Key Notes

- Bitcoin USD payments over Lightning Network launch later in November with Bitcoin Map for merchant discovery and local spending options.

- Stablecoin support will allow eligible customers to send and receive stablecoins with USD balance interoperability, subject to regulatory approval.

- Cash App Borrow expanded to 48 states with loans up to $500 requiring no credit checks, while Moneybot AI assistant enters pilot phase.

Cash App announced Bitcoin BTC $101 343 24h volatility: 1.2% Market cap: $2.02 T Vol. 24h: $76.40 B USD payments over Lightning Network and stablecoin support on Nov. 13 as part of its first bundled release featuring 11 product updates and over 150 improvements.

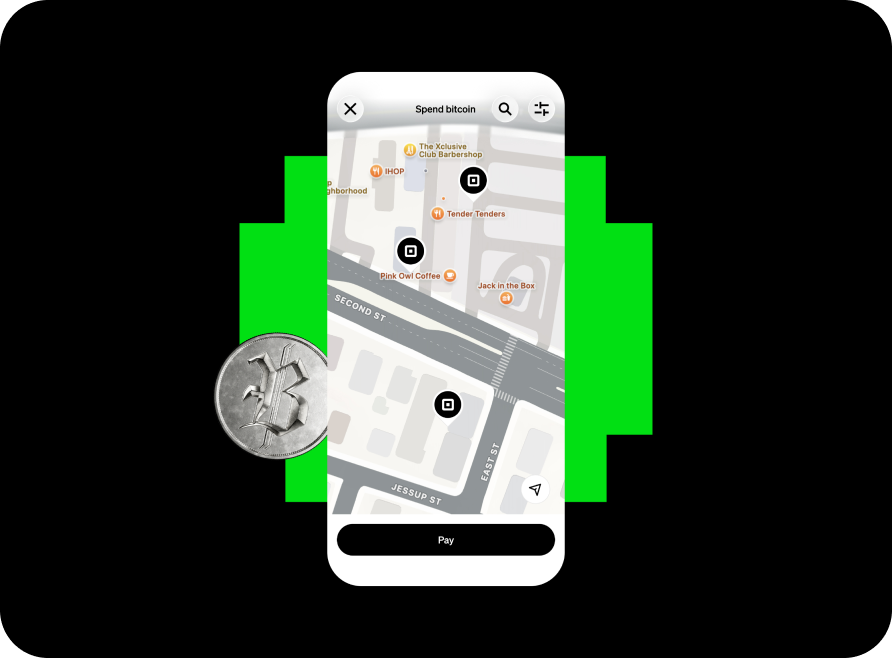

Bitcoin USD payments over Lightning Network will launch later in November, enabling users to spend Bitcoin with automatic USD conversion, according to the Cash App’s announcement . The update includes the Bitcoin Map for discovering merchants and local spending options.

Photo Credit: Cash App (Preview of the Bitcoin Map Feature)

Stablecoin support will allow eligible customers to send and receive stablecoins with interoperability to USD balances. The features are subject to regulatory approval and unavailable to New York or non-US residents.

The company’s security measures have prevented over $2 billion in scams since 2020 and reimbursed $8 million in 2024.

AI Assistant and Lending Expansion

Moneybot, an AI-powered financial assistant, is currently available to a select pilot group and will roll out more broadly in the coming months. The assistant provides personalized insights based on user activity.

Cash App Borrow expanded to 48 states, excluding Colorado and Iowa, with first-time borrowers eligible for up to $500 based on financial behaviors like cash flow, according to the Cash App Borrow page . The feature requires no credit checks and maintains repayment rates above 97%.

Cash App Green benefits are unlocked for over 8 million users who meet $500 monthly spend or $300 deposit thresholds, including no ATM fees, higher Borrow limits, and increased savings interest.

Stablecoin Market Context

The stablecoin announcement follows recent infrastructure developments. Mastercard and Ripple tested stablecoin settlement for Gemini credit card transactions using RLUSD on the XRP Ledger, as previously reported by Coinspeaker.

The Sui Foundation launched USDsui native stablecoin on Nov. 12 to capture network yield revenue from reserves, with integration support from Bridge and Stripe under US regulatory compliance.

Square enabled Bitcoin payments for merchants with Lightning Network integration on Nov. 10, supporting real-time conversions and instant settlements. Cash App’s bitcoin features build on this infrastructure for consumer applications, as both platforms are owned by Block Inc.

Additional updates include Afterpay integration within Cash App without a separate login, teen accounts earning up to 3.5% APY on savings with expanded parental controls, and improvements to the Pools feature used by 1.7 million customers since its August 2025 launch.

next