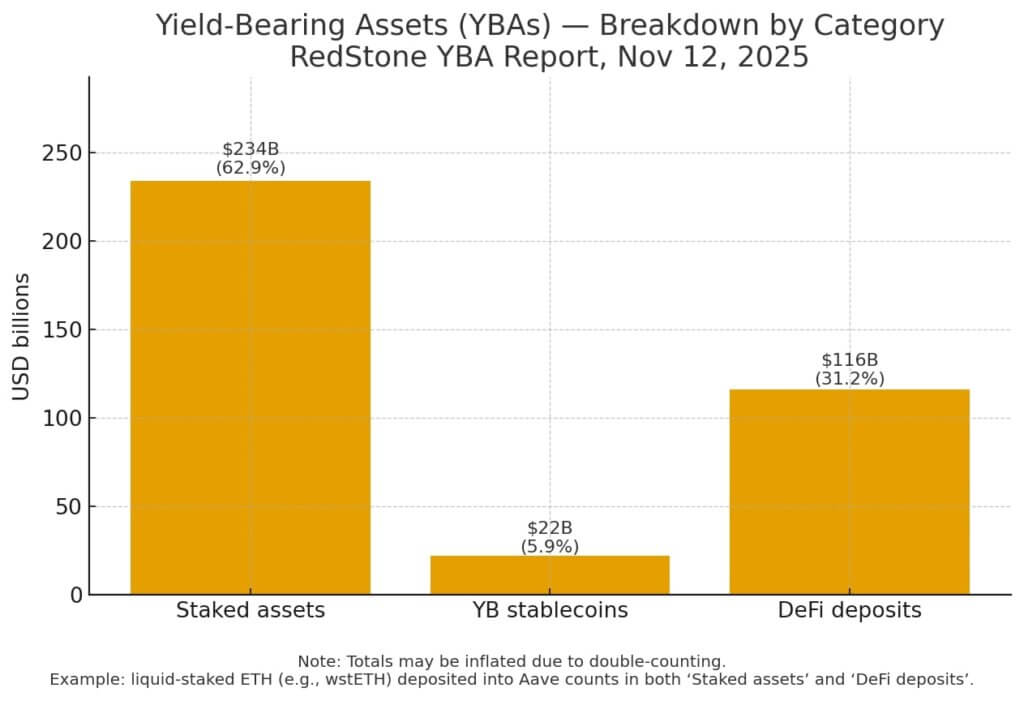

Only 10% of crypto earns yield now — why most investors are sitting on dead money

US President Donald Trump Signs 43-Day-Long Plan! The White House Makes Important Statement That the Fed Won't Like!