Visa Launches U.S. Stablecoin Payout Pilot to Accelerate Global Digital Payments

Visa is taking another major step in digital payments with a new pilot program that allows U.S. businesses to send stablecoin payouts directly to crypto wallets. Announced at the Web Summit in Lisbon, the initiative connects traditional bank accounts to blockchain-based transfers, aiming to speed up cross-border payments and support the expanding freelance economy.

In brief

- Visa’s new pilot enables U.S. businesses to send stablecoin payouts directly from traditional bank accounts to supported crypto wallets.

- Workers can receive funds in fiat or stablecoins, gaining faster access to earnings and improved flexibility in global transactions.

- Transfers settle within minutes, offering gig platforms and freelancers a faster alternative to traditional cross-border payment rails.

- Broader rollout expected by 2026 as Visa expands blockchain integrations amid rising institutional stablecoin adoption.

Visa Pilot Brings Near-Instant USDC Payouts to U.S. Businesses

Payments in the pilot program run through Visa Direct, the company’s digital network. Businesses holding traditional U.S. dollar accounts can send U.S. dollar–pegged stablecoins such as USD Coin (USDC), while recipients can choose to receive their funds directly in stablecoins via supported crypto wallets.

Chris Newkirk, Visa’s president of money movement solutions, explained that the goal is to provide swift and universal access to financial services . According to Newkirk, faster payouts can benefit workers and small businesses that depend on quick settlements.

Launching stablecoin payouts is about enabling truly universal access to money in minutes, not days, for anyone, anywhere in the world.

Chris Newkirk

The company is onboarding initial partners and expects broader access by 2026, focusing on international businesses and gig platforms that process high volumes of microtransactions.

Gig Platforms to Gain Faster Digital Payouts Through Stablecoin Pilot

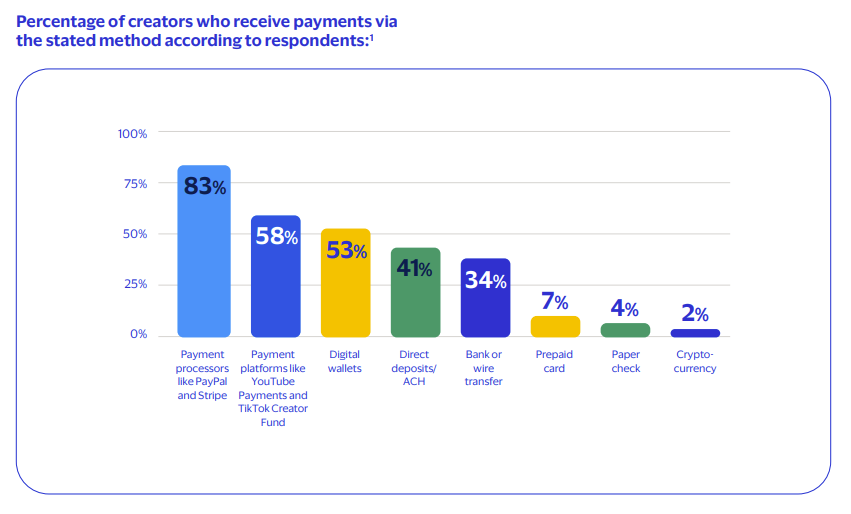

According to Visa’s research, 58% of gig workers prefer digital payments for faster access to funds—a result that supports the company’s push to expand its payment infrastructure.

The pilot introduces several features designed to simplify global transactions:

- Direct fiat-to-stablecoin transfers: Businesses can send payouts from traditional accounts straight to stablecoin wallets without intermediaries.

- Flexible recipient options: Workers can choose to receive funds in either stablecoins or fiat currency.

- Faster settlements: Transfers are completed within minutes instead of days.

- Focus on freelancers and global operators: Built for sectors that depend on quick digital payments.

- Gradual rollout: Testing with select partners before a full-scale launch in 2026.

Visa’s latest move marks another step in its expansion into blockchain-based payments . In July, the company added new stablecoins—including Global Dollar (USDG), PayPal USD (PYUSD), and Euro Coin (EURC)—to its settlement platform on the Stellar and Avalanche networks. Two months later, Visa Direct began testing instant transfers using USDC and EURC to accelerate treasury settlements.

The expansion comes amid clearer U.S. regulations under the GENIUS Act, a federal framework for stablecoins. As oversight increases, major players—including Citigroup, Western Union, and several Wall Street banks—are introducing their own stablecoin initiatives, making digital settlement a growing focus of global finance.

Supporting this trend, BNY’s recent findings show rising institutional use of stablecoins for decentralized transactions. The bank notes that more firms are shifting high-value transfers to stablecoins to improve liquidity management and reduce delays in legacy systems . It projects that transaction volumes could reach $1.5 trillion by 2030 as adoption widens across financial services.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Prospects of Ethereum Protocol Technical Upgrade (1): The Merge

This article will interpret the first part of the roadmap (The Merge), explore what technical design improvements can still be made to PoS (Proof of Stake), and discuss ways to implement these improvements.

DYDX Boosts Market Moves with Strategic Buyback Decision

In Brief DYDX increases revenue allocation for token buybacks from 25% to 75%. Price gains expected due to reduced supply pressure and strategic decisions. Increased buybacks viewed as a crucial financial strategy amidst volatile conditions.

Corporate Crypto Treasuries Shift as Bitcoin Loses Ground to Altcoins

Bitwise Chainlink ETF Hits DTCC Registry, Edging Closer to SEC Approval