Uniswap News Today: Uniswap’s Token Burn Approach Boosts Alignment of Interests, Triggers 30% Price Jump

- Uniswap proposes "UNIfication" to activate protocol fees, burn 100M UNI, and restructure governance, sparking a 30% UNI price surge. - The plan includes retroactive token burns, fee discount auctions, and MEV capture to reduce supply and align incentives with token holders. - Governance consolidation under a 5-member board and a commitment to non-monetized tools aim to unify development while facing regulatory scrutiny. - Market optimism reflects demand for treasury fee redirection, though delayed implem

Uniswap Suggests Automated Token Burn,

Uniswap Labs and the

A key aspect of the proposal is the introduction of a protocol fee system, which would allocate a share of trading fees—across both the

The governance revamp goes beyond tokenomics. Uniswap Labs, the protocol’s main developer, will integrate the Uniswap Foundation’s ecosystem teams, forming a five-person board led by co-founders Hayden Adams, Devin Walsh, and Ken Ng. The new structure also ensures Uniswap Labs will not monetize its interface, wallet, or API, with all future earnings linked to the interests of UNI holders. “These products already generate considerable organic activity for the protocol,”

The strong market reaction highlights the importance of these updates. UNI’s 30% jump signals investor confidence in a tighter supply and greater value for token holders. The proposal addresses long-standing requests from UNI community members for a “fee switch” to redirect trading fees to the treasury or directly to holders.

Nonetheless, regulatory uncertainty continues to loom over the plan.

With the proposal now up for a governance vote, its approval could reshape Uniswap’s position in the DeFi sector. If adopted, the changes would not only restrict token supply but also establish a more cohesive organizational model, potentially serving as an example for other decentralized projects seeking to balance expansion and governance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple Commits $4B to Build Crypto’s Bridge to Wall Street

Bitcoin price risks deeper losses as Nasdaq correlation turns one-sided: Wintermute

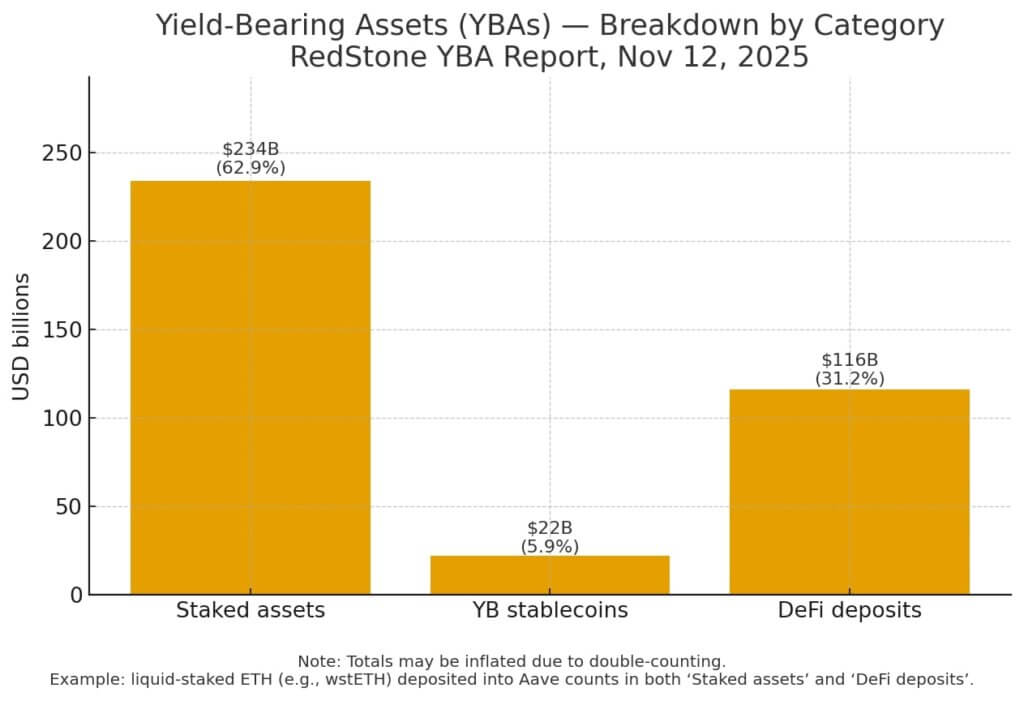

Only 10% of crypto earns yield now — why most investors are sitting on dead money

US President Donald Trump Signs 43-Day-Long Plan! The White House Makes Important Statement That the Fed Won't Like!