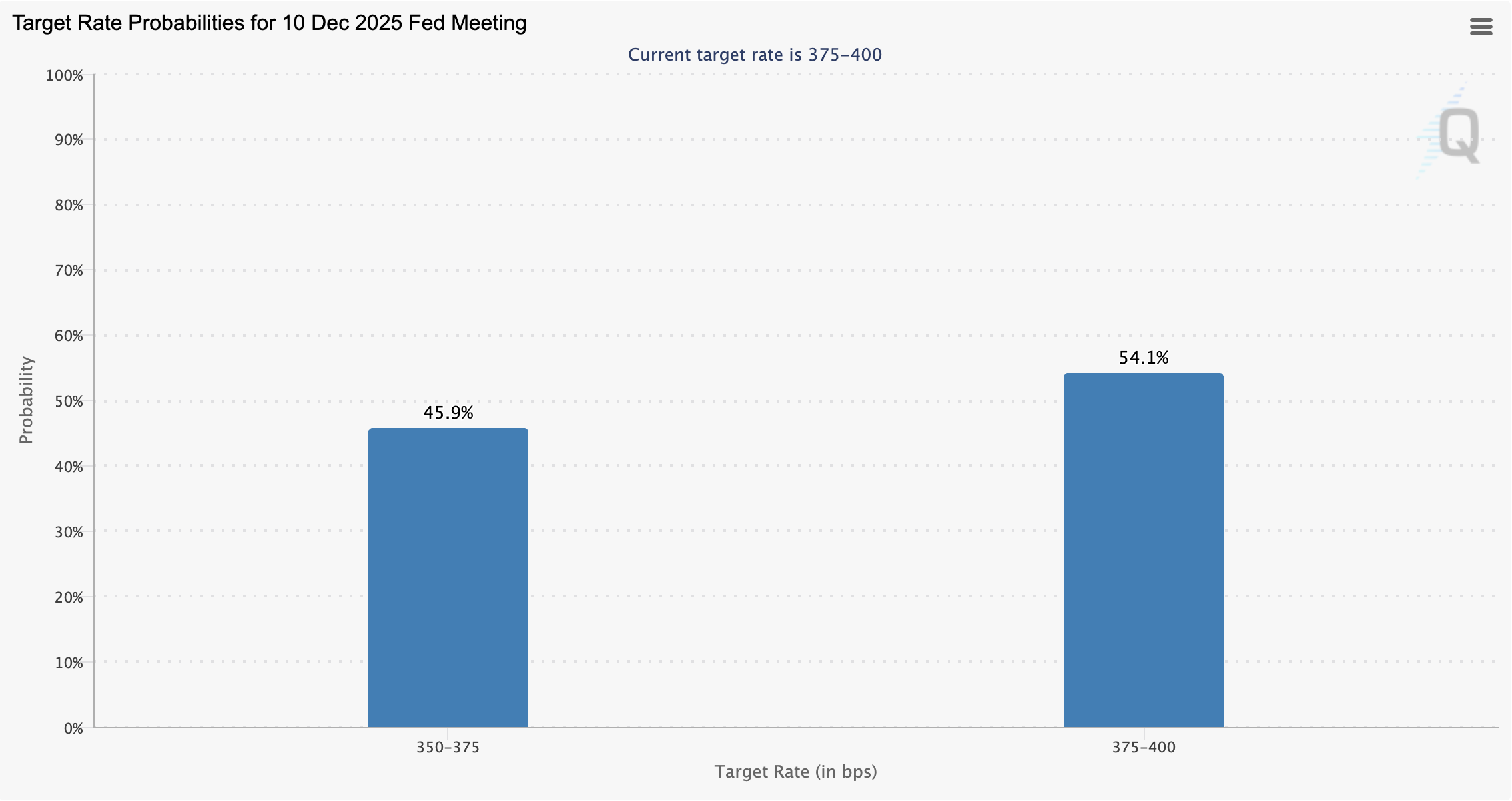

Probability of December interest rate cut falls below 50%

Only 45.9% of investors anticipate an interest rate cut at the next US Federal Open Market Committee (FOMC) meeting in December, amid declining market sentiment and a downturn in the cryptocurrency market.

The odds of a 25 basis point (BPS) interest rate cut in December were nearly 67% on Nov. 7, according to data from the Chicago Mercantile Exchange (CME) Group.

In September, several banking institutions forecast at least two interest rate cuts in 2025, with market analysts at investment banking company Goldman Sachs and banking giant Citigroup each projecting three 25 BPS cuts in 2025.

Interest rate decisions influence crypto prices. Lower interest rates translate into more liquidity flowing into asset markets and propping up prices, while higher rates mean liquidity and prices will be constrained.

The declining odds of a December rate cut are feeding negative market sentiment and may signal that more short-term price pain is coming to the crypto market until the Federal Reserve resumes easing rates.

Related: Stablecoin demand is growing, and it can push down interest rates: Fed’s Miran

Federal Reserve’s Jerome Powell casts doubt on a December rate cut

“There were strongly differing views about how to proceed in December. A further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it. Policy is not on a preset course,” Federal Reserve Chair Jerome Powell said in October.

As expected, the Federal Reserve slashed rates by 25 BPS in October; however, crypto prices extended their decline following the lowered rates.

The October rate cut was “fully priced in” by investors, who widely anticipated the cut months ahead of time, according to Matt Mena, a market analyst at investment company 21Shares.

Economist and former hedge fund manager Ray Dalio warned that the Federal Reserve is cutting rates into record-high asset prices, relatively low unemployment and low credit spreads, a historic anomaly.

In November, Dalio said the Federal Reserve is likely stimulating the economy into a bubble, adding that this is a feature typical of debt-laden economies headed toward hyperinflation and currency collapse.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari: Crypto Kid

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PrizePicks Integrates Fantasy Sports with Prediction Markets Through Blockchain Collaboration

- PrizePicks partners with Polymarket to integrate blockchain-based prediction markets into its fantasy sports app, expanding revenue streams and user engagement. - The collaboration leverages Polygon blockchain and CFTC-regulated contracts, enabling U.S. users to wager on sports, entertainment , and cultural events with federal compliance. - Industry trends show prediction markets as a complementary revenue model, with competitors like Flutter and Onyx Odds entering the space amid regulatory shifts. - Cha

Bitcoin News Today: Bitcoin Holds $94K Level: Bulls Struggle to Defend Amid Rising Bearish Outflows

- Bitcoin tests $94,000 support amid volatile swings driven by mixed institutional demand and macroeconomic uncertainty. - ETF outflows ($866M) and bearish technical indicators highlight fragile investor sentiment despite short-term RSI divergence. - Analysts split on $100,000 threshold viability as LCPC AI notes growing DeFi/AI interest while Saylor predicts BTC outperformance. - Macroeconomic risks persist with government reopening potentially triggering data-driven volatility and unresolved fiscal issue

Bitcoin Updates Today: With Bitcoin Facing Decline, Will Layer Brett's Mixed Approach Endure the Downturn?

- Bitcoin's price fell below $100,000, triggering market fears and driving investors toward altcoins like Layer Brett (LBRETT). - LBRETT, an Ethereum Layer 2 meme coin with 587% staking rewards, raised $4.44M in presale by combining meme appeal with scalable infrastructure. - Analysts highlight LBRETT's decentralized governance and low-cost transactions as advantages over speculative coins like Dogecoin amid bearish conditions. - Technical indicators suggest Bitcoin could rebound toward $106,453 or face de

Community colleges are becoming more attractive as students place greater importance on cost rather than reputation

- Chris Tomasso, CEO of First Watch , advocates for community colleges as a cost-effective alternative to traditional universities, emphasizing practicality over prestige. - Rising student debt and tuition-free programs in 30+ states drove a 4% 2025 community college enrollment increase, outpacing university growth. - For-profit institutions like Legacy Education saw 38.5% revenue growth from enrollment surges, while Stride Inc. faces lawsuits over alleged enrollment fraud and declining student numbers. -